This week, the meme coins market has witnessed a noticeable decline in activity, with the sector’s capitalization dropping 5% over the past five days.

Many meme assets have seen their value fall during this time, with several prominent tokens suffering double-digit losses.

Dogwifhat (WIF) Records Losses as Short Traders Take Over

WIF has experienced the steepest decline among the top five meme assets by market capitalization this past week. Trading at $1.48 at press time, the altcoin’s value has dropped by 20% during this period. On Thursday, the meme coin hit a weekly low of $1.45 before rebounding slightly.

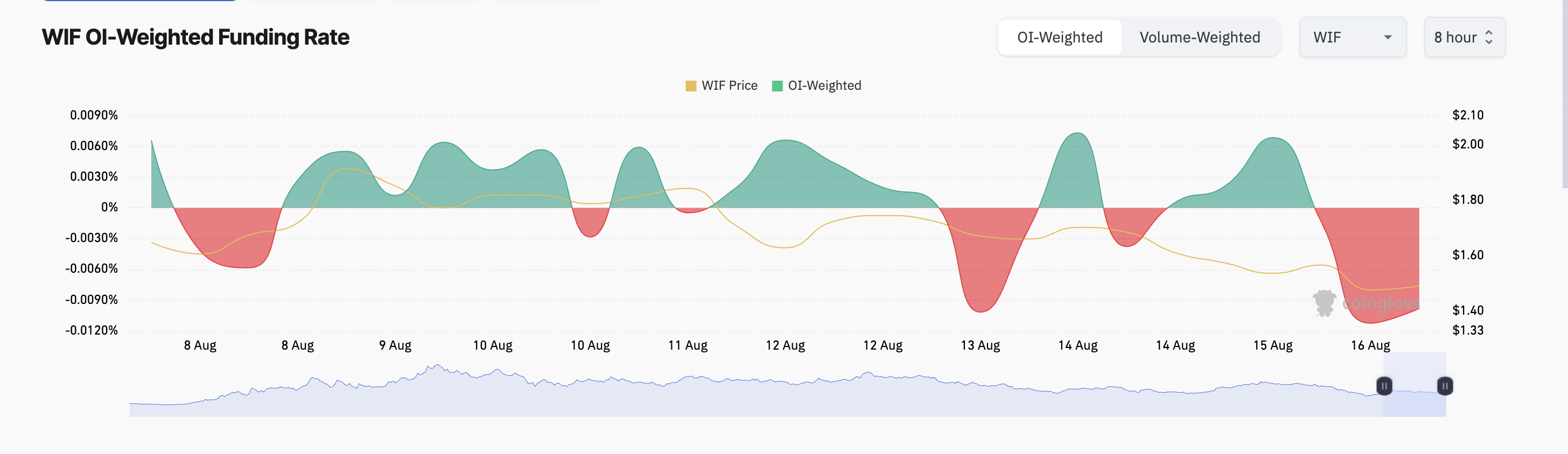

WIF’s downtrend has fueled a rise in demand for short positions in its derivatives market. Coinglass data shows that WIF’s funding rates have remained mostly negative throughout the week, currently sitting at -0.0098%.

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are negative, more traders are betting on a price decline than those buying and hoping for a rally.

In the spot market, demand for WIF has also declined significantly. Its Relative Strength Index (RSI) is trending downward at 38.22, indicating that selling pressure is currently stronger than token accumulation.

Read more: How To Buy Dogwifhat (WIF) and Everything Else To Know

If this downtrend continues, WIF’s value could drop further to $1.07. However, a shift in market sentiment and a spike in demand could push its price up to $1.96.

Pepe (PEPE) Risks 23% Fall as Selling Pressure Mounts

The frog-themed coin Pepe is currently trading at $0.0000075, with its value down by 14%. This week, PEPE’s Accumulation/Distribution (A/D) Line has been in a consistent downtrend. At 780.42 trillion at press time, it has dropped by 5% over the past seven days.

The A/D Line tracks money flow into or out of an asset, indicating whether it is being accumulated or distributed. A declining A/D Line signals that selling pressure is outweighing buying activity — a bearish indicator that suggests further price drops.

Adding to this outlook is PEPE’s decreasing Chaikin Money Flow (CMF). Currently at -0.18 and below zero, the CMF is also trending downward. A falling price paired with a declining CMF confirms rising selling pressure, indicating that more traders are offloading PEPE than accumulating it.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

If PEPE’s buying pressure remains low, its price may fall 23% to trade at $0.0000058. This bearish projection would be invalidated if the meme coin saw a demand spike, pushing its price to $0.0000085.

Bonk (BONK) Poised for a “Death Cross”

A one-day chart analysis of BONK reveals the potential formation of a “death cross,” where the 50-day simple moving average (SMA) (blue line) is nearing a cross below the 200-day SMA (yellow line).

A “death cross” occurs when the 50-day SMA dips below the 200-day SMA, signaling a bearish trend. This suggests that BONK’s short-term rally is weakening and may be shifting toward a downtrend. Traders often view this pattern as a sell signal, prompting them to exit long positions and consider taking short positions.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

At press time, BONK trades at $0.000018, having declined 11% this week. If selling pressure mounts as the “death cross” forms, its price will drop to $0.0000015. However, if the moving averages change course due to any rally in demand, it may push BONK’s price up to $0.000022.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.