A stablecoin is a cryptocurrency designed to maintain a set value. While there are numerous types of stablecoins, this guide focuses on algorithmic stablecoins, which differ from other types of stablecoins in terms of functionality. Instead, they rely heavily on smart contracts and intelligent algorithms to maintain value.

Read on to learn how algorithmic stablecoins work, how they maintain their pegs like other collateralized digital assets, and how the crypto markets react to these special tokens.

KEY TAKEAWAYS

➤ Algorithmic stablecoins use smart contracts and algorithms to maintain price stability by adjusting supply and demand without relying on collateral.

➤ These stablecoins can be categorized into types like rebase and seigniorage, each using different mechanisms to stabilize around a target peg.

➤ The risks of algorithmic stablecoins include potential “death spirals” if demand falls, leading to de-pegging events as seen with TerraUSD (UST).

➤ In spite of failures, algorithmic stablecoins have received much criticism, influencing users to opt for asset-backed stablecoins instead.

What are algorithmic stablecoins?

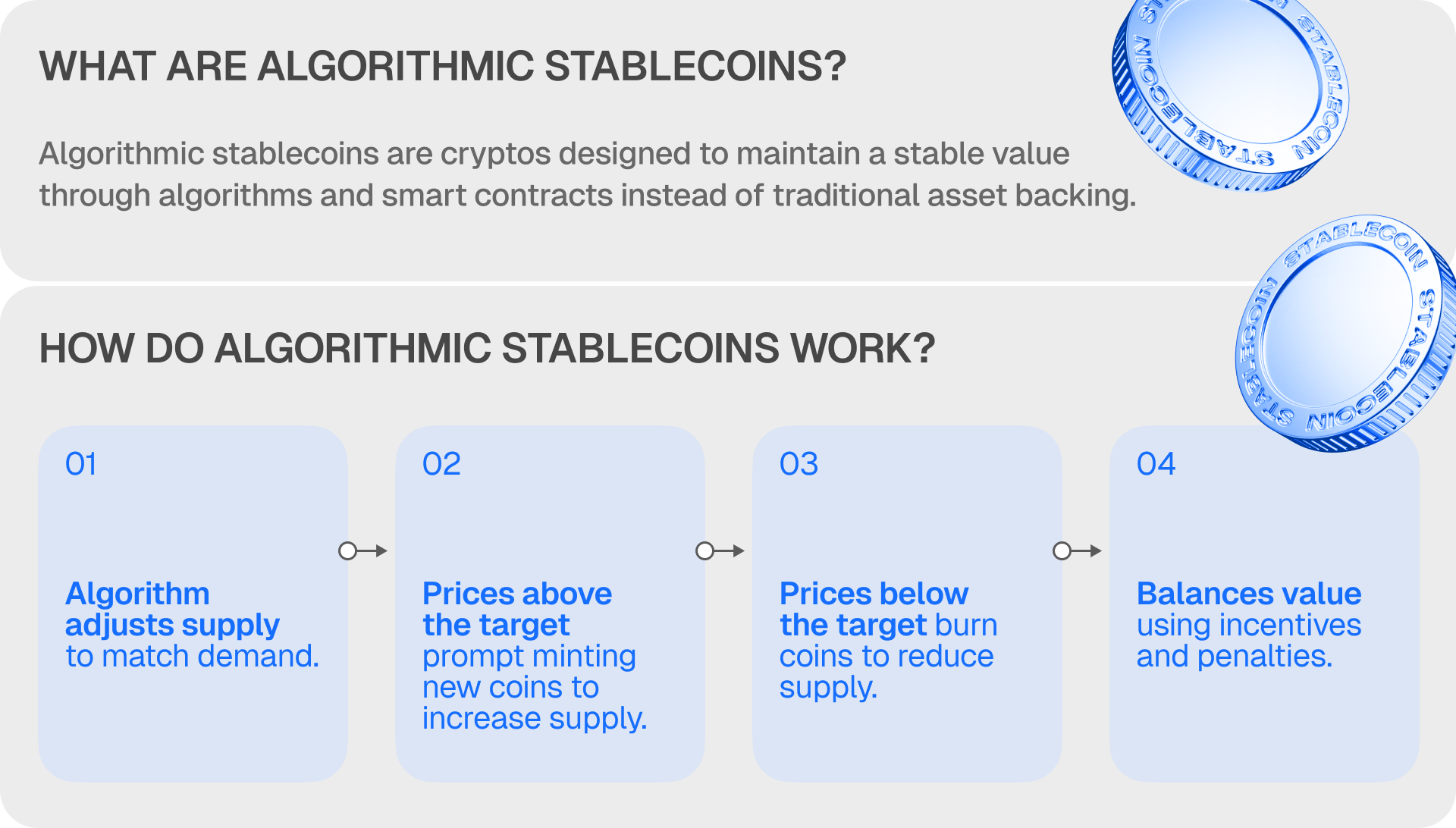

Algorithmic stablecoins maintain price stability by using smart contracts to maintain the balance of supply and demand. These decentralized stablecoins tie their value to an asset like the U.S. Dollar.

In other words, an algorithmic stablecoin may hold its price at a dollar. If the price of the coin rises, then they use algorithms that can mint more coins (lower demand/increase supply) to drop the price back to a dollar. When the price drops, the algorithm burns some coins (e.g., removes them from circulation) to increase the price (lower supply/increase demand).

A critical note here is that algorithmic stablecoins, in their purest form, do not rely on collateral. They are not supported by any reserve asset, such as most stablecoins. They use algorithms instead, which are specific instructions or rules that must be followed to produce a result.

These computer algorithms are designed to encourage market participants to trade stablecoins according to supply and demand. This action manipulates the circulating supply to ensure that the coin’s price is stable around its peg.

How do algorithmic stablecoins work?

The main types of algorithmic stablecoins are seigniorage and rebase. While there are many different mechanisms that each stablecoin may use to implement these strategies, these are the general methods each may use.

Rebase stablecoins

How do rebase stablecoins work? To maintain the peg, rebase stablecoins change or rather stretch/contract the supply. You can also term rebase stablecoins as elastic tokens.

Instead of using reserves to keep the peg in place, rebase tokens automatically put tokens into circulation by minting new tokens when the price drops below their pegged value of $1.

The algorithm also burns tokens when the value of the pegged token drops below $1. Despite the supply volatility, its price tends not to fluctuate, and it depends on the value of the asset it tracks.

Seigniorage stablecoins

Seigniorage stablecoins use a dual-token mechanism to maintain a stable price peg, usually $1, by balancing supply and demand through automated adjustments. In this model, the stablecoin system typically includes two tokens: a stablecoin and a governance token (yield-bearing).

How do seigniorage stablecoins work?

To stabilize the value of the stablecoin, the system uses a governance token that can be staked to earn rewards when demand rises. When the stablecoin’s price is above its peg, the system mints new stablecoins to curtail demand and bring the price back to target.

Holders of the governance token, who assume more risk, receive rewards in the form of the newly minted stablecoins, incentivizing demand for the governance token itself.

If the stablecoin’s price falls below the peg, a mechanism encourages users to exchange governance tokens for stablecoins, reducing the stablecoin’s supply through a burning process. This dual-token system, where governance token demand is paired with a burn mechanism, enables a balance of supply and demand to retain the stablecoin’s peg.

What happens when a stablecoin loses its peg?

Sometimes, a drop in an algorithmic stablecoin’s value can result in a death spiral. This is a slightly trickier situation. For example, in a seigniorage mechanism with a dual token market, the algorithm relies heavily on the demand of both tokens.

Without going into specifics, if the demand for one token drops, the demand for the other token is supposed to increase, and vice versa. This is how the stablecoin maintains its peg.

However, when the demand for both tokens decreases, the protocol cannot maintain the incentive mechanisms (e.g., redemptions and staking), and the price continually drops. We refer to this event as a death spiral.

Pros and cons of algorithmic stablecoins

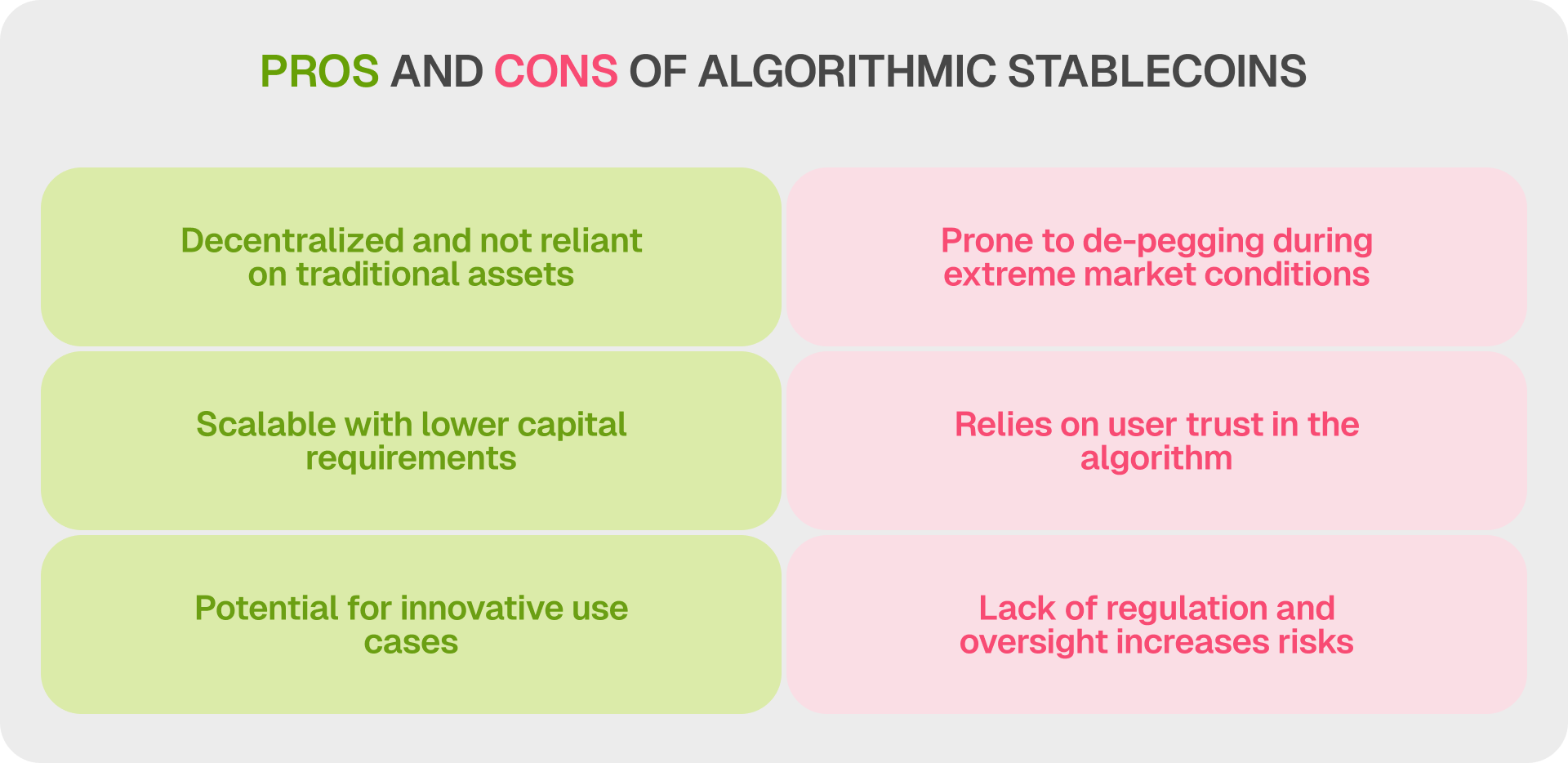

Algorithmic stablecoins could increase the popularity of cryptocurrency as a medium of exchange for financial transactions and other purposes. But what are the benefits and risks of using them?

Benefits of algorithmic stablecoins

Some applications include the use of stablecoins for trading, using them to run DAOs (decentralized autonomous organizations), and providing incentives to holders.

Similar to the way central banks issue new coins, algorithmic stablecoins are designed to expand or contract their total supply to maintain their peg. But in the case of these algorithmic stablecoins, the token holders are the ones to benefit from the price difference and not a central entity.

Another benefit is the exact utility of the token. Usually, these stablecoins are not only a medium to exchange value but can also play a part in certain decentralized protocols. Staking stablecoins is one of the most popular use cases.

The basics of stablecoins are fairly easy to understand, but like with all things crypto, the deeper you go, the more there is to process. Learn everything you need to know at the BeInCrypto Telegram group.

Risks of algorithmic stablecoins

New investors may think that algorithmic stablecoins are low-risk. It’s important to remember that algorithmic stablecoins have no specific backing.

The design of algorithmic stablecoins aims to maintain price stability through the actions of users who interact with the system. If there is no big incentive for investors to buy the secondary tokens that could bring the price of the stablecoin back up to its peg, the contraction mechanism could fail.

There is a possibility that the stablecoin never manages to maintain the peg. This happens when the stablecoin burning frequency is low, and the investors keep selling. This approach can cause depegging, leading to a “death spiral.”TerraUSD (UST) is an excellent example of a stablecoin that experienced a death spiral in 2022.

What are some examples of algorithmic stablecoins?

Let’s shed some light on how exactly algorithmic stablecoins work, with the help of examples of the most popular ones. Here are the top algorithmic stablecoins that can help you understand their functionality.

Basis Cash (BAC) — Do Kwon’s first stablecoin project

Do Kwon, Terra’s creator, also has other failed stablecoins apart from LUNA. He released Basis Cash (BAC) under the Rick Sanchez pseudonym. It was one of the first algorithmic stablecoins. BAC’s goal was to maintain a 1:1 dollar peg.

The BAC protocol was created to contract and expand supply in a manner similar to that of central banks trading fiscal debt to stabilize purchasing powers without collateral. The Basis Share, Basis Bond, and Basis Cash were all intended to be exchangeable. Do Kwon intended to distribute BAC tokens via yield farming and liquidity to BAC-DAI.

However, Basis Cash (BAC) depegged from the U.S. dollar, and thus it failed to be a reliable stablecoin.

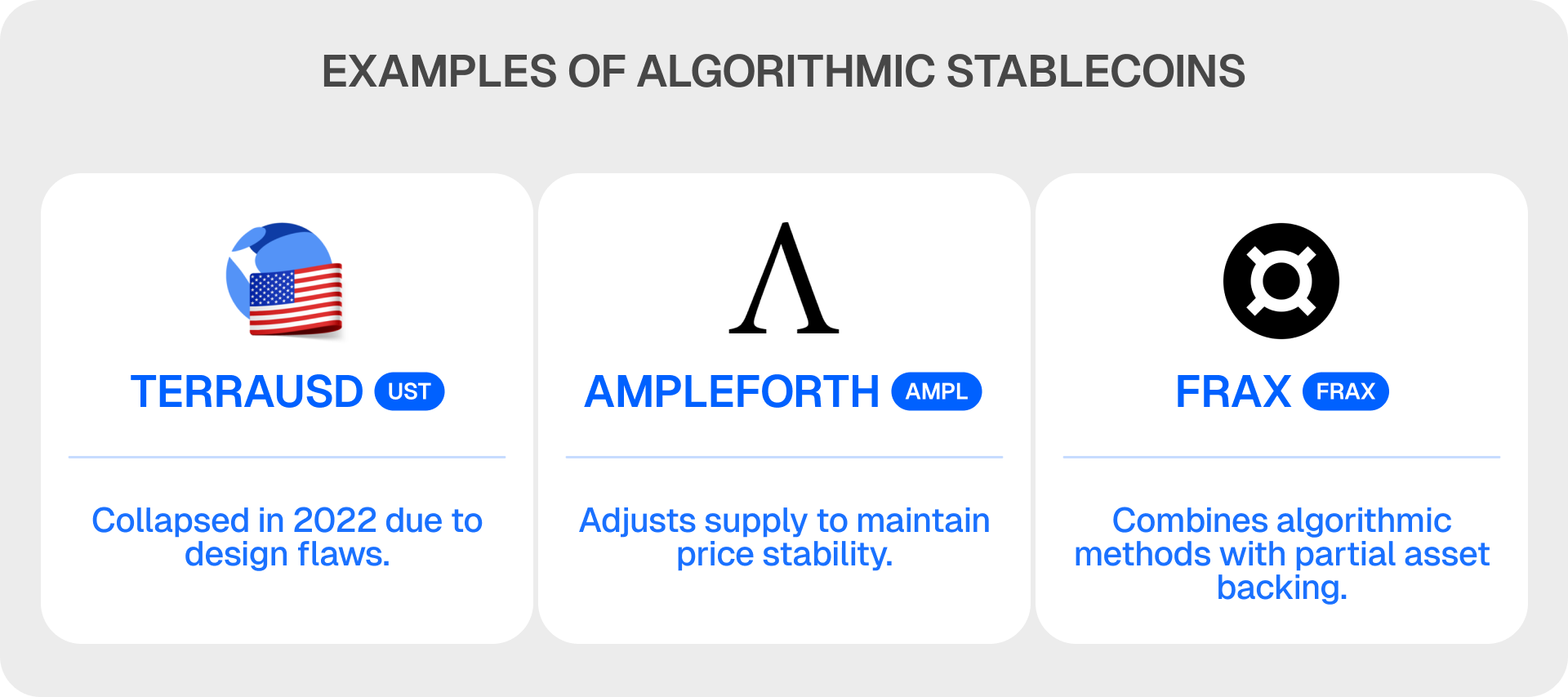

Ampleforth (AMPL)

Ampleforth is an Ethereum-based protocol that aims to maintain the value of the AMPL cryptocurrency asset at an equal value to the U.S. Dollar.

Evan Kuo, a serial entrepreneur, and Brandon Iles, an ex-Google senior software engineer, ideated Ampleforth. The Ampleforth Foundation is the management and development firm behind the Ampleforth protocol.

The AMPL stablecoin came forth as a rebase stablecoin. This means that instead of owning a fixed number of AMPL, the holders own a fixed percentage of the total AMPL circulating supply. The total supply contracts or expands according to the current token price.

If the AMPL price is over $1, the protocol increases the circulating supply and distributes the newly minted tokens to existing holders. However, the AMPL token supply decreases when the AMPL price drops below $1.

All Ampleforth wallets will be affected by this change. Their wallet balances will be adjusted in proportion. AMPL holders will retain the same token supply regardless of this change. This means that even if you had 1% of AMPL tokens prior to a rebasing, you would still have the same percentage of the total supply after the rebasing.

TerraUSD (UST)

The TerraUSD (UST) token was the Terra blockchain’s failed algorithmic, yield-bearing stablecoin. TerraUSD was designed to provide value to the Terra community and offer a scalable solution to DeFi protocols.

Terraform Labs developed UST in 2018 in a project led by Do Kwon and Daniel Shin. TerraUSD (UST) came forth as a seigniorage stablecoin with the aim of maintaining its peg to the U.S. dollar through the work of arbitrageurs.

In this case, Terra’s blockchain native coin, LUNA, was the volatile cryptocurrency used to balance the price of the UST stablecoin while also functioning as a governance token for the network.

Terra’s UST worked closely with LUNA, an elastic token that expands and contracts its total supply to maintain the stablecoins’ equilibrium and encourage arbitrage.

For instance, if you wanted to buy the UST stablecoin, you needed to mint UST by paying with LUNA tokens. The protocol then burned those LUNA tokens, constricting the total supply and causing a slight increase in the price of LUNA. To mint LUNA, you would have to convert UST stablecoins. UST prices would rise slightly as a result.

The Terra/Luna collapse

TerraUSD failed because of a bank run. Simply put, two large addresses withdrew about $375 million in UST from the Anchor Protocol, which led to a depeg. As traders lost confidence in the UST stablecoin, they began to withdraw their UST and convert it into LUNA. This massive increase in supply dropped the price of LUNA as well.

This event is called a death spiral. The Anchor Protocol offered unsustainably high yields, and the complexity of its design made it difficult to ascertain the risks associated with using the protocol.

The collapse of the Terra Luna ecosystem subsequently wiped out billions of dollars in value across the crypto market as a whole and led to many bankruptcies.

Do algorithmic stablecoins have a future?

Algorithmic stablecoins are innovative mechanisms that can elevate decentralized finance. However, most of the algorithmic stablecoins have failed to date because of their experimental nature. So far, the main use case for these types of stablecoins has been speculative trading.

However, algorithmic stablecoins, for now, feature as opportunities for innovation and expansion of the DeFi space. At the same time, many countries are now researching stablecoins in a quest to regulate them and even issue their own stablecoins as an alternative to government-based financial systems.