Litecoin (LTC) price has gained 25% since dropping to a three-month low of $72 on June 14. As LTC now approaches $90, several on-chain metrics are flashing red signals. Will the bears trigger another price correction?

Proof-of-Work networks like Litecoin have scored big wins in recent weeks after the SEC court filings called the legal status of several prominent Proof-of-Stake altcoins into question.

The underlying on-chain data reveals worrisome trends as LTC approaches the next major price milestone at $90. Here’s how the bears could trigger a potential price correction in the coming weeks.

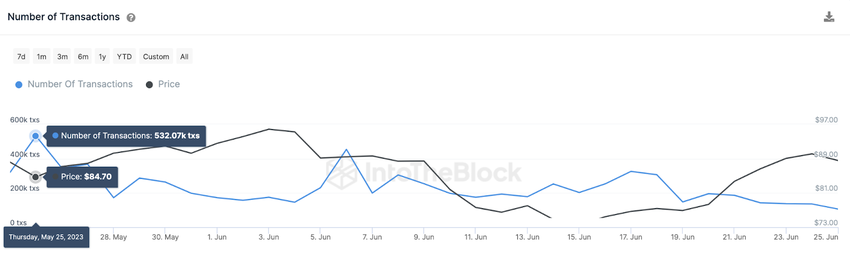

Litecoin Transactional Activity is Down by 80%

On-chain data shows that the underlying transactional activity has not fully accounted for Litecoin’s recent price rally.

Firstly, a month ago, on May 25, LTC recorded 532,000 transactions. At the close of June 26, that figure is down to 106,000. This represents a whopping 80% decline in transactional activity on the Litecoin network.

More importantly, between June 20 and June 27, LTC price gained 14%. Meanwhile, the number of transactions has dropped by 46% during this period.

The number of Transactions, quite literally, measures underlying economic activity on a blockchain network by summing the daily number of confirmed transactions.

When it declines considerably while the price rises, it signals that the price rally is largely driven by intense speculation rather than organic network value growth.

Unless the transactional activity rises to match the positive price trend, the ongoing LTC rally may soon hit a roadblock.

Litecoin Network Value is Declining

Despite the recent price gains, Litecoin’s underlying network value appears to be in decline. This further confirms the potential for a bearish LTC price correction.

The Santiment chart below shows that LTC Network Value to Transaction Volume ratio has skyrocketed by 240% in the past week. On June 20, the Litecoin NVT ratio stood at 3.75. And as of June 27, it has jumped astronomically to 12.83.

In simple terms, when the NVT ratio increases, as seen above, it indicates that the price is growing significantly faster than the underlying transactional activity.

In conclusion, the drop in transactional activity and uptrend in the NVT ratio are critical metrics that call for the bulls to exercise caution.

Read More: Best Crypto Sign-Up Bonuses in 2023

LTC Price Prediction: Potential Correction Toward $80

Considering the abovementioned factors, LTC will likely enter another retracement below $80 before the bulls regroup to make a run for $100.

However, LTC will experience considerable support, around the $85 range. At that zone, 437,140 investors that bought 1.6 million LTC at the average price of $84.78 could hold firm.

But if the support gives as anticipated, the bears can force the price correction slightly below $80.

Yet, if LTC witnesses a sharp upturn in transactional activity, the bulls could remain in control and push for $100. But, as seen above, the LTC price will have a hard time breaking out of the $92 resistance.

The one million investors that bought 14.23 million LTC coins at the maximum price of $91.24 could trigger a pullback. And if the resistance fails to hold, then the bulls can rally toward $102 for the first time since April 2023.

Read More: 9 Best Crypto Demo Accounts For Trading