MetaMask and Uniswap pull swap support for Richard Heart’s HEX token following the US Securities and Exchange’s (SEC) lawsuit against the founder.

The largest decentralized exchange on Ethereum removed support for the token after the SEC sued Heart for offering what it claims to be an unregistered security.

MetaMask and Uniswap Users View HEX Ban as Unnecessary

Self-custodial wallet MetaMask also stopped HEX swaps, prompting criticism from both users of both platforms. One user on Uniswap pointed out that the platform is unfairly targeting HEX when many other scam tokens launch daily.

Earlier this week, the SEC sued HEX creator Richard Heart for securities fraud.

According to the SEC, Heart offered returns on HEX and two other tokens in products that qualify as investment contracts. The founder also allegedly committed securities fraud by spending investor funds to buy luxury goods.

As a result, the agency demanded he be banned from participating in future token sales and pay disgorgement and civil fines.

The lawsuit is the latest SEC crypto enforcement action in a recent blitz that threatens US leadership in the space. Already, the SEC has sued several firms and individuals responsible for allegedly breaking US laws by offering tokens as unregistered securities.

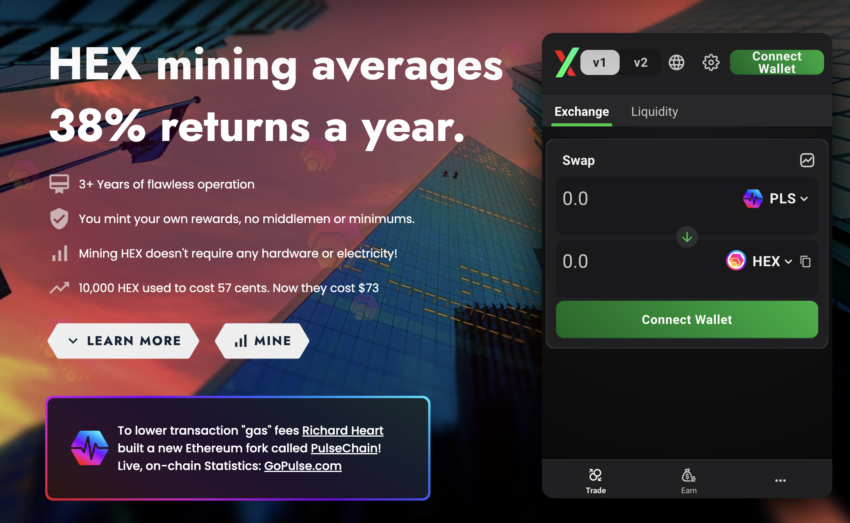

A visit to the HEX website suggests that it may satisfy certain prongs of the Howey Test that pertains to an expectation of profit.

At press time, the HEX token is up 9% in the last 24 hours and is trading for $0.00528.

DeFi Regulation Starting to Emerge

Historically, governments have experienced challenges in creating rules for the decentralized finance (DeFi) space.

The SEC recently reopened the comment period for proposed changes to its definition of an exchange. Before the reopening, the agency warned that some decentralized finance platforms fitting the current description of an exchange could soon face action.

To learn more about the differences between centralized and decentralized exchanges, check out our guide: CeFi vs. DeFi: Everything You Need To Know

Last month, a new US bill proposed new anti-money laundering rules for DeFi. Under the proposed law, any protocol without a majority owner will need anyone investing $25 million or more in its development to ensure compliance.

Even Europe’s Markets-in-Crypto-Assets laws, set to become effective in 2024, do not cover DeFi.

Got something to say about Uniswap and MetaMask banning HEX swaps or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.