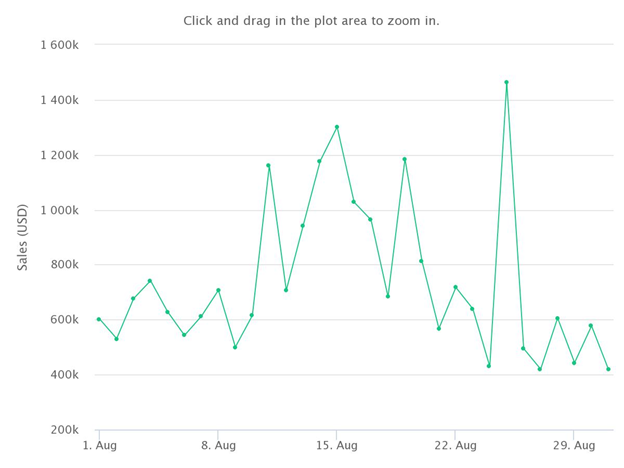

Otherdeed unique buyers plunged below 2,000 in August signaling a substantial decline in investor interests in the Otherside Metaverse and broader NFT market.

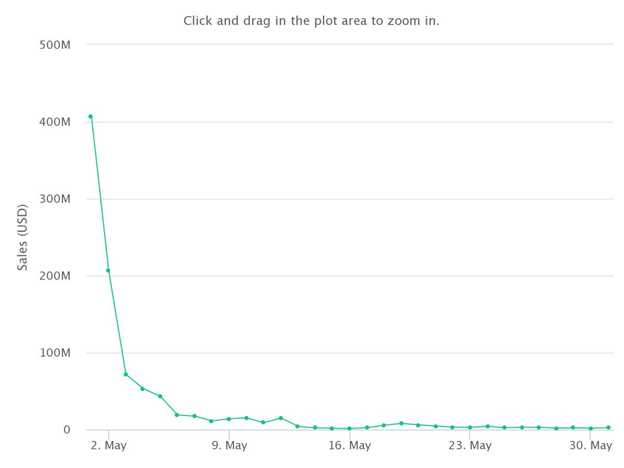

Otherdeed has broken several records in the non-fungible token (NFT) sector since it hit the markets in May. In its first month as a tradable NFT, the virtual land project generated approximately $943 million in sales.

Within the period, 20,519 unique buyers completed 42,098 transactions.

Unfortunately, the project, like others in the NFT and crypto space has been affected by the lack of investor interest in recent months.

This culminated in the sharp decline of unique buyers to 1,934 in August. August’s value was a 90% dip from May, 40% below June, and a 22% drop from July’s 2,510, data from CryptoSlam showed.

Sales volume in August 2022 was around $23 million.

Total transactions and average sales correlate to unique buyers

Most NFTs do not get the hype Otherdeed received from market analysts, traders, and investors due to its direct association with the popular Bored Ape Yacht Club movement.

This explains why the NFTs saw more than 42,000 sales in May. Since then, there has been a sharp drop in monthly total transactions.

Total transactions in June were 6,646 — an 84% decrease in 30 days.

To make matters worse, NFT global market sales have declined in the last three months to new lows which have reflected the smaller number of total transactions Otherdeeds are involved in.

Average sale value sank by more than $16,000

Otherdeed average sale value was $6,059 in August and this was a 72% decrease from May’s $22,417

Despite the decline, the average sale of Otherdeed was higher than popular collectibles such as Axie Infinity, Art Blocks, and NBA Top Shots but fell below Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and CryptoPunks.

Why the decline in Yuga Labs’ NFT projects?

Yuga Labs is the development team behind BAYC, MAYC, and Bored Ape Kennel Club (BAKC) in addition to Otherdeeds. Some stakeholders believe the company’s struggles over the past month coupled with the unprofitability of digital collectibles are to blame for the fallen statistics.

Fitburn CEO Ferhat Kacmaz told Be[In]Crypto, “Yuga Labs is disadvantaged for quite a number of reasons including the ongoing Class Action lawsuit it is battling. A group of investors is accusing the startup of inducing buyers to acquire Bored Apes at inflated prices. While Bored Apes and its associated Metaverse project Otherdeeds remain one of the most valuable digital collectibles around today, its dedicated community seems to be shifting gear to other equally valuable collections. It is no surprise that the broader NFT market is declining, considering investors are taking a more conservative approach to risky assets in the face of raging inflation.”