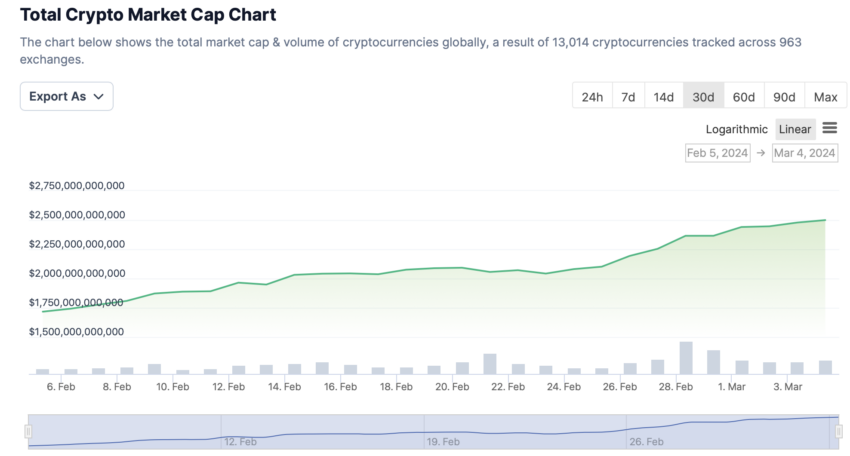

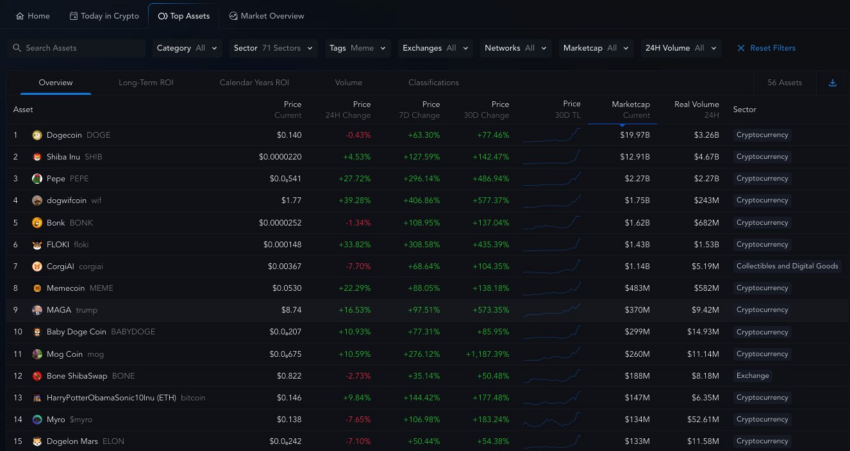

With the crypto market cap surpassing $2.5 trillion, numerous memecoins are emerging as notable winners. The memecoin sector is flourishing and has exceeded the market capitalization of non-fungible tokens (NFTs).

Could this be a sign that retail traders are moving into more risk-on assets?

Crypto Market Cap Is Soaring, Memecoins Dominate

The latest data from CoinGecko shows that the crypto market cap has exceeded $2.5 trillion.

In the midst of this milestone, Messari CEO Ryan Selkis highlighted that the meme coin market reached $40 billion, surpassing many other emerging sectors, including decentralized finance.

“Memecoins ($40B+ in aggregate market cap) are bigger than DeFi, DePIN, Exchange cohorts.”

The majority of major crypto tokens in the market have experienced a price surge over the past week, contributing to the spike in market cap. Meme coins like PEPE have surged by around 300% in the last seven days.

Read more: 10 Best Crypto Exchanges And Apps For Beginners In 2024

Additionally, Dogecoin (DOGE) has seen an 83% increase during the same period.

Even among the major cryptocurrencies, significant price bumps have been observed. Ethereum witnessed another spike this week, recording a 12.51% increase in price, while Bitcoin has surged by 24.4% over the past seven days.

Speculative Events May Lead to Higher Market Cap

Meanwhile, the potential of additional Bitcoin ETF providers shortly will open the floodgates for funds to enter the crypto market. This would likely consequently lead to a larger boost in market cap.

On February 29, BeInCrypto reported that Bank of America’s Merrill Lynch and Wells Fargo & Co would be opening up spot Bitcoin exchange-traded funds (ETF) to their clients.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

The community is closely watching Ethereum’s price due to ongoing speculation regarding the potential approval of the spot Ethereum ETF in May.

A rise in a crypto’s price usually results in a corresponding increase in its market capitalization. This is calculated by multiplying the current price by the circulating supply of the crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.