One of the latest Bitcoin innovations to sweep the market — Ordinals — has seen widespread adoption. It is only natural that popular BRC-20 platforms have emerged to capitalize on this new trend. For those looking to ride this new wave, here are the top BRC-20 platforms to find the most coveted Ordinals.

- Top 5 BRC-20 platforms to trade Ordinals

- 1. Gate.io

- 2. OKX

- 3. Binance

- 4. UniSat

- 5. Ordinals Wallet

- What is an Ordinals platform?

- How do Ordinals marketplaces work?

- BRC-20 marketplaces vs. traditional NFT marketplaces

- 3 best Bitcoin Ordinals collections

- What’s the Bitcoin NFT hype about?

- BRC-20 platforms simplify trading

Top 5 BRC-20 platforms to trade Ordinals

1. Gate.io

Gate.io has achieved several milestones in the Ordinals market, making it is an obvious contender as a top BRC-20 platform. More specifically, Gate.io exceeded 10% of the exchange token share for 27 tokens and 30% for 14 tokens. Additionally, the platform exceeded $23 million in 24-hour trading volume, averaging 44.43% of exchange volume.

In addition to an Ordinals marketplace, the platform also has an Inscription Launchpad, a platform for launching and subscribing to inscription projects. This supports various blockchain protocols including Bitcoin NFTs, BRC-20 tokens, and Ethscriptions. Gate’s Inscription Navigation offers a one-stop platform that aggregates information on inscriptions across public blockchain ecosystems like Bitcoin, Ethereum, Dogecoin, and TON. This allows users to easily understand the latest trends and data in the inscription market.

These three components form a holistic a feature-packed ordinals platform. The Inscripton launchpad’s offerings in particular are highly competitive and user-centric. Projects launched on alternative platforms often require participants to commit assets to fund the projects, or complete tasks to be eligible. These features pose additional barriers to users becoming early adopters of new Inscription projects.

In contrast, projects on Gate.io are free to participate in and provide clear and transparent launch mechanisms ensure consistency and fairness. This again sets Gate.io apart from some competitors, where the quality of project launch offerings might vary. When subscribing to a project launch, users can also choose to delay claiming your tokens until network fees are lower.

• Supports BRC-20, DRC-20 (Dogecoin), TON-20 (Open Network), LTC-20 (Litecoin), and more

• Also supports Bitcoin NFT trading

• Data metrics for market analysis

• BRC-20 launchpad

• One-stop inscription services for buyers and sellers

- Supports both tokens and NFTs

- Supports inscriptions from multiple blockchains

- High trade volume for liquidity

- Launchpad and data metrics

- Unavailable in some countries

2. OKX

The OKX platform for BRC-20 tokens and inscriptions is a one-stop shop for many activities involving the Bitcoin phenomenon taking over the blockchain. Users can buy and sell tokens and NFTs, and the exchange also allows you to inscribe directly from the platform.

On top of this, OKX’s proprietary wallet also allows you to hold these assets. Users of the OKX exchange will enjoy the low trading fees of 0.08% (maker) and 0.1% (taker) when trading BRC-20 tokens.

• Tokens and NFTs

• Inscribe and launch collections directly from the platform

• Wallet supports both NFTs and tokens

• NFT studio for creating NFTs

- There are over 150 NFT collections to choose from

- Low trading fees

- Supports hundreds of tokens

- Limited to the Bitcoin blockchain

- Does not offer data metrics

3. Binance

Binance provides users a single platform to purchase and manage their BRC-20 tokens and NFTs. The platform houses 60,000 BRC-20 tokens, giving users a wide variety of tokens.

The exchange also allows users to speed up their BTC transactions through the BTC Transaction Accelerator. This will enable users to speed up the inscription process or trade BRC-20 tokens. The Binance Inscriptions Marketplace also utilizes the UniSat marketplace to enhance liquidity. Lastly, the Binance wallet integrates smoothly with the platform so users can easily exchange their tokens and NFTs to and from their wallets.

• Inscribe, buy, sell, and trade on the platform

• Accelerator to speed up inscriptions and trading

• Thousands of tokens and NFTs to choose from

• Integrates tokens and NFTs into wallet

- Deep liquidity

- Easy transfers

- Fast transactions

- Low fees

- Limited functionality by region

4. UniSat

Unlike most of the options on the list, UniSat is a wallet that you can download on the Chrome Store or directly from GitHub. The wallet is open-source, supports Bitcoin transfers, in addition to BRC-20 tokens, NFTs, and an in-app platform for trading all of the aforementioned assets.

With UniSat, users do not have to run a full node to inscribe Satoshis. It also allows you to mint or inscribe your own tokens and collections. Moreover, you can see unconfirmed NFTs and allows for the querying of BRC-20 token information.

• Inscribe, buy, sell, and trade

• Marketplace for tokens and NFTs

• Supports BRC-20 and Atomicals

• Supports image, text, video, and audio

- Open-source

- Supports multiple NFT formats

- Does not require users to run a full node

- All-in-one platform to manage BRC-20 and NFTs

- Currently in beta mode

5. Ordinals Wallet

Ordinals Wallet is another wallet on our list that houses a marketplace for BRC-20 tokens. This wallet is built by Bitcoiners, for Bitcoiners. In the spirit of Bitcoin, the Ordinals Wallet is community-funded and open-sourced.

The wallet currently does over $82 million in total volume, has nearly one million inscriptions, and almost half a million wallets have been created. On top of this, Ordinals Wallet is non-custodial, so users don’t have to worry about getting rugged by a counterparty.

• In-app marketplace

• Buy, sell, trade, view, and inscribe

• Supports BTC, DOGE, and BELLS

• NFTs and tokens

- Open-source

- Non-custodial

- Community funded

- User friendly interface

- Unavailable on mobile

What is an Ordinals platform?

An Ordinals platform is somewhere you go to purchase Ordinals. This typically occurs on an exchange or a wallet. Ordinal marketplaces are not all too different from your run-of-the-mill NFT marketplace or cryptocurrency exchange.

However, Ordinals is a unique technological phenomenon unique to the Bitcoin blockchain and similar blockchain networks. Therefore, the average Ordinals platform will support both tokens and NFTs (non-fungible tokens) instead of traditional exchanges, which may support one another.

This is because the Ordinals implementation allows you to create tokens or NFTs using the same underlying concept.

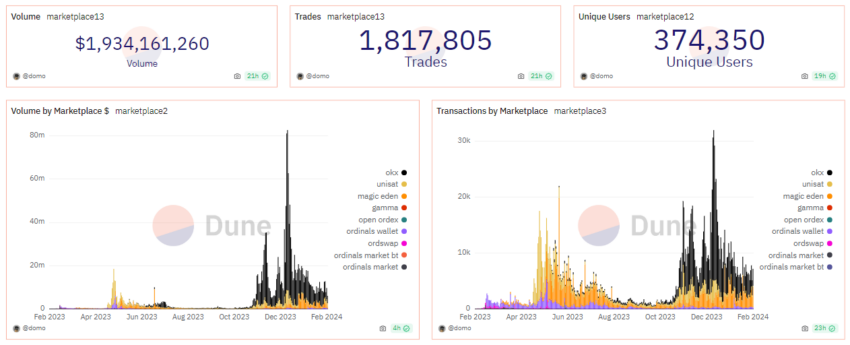

Ordinal marketplaces are very popular, accomplishing almost $2 billion in volume. Importantly, Bitcoin ordinals dominated network transaction volumes on release, becoming the primary driver of transactions and fees on the Bitcoin blockchain in August 2023.

What are BRC-20 tokens?

Despite the similar names, BRC-20 has no similarities to the ERC-20 token. BRC-20 is, however, a token standard for implementing fungible tokens on Bitcoin. Let’s break it down.

An Ordinal number, also known as a unique Bitcoin NFT identifier, represents a natural number assigned to a specific set of Satoshis.

Thanks to the Ordinals Protocol, these numerically designated Satoshis can now be associated with something more concrete, such as a digital file, be it an image, video, or any other digital asset. These numbered and tagged Satoshis become NFTs that hold significance within the Bitcoin ecosystem.

The concept of BRC-20, on the other hand, is an application of the Ordinals Protocol, essentially introducing a novel inscription strategy.

It is important to note that a BRC-20 token does not function as an Ordinal or Bitcoin NFT itself. Instead, it enables the tagged or numbered Satoshis to function as fungible tokens. In summary:

- Ordinals: Represent natural numbers assigned to Satoshis, primarily for tracking purposes within the Bitcoin network.

- Inscriptions: Under the Ordinals Protocol, inscriptions involve associating these numbered and tagged Satoshis with tangible digital assets, effectively creating NFTs within the Bitcoin ecosystem.

- BRC-20s: BRC-20 tokens, while related to the Ordinals Protocol, serve as an experimental implementation, allowing the tagged Satoshis to function as fungible tokens within the Bitcoin network, functioning more like standard tokens than NFTs.

How do Ordinals marketplaces work?

Ordinals are a unique application initially created on Bitcoin. Therefore, they require unique implementations to facilitate trades. For example, a Taproot-enabled wallet must engage with BRC-20 tokens and safely avoid cryptocurrency scams. Most Ordinals marketplaces use partially signed Bitcoin transactions (PBSTs) to allow users to trade.

Here’s how it works:

- Seller’s role:

- The seller initiates the process by signing an open and partially signed Bitcoin transaction.

- This transaction represents the transfer of ownership of a specific Ordinal, which is essentially a unique Bitcoin NFT identifier.

- Buyer’s role:

- The buyer steps in to complete the partially signed Bitcoin transaction initiated by the seller.

- This completion typically involves adding their own signature or making any necessary adjustments.

- Marketplace’s role:

- As an intermediary, the Ordinals marketplace ensures that the buyer and seller can trust the transaction.

- It handles the coordination between the parties and may hold the partially signed transaction until both parties have completed their parts.

- Finalizing and broadcasting:

- Once the buyer has completed their part and the transaction is fully signed, the marketplace converts it into a complete Bitcoin transaction.

- This final transaction is then broadcasted to the Bitcoin network, confirming the transfer of ownership of the Ordinal.

BRC-20 marketplaces vs. traditional NFT marketplaces

In the same way that BRC-20s are different from ERC-20s, BRC-20 marketplaces have some stark differences from traditional NFT marketplaces.

Traditional NFT marketplaces have a more developed ecosystem with features like auctions, fixed-price listings, and royalties for creators on resales. They also support various wallets and have interfaces that allow for easy browsing, buying, and selling of NFTs.

Ordinal marketplcaes are newer and typically offer a more basic set of features. This is because they rely on using the Bitcoin blockchain to create unique digital assets, which may limit some functionality seen in more mature NFT marketplaces. Aside from this, the differences in each platform are more technical than conceptual. However, if Bitcoin allows for more functionality in the future, these differences may widen.

3 best Bitcoin Ordinals collections

Due to the volatile and extremely ephemeral nature of Bitcoin ordinals interest, the top Bitcoin ordinals collections can be measured using many metrics. The top collections also change frequently, and many metrics can differ based on the source.

For our method, we will use the most traders of an NFT with data sourced from DappRadar and social media presence. This will also exclude most collections that have been created recently.

1. Bitmap

Bitmap represents a metaverse initiative built on the Bitcoin blockchain, where each piece of virtual land corresponds to a specific Bitcoin block number.

“Each Bitmap/District contains a certain number of ‘parcels’… One of the cool things about parcels, is that the owner of the Bitmap can, if they so choose, inscribe one of them onto a separate Satoshi, creating a new asset.”

Neil Fitzhugh, web3 consultant: X

2. RSIC Metaprotocol

The RSIC Metaprotocol, tied to the Runes coin, introduces a novel method for its pre-launch phase by airdropping RSIC ordinals to NFT wallets holding specific collections (e.g., Bitcoin frogs, puppets, Node Monkes).

This approach redefines token distribution by activating RSIC ordinals within a wallet, which triggers the mining of Runes coins with each Bitcoin block. At its core, the RSIC Metaprotocol is a peer-to-peer system designed to mine runes.

3. NodeMonkes

NodeMonkes is an inaugural collection of 10,000 digital collectibles on the Bitcoin blockchain, inscribed using the Ordinals protocol. This project has attracted significant attention and controversy. Its creators, who prefer to remain anonymous, are behind this pixelated Ordinals endeavor and have not outlined any future utility or roadmap for the project.

What’s the Bitcoin NFT hype about?

Bitcoin NFT popularity can be attributed to a few factors. Bitcoin NFTs were a new and untapped market when they came onto the scene. For better or worse, many traders constantly wait for the “next big thing” to deploy capital on the sidelines and make money.

On the other hand, Bitcoin NFTs came during a time of stagnant and under-utilized innovation on Bitcoin. So, Bitcoin NFTs and the technology underpinning them represent a step forward for some.

However, much to the chagrin of many, this has also increased block space utilization, thus skyrocketing fees on the network. This has led to some contention in the Bitcoin community and has sparked a greater conversation on what constitutes “spam” on the blockchain.

The aforementioned scenarios, in addition to the controversy around flooding block space with meme tokens and NFTs, including NFT trading, have stirred a newfound interest in Bitcoin NFTs and, subsequently, the Bitcoin protocol.

BRC-20 platforms simplify trading

BRC-20 platforms represent the tenacity of the crypto community to improve and look for innovation constantly. These Ordinals marketplaces are also a way to onboard users, which is great in a field of increasing complexity. If you have specific NFT trading needs and want to trade some BRC-20, consider exploring the BRC-20 platforms and the marketplaces we’ve recommended.

Frequently asked questions

You can sell BRC-20 tokens on any platform that supports them. Many popular centralized exchanges, such as Gate.io, OKX, or Binance support BRC-20. Some even allow you to hold them in your crypto wallet.

You can buy many BRC-20 tokens on popular marketplaces and wallets. Some of these include UniSats, OKX, or Ordinals Wallets. Traders should keep this in mind that there may be different fees associated with each method.

BRC-20 tokens are a standard for padding JSON data into Satoshis. With this method, users can create fungible tokens. This is not to be confused with Ordinal theory, which BRC-20s use to create tokens.

BRC-20 tokens have a market cap of about $2 billion dollars. This is due to the fact that inscriptions are very popular and make up a majority of fees and trading on the blockchain. It is also important to note that there are similar blockchains which use the BRC-20 implementation, but are not technically BRC-20s.

A BRC-20 is a token that exists on the Bitcoin blockchain. There are other blockchains that use the BRC-20 standardization to create tokens as well. Some of these include Dogecoin and Litecoin.

Prices of BRC-20 tokens vary from token to token. Some are a few cents while others can reach hundreds of dollars. BRC-20s are typically denominated and paid for in Satoshis.

BRC-20 was created by an anonymous developer named Domo. The technology that BRC-20s use, Ordinals, was created by Casey Rodarmor. Rodarmor is a former Bitcoin Core contributor.

ORDI is a memecoin on Bitcoin. It was the first BRC-20 token. Domo, the BRC-20 creator, also created ORDI.

To check your BRC-20 token balance you will need a wallet that supports Ordinals. Some wallets also allow you trade BTCs in addition to your BRC-20 tokens. They even simplify the process by specifying which Satoshis you wish to send.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.