The London Stock Exchange Group (LSEG) is launching a blockchain-based system to trade digital assets. Rather than offering the exchange and settlement of crypto assets, the new network will offer the efficient exchange of digitized stocks and bonds.

Murray Roos, head of the LSEG, said digital technologies will provide a novel opportunity for exchanging digital assets across a fully-regulated platform. The exchange is in talks with regulators in the UK and elsewhere to hopefully launch the business in one year.

LSEG Adopts AI and Blockchain in Quick Succession

Roos said of the project:

“The ultimate goal is a global platform that allows participants in all jurisdictions, as well as the government and Treasury in the UK…something that isn’t possible in the analog world.”

Learn the basics of asset tokenization here.

In the US, the exchange must abide by rules put forward by the US Securities and Exchange Commission (SEC). Generally, to ensure minimal conflict of interest, businesses must separate clearinghouse and brokerage functions.

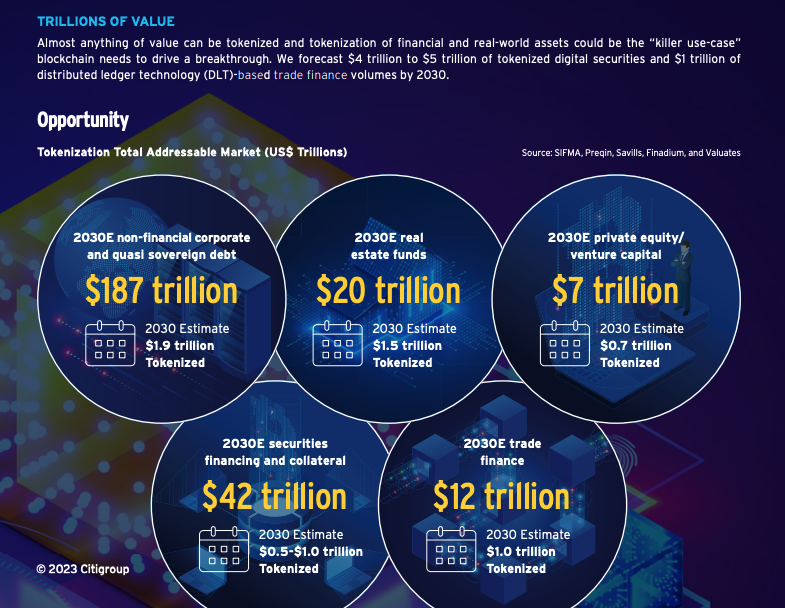

LSEG’s digital platform will seek to improve transaction speeds on private markets before the public launch. In a report earlier this year, Citi predicted tokenization would grow 80x in private markets by 2030.

Meanwhile, LSEG is experimenting with new artificial intelligence trading models combining corporate and customer data. Banks and LSEG can share data over a secure connection to prevent data leakage into the trading models of other exchanges.

Tokenized Assets Bring Ownership Out of the Dark Ages

The exchange of real-world assets presents significant challenges since they are often mired in opaque ownership and legal processes. Traditional laws also tie up ownership in large stakes not easily sold to generate cash.

Learn about the best crypto exchanges for beginners here.

That’s where investment bankers, including BlackRock CEO Larry Fink, see an opportunity for improved efficiency. Fink said earlier this year that tokenization is the future of markets. At the same time, several banks, including Singapore’s Sygnum Bank and Germany’s Deutsche Bank AG, have signaled serious intent to offer asset exchanges over blockchains.

Property expert SteelWave can split ownership of an asset into liquid securities tradable on an exchange. Ownership fractionalization protects investors from selling shares at steep discounts.

Earlier this year, the UK Law Commission proposed cryptocurrencies and NFTs be treated like property. If approved, digital assets would fall under personal property definitions of a “thing in possession” or a “thing in action.”

Got something to say about the London Stock Exchange Group launching tokenized assets on the blockchain or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.