The United States Internal Revenue Service (IRS), set to receive $80 billion in federal funding, has released drafts of individual tax return forms 1040 and 1040-SR for the 2022 financial year that hints at paying taxes on NFT gains.

In the 2022 Form 1040 draft, the IRS requires individual U.S. taxpayers to declare ownership of or gains from any cryptographically secure digital value representations, including non-fungible tokens, stablecoins, and virtual currencies.

If you want to know more about trading cryptocurrency, join BeInCrypto Trading Community on Telegram with like-minded people. Here you can share your experience, discuss and read all the hottest news on trading crypto, Web3 and the Metaverse. Join us

The taxpayer must answer in the affirmative if they have received digital assets as awards, rewards, or payments for property or services. These include receiving cryptocurrencies through hard forks, mining, and other transaction validation methods like staking. Furthermore, taxpayers must say yes if they got rid of any digital assets that were capital assets. Firstly, they must use Form 8949 to calculate that asset’s associated capital gains or losses. Afterward, they must record the capital gain or loss on Schedule D of Form 1040.

Any digital assets received from customers for services, or sold to customers to generate income, must be reported. The reporting is similar to how income or loss from a sole proprietor is reported using IRS Schedule C.

The good news for taxpayers is that they do not need to say yes if they held or moved crypto assets between their own wallets that they purchased using fiat currency during 2022.

IRS rules around crypto and NFT gains

The Internal Revenue Service considers crypto assets and NFTs property for tax purposes.

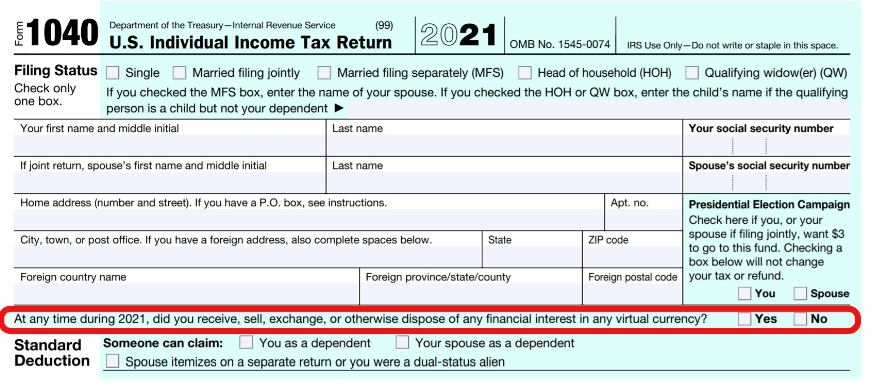

The question about taxable crypto activity has appeared on income tax return forms since 2019. Accordingly, the 2021 form contained the crypto asset question:

“If you check yes, you’re flagging yourself, and the IRS is going to be looking for some sort of capital gain or loss on your Schedule D,” said Tommy Lucas, a certified financial planner.

Hodlers may benefit from longer-term capital gains tax of 0%-20%. Traders who enter and exit more quickly could pay up to 37% tax on their NFT. If crypto firms don’t keep detailed records, traders could be in trouble. Incomplete records make it difficult for traders to determine the cost bases of their crypto purchases, including NFTs. Finding out the cost basis is a critical step in determining crypto or NFT gains or losses.

IRS beefs up enforcement thanks to federal funding

If a taxpayer does not answer the crypto question on Form 1040, the IRS could audit them. After that, the IRS could then fine the taxpayer, or charge them with tax evasion.

Under the new Inflation Reduction Act, the IRS will receive $46 billion from the U.S. federal government for tax crime enforcement. This includes cracking down on cryptocurrency-related tax evasion.

Recently, the IRS issued a “John Doe” summons to New York-based M.Y. Safra Bank to provide transaction records of customers of a crypto brokerage that used the bank’s services. Following this, they intended to use these records to reveal non-compliant tax practices amongst the brokerage’s customers.

“The government is committed to using all of the tools at its disposal, including John Doe summonses, to identify taxpayers who have understated their tax liabilities by not reporting cryptocurrency transactions, and to make sure that everyone pays their fair share,” said U.S. Attorney Damian Williams at the time.

< Previous In Series | Taxes | Next In Series >

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here