‘Let Them Get Wiped Out’

Social Capital CEO Chamath Palihapitiya recently went on CNBC and argued that the excessive concern over how the richest corporations and Americans would fare during this crisis is wrong.“Who cares? Let them get wiped out?” he said.

The comment went viral recently and Americans seemed to agree.The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1

— CNBC (@CNBC) April 9, 2020

Palihapitiya stressed that there was “a lie perpetuated by Wall Street” that when a corporation fails it necessarily fires all its workers. In fact, as Palihapitiya argues, most bankruptcies end up simply getting reacquired. The people that really get hurt are those that are the speculators and the ones that hold the equities—and they should be allowed to get wiped out. So, in Palihapitiya’s words, these people and entities deserve no support; they are not the ones holding the economy together, and that is the bargain they chose when they decided to be only investors.Here we go .. bailout for everyone .. but YOU the guy on main street who played by the rules, invested in their 401Ks, and HELD when the market dropped .. .. you should have known better .. you get diluted and wiped out.

— MRKD26 (@MRKD26) April 9, 2020

Also a Bitcoin Bull

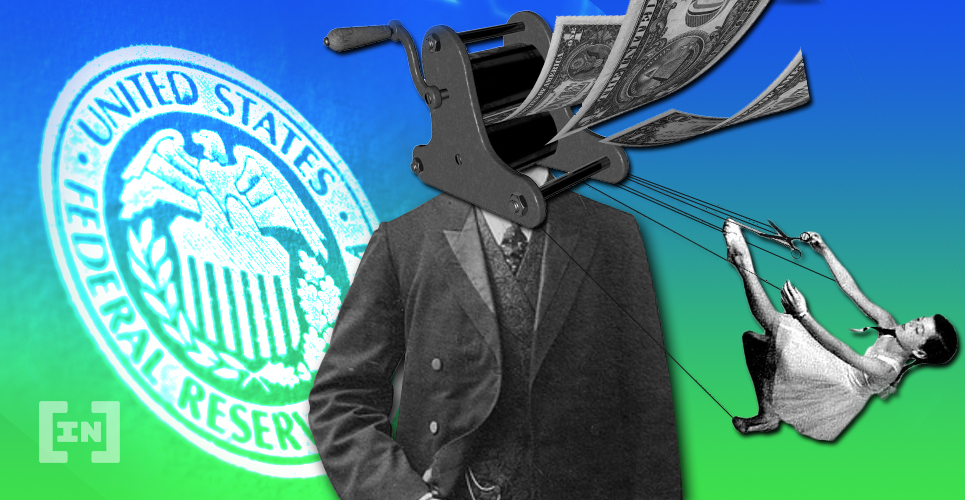

Palihapitiya’s opinions are inherently tied to the strong belief that nobody in the market deserves any favors. He so happens to be a strong believer in Bitcoin. The Social Capital CEO said he bought a lot of Bitcoin back in 2013 when it was trading for just $80. He claims that he owned around 5% of all BTC in circulation at one point. Because the financial system is looking weaker than ever, Bitcoin could become a safe haven, but it all depends on which path society chooses. Because of this, Palihapitiya maintains that “it’s either zero or it’s millions.” [Forbes] However, he has not suggested that Bitcoin will immediately fare well if this economic crisis worsens. In fact, it’s still an extremely speculative investment that will oscillate even more wildly during this crisis. However, if Palihapitiya is correct, there is potential for there to be light at the end of the tunnel.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.