The NEO price trades inside a short-term bullish pattern just above a long-term horizontal support area.

While long-term readings are still undetermined, short-term ones suggest that a breakout will transpire soon.

NEO Falls Despite Long-Term Breakout

The weekly timeframe technical analysis shows that the NEO price broke out from a 609-day descending resistance line at the beginning of January. Breakouts from such long-term levels will lead to significant future price increases.

After breaking out, NEO reached a new yearly high of $15.80 in February. The high was made above the $12 horizontal resistance area. After the breakout, the area was expected to provide support.

However, the alleged breakout (green circle) was only a deviation. Shortly afterward, NEO fell below the horizontal area, validating it as resistance (red icon). This led to a low of $6.38 in August.

Moreover, the weekly RSI supports the ongoing descent. With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true. The indicator is below 50 (red circle) and decreasing, both signs of a bearish trend.

The closest support area at $6.30 is 15% below the current price, while the closest resistance at $12 is 60% above it.

NEO Price Prediction: Will Breakout Transpire?

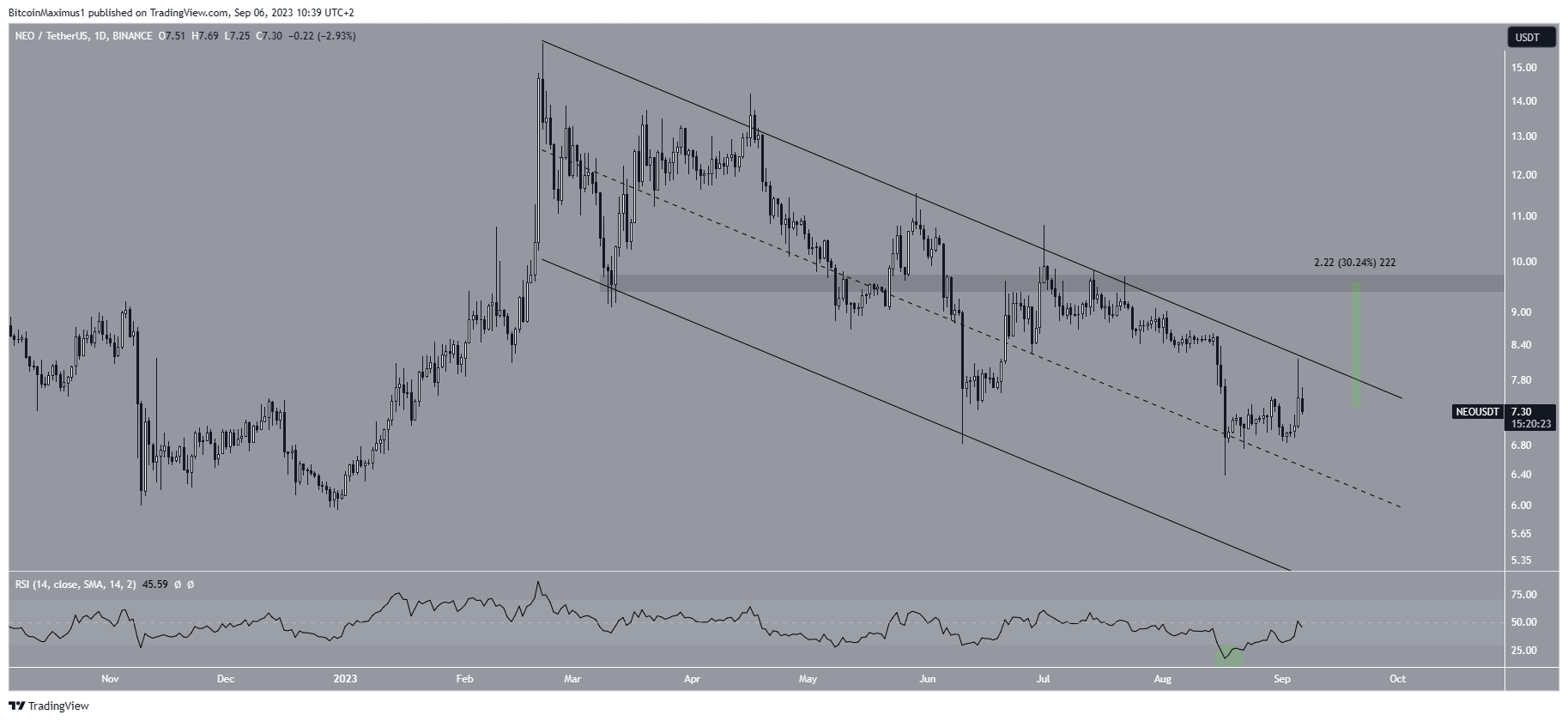

The technical analysis from the daily timeframe provides a more bullish outlook than that from the weekly one. The reason for this comes from both the price action and technical indicator readings.

As for the price action, NEO has fallen inside a descending parallel channel since the yearly high in February. These channels usually contain corrective movements. Therefore, the most likely future price scenario is an eventual breakout from the channel. Also, NEO is trading in the channel’s upper portion. This is another sign that supports the possibility of a breakout.

Next, the RSI fell to 19 on August 17 (green circle). This is the lowest RSI value since March 2020, when the previous bull cycle began. Therefore, such low RSI values are often associated with price bottoms. The indicator has increased since but is not above 50 yet.

So, the most likely future price outlook is an increase to the next resistance at $9.60. This would amount to an upward movement of 30% measuring from the current price.

Despite this bullish NEO price prediction, failure to break out from the channel can lead to a retest of the long-term support at $6.30, a 15% drop from the current price.

The support area will coincide with the channel’s midline between September 15 and 20. Therefore, if the price fails to break out, it could drop to this confluence of support levels.

For BeInCrypto’s latest crypto market analysis, click here.