Citi Bank predicts in its March report that blockchain-based tokenization will reach a user base of billions and a value of trillions of dollars.

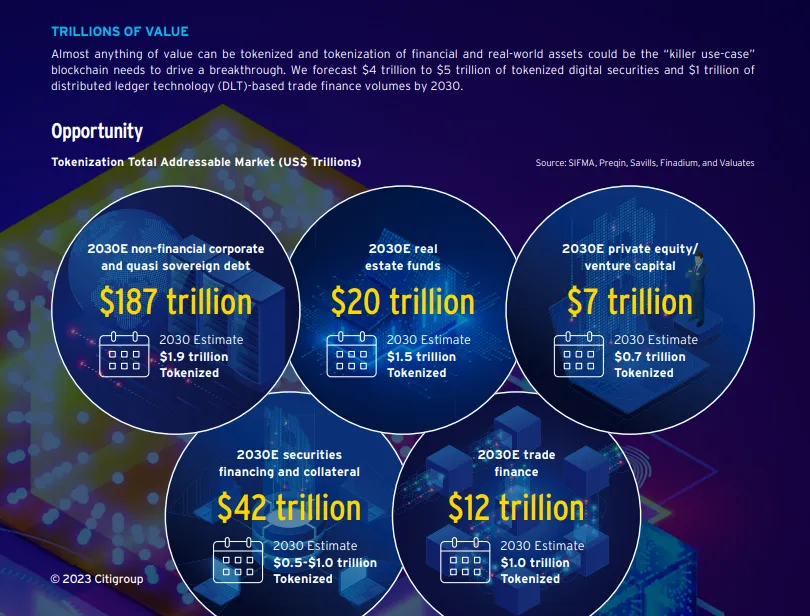

Kathleen Boyle, the managing editor of Citi GPS, has put bets on the tokenization of financial and real assets. The executive notes it to be the “killer use case” of blockchain. The “Money, Tokens and Games” report anticipates that tokenization will increase by a factor of 80x in private markets.

Tokenization and CBDCs in 2030

According to Citi, the acceptance of central bank digital currencies (CBDCs) by major central banks and the use of tokenized assets in gaming and blockchain-based payments on social media will hasten the adoption of blockchain.

The March report underlined, “By 2030, up to $5 trillion of CBDCs could be circulating in major economies in the world…tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030.”

BeInCrypto recently brought attention to strong advances in CBDCs. Reputable banking organizations recently deemed SWIFT’s experimental CBDC Connector pilot tests to have “clear potential and value.”

According to the Atlantic Council, 114 nations comprising more than 95% of the world’s GDP are considering a CBDC. Notably, only 35 nations were contemplating a CBDC two years ago. Meanwhile, 11 countries have already launched a digital version of their sovereign currency.

The surge in the NFT market also represents the rise of tokenized assets in gaming. According to an analysis, the NFT market could gradually expand at a CAGR of 37.1% until 2028. The NFT Spend Value is expected to rise from $46.15 billion in 2022 to $278 billion by 2028.

US Market to Slow Down Adoption?

The U.S. has witnessed an ongoing rise in the legislative debate, pushing tokenization into a difficult position. Recently, the chair of the securities regulator claimed that separate legislation for crypto is unnecessary. Gary Gensler indicated in his statement that the definition of a security, even with regard to digital assets, may be governed by SEC regulations.

In response to the remark, Ripple CEO Brad Garlinghouse called attention to the growing regulatory discussion among US lawmakers.

The SEC chair also referred to the crypto markets’ lack of compliance as the “Wild West” again in his most recent testimony. Meanwhile, Senator Elizabeth Warren has re-ignited calls for a crypto ban from the anti-crypto lobby before her re-election bid.

Meanwhile, the commodities authority recently filed a lawsuit against Binance and founder Changpeng Zhao while unloading a torrent of complaints.

The biggest exchange by volume will defend itself against claims of insider trading and KYC regulations breaches as the Ripple and SEC lawsuit continues to drag on even after two years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.