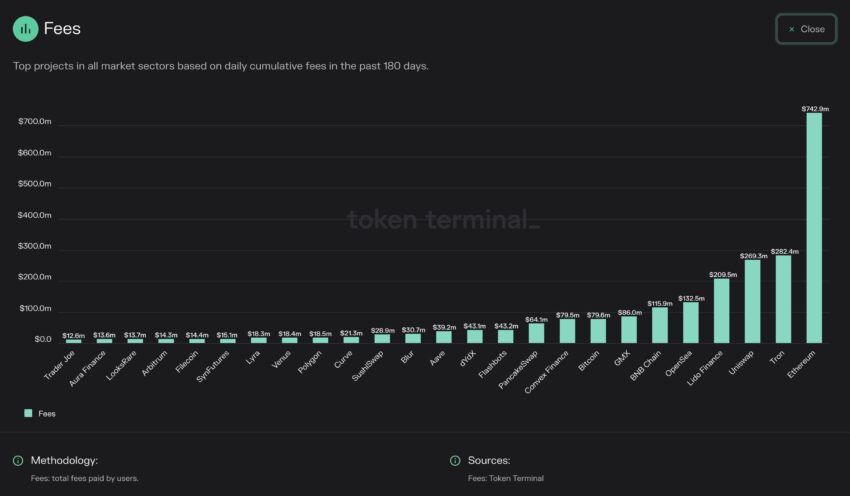

The Ethereum network is way ahead of its blockchain peers in terms of generated fees. This metric reflects its continued adoption.

On April 10, blockchain data firm Token Terminal reported on the top network fee generators over the past six months.

It came as no surprise that Ethereum was way ahead of the others, generating more than double the fees of the second-highest contender.

Over the past half a year, Ethereum has generated a whopping $743 million in cumulative daily fees. According to Token Terminal, Ethereum’s closest rival, TRON, generated less than half of this at $282 million.

Furthermore, Ethereum generated almost ten times more fees than the Bitcoin network, which had just under $80 million for the period.

Current Ethereum Fees Low (But High)

Token Terminal stated that looking at fees is important because it is a metric that “tells us which protocols are actually used.”

Protocol usage and adoption are signs of continued growth for the ecosystem, and Ethereum is clearly the industry leader.

Uniswap was the third largest crypto network in terms of fees generated, with $269 million over the past six months.

According to Crypto Fees, Ethereum has generated around $6 million per day in fees on average over the past week. Rival platform Solana, which has been called an ‘Ethereum killer,’ has generated just $36,700 in average daily fees.

Moreover, BitInfoCharts is reporting relatively low average transaction fees for Ethereum of around $4.70. However, for average non-whale users, this remains quite costly compared to alternative networks. Despite its high fees, Ethereum remains dominant in this metric.

Layer 2 networks have emerged as a solution to this conundrum. The most popular L2, Arbitrum One, is the sixth-highest network in terms of fees generated. According to Crypto Fees, it has generated a daily average of $236,000 in fees over the past week.

Additionally, L2fees reports that it costs just $0.06 to make an Ethereum transaction on the Aribtrum network and $0.17 for a token swap.

However, it can take a week to get Ethereum off of the network due to the nature of its optimistic rollup technology. Therefore, it is far from a perfect solution.

ETH Price Outlook

Ethereum prices have remained flat over the past 24 hours. As a result, the asset was trading for $1,859 at the time of writing.

ETH remains in the shadow of Bitcoin, which has consolidated for the past three weeks or so. More volatility could be imminent this week with the Shanghai (Shapella) hard fork on April 12.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.