Solana (SOL) price has been facing significant challenges in breaking above key resistance levels. In August, the cryptocurrency made two failed attempts to breach the $160 mark within the same month.

Despite these setbacks, there is a potential for recovery once investor sentiment shifts. However, the possibility of Solana falling back to $126 remains a concern.

Solana Enthusiasts Have Learned the Pattern

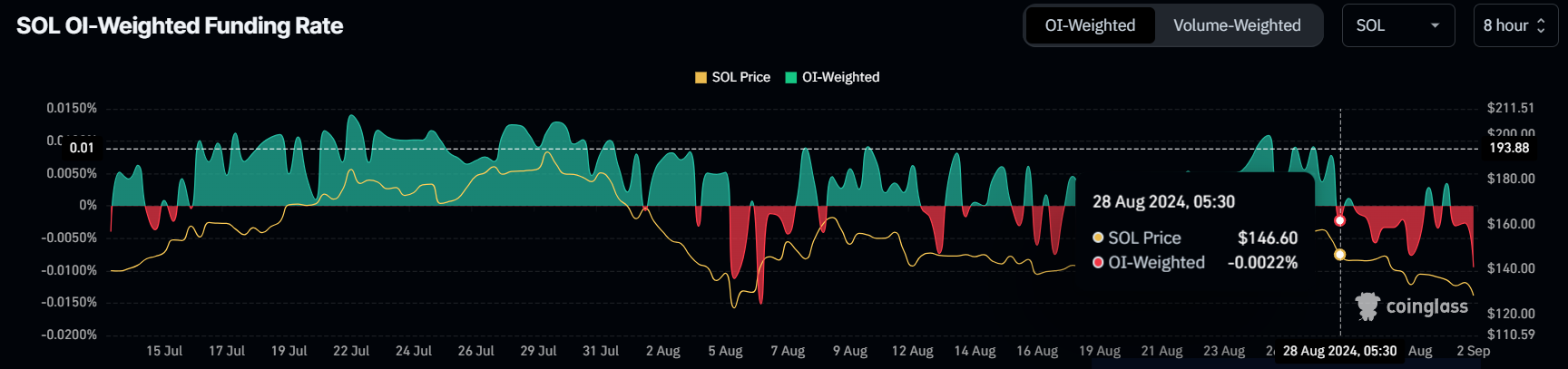

SOL Traders were largely prepared for a drop in Solana’s price, especially as the funding rate shifted from positive to negative around August 28. This shift indicated that traders were betting on further declines, anticipating a drop to $126. Given the altcoin’s consolidation has become a pattern, the negative sentiment was not arbitrary.

The consolidation range that has formed between $126 and $160 has become a focal point for traders. As a result, many have identified this as an opportunity to capitalize on short-term price movements.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

Furthermore, the broader macro momentum for Solana is also showing signs of strain. Technical indicators like the Relative Strength Index (RSI) suggest that bearish momentum is currently peaking.

However, the RSI has historically bounced back from similar ranges, indicating that the selling pressure could soon ease. This potential slowdown in selling could provide the necessary room for Solana to begin a recovery, although the overall market conditions remain a critical factor.

While the RSI indicates that Solana is nearing oversold territory, this does not guarantee an immediate recovery. The momentum behind Solana’s recent decline has been strong, and it may take time for the market to absorb this selling pressure fully.

SOL Price Prediction: Another Day, Another Bounce

Solana’s price has declined by more than 20% in the past eight days after failing to breach the $160 resistance level. This significant drop makes it likely that Solana will revisit $126 before any substantial recovery occurs. $126 has previously acted as a strong foundation for price rebounds, but the recent failed attempts to breach $160 indicate a persistent bearish outlook.

Additionally, the $126 to $160 range has been tested multiple times since mid-April, creating a well-defined consolidation zone. While a breakout from this range is possible, it remains unlikely without a significant shift in broader market conditions. Even if Solana manages to recover, failure to break through the $155 or $160 resistance levels could result in another decline, making a drop to $126 a likely scenario.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if Solana’s recovery coincides with positive market cues, there is a chance of breaching the $160 resistance. Such a breakout could enable Solana to rise toward $169. This would require a combination of improved market sentiment and sustained buying interest, both of which are uncertain at present.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.