MicroStrategy aims to sell up to $2 billion of its class A shares to invest in Bitcoin and for other corporate uses.

The Virginia-based company disclosed this plan in a recent regulatory filing with the US Securities and Exchange Commission (SEC).

MicroStrategy Eyes $2 Billion Bitcoin Buy

According to the filling, MicroStrategy, widely recognized in the digital assets industry for Michael Saylor’s unwavering belief in Bitcoin, plans to increase its cryptocurrency holdings. However, it does not specify a timeline for the share sales. The exact portion of proceeds allocated for Bitcoin purchases is also not mentioned.

This announcement comes with MicroStrategy’s release of its second-quarter financial results. The report reveals a quarterly loss driven by an impairment charge on its Bitcoin holdings, valued at approximately $13.77 billion.

During the second quarter of 2024, MicroStrategy acquired 12,222 Bitcoin, spending over $805 million at an average price of $65,880 per coin. This acquisition increased the company’s total Bitcoin holdings to 226,500, solidifying its position as a public company with the largest BTC reserve.

Commenting on the second-quarter results, the firm’s president Phong Le described their Bitcoin strategy as “successful,” noting a 70% surge in the market value of the company’s holdings.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis,” Le stated.

Read more: Who Owns the Most Bitcoin in 2024?

Despite the bold statements from MicroStrategy’s management, broader market sentiment remains negative. The US government initiated the bearish trend by announcing a $2 billion sell-off from seized BTC holdings, followed by Fed rate pause decision on July 31 and a weak US jobs report on August 2.

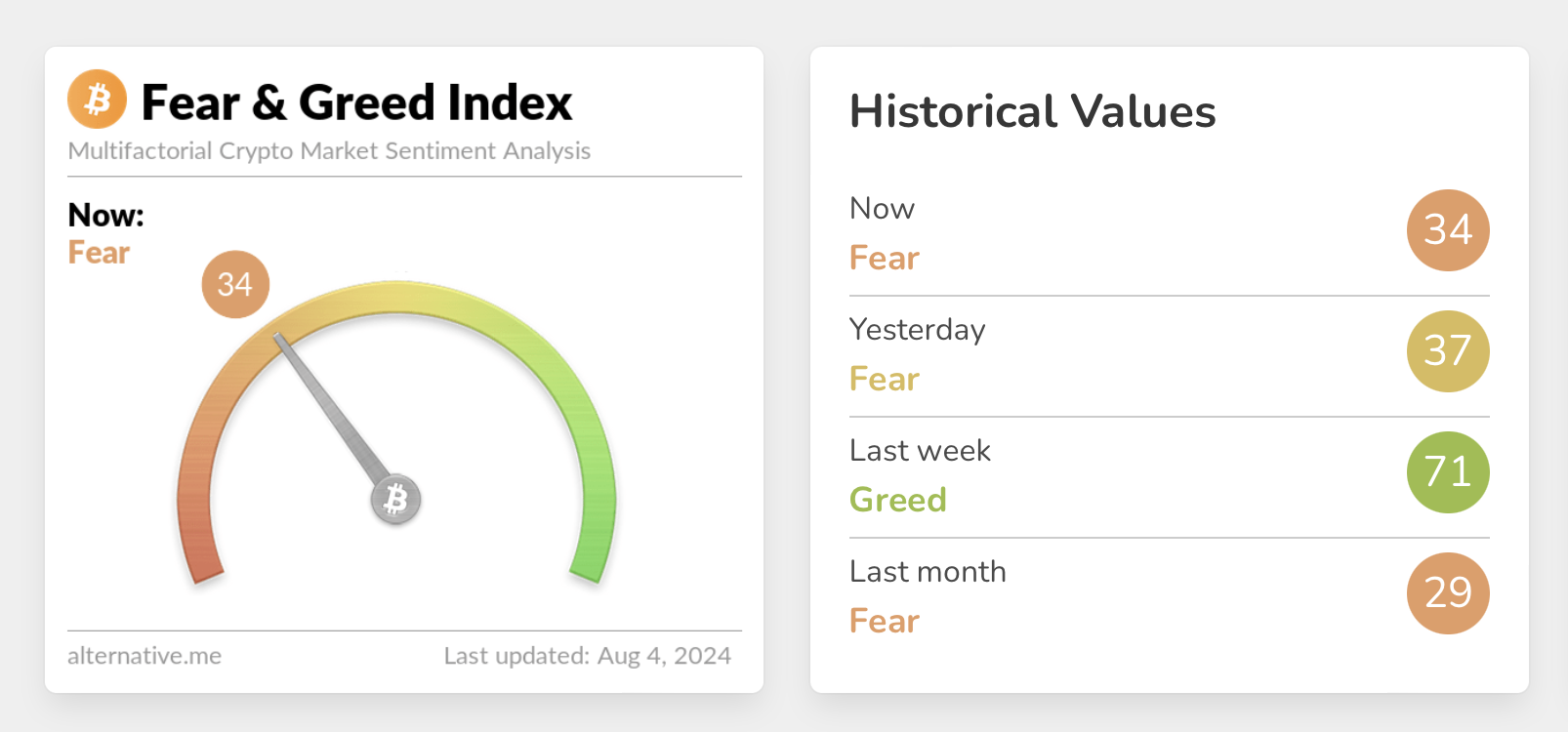

Contributing to the bearish momentum, Genesis Trading transferred over $1.5 billion in Bitcoin and Ethereum. As a result, Bitcoin’s price fell below $61,000, and the Fear and Greed Index dropped into the fear zone.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite these fluctuations, industry leaders’ long-term perspective on Bitcoin remains optimistic. VanEck CEO Jan Van Eck predicts that Bitcoin could eventually match half the market capitalization of gold. This estimation would value Bitcoin at approximately $350,000.

“To me, its no doubt that Bitcoin is being adopted the way gold is. Its obvious,” Jan Van Eck said.