Due to its increasing monthly sales volumes in March and April, Bored Ape Yacht Club has hit a sales milestone that bodes well for the entire non-fungible token (NFT) space.

Bored Ape Yacht Club is one of the most popular names when it comes to digital collectibles.

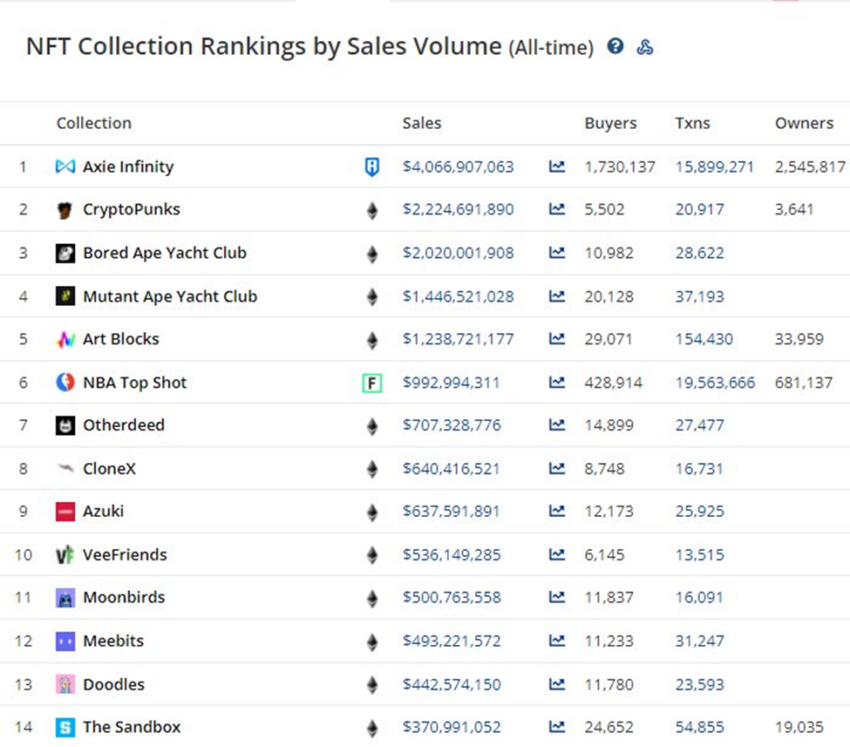

According to Be[In]Crypto Research, Bored Ape Yacht Club had an all-time total sales volume of around $2.04 billion, as of May 4, 2022.

This comes as a huge boost to the project after the successful launch of the Otherside metaverse by Yuga Labs.

This places Bored Ape Yacht Club behind Axie Infinity (AXS) and CryptoPunks in terms of sales.

With that said, BAYC is still ahead of other top projects like Art Blocks, NBA Top Shot, Otherdeed, CloneX, Azuki, VeeFriends, Moonbirds, Meetbits, and The Sandbox.

What contributed to the spike in Bored Ape Yacht Club sales volume?

The eligibility of holders of Bored Ape Yacht Club as potential earners of free airdropped ApeCoin (APE) as well as potential owners of plots of land in the Otherside metaverse can be attributed as the primary cause for the soaring BAYC sales volume.

When ApeCoin was launched in March 2022, the ApeCoin Foundation announced an airdrop of 150 million APE.

Owners of Bored Ape NFTs are eligible to claim up to 10,094 APE. The airdrop is still ongoing and will end on June 15, 2022.

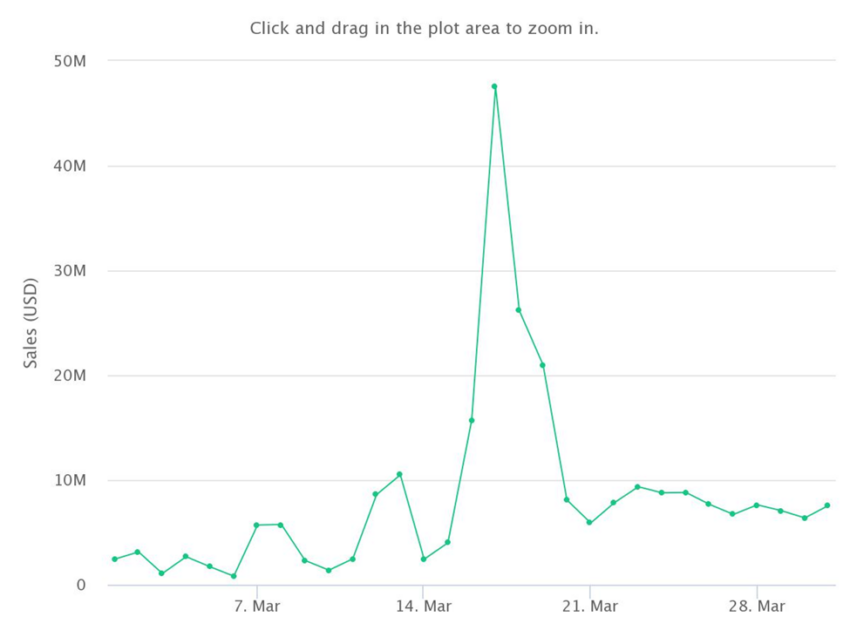

After sinking by 59% to a yearly low of 381 in the total number of unique buyers in February from 933 in January, BAYC saw an increment in unique buyers in March.

In March 2022, BAYC’s unique buyers were 669, and this corresponded to total transactions of 1,011 ― a 75% increase in 31 days.

Overall, BAYC’s sales volume in March was approximately $256.95 million, and this was a 106% spike from February 2022 sales of $124.42 million.

In April, the creators of BAYC, Yuga Labs announced April 30 as the launch date for the Otherside metaverse. Otherside introduced 200,000 plots of land to the BAYC community.

Half of the land (100,000) will be rewarded to those who contribute to the development of the metaverse.

Out of the remaining half, 55,000 plots were put on sale on April 30, and the remaining 45,000 were airdropped to holders of Bored Ape Yacht Club and Mutant Ape Yacht Club for free.

This impacted the average sale value of BAYC positively. By the end of April 2022, BAYC’s average sale value reached an all-time high of $308,497.23 which was around 101 ETH. BAYC’s sales volume for April was in the region of $236.31 million.

Impact on APE price

APE opened on April 1, 2022, with a trading price of $12.70, reached a monthly high of $26.91 on April 28, and closed the month with a price of $20.01. Overall, there was a 57% increase between the opening and closing prices of April.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.