Litecoin (LTC) price has reclaimed the $65 territory after briefly dropping to a new 2023 bottom of $58 last week. On-chain analysis examines if the early recovery signals could evolve into a prolonged bull rally.

Litecoin (LTC) whales swooped in to buy the dip last week, inadvertently triggering a 12% rebound toward $66 around September 15. But as the next Federal Open Market Committee (FOMC) meeting draws near, Litecoin whales seem to have cooled their buying pressure. Which way will the LTC price head after the Fed rate announcement on September 19?

Litecoin Whales Have Cooled the Buying Pressure

Litecoin (LTC) whales swooped in to buy the dip last week. But they seem to be taking a more subdued stance ahead of the upcoming Fed meeting.

On-chain data shows how the whales holding 10,000 to 1 million LTC coins had played a pivotal role in the recent price rebound. Between September 10 and September 14, they bought the dip to the tune of 510,000 LTC coins, increasing their balances from 38.94 million LTC to 39.45 million LTC.

But since then, they have taken a neutral stance, keeping their balances steady around the same levels.

Whale investors are individuals or corporate entities holding a significant amount of cryptocurrency, ideally $100,000 or more. Due to their substantial holdings, their trading activity often moves the markets significantly.

At current prices of $65, the 510,000 LTC the whales accumulated over the past week is worth approximately $33.2 million. The chart above illustrates how the price trend increased once the whale cohort started to buy the dip last week. And unsurprisingly, LTC price has stalled at $65 since they stopped buying.

Notably, whale investors are known to be sensitive to changes in interest rates set by central banks like the US Federal Reserve, as it impacts yield on other investment alternatives.

Hence, if the Fed cuts rates or holds it steady at 5.50% as Reuters economists anticipate, it could trigger a bullish market reaction, and the Litecoin whales could start buying again.

Read More: 6 Best Copy Trading Platforms in 2023

Retail Investors are Yet to Ape In on the Recent Price Recovery

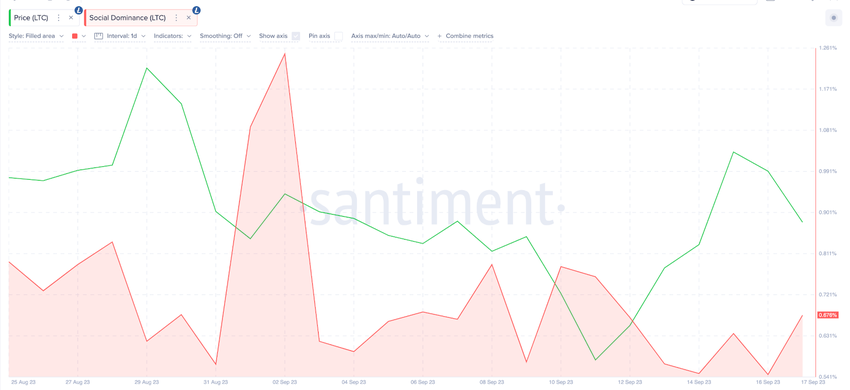

Despite the recent 12% price bump, LTC has continued to fly under the radar of the retail market participants. As depicted below, while Litecoin price trended upwards, Social Dominance has remained flat, around 0.60% to 0.70%, over the past week.

Social Dominance measures the percentage of social media mentions a cryptocurrency attracts about the top 50 most talked about projects. During a price rally, a downtrend in Social Dominance means the project is not yet attracting extreme media attention. This could mean the Litecoin price is yet to hit a market top.

Hence, the chart above illustrates that Litecoin price still has significant room to rally upward before market euphoria sets in.

In conclusion, if the Fed holds rates steady, Litecoin whales could start buying again. And if the retail investors also get in on the act, LTC price could hit a prolonged rally toward $80.

LTC Price Prediction: $80 is a Viable Target

From an on-chain perspective, the whales could trigger another Litecoin price rally toward $80 territory if the upcoming Fed meeting yields a favorable outcome for the crypto market.

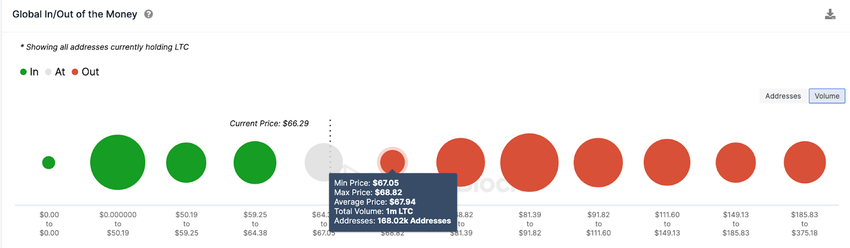

The In/Out of Money Around Price data, which depicts the purchase price distribution of current Litecoin holders, also validates this bullish stance.

It shows that if the LTC price scales the $68 obstacle, the bulls could gain momentum to push for $81.

As shown below, the 168,020 addresses bought 1 million LTC at the maximum price of $68 currently pose a major resistance. But if the whales’ optimism intensifies, the Litecoin price rally could hit $81

Conversely, the bears could seize control if the LTC price drops below $50. However, as shown below, 623,820 addresses had bought 5.23 million Litecoin at the minimum price of $59. They could offer considerable support by making spirited attempts to cover their positions.

But if that support level caves in, then the LTC price could eventually drop toward $50