The Litecoin (LTC) price is trading at a make-or-break support level that could be crucial in determining the future trend.

A breakdown from the current support will invalidate a year-long bullish structure. On the other hand, a sharp bounce will likely lead to another attempt at breaking out above $100.

LTC Price Struggles After Failed Breakout

The analysis of LTC’s weekly time frame provides a mixed reading, leaning on bearish.

The price has fallen since April when it was rejected by the $100 horizontal resistance area (red icon). Then, the price created a lower high, validating the area as resistance and causing another drop.

This took the LTC price to an ascending support line that has been in place since June 2022.

Whether the price breaks out or bounces at this line could determine the future trend.

The RSI is leaning bearish, supporting the possibility of a breakdown. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true. The indicator has fallen below 50 and is decreasing, a sign of a bearish trend.

Litecoin (LTC) Price Prediction: Will Breakdown Ensue?

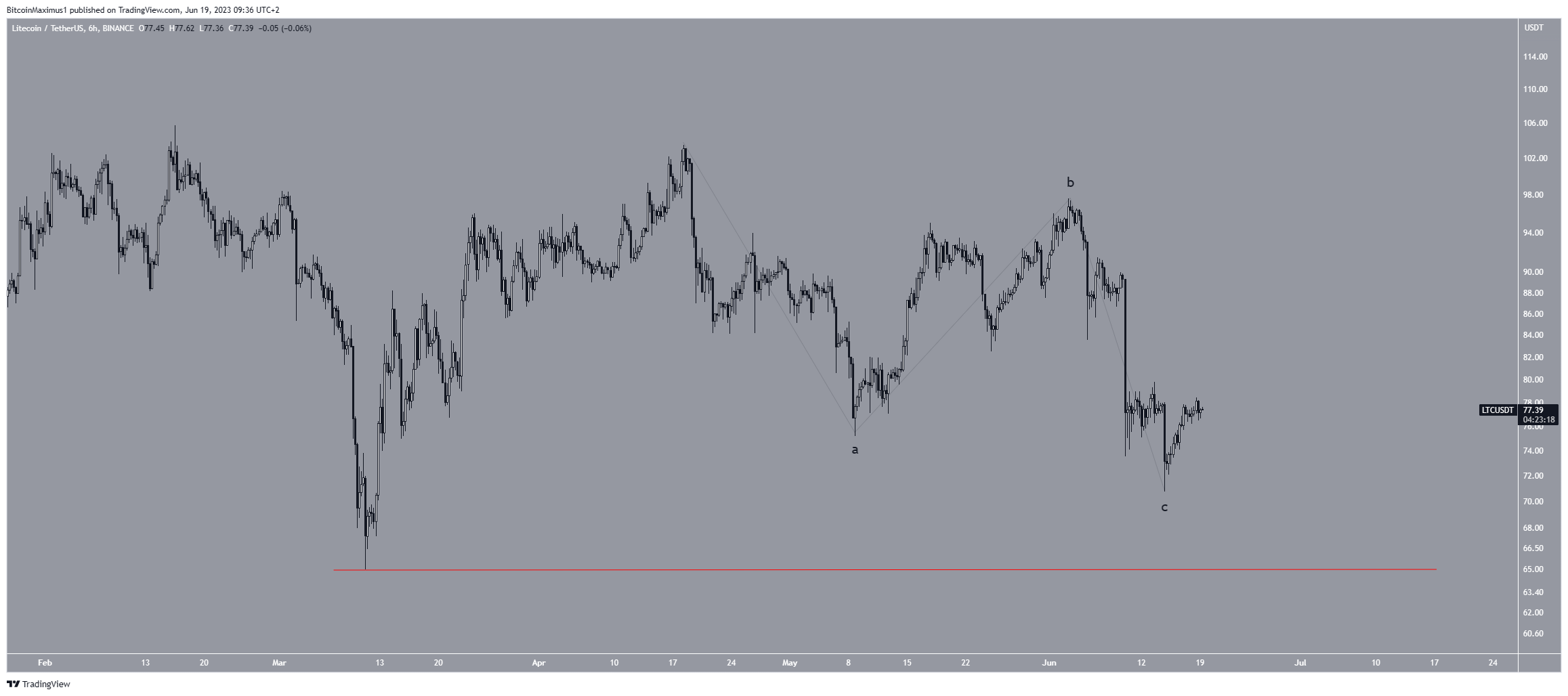

While the 3-day chart is bearish, the six-hour chart is still undetermined. The main reason for this is that the decrease since April 18 looks like a corrective A-B-C structure. Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend.

If the drop is an A-B-C corrective structure, the LTC price trend is actually bullish. The price will move above the $100 resistance area in this case.

However, a decrease below the previous low of $65 (red line) will invalidate this bullish forecast. This would mean that the trend is bearish, and new lows will follow.

Since this would also cause a breakdown from the long-term ascending support line, it could catalyze a fall to $50.

Therefore, the LTC price prediction will determine whether the price breaks below $65 or bounces at the current ascending support line. The former will likely lead to a drop to $50, while the latter could cause a bounce to $100.

More From BeInCrypto:

For BeInCrypto’s latest crypto market analysis, click here