Venus Protocol is an on-chain money market that spans multiple blockchains and puts community-driven governance at the forefront. While it draws inspiration from the Sky protocol (formerly MakerDAO), the platform has made many additions and improvements to its design. Here is what you need to know about Venus in 2025.

KEY TAKEAWAYS

➤ Venus Protocol is a decentralized lending and borrowing platform with multichain support.

➤ Venus expanded significantly, integrating multiple Ethereum layer-2 solutions like zkSync and Arbitrum.

➤ It uses a dual token system for operations and community-driven governance, allowing holders to influence decisions.

➤ The protocol emphasizes risk management through isolated pools, automated liquidations, and real-time collateral monitoring.

What is the Venus Protocol?

Venus Protocol, commonly referred to as Venus, is a lending and borrowing protocol on various EVM-compatible blockchains. It functions as both an algorithmic money market and an algorithmic stablecoin protocol, enabling you to:

- Borrow

- Lend

- Swap

- Bridge

- Mint the VAI stablecoin via over-collateralized debt positions (CDPs)

Venus milestones

Venus launched in 2020. Since its inception, it has gained wide adoption and reached many milestones, becoming one of the most widely used lending applications in crypto.

In 2024, Venus expanded its presence by migrating to six major networks: Ethereum, Arbitrum One, opBNB, zkSync Era, Optimism, and Base. This move broadened Venus’s user base and solidified its position as a leading multichain lending protocol.

Its infrastructure continued to evolve by integrating LayerZero-powered XVS bridges and omnichain governance. As a result, this collective system has a total value locked (TVL) exceeding $1.9 billion across all supported chains as of June 2025.

Additionally, Venus’ IGNITE campaign has been live on ZKSync as part of a broader initiative since early January 2025. This campaign will distribute up to 300 million ZK tokens over nine months to increase adoption and usage.

Venus Protocol’s TVL on ZKSync has exceeded $65 million, establishing it as the protocol’s second-largest source of locked assets. This achievement represents a pivotal advancement in Venus’s multichain strategy, complementing other EVM-compatible deployments.

Venus features

| Features | Description |

| Lending and borrowing | Supply assets to earn interest or borrow by over-collateralizing |

| Stablecoin (VAI) | Mint VAI stablecoin using collateral, over-collateralized, and pegged to USD |

| vTokens | Receipt tokens representing supplied collateral, redeemable for underlying assets |

| Governance (XVS) | Community-driven protocol upgrades, risk management, and asset listings |

| Dynamic interest rates | Algorithmically determined based on market utilization |

| Multi-asset support | Includes BTC, ETH, BNB, stablecoins, XRP, LTC, and more |

| Fast and low-cost transactions | Leveraging EVM rollup compatibility for speed and affordability |

| Risk management | Automated liquidations and real-time collateral monitoring |

| Composability | Integration with other DeFi protocols and strategies |

Algorithmic money market

Venus allows you to deposit crypto as collateral and borrow assets or earn interest. The protocol pools your assets in smart contracts, distributing vTokens (e.g., vBTC to BTC, vUSDT to USDT) to depositors, which represent their claim on the underlying collateral.

Permissionless lending and borrowing

The protocol is permissionless; anyone can participate. Borrowers must pledge collateral, with typical collateralization ratios ranging from 40% to 75%, depending on the asset and protocol governance. Loans are over-collateralized to ensure protocol security.

Stablecoin minting

With Venus, you can mint VAI, an algorithmic stablecoin pegged to USD. It has functionality similar to that of the DAI stablecoin. Anyone can mint VAI by supplying collateral. This allows you to access loans without credit reports or selling your assets. You can use VAI in other DeFi applications or earn additional yields.

Governance

The XVS token governs the Venus Protocol. Staking XVS in the Venus Vault also allows you to earn rewards. XVS holders can:

- Propose and vote on protocol upgrades

- Add new collateral types

- Adjust risk parameters

- Change interest rates

Risk management

Venus uses an automated risk management mechanism. This includes collateral monitoring and liquidation mechanisms. If your collateral value falls below the required threshold, your position may be partially or fully liquidated to maintain the solvency of the protocol.

How does Venus work?

Venus supports a broad range of tokens as collateral that generate interest. Those who deposit a supported cryptocurrency or stablecoin into Venus receive an equivalent amount of vTokens (LP Tokens).

Venus app

The central hub for all of Venus’s features is the Venus app.

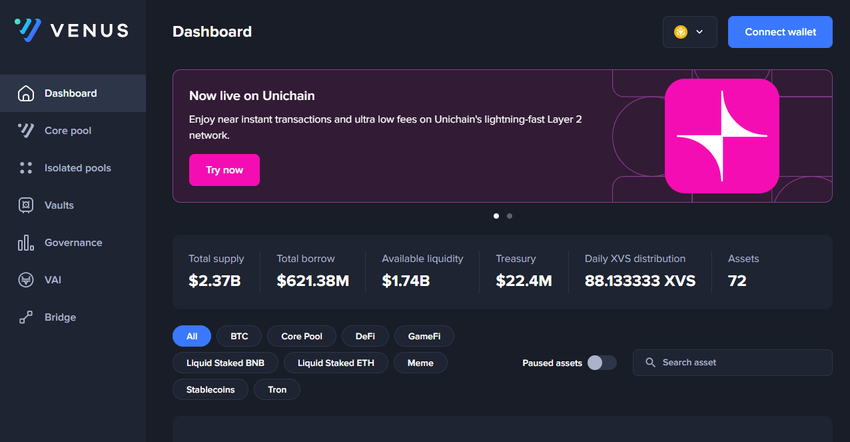

Dashboard and Account

When you navigate to the official website, you will see the Dashboard. You will find the Supply and Borrow markets and their stats on the Dashboard interface. You will also notice a column called “Pool” that identifies each market’s associated pool.

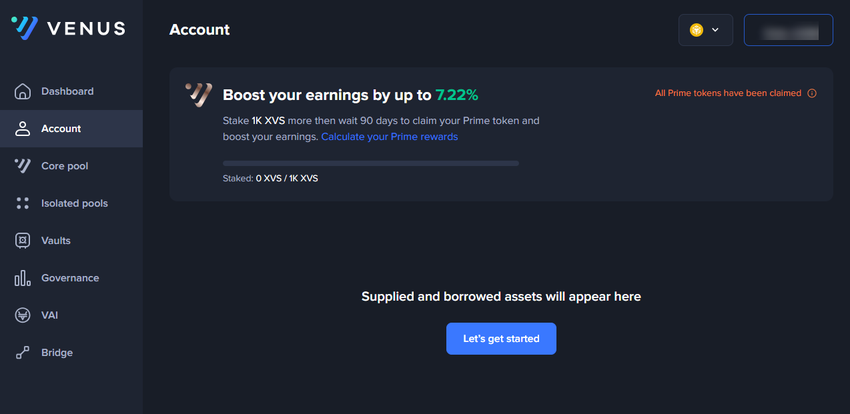

The Account interface gives you a summary of the assets you have supplied and borrowed. You can track your balances and oversee the status of your transactions here.

Pool, Core Pool, and Vaults

The Core Pool is your central point for exploring all available primary markets. Here, you can click on each market to review important metrics. Additionally, the Pools interface lets you explore all the isolated pools available. You can click on each pool to see all the markets that fall within it.

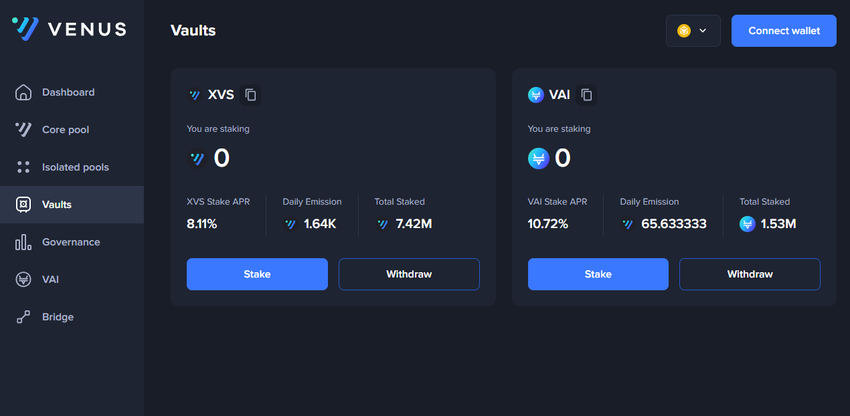

The Vaults interface provides access to manage your position in vaults on the Venus Protocol. Vaults are tailored to offer you automatic strategies for maximizing yields and effectively managing your assets.

Governance

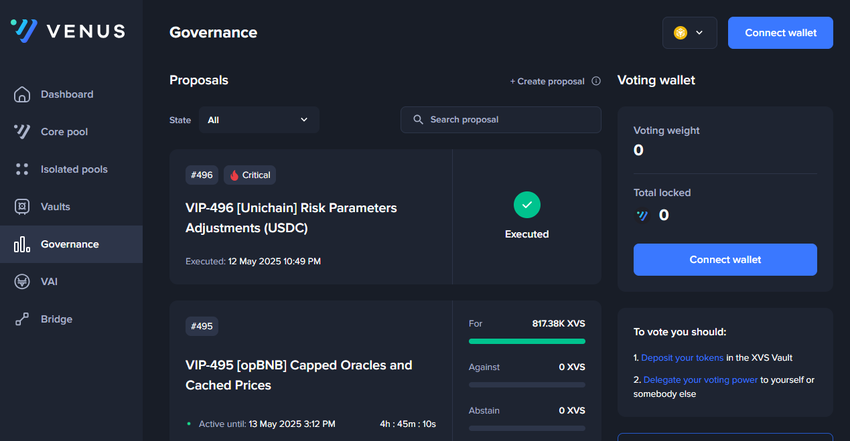

The Governance interface provides access to the governance features of the Venus Protocol. In this area, you can vote and participate in decision-making processes that influence the protocol’s future.

XVS and VAI

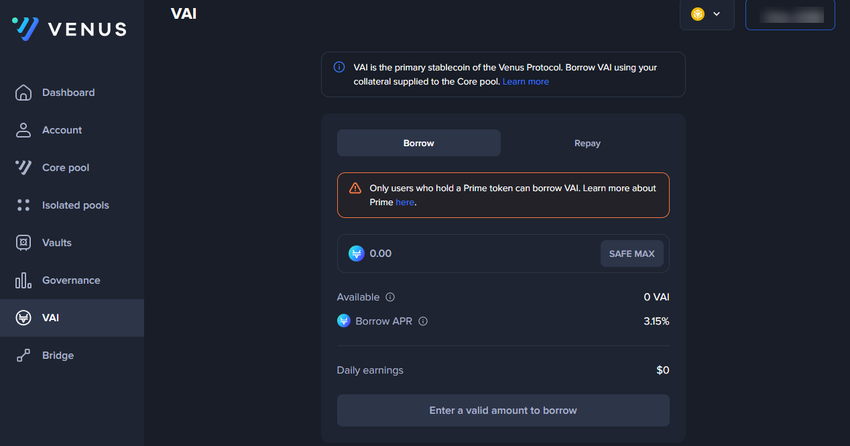

With the VAI interface, you can mint and manage the VAI stablecoin, which is created on Venus Protocol and is pegged to the value of $1. Do note this feature is reserved to Venus Prime users only at this time.

Pools

Lending pools allow crypto holders to earn income by receiving interest on the assets they supply. They also enable you to access assets you may not currently own without the need to sell any part of your portfolio.

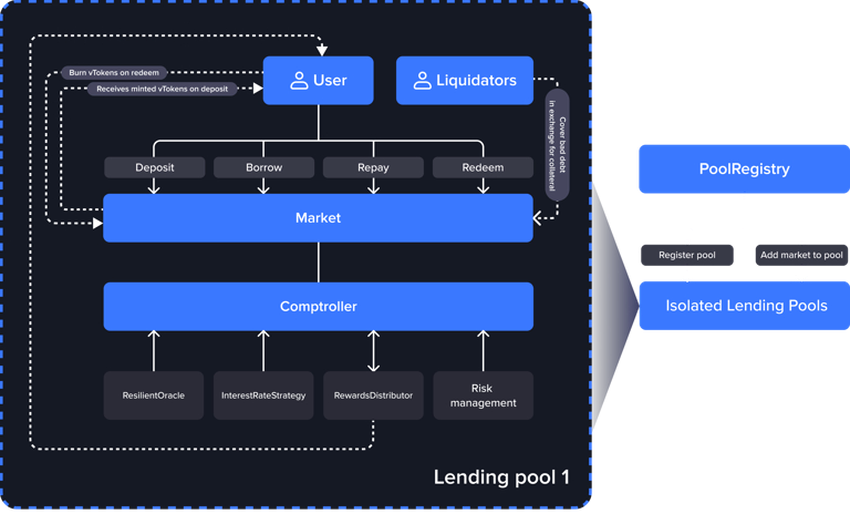

The first generation of lending pools (like the Venus Core Pool) brought together a variety of assets that you could explore and interact with. However, this came with some risks. Isolated Pools were created as a result.

Isolated Pools are a feature unique to the Venus Protocol. These are unique collections of assets, each with specific risk management strategies. This design opens up more opportunities for you to manage risk and allocate your assets.

Additionally, they safeguard the liquidity of the entire protocol from potential failures by being confined to isolated markets. Isolated Pools also provide tailored rewards for each market within the pool.

Every pool has a “Comptroller” that manages interactions across various markets. The Comptroller oversees all activities related to minting, redeeming, transferring, borrowing, lending, repaying, liquidating, and seizing carried out by the vToken contract.

Vaults

Vaults provide a mechanism for you to stake tokens and earn passive income, whether for XVS or VAI. This process allows you to participate in and contribute to the stability and security of the Venus ecosystem while maximizing returns on your holdings.

Tokenomics

XVS is Venus Protocol’s native and governance token. You can boost your voting power by staking XVS tokens in the vault, with that voting power being proportional to the amount you stake.

This allows you to participate in the voting process for Venus Improvement Proposals (VIPs), thereby decentralizing the protocol and allowing the community to play a central role in the development and evolution of Venus.

Moreover, staking your XVS tokens in the vault can earn yield, incentivizing participation in the Venus governance process. This alignment creates a shared interest between XVS holders and the overall well-being and success of the Venus Protocol.

VAI

VAI is the stablecoin for the Venus Protocol. It incorporates various stability mechanisms to ensure its peg to $1, most notably through the stability fee system.

When you repay your minted VAI, you incur a fee, which is calculated on a block-by-block basis and added to your minted VAI balance. This fee system motivates you to either mint or burn VAI in response to price fluctuations, thus contributing to its stability.

Venus DAO

Venus Protocol is managed by a decentralized autonomous organization (DAO), which means that all governance decisions are made by the XVS token holders, not by a central authority. The DAO is structured into three sub-DAOs:

- Venus Lab — The research and development company for Venus. It oversees the protocol’s development.

- Vanguard Vantage — Oversees treasury operations, governance, ecosystem development, business growth, and financial health while ensuring responsible allocation of funds.

- Venus Stars — Essentially, ambassadors representing the Venus Protocol on various platforms, events, and forums. They focus on community engagement, support, growth, and expanding the Venus user base.

The governance process welcomes XVS token holders to lock their tokens in the XVS Vault, granting them voting power. Through governance proposals, also known as Venus Improvement Proposals (VIPs), you can come together with other users to decide on upgrades to the protocol.

The next generation of decentralized lending?

While Venus has similar features to many other decentralized applications, the platform displays some innovative new ideas. It is community-governed, has a dual token system, and promotes a feedback loop that strengthens the security of the platform in an omnichain world. As a result, it has become one of the most widely used money markets on multiple blockchains. Do remember, though, that interacting with DeFi protocols and lending carries risk, in part due to the volatility and composability of digital assets. You may lose capital.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research (DYOR).