The Litecoin (LTC) price rise was directly influenced by Bitcoin these last few weeks as the altcoin rose from $68 to crossing $100.

However, this was short-lived, as the cryptocurrency corrected soon after bringing LTC down to $95. Is there any chance for Litecoin to climb back up again?

Litecoin Investors Take Charge

Litecoin price fluctuation has left nearly 351,000 investors frustrated as these holders have been waiting for LTC to cross the $100 mark for nearly ten months. The silver to Bitcoin’s Gold did manage to do that this week, but the decline reset these investors’ losses.

These addresses bought their LTC at the time when the cryptocurrency was trading between $94 and $101. About 3.96 million LTC worth nearly $400 million is stuck in limbo due to the unstable price of Litecoin.

But now that the opportunity has risen again for them to become profitable, they will potentially sell for as much profit as they could. Either that or to at least break even since LTC fell once, it could again. However, until then, they will likely sit tight and refrain from selling.

This conviction of awaiting profits during this bull run can also be seen among other cohorts of LTC investors.

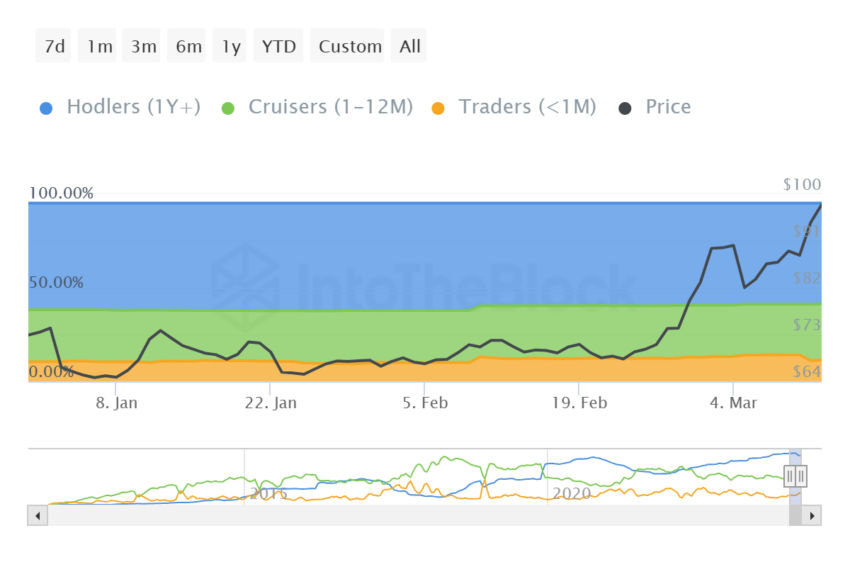

Most of the supply is sitting among long-term holders, i.e., investors that have been holding their assets for more than a year. These are also known as Hodlers. But the most concerning cohort is the Traders, a.k.a. short-term holders (addresses that tend to buy and sell their assets rather frequently).

Thus, the supply transfer from this cohort to mid-term holders (Cruisers) is a positive development. Since cruisers tend to hold on to their LTC for a month and a year, they will refrain from immediately selling. Nearly 2 million LTC worth $190 million have moved into their wallets in the last three days.

This shows that there is some conviction among Litecoin investors as they wait for the cryptocurrency to climb above $100 again.

LTC Price Prediction: Can $100 Flip Into Support

If the aforementioned conditions contribute to the price action, the LTC price might recover from $94. A bounce back would reinitiate a rally, and breaching $104 would turn the $400 million supply profitable.

Flipping this level into a support floor would push LTC further. However, a failed breach or profit booking could bring the altcoin back down. Losing $96 would restart the bearish momentum, and a drop to $90 would invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.