In a recent, intriguing statement, Samson Mow, the CEO of JAN3, boldly predicted a meteoric rise in Bitcoin’s value to $1 million, suggesting this could happen “in days to weeks.”

This forecast, while startling, is not baseless. Mow elaborated that Bitcoin often defies expectations and causes disruption, especially when it’s least expected.

Bitcoin Price Prediction: $1 Million

At the core of Mow’s argument is the concept of “max pain” for the majority. Bitcoin’s unpredictable nature, as Mow noted, is its hallmark. This unpredictability could lead to a rapid increase in Bitcoin’s price, disrupting not just individual plans but entire economic systems.

For instance, JAN3, under Mow’s leadership, has been planning to onboard nation-states into the Bitcoin ecosystem. This is a process that would be severely impacted by such an abrupt price hike.

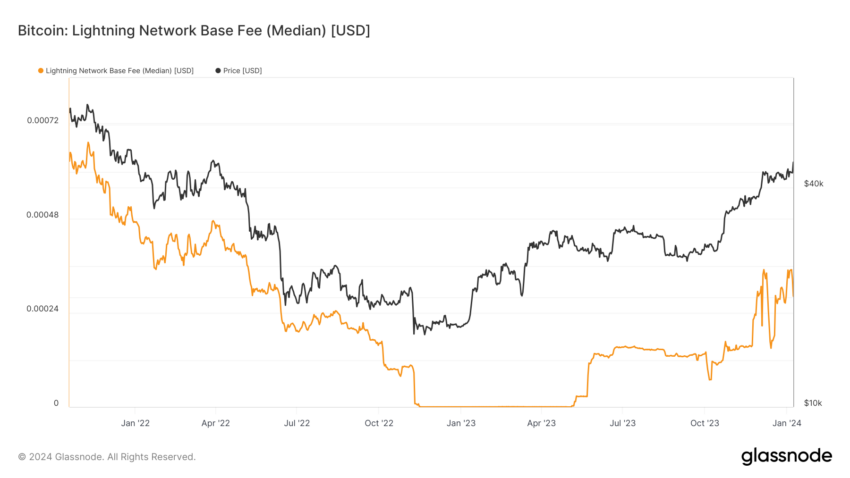

Mow also discussed the Plan B’s Stock-to-Flow (S2F) model, a popular method for predicting Bitcoin’s price, which would break under such circumstances. Additionally, the Lightning Network, designed to enable cheaper and faster Bitcoin transactions, could become impractical if Bitcoin’s price soared to $1 million.

The assumption of “cheap” transaction fees would no longer hold, rendering current lightning channels potentially useless.

“The main problem with Lightning is that it was designed to interact with the main chain under the assumption that fees would be ‘cheap’ ish (potentially with bigger blocks down the road). But it breaks down when fees are not cheap… And the problem is that fees are not going to get cheaper. Bitcoin transaction fees are only going to get more expansive both in BTC and dollar terms,” Mow explained.

One of the most striking impacts of a sudden price increase to $1 million would be on entities like MicroStrategy and countries like El Salvador.

MicroStrategy, led by Michael Saylor, would find their goal of owning 1% of the Bitcoin supply elusive. This is despite the company’s massive investment. Meanwhile, El Salvador, which has taken significant steps to adopt Bitcoin, would miss an opportunity to issue Bitcoin bonds and build their reserves at lower prices.

BTC Skeptics Would Be in Max Pain

Mow humorously noted that this scenario could lead to job losses for prominent economists and central bankers like Christine Lagarde and Jerome Powell, as the financial world shifts rapidly to accommodate Bitcoin. This hyperbitcoinization would come with its share of challenges, forcing the legacy financial system to reorganize around Bitcoin swiftly.

Interestingly, Mow also mentioned the psychological impact on gold advocates like Peter Schiff, who have long opposed Bitcoin. A swift rise to $1 million would be a tough pill to swallow for them, especially with gold prices stagnating.

“Lagarde, Powell, and many highly regarded economists lose their jobs… [And] Peter Schiff and goldbugs suffer a collective mental breakdown after Bitcoin goes to $1 million fast,” Mow added.

In a broader context, Mow’s prediction hinted at a missed opportunity for the global population. The rapid ascent to $1 million would mean most people missed their chance to invest in Bitcoin. Instead, earning Bitcoin through work would be the only viable option left for many.

Read more: Who Owns the Most Bitcoin in 2024?

Mow concluded by emphasizing that the likelihood of Bitcoin making an unexpected move that results in “max pain” for the largest number of people is high. Factors like spot Bitcoin ETF approvals, the upcoming Bitcoin halving, nation-state adoption, renewed quantitative easing, and the Veblen effect are not yet reflected in Bitcoin’s price, according to him.

While Mow’s prediction may seem far-fetched to some, it is a reminder of Bitcoin’s inherent unpredictability and potential for disruption.

Former Coinbase CTO Balaji Srinivasan, also made headlines in March 2023 with his forecast of an upcoming crisis. He suggested this crisis would trigger a deflationary spiral for the US dollar, ultimately culminating in a hyperinflationary environment. Such a scenario, Srinivasan projected, would propel the price of Bitcoin to an unprecedented $1 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.