Bitcoin’s (BTC) attempt at a modest rally during US trading hours on Friday was swiftly quashed. The largest cryptocurrency experienced a sharp drop, falling from $65,000 to below $62,000.

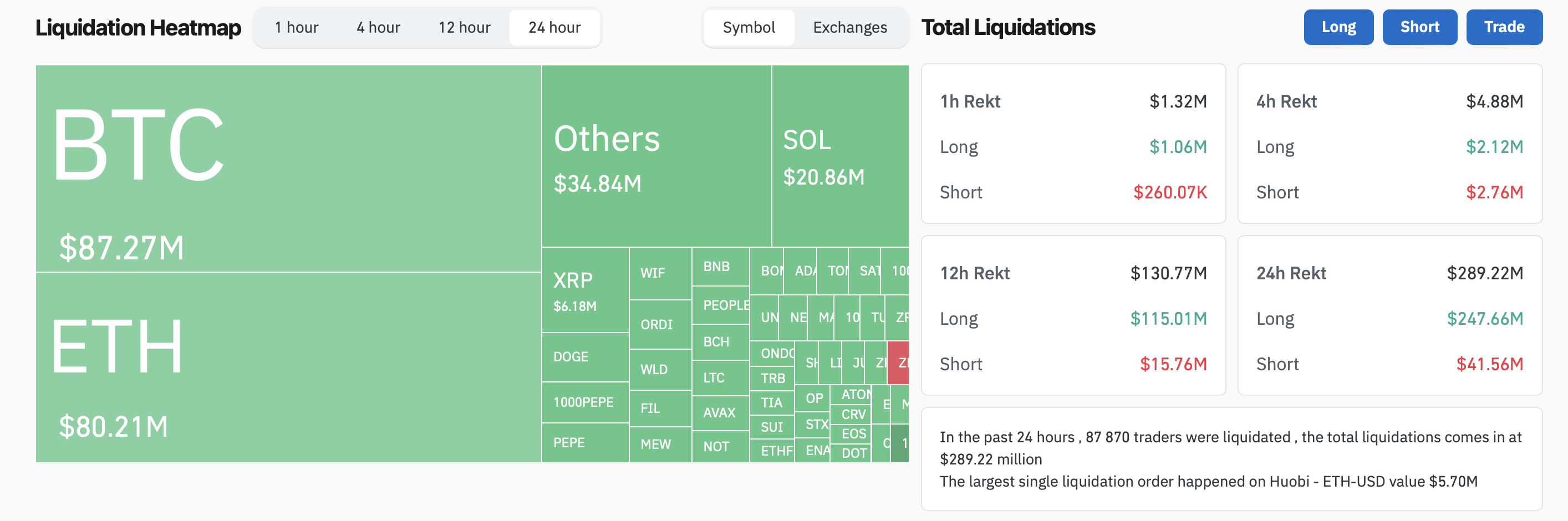

This sudden decline triggered a wave of liquidations, erasing $290 million in both long and short positions over the past 24 hours.

Bitcoin Sinks Below $62,000

The recovery rally ahead of the FOMC meeting and positive July CPI data fostered a bullish sentiment. However, the long-anticipated rate cut was delayed, with the next possible decision in September. Consequently, the excitement in the crypto market subsided quickly, leading to a bearish turn of events.

A weak US jobs report for July released earlier on Friday caused bond yields and the dollar to plunge. Typically, such a scenario boosts risk assets like stocks and Bitcoin, but not this time. Initially, Bitcoin managed a slight gain, climbing above $65,000. However, it soon fell victim to the broader risk-off sentiment, dropping below $62,000.

“Bearish macro sentiment from the high unemployment print had spillover effects on crypto with increased anticipation of recession down the road. VIX crossed above 28 today, the highest print since the regional banking crisis in Mar23. Crypto vol market indicated expectations for price volatility to settle down into the summer in spite of the jumpy price action we’ve seen in the last few days,” QCP Capital analysts wrote.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Adding to the bearish momentum, Genesis Trading transferred over $1.5 billion in Bitcoin and Ethereum. This move caused BTC to fall 2.2% and ETH to register a 2.5% correction within an hour. The transactions, involving 16,600 BTC and 166,300 ETH, are likely initiating in-kind repayments to creditors.

During this market upheaval, both mainstream and emerging digital assets suffered. Data from CoinGlass showed Bitcoin as the hardest hit, with liquidations totaling $87.27 million. Ethereum and Solana (SOL) followed with $80.21 million and $20.86 million in liquidations, respectively.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

This development follows several supply shocks to the crypto market. In early July, the German government sold 50,000 BTC. Additionally, distributions from the bankrupt exchange Mt. Gox have begun, and there are looming sales from the US government’s Bitcoin stash. The latest actions involving Genesis further add to the growing list of factors putting downward pressure.

“August started off with significant setbacks: global stock markets are in red. The Bank of Japan’s rate hike, coupled with disappointing US economic data and lackluster tech earnings has triggered a significant sell-off across major indices. Adding to that, Bitcoin dipped to $63,569 and is undergoing an intense sell-off. As picked up recently by Arkham Intelligence, Genesis transferred $1.5 billion in Bitcoin and Ethereum to repay its creditors. Just like the Mt.Gox, this move is sparking a selloff scare that is driving Bitcoin’s volatility at the moment,” Akshay Nassa, Founder of Chimp Exchange, told BeInCrypto.

Outflows from Bitcoin exchange-traded funds (ETFs) further complicate the market scenario. According to SoSoValue, the total net outflow on August 2 was $237 million. Grayscale ETF GBTC saw a single-day outflow of $45.94 million, Fidelity ETF FBTC had a net outflow of $104 million, and BlackRock ETF IBIT experienced a single-day inflow of $42.81 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.