Privacy coins offer a solution for crypto users seeking anonymity in transactions — something traditional cryptocurrencies don’t fully provide. While cryptocurrencies like Bitcoin operate on a public ledger where transaction details are visible, private coins use advanced cryptographic techniques to hide all identifiable information. This guide explores some of the most popular privacy coins available today and highlights their key features.

KEY TAKEAWAYS

• Privacy coins are digital assets designed to prioritize privacy and anoymity.

• They provide users with control over their financial privacy by preventing transaction tracking.

• Leading privacy coins include Monero, Zcash, DASH, Oasis Network, Decred, and Aleph Zero.

• Privacy coins usually face stringent regulatory scrutiny and comparatively slower processing times.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research and consult a qualified financial advisor before making any investment decisions.

What are the top privacy coins?

1. Monero

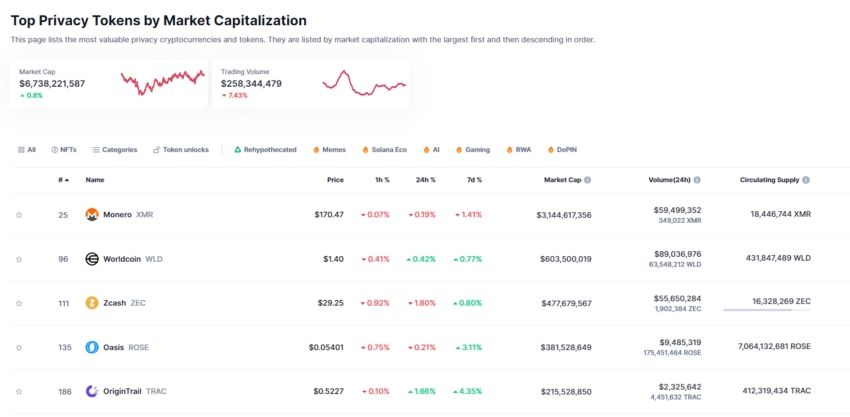

Monero (XMR) is the largest privacy coin by market cap and regularly ranks among the top cryptocurrencies. It operates as a proof-of-work (PoW) blockchain and uses ring signatures and stealth addresses to offer complete anonymity to users.

Unlike other privacy coins, Monero’s anonymity features are automatic. Every transaction defaults to private to ensure users don’t inadvertently reveal any information.

In addition, Monero coins are fungible, meaning they can be substituted for each other without carrying a traceable history unlike Bitcoin and other assets.

However, Monero’s strong privacy features have raised concerns among critics who believe it is used for illicit activities.

| Pros | Cons |

|---|---|

| Strong privacy and anonymity features | Limited adoption compared to Bitcoin |

| Decentralized and secure | Not listed on some major exchanges |

| Untraceable transactions | Can be associated with illicit activities |

| Fungible (each XMR unit is interchangeable with other units) | Lower liquidity compared to larger cryptos |

| Active developer community | Higher transaction fees than some alternatives |

2. Zcash

Zcash offers two types of transactions: private and transparent. Private transactions use z-addresses, while transparent ones use t-addresses.

When z-addresses are involved, the transaction details, including the sender, receiver, and amount, remain completely confidential. However, transactions from a z-address to a t-address, called “deshielding,” reveal certain details on the blockchain (though the sender’s z-address remains hidden).

In contrast, “shielding” occurs when moving funds from a t-address to a z-address, which makes the transaction private. Zcash’s combination of shielded and transparent transactions allows users to decide how much privacy they want. However, fully shielded transactions are less common than initially anticipated.

| Pros | Cons |

|---|---|

| Strong privacy with optional shielded transactions | Privacy features are not enabled by default |

| Allows selective disclosure for auditing purposes | Higher transaction fees than some other cryptos |

| Advanced cryptography (zk-SNARKs) for anonymity | Limited adoption compared to larger cryptocurrencies |

| Transparent and shielded addresses offer flexibility | Lower liquidity and less exchange support |

| Actively developed and supported by a strong team | May face regulatory scrutiny due to privacy features |

3. DASH

DASH’s technology makes it an attractive option for investors seeking both speed and security in their transactions. Its InstantSend and ChainLocks features provide near-instant confirmation and enhanced protection.

Meanwhile, the optional PrivateSend feature adds flexibility by allowing users to choose between transparent or anonymous transactions depending on their needs.

The PrivateSend feature is optional and works by splitting transactions into smaller parts, making them harder to trace. However, DASH must be turned private ahead of time, and these transactions cost a little extra due to the additional effort.

As a well-established project with continuous development, DASH offers a strong use case as a secure and practical digital asset. This ability makes the coin a solid choice for those looking to invest in cryptocurrency with real-world applications and a focus on fast, secure payments.

| Pros | Cons |

|---|---|

| Fast transactions with InstantSend | Optional privacy, not default |

| Low transaction fees | Limited adoption compared to major cryptocurrencies |

| Scalable network with ChainLocks for security | PrivateSend transactions come with higher fees |

| Well-established with a large user base | Privacy features may raise regulatory concerns |

4. Oasis Network (ROSE)

Oasis Network emphasizes privacy and user control over data. It allows users to decide which information they want to share while securing transactions through techniques like homomorphic encryption and secure enclaves.

This architecture ensures that transactions remain private while still being scalable and secure. Users retain autonomy over their personal data, which is a core feature of the network’s commitment to privacy.

| Pros | Cons |

|---|---|

| Focus on privacy and data tokenization | Less mainstream adoption compared to major blockchains |

| Scalable and efficient with high throughput | Still relatively new, with a developing ecosystem |

| Dual-layer architecture for better performance | Lower liquidity compared to top-tier cryptocurrencies |

| Enables private DeFi and confidential smart contracts | Privacy features may raise regulatory concerns |

5. Decred

Launched in 2016, Decred (DCR) is designed to give its community significant control over decision-making processes through a hybrid Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus model.

This structure ensures that both miners and stakeholders have a say in the project’s development, making it more resistant to centralization. This makes it an appealing option for privacy enthusiasts who also value decentralization.

Decred also integrates privacy features through its CoinShuffle++ protocol, which anonymizes transactions by mixing them. This helps users maintain privacy without sacrificing transparency or security.

| Pros | Cons |

|---|---|

| Decentralized governance with community voting | Not as widely accepted as mainstream coins |

| Strong privacy features via CoinShuffle++ | Limited liquidity on major exchanges |

| Low transaction fees | Less exposure compared to larger projects |

| Hybrid PoW/PoS model enhances security |

6. Aleph Zero

Aleph Zero leverages zero-knowledge proofs to ensure the privacy of user identities and transactions. This privacy coin aims to offer strong security in the web3 space, helping users maintain anonymity while engaging in decentralized finance.

Due to its decentralized and affordable setup, Aleph Zero can be particularly appealing to those who want strong security without relying on external vendors.

| Pros | Cons |

|---|---|

| Strong privacy features using zero-knowledge proofs | Complicated recovery process for lost credentials |

| Decentralized and scalable | Limited support for setting up new accounts |

| Affordable and independent of external vendors | Not widely supported on major exchanges |

| Fast transaction speeds with high security | Lower adoption rate due to being relatively new |

Top privacy coins compared

| Feature | Monero (XMR) | Zcash (ZEC) | Dash (DASH) | Oasis Network (ROSE) | Decred (DCR) | Aleph Zero (AZERO) |

|---|---|---|---|---|---|---|

| Market cap (as of Sept. 12, 2024) | $3.14 billion (#25) | $478 million (#111) | $287 million (#156) | $382 million (#134) | $197 million (#195) | $101 million (#320) |

| Privacy | Strong, default privacy with RingCT | Optional privacy with zk-SNARKs | Optional privacy with PrivateSend | Privacy-focused with confidential computing | Strong privacy via CoinShuffle++ | Privacy features via zero-knowledge proofs |

| Consensus | Proof of Work (PoW) | Proof of Work (PoW) | Proof of Work (PoW) + Proof of Service (PoSe) | Proof of Stake (PoS) | Hybrid PoW/PoS model | Hybrid PoW/PoS model |

| Transaction speed | Moderate | Moderate | Fast with InstantSend | High throughput with scalable architecture | Moderate | Fast transaction speeds |

| Scalability | Limited | Moderate scalability with optional privacy | Scalable with fast transactions | Scalable, dual-layer architecture | Moderate | High scalability |

| Development | Active community, regular updates | Strong development with privacy focus | Well-established, regular improvements | Active development with strong partnerships | Steady development and governance | Active development, still relatively new |

| Governance | Decentralized with community involvement | Decentralized, supported by the Zcash Foundation | Decentralized governance with voting system | Decentralized governance with staking | Decentralized governance with voting | Decentralized governance with community voting |

| Adoption | Widely used for privacy-focused transactions | Moderate, strong privacy adoption | Widely used, especially in regions like Venezuela | Still developing, niche adoption | Moderate | Still new, low adoption rate |

| Unique features | Complete anonymity, untraceable transactions | zk-SNARKs for shielded transactions | InstantSend for quick transactions | Confidential smart contracts, private DeFi | Hybrid consensus, CoinShuffle++ privacy | Zero-knowledge proofs, scalability focus |

Why should you use a privacy coin?

While Bitcoin and traditional cryptocurrencies don’t necessarily expose personal information, they make it possible to trace transaction data. Bitcoin can be traced back to its first spend, which can draw some unwanted attention. This reveals a variety of wallet addresses and other information some traders might not want public.

That’s not to mention the know-your-customer and anti-money-laundering policies in place at most exchanges, which force users to reveal their information to trade there.

Privacy coins circumvent that issue, anonymizing both parties involved in a transaction. Utilizing technologies such as zk-SNARKS, the transaction is still recorded on the blockchain for history’s sake without revealing wallet addresses.

Of course, these transactions can be more expensive or take a little longer due to this extra process, but the effort is worth it for those who care to make transactions completely anonymously.

What is the most private cryptocurrency?

There is no “best privacy coin” simply because each project utilizes a different form of anonymity. For instance, DASH’s private transactions work great thanks to its PrivateSend feature, but some users might want the protection offered on Aleph Zero or the community-driven nature of Decred. BeInCrypto recommends that users choose the privacy coin they believe and resonate with the most rather than the one with the highest market cap or best marketing campaign.

Frequently asked questions

What is a privacy coin?

What are some examples of privacy coins?

How do Monero and Zcash ensure the anonymity of transactions compared to traditional cryptocurrencies?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.