Sam Bankman-Fried (SBF) rose to prominence as the head of the now-defunct FTX, one of the largest crypto exchanges in the world at one point, and Alameda Research, its sister company. Before their collapse, SBF’s net worth was reportedly over $26 billion, which was wiped clean in November 2022. A year later, a New York Jury found Sam Bankman-Fried guilty of several counts of fraud and conspiracy.

Many considered SBF to be the poster boy for crypto; however, the former media darling now lives in infamy with a name forever tarnished from scandal, often being compared to Bernie Madoff. Learn about the man behind the name in this guide on Sam Bankman-Fried.

KEY TAKEAWAYS

► Sam Bankman-Fried’s (SBF) rapid rise and fall as FTX’s founder reflects both his infamy and impact that he left on the crypto industry.

► Bankman-Fried was found guilty of fraud and conspiracy after using customer funds for personal expenses, political donations, and risky investments.

► Caroline Ellison, his close associate and former Alameda Research CEO, pleaded guilty and cooperated with prosecutors against SBF.

► Bankman-Fried’s 25-year prison sentence underscores the severe consequences of regulatory noncompliance and financial mismanagement.

Who is Sam Bankman-Fried?

Sam Bankman-Fried was born to two Stanford Law School professors in California on March 6, 1992. SBF grew up in a well-educated family, which influenced the schools he went to. SBF attended Crystal Springs Uplands School in Hillsborough, California, for his high school.

He also attended Canada/USA Mathcamp, a summer academic program for mathematically gifted high school students. In the summer of 2013, while studying at the Massachusetts Institute of Technology (MIT), Sam Bankman-Fried went on to work as an intern at Jane Street Capital, a proprietary trading firm with a focus on international exchange-traded funds (ETFs).

After graduating from MIT in 2014 with a degree in physics and a mathematics minor, SBF rejoined Jane Street Capital as a full-time employee. He left Jane Street Capital in 2017.

In September of 2017, Bankman-Fried established Alameda Research, a cryptocurrency trading firm, alongside Tara Mac Aulay.

Sam Bankman-Fried, the founder

In April 2019, SBF founded the crypto exchange FTX, which launched in May 2019 and was closely intertwined with Alameda. And as the crypto world burst into notability during the COVID-19 period, so did Bankman-Fried and his crypto exchange firm.

Besides being the “poster boy for crypto,” Bankman-Fried also gained popularity for his effective altruism, donating millions of dollars to causes he believed in. SBF said that he wanted to make loads of money, which he would, in turn, give away to help make the world better.

Did you know? Bankman-Fried is also a teetotaller and a vegan who has reportedly stuck to his principles despite not being provided with vegan meals in prison.

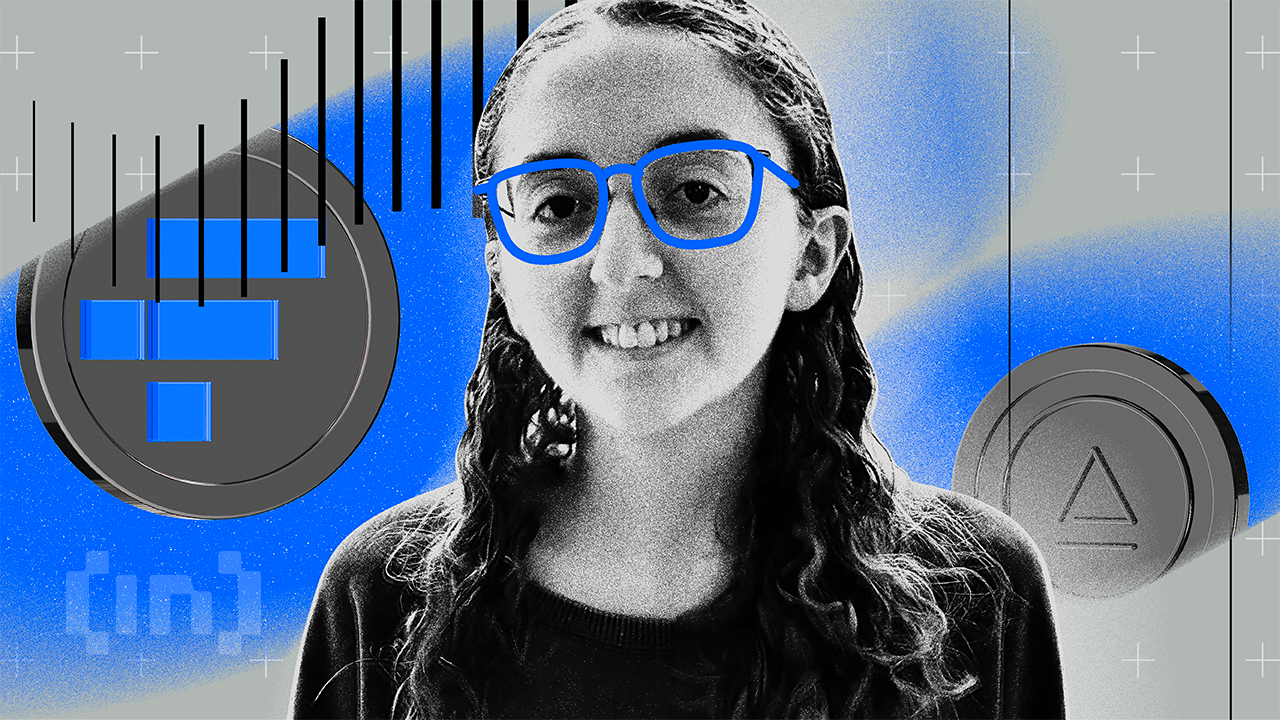

Enter Caroline Ellison

SBF’s interest in effective altruism is one of the reasons he bonded with Caroline Ellison. In addition to having an on-off relationship with Sam Bankman-Fried, Ellison was the CEO of the Alameda Research firm.

Ellison met SBF while working at Jane Street Capital after graduating from Stanford University with a degree in mathematics.

After launching Alameda Research, Bankman-Fried persuaded Ellison to join the crypto trading firm. They also lived together, with other FTX employees, at SBF’s Bahamas penthouse. In 2019, after SBF launched the FTX crypto exchange, Ellison started taking on more responsibilities at Alameda Research.

In 2021, Bankman-Fried left to focus on his crypto exchange, FTX, leaving Ellison and Sam Trabucco to run Alameda as co-CEOs. Sam Bankman-Fried, however, remained the final decision-maker at his crypto trading firm.

Following the FTX collapse, investigations revealed that Ellison oversaw risky bets that Alameda made using customer funds. This led to her pleading guilty to seven criminal charges. She agreed to a deal to cooperate with federal prosecutors, was the star witness in Sam Bankman-Fried’s case, and was subsequently sentenced to two years.

Beyond donating to good causes, Bankman-Fried also made political donations. He contributed over $70 million to election campaigns in less than 18 months, which made him a top political donor. Ahead of the 2022 midterm elections, Bankman-Fried donated about $40 million to political action committees and politicians, mostly to the Democratic Party and left-leaning groups.

What is Sam Bankman-Fried’s background?

While at Jane Street Capital, Bankman-Fried specialized in arbitrage trading strategies, concentrating on ETFs. Arbitrage trading is when a trader buys an asset in one market and sells it almost immediately in another market for a profit.

SBF worked at the New York-based firm for three years before quitting in 2017 after stumbling upon cryptocurrency. Bitcoin was gaining traction globally by this time, with its price action on the rise. The crypto industry was still in its infancy stage, so there was little to no crypto trading infrastructure.

While many buyers flooded the crypto market, few firms offered cryptocurrency trading platforms. Bankman-Fried saw an opportunity to use arbitrage trading in crypto. He started by zeroing in on Japanese arbitrage trading.

Bankman-Fried would buy Bitcoin in the U.S. and sell it for a profit in various Asian markets, pocketing up to 10%. As money began to flow in, SBF founded Alameda Research in November 2017, a few months after turning 25.

He hired a few colleagues from the effective altruism community and allegedly donated at least half of the firm’s profits to charity. At its peak, Alameda Research traded $25 million in Bitcoin daily. In 2019, he established the FTX crypto exchange and relocated to Hong Kong.

What is Sam Bankman-Fried known for?

Until November 2022, Sam Bankman-Fried was known as the founder of Alameda Research, a crypto trading firm, and FTX, one of the world’s largest crypto exchanges. FTX made revenue by charging users trading fees and through the sale of the FTX-created token, FTT. FTT enabled users to buy and sell on FTX at a discount.

Bankman-Fried championed crypto regulations and was associated with influential politicians. In 2022, he was reportedly among the top political donors to the Democratic Party.

Bankman-Fried’s prominence shot up in November 2022 following the collapse of FTX. FTX filed for bankruptcy in November, and Bankman-Fried stepped down as the CEO.

In the same month, Sam was arrested in the Bahamas for various counts of fraud and extradited to the US. His charges? He secretly channeled customer funds to support its sister firm, Alameda.

After a five-week trial in Manhattan, he was found guilty of two charges of wire fraud, two charges of wire fraud conspiracy, one charge of securities fraud, one charge of commodities fraud conspiracy, and one charge of money laundering conspiracy that has been termed one of the biggest financial frauds in U.S. history.

How did Bankman-Fried earn his money?

Sam Bankman-Fried started earning money while working at Jane Street Capital when he was around 21. He became interested in cryptocurrencies and eventually started to make money via cryptocurrency arbitrage.

His cryptocurrency arbitrage trading venture became successful, creating his crypto trading firm, Alameda Research. By 2019, Alameda Research was making a profit, which led Bankman-Fried to launch his cryptocurrency exchange, FTX. By 29, Sam Bankman-Fried’s net worth stood at a staggering $22.5 billion.

But beyond crypto trading, SBF became a beacon of hope for other companies struggling during the 2022 crypto winter. He bailed out Voyager Digital, a bankrupt crypto broker, and also gave crypto lending firm BlockFi $250 million as credit.

He also launched his venture fund, FTX Ventures, in 2022, which invested in various companies in different industries and managed nearly $2 billion in assets before it declared bankruptcy alongside FTX.

What was Sam Bankman-Fried accused of?

Accusations stated that Sam Bankman-Fried funneled billions in customer funds from his crypto exchange, FTX, to Alameda Research. Alameda then used the funds to bet on risky crypto investments and bail out other struggling crypto firms.

For clarity, in many parts of the world, companies with multiple affiliated entities must keep accounts separated. Additionally, if companies have agreed — such as through terms of service — to segregate customer funds from their own, they are obligated to honor that commitment.

Bankman-Fried was also accused of using customer funds to make huge political donations to both Democrats and Republicans as well as for personal expenses. The former FTX CEO diverted customer funds to prop up his lavish lifestyle, covering personal expenses of millions of dollars.

For instance, he invested $200 million in real estate in the Bahamas and used the funds to repay various entities that had loaned money to Alameda.

After his case went to trial, SBF was found guilty of seven different counts of conspiracy and fraud charges. According to the prosecutors, SBF’s fraud began in 2019 and continued till November 2022, when FTX collapsed.

What was Caroline Ellison accused of?

Caroline Ellison, who was Sam’s on-and-off girlfriend and the former CEO of the now-collapsed Alameda Research, was accused of conspiracies to commit commodities fraud, securities fraud, wire fraud, and money laundering. According to prosecutors, Ellison played a massive role in the crimes that SBF committed while at the helm of FTX.

Ellison pleaded guilty to the seven charges that largely mirror those against her ex-boyfriend and former boss, Sam Bankman-Fried. In her defense, Ellison told jurors that Bankman-Fried made her defraud FTX customers of their billions of dollars knowingly.

Besides the U.S. prosecutors, the U.S. Securities and Exchange Commission (SEC) also charged the former Stanford math graduate with fraud. According to the SEC, Ellison and FTX’s former CTO, Gary Wang, aided Bankman-Fried in diverting customer funds to Alameda Research while providing investors with misleading information about it.

Under SBF’s directive, the SEC also alleged that Ellison manipulated FTT’s price and used it to mislead investors about the company’s real health. FTT was an FTX-issued digital token. Ellison agreed to cooperate with U.S. prosecutors and became the star witness in Bankman-Fried’s case.

The collapse of the SBF financial empire

The SBF financial empire collapsed within ten days and had a rippling effect on the whole cryptocurrency industry. At the time, FTX was the third-largest crypto exchange in terms of trading volume globally.

On Nov. 2, 2022, CoinDesk reported that Alameda Research’s balance sheet comprised the FTT, FTX’s native crypto token. The report also implied the token could easily be manipulated as its supply was centrally controlled. It had also been used as collateral for various loans.

Binance, the world’s largest crypto exchange, announced its intent to sell all its FTT holdings valued at around $529 million on November 6, 2022. Binance’s CEO, Changpeng “CZ” Zhao, said the move to liquidate the exchange’s FTT holdings was based on risk management.

This had become necessary after the collapse of the LUNA stablecoin earlier in the year. The next day, FTX started experiencing liquidity issues. In a series of tweets, Sam Bankman-Fried attempted to reassure his investors that its assets were fine.

Binance gets involved

However, following the CoinDesk report, customers began demanding withdrawals amounting to $6 billion. Following these issues, SBF tried raising capital from venture firms before reaching out to its competitor, Binance. Within two days, the value of the FTT tokens had declined by over 80%.

Binance publicized that it had reached a non-binding deal to buy the non-U.S. FTX business entity for an undisclosed amount on Nov. 8, 2023. However, Binance backed out of the deal to buy FTX the following day. Binance announced that the cancellation resulted from corporate due diligence that revealed FTX’s mishandling of client funds, among other concerns.

“Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of [FTX].

“Every time a major player in an industry fails, retail consumers will suffer. We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.”

Binance: X

The Bahamas’ securities body froze all of the FTX Bahamian subsidiary’s assets after news broke that SBF was looking to raise $8 billion worth of investment to bail out FTX. The California Department of Financial Protection and Innovation also announced on the same day that it had launched investigations into FTX.

On Nov. 11, 2022, Sam Bankman-Fried filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code. He also resigned as the CEO of FTX on the same day. Alameda Research and over 130 legal entities associated with FTX also faced the same fate.

John J. Ray III was appointed as the new FTX CEO to replace Bankman-Fried, given the pivotal role he played during the restructuring of Enron, an American energy company that filed for bankruptcy in December 2001.

On Nov. 12, 2022, observers noticed the movement of hundreds of millions of dollars of customer funds to other crypto wallets. FTX claimed someone had hacked the crypto exchange and moved about $477 million.

How much money was lost in FTX?

When FTX and FTX US filed for bankruptcy, an estimated $8.7 billion of customer funds were missing. The billions of dollars went to luxury real estate, personal loans, and political donations. While testifying against SBF, Ellison revealed that Alameda Research had used customer funds from FTX to meet its liabilities.

What happened to Bankman-Fried?

Following the FTX collapse, SBF’s net worth, estimated to be over $26 billion, declined to $1 billion before he lost it all. In an interview with the New York Times in November 2022, Bankman-Fried said he had around $100,000 left in his bank account.

Once revered as a top crypto mogul, Bankman-Fried’s profile as an entrepreneur, philanthropist, and political donor ended in ruins due to several legal charges by the end of 2022.

Sam Bankman-Fried’s arrest

On Dec. 12, 2022, Bahamian authorities arrested Bankman-Fried at his penthouse on behalf of the US government. The following day, the U.S. Department of Justice (DOJ) unsealed Bankman-Fried’s indictment. The DOJ charged him with eight criminal counts, including money laundering, securities and wire fraud, and unlawful political campaign financing.

The U.S. Commodity Futures Trading Commission (CFTC) and the SEC also levied various charges against SBF. The two U.S. authorities were pursuing civil claims of commodities and securities fraud against Bankman-Fried.

On Dec. 21, 2022, SBF was extradited to the U.S. for criminal charges. He appeared before a Manhattan federal court on Dec. 22, 2022. He was later released on a cash bail of $250 million — the largest bond in U.S. history. The court placed him under house arrest and had him stay at his parents’ home in California.

On Jan. 3, 2023, Bankman-Fried pleaded not guilty to the criminal charges. The Department of Justice filed four additional criminal charges linked to unlicensed money transmission on Feb. 23, 2023. On March 28, 2023, the DOJ charged SBF with foreign bribery. Two days later, on March 30, 2023, he pleaded not guilty to the new charges.

In July 2023, Bankman-Fried faced new accusations of tampering with a witness, Caroline Ellison. This was after he leaked the contents of Ellison’s diary to The New York Times. A federal judge placed SBF under a gag order on July 26, 2023, so he couldn’t communicate with the media and the public.

On Aug. 14, 2023, the court revoked his bail and remanded him to the Metropolitan Detention Center. His trial for seven out of the eight criminal charges began on Oct. 2, 2023. The jury overseeing the case returned a guilty verdict on all seven charges on Nov. 2, 2023.

Sam Bankman Fried behind bars

The future looks bleak for Bankman-Fried in 2024 since CNBC disclosed that a federal court in Manhattan, on March 28, 2024, handed down a 25-year prison sentence to Bankman-Fried.

This sentence was less than the 40 to 50 years requested by prosecutors yet significantly more than the five to six-and-a-half years his defense attorneys had proposed. In addition to his prison term, he is ordered to forfeit $11 billion to the U.S. government. The presiding judge, with three decades of judicial experience, noted he had never seen a trial testimony like that of Bankman-Fried’s.

Bankman-Fried accepted some level of guilt but argued that his exchange’s customers would eventually be reimbursed, blaming delays on federal bankruptcy court procedures. His family, expressing deep sorrow, vowed to keep supporting and advocating for him.

What’s next for Bankman-Fried?

As Sam Bankman-Fried faces a future marked by a 25-year prison sentence, his path is unquestionably fraught with adversity. The culmination of his legal battles — a harsh sentence and an order to forfeit $11 billion — highlights the severity of his crimes and their impact on the financial and political spheres.

Despite his acceptance of some guilt and promises of reimbursement to customers, the consequences of his actions have led to irreversible changes in his life and career. Once a celebrated figure in cryptocurrency, Bankman-Fried’s fall from grace now serves as a cautionary tale about the consequences of overreach and the importance of regulatory compliance.