Litecoin price surged 10% in April to retest $100 for the first time since Feb. 15. While a 30% retracement truncated the February rally at $102, on-chain data shows that Litecoin miners and whales could push the current bull run further. Will LTC breach the $110 resistance?

On April 10, the Litecoin team announced a series of major product updates. By April 14, LTC price had surged 8% as markets reacted positively to the announcement. On-chain data shows that the accumulation wave among Litecoin miners and crypto whales appears to be the major driving force behind the current bull rally.

Litecoin Miners Are Positioning for Future Price Gains

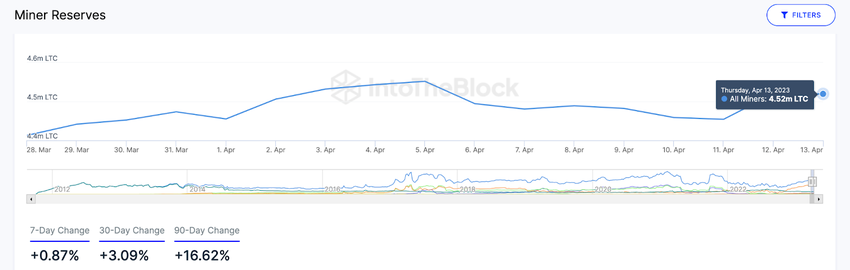

After a brief sell-off in March amid rising costs, Litecoin miners have recently accumulated a significant chunk of their block rewards. According to blockchain intelligence platform IntoTheBlock, Litecoin miners began stacking up their reserves around March 28.

The chart below shows how they have added 1.11 million LTC to their reserves between March 28 and April 12.

When miners refrain from selling off their block rewards, it implies that they are positioning themselves for future price gains. And with the next Litecoin halving event in less than 120 days, the miners will likely grow more prudent with their LTC reserves.

Likewise, the accumulation wave among a strategic cohort of LTC whales also adds credence to the current bullish stance.

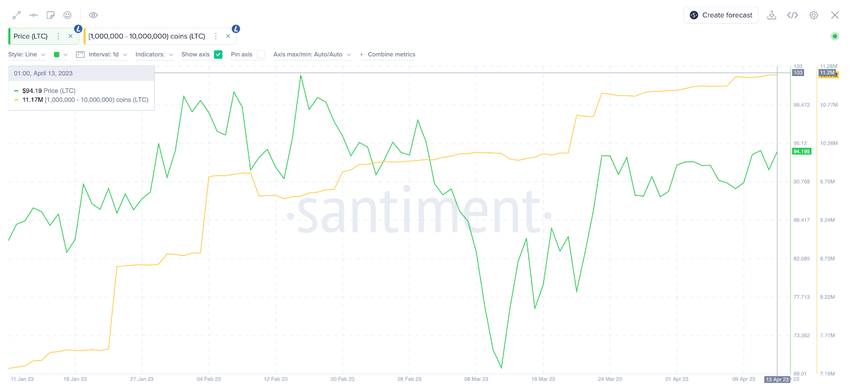

According to Santiment, crypto whales holding balances of 1 million to 10 million LTC coins have continued to accelerate their accumulation frenzy that began back in February.

The chart below shows that the whales added 2.37 million LTC between Feb 3 and April 13.

At the current market value of $98, the newly added LTC coins are worth over $230 million. If the crypto whales continue to stack up, LTC could soon break out of the $100 price barrier.

LTC Price Prediction: $113 Is the Next Target

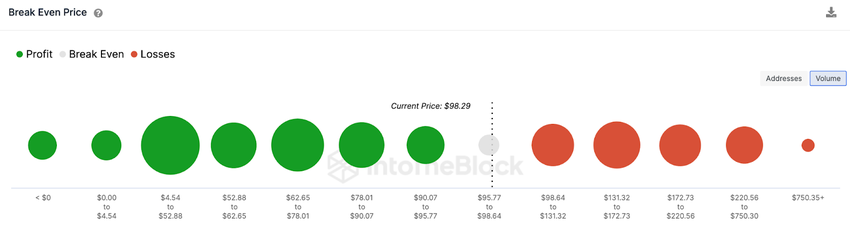

The bearish resistance halted Litecoin’s previous rally, around the $102.5 mark in February. However, IntoTheBlock’s Break Even price distribution data shows that LTC could reach $113 before facing significant pushback.

The chart below depicts that if LTC can break its current $98 resistance, it can enter a prolonged rally. But the break-even army of 149,000 addresses holding 488,000 coins could pose some resistance.

If LTC breaches that resistance, the bull can stretch the rally to $131. However, another cluster of 986,000 addresses could sell off some of their 6 million coins once LTC approaches their average break-even price.

Still, the bears could seize control if LTC losses its current support at $95. But the 476,000 addresses holding 4.33 million coins will look to prevent this.

Failure to hold the $95 support level could see Litecoin retest $85, where 500,000 addresses holding 7.47 million coins could stand firm.