Lookonchain, an on-chain analytics platform, reported that a crypto whale created a new wallet on May 16 and withdrew 1,870.68 ETH from the crypto exchange Gemini. Subsequently, the crypto whale used 1,870 ETH to acquire the 6 million ONDO tokens.

This transaction has caught the crypto community’s attention. Coincidentally, ONDO, the native token of Ondo Finance, witnessed a notable price increase following the purchase.

What Comes Next for ONDO’s Price?

On-chain data shows that this crypto whale bought ONDO at an average price of $0.95. This entry price is intriguing, as some analysts believe ONDO’s fair price range is between $0.40 and $0.70. Given their significant investment above the anticipated range, Lookonchain suspects the whale might have insider knowledge.

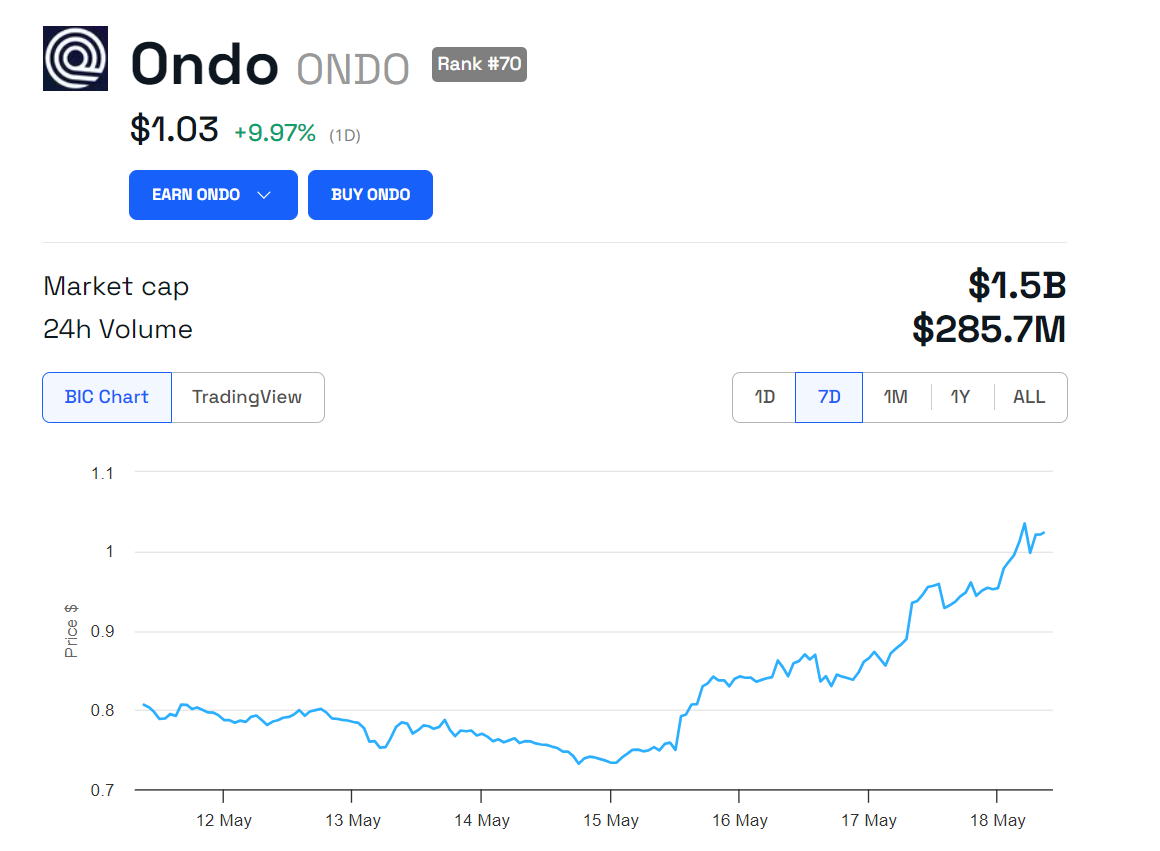

Following the whale’s purchase, ONDO’s price surged. It surpassed the $1 mark and briefly hit $1.04. This surge brings ONDO closer to its all-time high of $1.05, recorded on March 31.

However, ONDO is trading at $1.03 at the time of writing. The figure marks a 9.9% increase over the last 24 hours and a 26.3% rise in the past week.

Read more: What Are Tokenized Real-World Assets (RWA)?

Crypto analyst Mags commented on the price movement. He shared his analysis for ONDO’s next price target.

“If the price closes above $1, the next target would be $1.40 and $2.70+,” Mags wrote.

Despite this recent transaction, Ondo Finance, known for its innovative approach to tokenized securities, has recently been in the spotlight. Earlier this month, the platform announced a strategic partnership with Zebec Network.

This collaboration aims to enhance USDY, a stablecoin’s operation. Furthermore, it will integrate Zebec’s Instant Card technology and real-world asset (RWA) payment solutions.

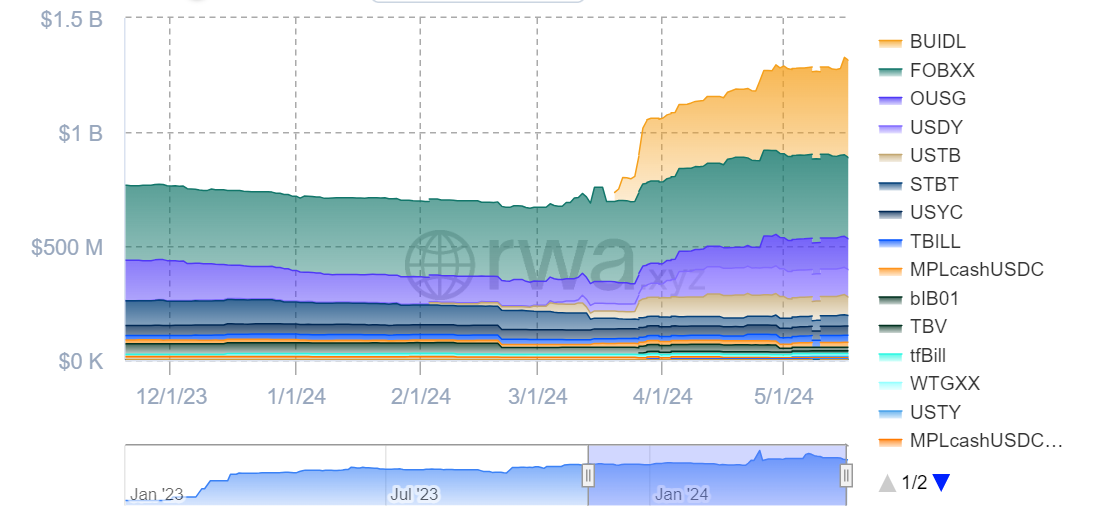

In another significant development, in March, Ondo Finance transferred $95 million to BlackRock’s newly launched tokenized fund, BUIDL. It aims to facilitate instant settlements for the Ondo Short-Term US Government Fund (OUSG), backed by US Treasuries. This move is particularly noteworthy since it is the first time a crypto protocol has used a tokenized fund for its offerings.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

According to RWA.xyz data, Ondo’s OUSG is currently the third-largest tokenized fund, with a market capitalization of $135.83 million. This aligns with recent research from CoinGecko, which predicts that RWA will be a dominant crypto narrative in 2024. Based on its data, as of May 18, crypto assets in the RWA category have a cumulative market capitalization of $8.43 billion.