Feeling uncertain about investing in PEPE tokens? Concerned about potential losses and considering whether to hold or sell your current holdings? Before making any decisions, check out this comprehensive PEPE price prediction guide. It offers valuable insights into how the price of PEPE could evolve over the years, extending all the way to 2035.

KEY TAKEAWAYS

➤ PEPE’s price is projected to reach up to $0.000354 by 2035 based on historical patterns and market growth expectations.

➤ On-chain metrics, such as active address count and whale activity, are critical indicators of market interest and potential price movement. A rise in active addresses often correlates with increased trading activity and price appreciation.

➤ PEPE holders and buyers must exercise caution due to the high volatility of meme coins like PEPE and the significant control of the token supply by a few large holders.

- Pepe (PEPE) price prediction 2024-2035

- Pepe technical analysis and short-term forecast

- Pepe (PEPE) price prediction 2024

- Pepe (PEPE) price prediction 2025

- Pepe (PEPE) price prediction 2026

- Pepe (PEPE) price prediction 2027

- Pepe (PEPE) price prediction 2028

- Pepe (PEPE) price prediction 2029

- Pepe (PEPE) price prediction 2030

- Pepe price prediction and fundamental analysis

- Pepe price prediction and on-chain metrics

- Is it worth investing in Pepe?

- Frequently asked questions

Pepe (PEPE) price prediction 2024-2035

Here is a table that captures all the key price levels for PEPE all the way until 2035:

| Price Prediction Year | Potential High | Potential Low |

| 2024 | 0.00003287 | $0.00000569 |

| 2025 | 0.00002907 | $0.00001729 |

| 2026 | 0.00009100 | 0.00003500 |

| 2027 | 0.00012000 | 0.00004600 |

| 2028 | 0.00015000 | 0.00005700 |

| 2029 | 0.00017900 | 0.00006900 |

| 2030 | 0.00020800 | 0.00008000 |

| 2031 | 0.00023700 | 0.00009100 |

| 2032 | 0.00026600 | 0.00010200 |

| 2033 | 0.00029600 | 0.00011300 |

| 2034 | 0.00032500 | 0.00012500 |

| 2035 | 0.00035400 | 0.00013600 |

If you wish to hold PEPE for a long time, say until 2035 or even beyond, we recommend using ERC-20 compatible crypto wallets — cold or hardware — to store the tokens. Also, it is worth noting that for any given year, the price might fall anywhere between the maximum and minimum price of PEPE.

Disclaimer: Financial decisions, especially those involving investments in highly volatile assets like cryptocurrencies, can significantly impact your financial well-being. Ensure you are well-informed and consult with a financial advisor if necessary before making any investment decisions.

Note: All profit projections, across years, will be measured from the current price level of PEPE — as of Nov.25, 2024.

Pepe technical analysis and short-term forecast

It is important to analyze the price action of PEPE to understand the potential in the short-to-long term. Also, increased social activity should not be ignored.

As of Aug. 15, 2024, the price of PEPE was in a neutral zone. While the triangle pattern held true, most of the price action happened.

However, PEPE managed to rake in some decent numbers in the recent rally, ensuring that the price chart now has new elements to look at.

The latest price chart shows PEPE consolidating and trading in a range after a quick rally. The price action breaching past the higher Bollinger Band hinted at a correction, which eventually happened.

However, with multiple Dojis in effect, there seems to be a war between the bears and bulls. If the price breaks past $0.000026, PEPE might see a quick surge to $0.000039, provided the market conditions remain optimistic.

Now, let us track the long-term pattern for PEPE:

Long-term price potential of PEPE

Here is the long-term analysis used to determine the PEPE price levels from 2024 to 2030 and then to 2035. Let us dive deeper!

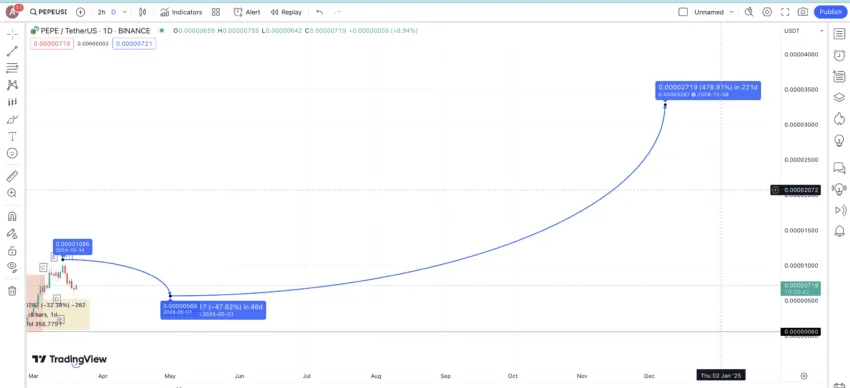

PEPE is a relatively new listing on most exchanges. Therefore, we do not have much actionable historical data to rely on. Still, here is the daily chart with one complete and one forming pattern, A-B-C-D-E and A1-?.

The first step is to locate the price peaks and distance taken to move from one point to the other for the first pattern. Here are the values:

| A to B | -86.21% in 139 days |

| B to C | 1323.40% in 166 days |

| C to D | -32.38% in 1 day |

| D to E | 68.30% in 3 days |

| E to F | -24.31% in 3 days |

| F to A1 | 43.57% in 2 days |

We also need to take the E to F and F to A1 levels into consideration to get hold of a few additional reference points. While the timeframes can vary, let us take the average price surge and average price drop values for our future reference:

Average price hike: 478.42% in 57 days

Average price drop: -47.63% in 48 days

We shall use these data points to chalk out the next leg of the pattern that starts at A1.

Pepe (PEPE) price prediction 2024

While we are closing in on 2024, PEPE is only 64% away from our projected high. Here is how the analysis reads, based on the long-term patterns from earlier:

| Outlook | Projected ROI | Possible high |

| Bullish | 64% | $0.00003287 |

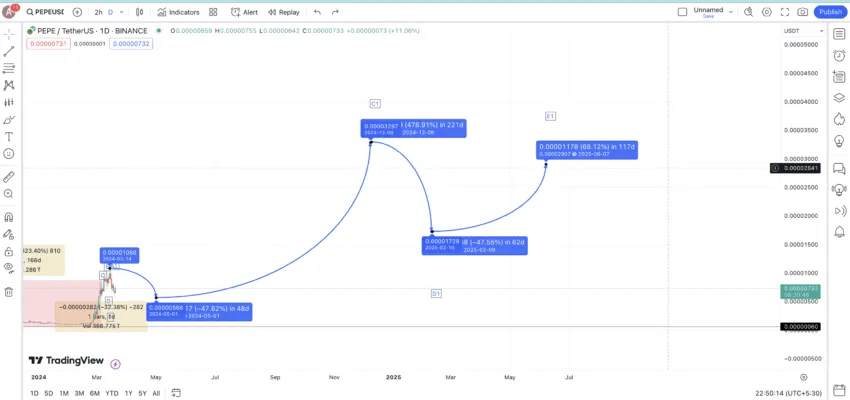

Assuming A1 is the first point of a new pattern, we expected B1 or the next low for PEPE to surface at $0.00000569, or at a 47.63% drop, by May 2024. And this level did hold, considering we weren’t in the bull market then.

As of 15 August 2024, the proposed May levels were almost reached, with PEPE dropping as close to $0.000006.

This could be the minimum price of PEPE in 2024. Also, the timeframe could vary depending on the market conditions and other factors.

The next high, or rather C1 could be at a 478.42% surge from B1. This puts the maximum price of PEPE at $0.00003287. Assuming that the market takes time to warm up, we can see this level by the end of 2024.

Based on current market trends and the post-Trump rally, PEPE did move all the way up to $0.000024, making us confident that the projected 2024 could be closer than ever.

Note: Unsure as to how these values and percentages are reached? Keep reading, as by the end of the yearly price predictions we shall have the actual long-term price breakup of PEPE for you to read through!

Pepe (PEPE) price prediction 2025

| Outlook | Projected ROI | Possible high |

| Bullish | 45% | $0.00002907 |

The next level from C1 or D1 could form at $0.00001729 — a drop of 47.63% from the last high, per the average price values from earlier. This could be the 2025 low for the price of PEPE. However, from this low or D1, the surge could be limited as after possibly gaining 450% in 2024, many holders will start offloading their assets.

The surge from D1 could, therefore, be limited to 68.3%, as per the above table data. This puts the 2025 PEPE price prediction high at $0.00002907. Do note that the timeframe can vary.

Pepe (PEPE) price prediction 2026

| Outlook | Projected ROI | Possible high |

| Bullish | 355% | $0.00009100 |

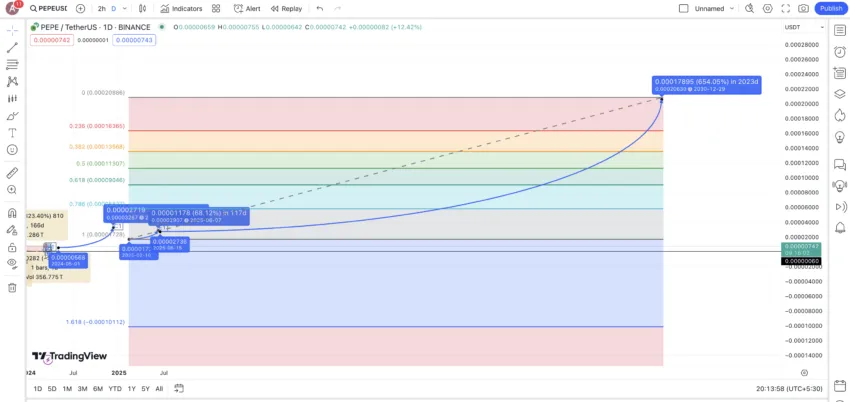

Following the trend established in previous years, the next level from the 2025 high of $0.00002907 could form at $0.00001729, representing a 47.63% drop from the last high. For 2026, we can use the average price hike of 478.42% over 57 days as a reference for the potential high. Assuming that the market conditions remain favorable and the broader crypto market continues to grow, we expect Pepe to reach new highs.

Using the Fib retracement tool and other technical analysis methods, we can predict that Pepe coin’s high in 2026 could be around $0.00009100. This represents a significant increase from the previous year’s levels.

Pepe (PEPE) price prediction 2027

| Outlook | Projected ROI | Possible high |

| Bullish | 500% | $0.00012000 |

For 2027, we continue to see a bullish trend based on historical patterns and the expected market conditions. Following the previous high, the price may drop to the aligned minimum price of $0.00004600, reflecting a typical market correction.

The projected high for Pepe coin in 2027 could be around $0.00012000, based on the average price surge seen in previous patterns and considering continued positive market developments.

Pepe (PEPE) price prediction 2028

| Outlook | Projected ROI | Possible high |

| Bullish | 650% | $0.00015000 |

Assuming the market conditions remain supportive and the cryptocurrency market continues its growth trajectory, the price of Pepe coin could see another significant rise in 2028. Following the previous high, the price might correct to around $0.00005700.

The high for 2028 is projected to be around $0.00015000, maintaining the bullish outlook and reflecting Pepe coin’s historical growth patterns.

Pepe (PEPE) price prediction 2029

| Outlook | Projected ROI | Possible high |

| Bullish | 795% | $0.00017900 |

For 2029, we anticipate the bullish trend to continue, with the price potentially dropping to an aligned minimum of $0.00006900 before rising again.

Using the same analysis framework, the high for Pepe coin in 2029 could be around $0.00017900, representing continued strong market growth.

Pepe (PEPE) price prediction 2030

| Outlook | Projected ROI | Possible high |

| Bullish | 940% | $0.000208 |

Now that we have the expected 2025 low and 2025 high for PEPE, we can extrapolate the findings to zero in on the price levels for 2030. Using the Fib retracement tool to connect the swing high and the swing low, we can expect the PEPE price prediction level for 2030 to surface at $0.000208.

PEPE is now the 5th largest meme coin, and a top 200 token by market cap.

Never fade the power of memes in crypto.

Miles Deutscher, crypto analyst: X

Another bullish take on PEPE’s price:

Historical price analysis of Pepe coin (PEPE)

Now that you have the long-term and short-term levels, it is appropriate to understand PEPE’s historical price action. This will help analyze the path ahead better:

Pepe coin (PEPE) has shown remarkable volatility and significant gains since its inception. Initially listed on decentralized exchanges in April 2023, Pepe coin quickly captured the attention of investors, achieving unprecedented gains. Early investors saw their holdings multiply by over 322,000x during a massive price surge in May 2023, making it one of the largest meme coin pumps ever.

Throughout 2023, Pepe coin maintained its momentum, consistently holding a market cap of over $1 billion despite market fluctuations. The coin’s price movements were characterized by substantial volatility, with daily price changes often exceeding 10-20%.

In early 2024, Pepe coin experienced another surge, pushing its market cap to $4.14 billion. This surge was partly driven by broader market trends and the anticipated impact of Bitcoin’s halving cycle. Historical data indicate that key support and resistance levels influence Pepe coin’s price movements. Significant support has been observed around $0.00000569, while bullish scenarios have seen resistance levels peak at $0.00003287.

Analyzing these historical price movements provides valuable insights into Pepe coin’s potential future performance. By understanding the patterns and trends that have characterized its price history, investors can make more informed predictions about its future trajectory.

Pepe price prediction and fundamental analysis

Pepe is a run-of-the-mill ERC-20 meme coin. Even the website mentions that the token doesn’t have any utility.

Did you know? Pepe boasts a redistributive token allocation system where a portion of each transaction is moved to the token holders, encouraging long-term investment.

If other fundamental aspects are to be considered, Pepe has its eyes set on NFTs, merchandise, crypto staking mechanisms, and more — furthering the long-term price potential of PEPE tokens. Pepe believes in the concept of meme takeover and features a reliable burn mechanism — a move that keeps the tokenomics deflationary.

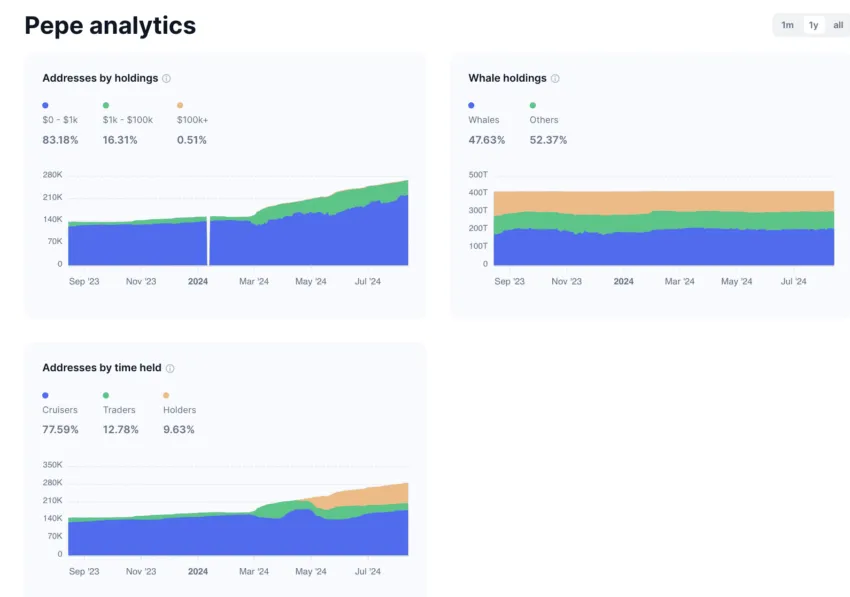

Over time, the future price of Pepe might surge, provided elements like Pepe Academy and Pepe Tools come into existence. But then, as of August 2024, Pepe whales controlled almost 47.63% of the supply.

However, in Nov. 2024, the whale concentration dipped to under 46%, which is a heartening sign.

Did you know?

Despite the profitability on display, the holder-concentration specific to PEPE has increased from 9.63% in August to 26.31%. This is a massively optimistic sign for the price action.

Regardless, Pepe’s fundamentals look strong.

BeInCrypto reached out to RK Gupta, co-founder of the Elite Crypto Tool. We asked about the approach investors should follow to ride the PEPE/meme coin wave. Gupta explained that users should “proceed with caution but look beyond the meme.”

Pepe’s recent surge is a fascinating example of the meme coin phenomenon. While there’s potential for continued growth, the market is known for its volatility. Investors should carefully consider the token’s utility, long-term plans, and inherent risks before diving in. Remember, investing in meme coins should be considered a high-risk, speculative investment.

Another investor’s hack: Don’t neglect underlying tech.

“While the meme factor can’t be ignored, many investors get caught up in the hype and overlook the underlying technology powering these meme coins. Here’s a pro tip: look for meme coins built on established blockchains like Ethereum or Binance Smart Chain. These blockchains offer greater security, stability, and potential for future integrations compared to lesser-known chains.”

RK Gupta, Co-founder of Cryptokosh/ Elite Crypto Tool: BeInCrypto

Another key piece of development as to be the development of Pepe Unchained, a layer-2 solution. Even though it isn’t directly related to Pepe, it could indirectly benefit PEPE by drawing attention to the broader Pepe ecosystem.

Pepe price prediction and on-chain metrics

It is important to note that on-chain metrics are short-term. But then, they do help highlight a trend that could be instrumental in defining the future price of a token. Let us take a look at the metrics that can help with the Pepe price forecast:

The active address count is probably the most dependable metric. A rise in the number signifies trading interest and the eventual rise in the price of PEPE tokens. Therefore, to gauge the future price of Pepe, it is important to keep track of the active address count and notice the spikes.

As of Aug. 2024, the active address count flattened out, showing waning interest in the meme coin.

“High growth memes usually exhibit the following early on: + consistently increasing holder count + more new buyers than recurring ones + minimal presence of whales.”

Ally Zach, Research Analyst at Pantera Capital: X

As of Nov. 2024, the active address count seems to have peaked. We also expect the price action to follow.

Now, let us look at the Nansen dashboard and analyze PEPE further:

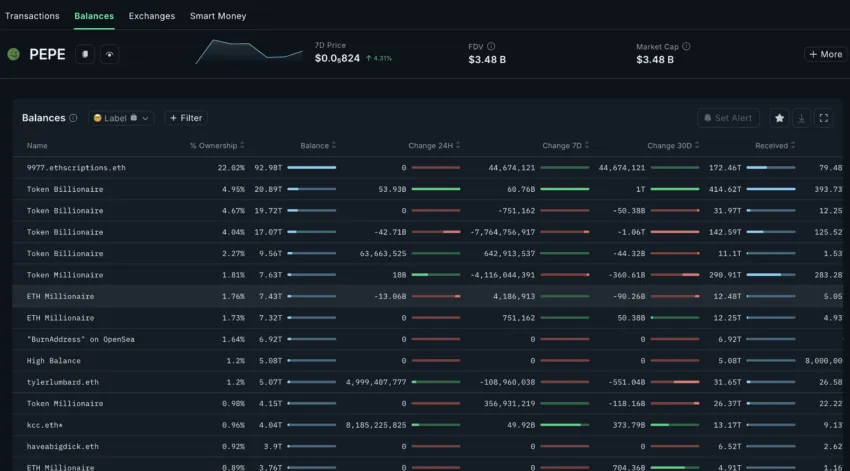

The transactions list showed that most actions favored selling PEPE in Aug. 2024. Although the orders weren’t huge, they clearly revealed a bearish to neutral trend. And PEPE did correct at the time.

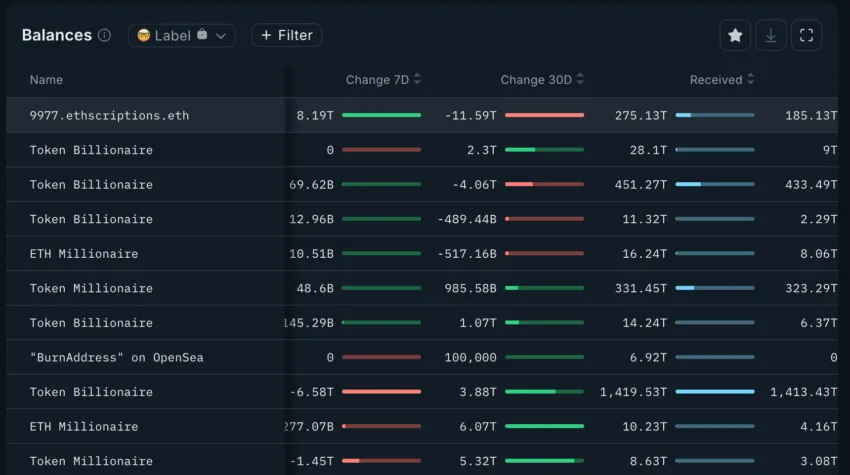

Shifting attention to the Balances tab as part of the Token God Mode suggested that token billionaires added to their PEPE reserves. The seven-day changes were skewed toward sell orders, but the 30-day balances were mostly green.

In Nov.2024, the trend seems to have reversed. Top wallets, over the past 30 days, seem to be stocking up on PEPE, hinting at a positive volume or inflow. This could be benefit the price action, over the next few weeks.

Is it worth investing in Pepe?

At its heart, PEPE is still a meme coin. However, this PEPE price prediction remains optimistic about all the ecosystem-specific use cases, eventually expecting the token to erase multiple zeros from its current price level. But then, the crypto market is volatile. Despite optimistic price projections, you should always have a quintessential do-your-own-research (DYOR) plan in place.

Frequently asked questions

What is PEPE?

Is PEPE available on OKX?

What is the future of the Pepe coin?

Where to buy Pepe in 2024?

What are the projected price levels for Pepe coin (PEPE) from 2026 to 2029?

Can PEPE go 100x?

Why is Pepe dipping?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.