ORDI’s price registered a notable rise at the beginning of the week as the broader crypto market experienced a slight recovery.

However, in addition to the overall market trends, consistent support from investors has kept ORDI in the green.

ORDI Investors’ Bullish Outlook

ORDI’s recent price increase can be attributed to several factors, with investor perseverance being a key element. The Chaikin Money Flow (CMF) indicator shows that the altcoin has seen consistent inflows since the end of June. These inflows have been crucial in maintaining ORDI’s resilience against recent bearish trends in the broader market.

If these inflows continue, ORDI could be well-positioned for further gains in the near future. Sustained capital movement into the altcoin suggests that investors are confident in its potential, which could lead to additional price appreciation, provided broader market conditions remain favorable.

Read More: Bitcoin NFTs: Everything You Need To Know About Ordinals

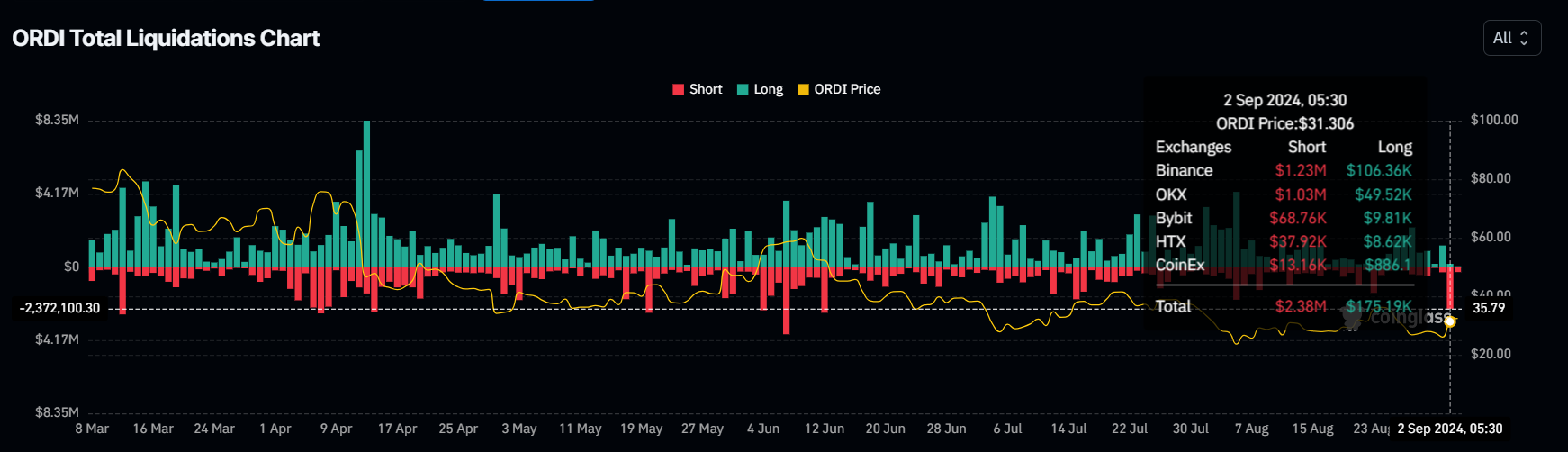

Conversely, bearish traders, especially those holding short positions, might need to reassess their strategies in light of recent developments. Yesterday, ORDI experienced short liquidations amounting to $2.38 million, the largest since mid-June. This significant liquidation event could prompt short traders to reconsider their positions.

Historically, spikes in short liquidations have often been followed by recovery periods for ORDI. This pattern suggests that the altcoin may be on the verge of an uptrend as short sellers are forced to exit their positions, reducing downward pressure on the price and paving the way for potential gains.

ORDI Price Prediction: Breaking the Pattern

ORDI’s price, currently at $32.40, has risen 23% over the last 24 hours after nearly falling to the support level of $25.55. If the positive factors continue, the altcoin could breach the resistance level of $35.56. Once this level is established as support, ORDI could rise substantially.

Historically, $35.56 has served as a strong support level, and a rise from this point could push the altcoin towards $40 and higher. The next major resistance is at $46.53, and reaching this point would require strong and consistent bullish signals.

Read More: Top 5 BRC-20 Platforms To Trade Ordinals in 2024

However, if ORDI fails to breach $35.56, it may face a downturn as investors might sell to secure their recent gains. This could lead to a drop to $30.00, and any further decline could invalidate the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.