Decentralized protocols are growing exponentially. And data is one of the vital cogs of a decentralized ecosystem. Encrypting that data properly is paramount. So NuCypher — a data encryption protocol — aims to do just that, storing and encrypting data relevant to the Ethereum network or related DApps. This NuCypher price prediction discusses the investment potential and desirability of the project.

Plus, our NuCypher price prediction model looks at the ROI potential of NU — NuCypher’s native token. This price forecasting model conducts fundamental and technical analysis, considers tokenomics, on-chain analysis, and more. Let’s get to it.

- NuCypher price forecast and fundamental analysis

- NuCypher token economics and the impact on future price predictions

- NuCypher price prediction and other key metrics

- NU price prediction and technical analysis

- NuCypher (NU) price prediction 2023

- NuCypher (NU) price prediction 2024

- NuCypher (NU) price prediction 2025

- NuCypher (NU) price prediction 2030

- NuCypher (NU’s) long-term price prediction until 2035

- Is the NuCypher price prediction model accurate?

- Frequently asked questions

Want to get NU price prediction weekly? Join BeInCrypto Trading Community on Telegram: read NU price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

NuCypher price forecast and fundamental analysis

NuCypher solves an important blockchain issue. It allows developers and network participants to store private insights on public ecosystems securely. Simply put, NuCypher is a KMS or a Key Management System with decentralization at its core.

Did you know? NuCypher boasts a privacy-preserving, cryptographic infrastructure that aims to encrypt end-to-end data sharing in public. One of its standout traits has to be the proxy re-encryption technology.

NuCypher, with its highly secure data handling capability, qualifies as a data management protocol in web3. Its peers include The Graph, Chainlink, Dent, and more. However, NuCypher strives to be different. Here is how:

- It keeps the use case simple — working as a blockchain privacy layer.

- A wider adoption might make blockchain more relevant in industries like healthcare, whereas conditional access to data might be necessary.

- NuCypher is a technically rich protocol using threshold signatures and other technologies to remain useful and relevant.

- Its native token, NU, helps run specific NuCypher nodes and even incentivizes participants to offer data-securing services.

- NuCypher merged with the KEEP Network (secured off-chain data containers) in 2022 to make way for the Threshold Network. However, the individual ecosystems are still relevant.

- It is a layer-2 protocol using proof-of-stake as the consensus mechanism.

However, there is a red flag. Popular exchanges like Binance and Crypto.com have delisted NuCypher to support the new merged token T (Threshold).

Therefore, the trading markets have shrunk for NuCypher, making the price optimism bleak. This could be the reason why NU could only go as high as $0.199 in 2023 as opposed to our otherwise conservative expectation of $0.4.

“Very happy to continue our collaboration with NuLink and to see all the progress they’ve made enabling NuCypher’s proxy re-encryption cross-chain”

MacLane Wilkinson,Founder of NuCypher: X in 2021

NuCypher token economics and the impact on future price predictions

NuCypher came in with a fixed supply of 1 billion tokens. Even though the supply is inflationary, the issuance rate is expected to drop, making the economics disinflationary in nature.

Currently, with NuCypher trading changing to Threshold trading across exchanges, token economics might not be the most important aspect of price prediction.

In 2020, NuCypher had plans:

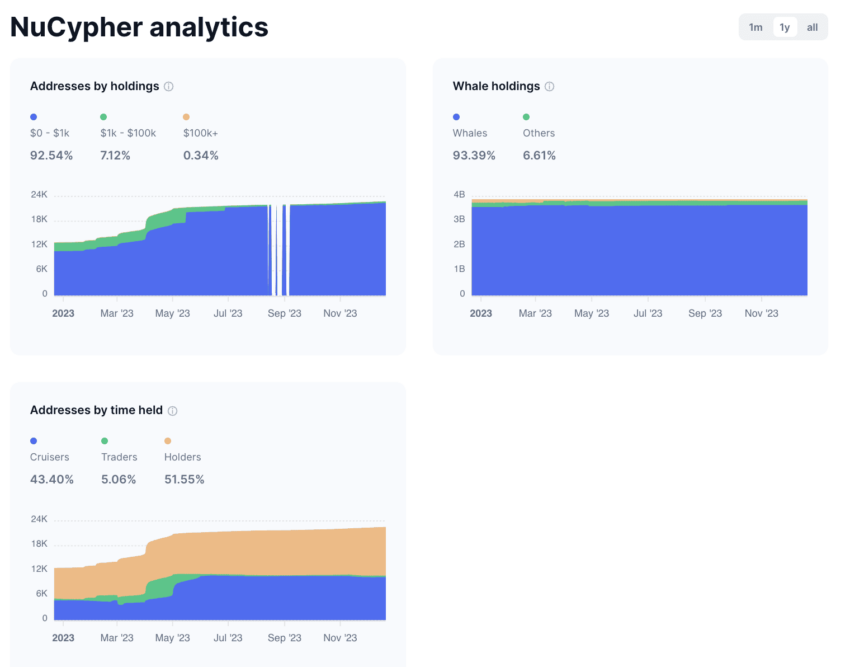

The matter of concern, however, is that the top 100 NU holders were in control of 99.52% of the overall supply, as of early 2023. And any dump due to the waning popularity might trigger a sharp price drop.

Yet, a glimmer of hope has to be that 51.55% of NU players are still holding onto the token, expecting a price rise.

NuCypher price prediction and other key metrics

The daily active address count peaked in early 2023, taking the prices higher. However, it was short-term optimism, as the prices were in a broader downtrend for the better part of 2023.

As of December 2023, the number of breakeven addresses is increasing, showing that people might book profits and exit on a given chance. This makes us a tad skeptical about the prices.

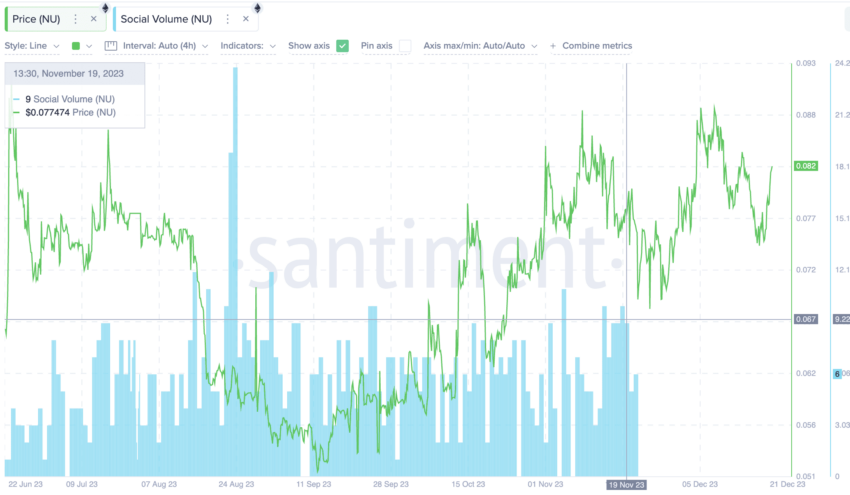

However, the social volume metric paints a different picture altogether. Since the peak in September 2022, social chatter involving NuCypher hasn’t been all that high. This might lead to future price stagnation in the mid-to-long term.

However, this was the case in early 2023. As of November 2023, the social volume, or rather the chatter involving NU picked up. Notably, even the prices rose along with it. Therefore, for the price of NU to surge, there must be some decent social activity involving the same.

NU price prediction and technical analysis

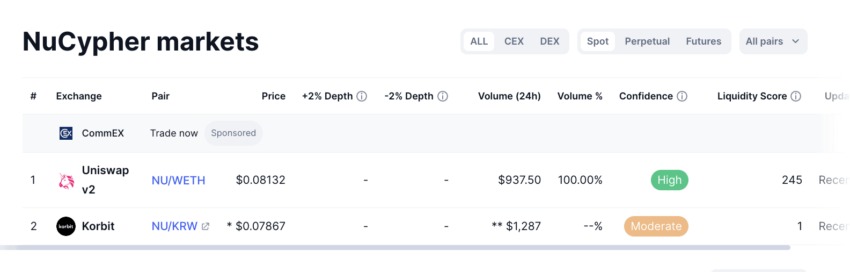

We have already taken a closer look at NuCypher’s fundamental stead. Plus, we know by now that the presence of Threshold has dented prices significantly. Yet, some exchanges like Coinbase still supported NuCypher trading in early 2023, albeit with limited liquidity. At present, only a handful of exchanges list the same.

There was a time when the market cap of NuCypher peaked all the way at $1.07 billion. The trading volume at that time was $470.80 million. However, since Threshold emerged, the market cap has fallen at least ten times, with trading volume levels as low as $1.85 million around early November 2022.

The NU-USD trading pair at Coinbase currently dominates the trading limelight with a decent liquidity score. We shall be using Coinbase’s NU-USD trading chart for our technical analysis.

And despite, Coinbase having delisted NU, the historical price patterns still hold.

Also, here is a chart depicting the current state of NU’s market cap:

Here is the raw chart for you to identify a pattern:

Pattern identification

The weekly prices of NuCypher show a clear pattern. On the left, we have a higher high formation leading to a peak, followed by a lower low formation and then a peak. And from that peak — the maximum price of $3.58 — NuCypher forms a series of lower highs. The pattern would be completed if NU successfully makes a higher high — just like at the chart’s beginning.

Also, if a higher high is made, smaller than the peak, you might be looking at a head and shoulders pattern for NuCypher. That might signify some weakness at NuCypher’s counter.

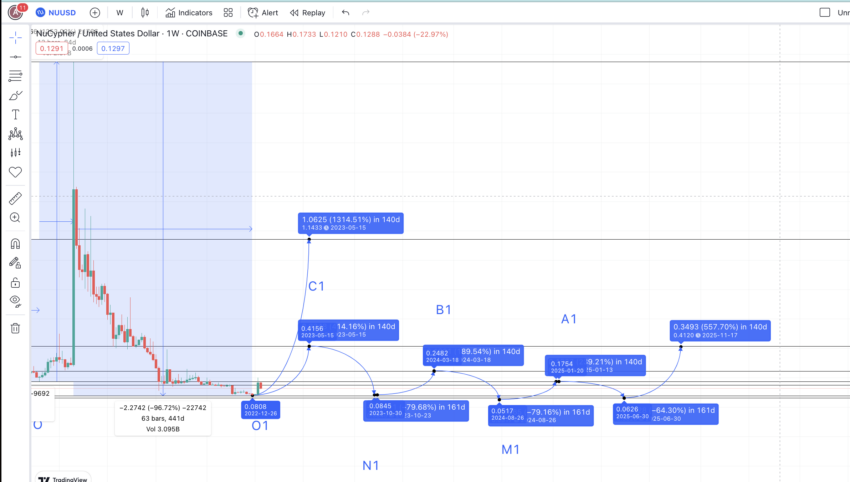

Here are all the marked points for your reference:

Our task is to locate the next set of points, C1, N1, B1, M1, and N1 if we believe NU could complete the pattern.

Price changes

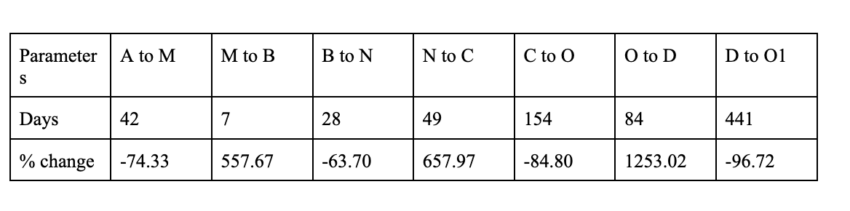

As it is a forward-moving pattern, we will create one table to trace the price changes and distances from A to O1.

We can infer the following things from the table above:

- The negative column values signify all the high-to-low moves. The average price change and distance for high-to-low moves are 79.88% and 160 days. Maximum distance and price drop percentages are 441 days and -96.72 — figures that we keep handy considering the bearish nature of the crypto market.

- The positive column values signify all low-to-high moves. In this case, the average price change and distance are 822.88% and 47 days. The maximum distance can be 140 days (the sum of all the column values holding positive percentages), and the minimum price hike would depend on the support and resistance lines on the chart.

We can use the above-mentioned insight to predict the future prices of NuCypher, in the short and long term.

NuCypher (NU) price prediction 2023

Contrary to our prediction, NU reached a high of $0.1989 in 2023. The low went as deep as $0.0514, as opposed to our expectation of $0.0845. However, these were still credible levels considering T breathing down NU’s neck and major exchanges delisting the same. Here is how our 2023 NU price prediction read:

Now we have the last low as O1. So, we can use the low-to-high average from the table above to plot the next high. The maximum distance can be 140 days, as mentioned above. The next high from O1 can surface at $0.4144 — a level that acts as a strong resistance for NuCypher. This translates into a peak of 414%, which is acceptable considering the current state of NuCypher.

However, if the quintessential head-and-shoulders pattern is to be completed, we can expect the price of NuCypher to reach $1.14. But after the creation of Threshold — the merger-specific token — a price bump of over 1300% doesn’t look practical.

If NuCypher reaches $0.4144, the low might just show up in 160 days per the high-to-low average. The average low can surface at a drop of 79.88%, a level that looks probable considering the decreasing popularity of NuCypher after the introduction of Threshold.

Therefore, the NuCypher low might surface at $0.0845. The high in 2023, as mentioned previously, might surface at $0.4144.

NuCypher (NU) price prediction 2024

Outlook: Bearish

Considering NU to eventually reach the 2023 levels in early 2024, we can recalibrate the high as $0.4144. Yet, if the adoption of NU picks up, here is the more conservative 2024 path that it can follow:

Now that we have C1 and N1 handy, we can try and locate the average prices — highs and lows — for 2024 and even 2025. The first level, or B1, should start from N1. The distance can be 140 days, and the peak can go as high as $0.2446. This puts B1 lower than C1 — a trend similar to the chart’s beginning.

This puts the NuCypher price prediction for 2024 at a high of $0.2446. The low, in that case, can surface at a low of over 79% — using the average from the table — and surface at $0.0517.

Projected ROI from the current level: 200%

NuCypher (NU) price prediction 2025

Outlook: Bearish

A1 or the NuCypher price prediction 2025 high can start from the 2024 low or M1. It might take NU 140 days to reach the same. Depending on the crypto market conditions, the price can take shelter at the immediate resistance of $0.1754 — which aligns with the existing price level of $0.175 as of Jan. 29, 2023.

Projected ROI from the current level: 116%

NuCypher (NU) price prediction 2030

Outlook: Bullish

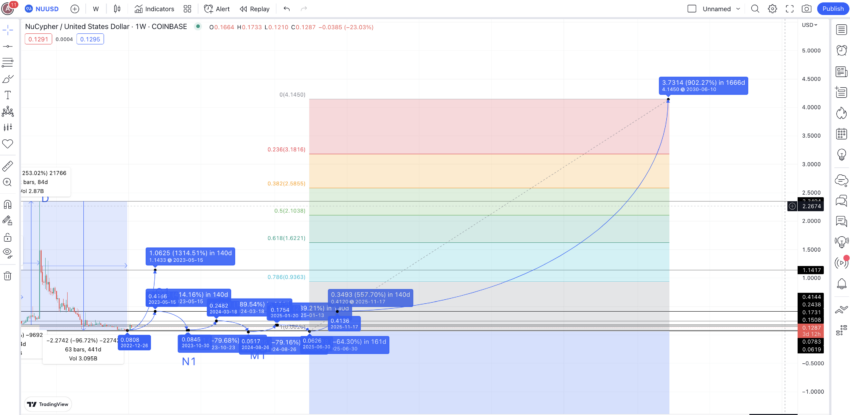

Now that we have the price levels till A1, it is clear the price of NuCypher won’t be all that buoyant till 2025. Not until it trades continuously inside the given pattern. Also, the NuCypher price forecast till 2025 replicates a bearish head-and-shoulders pattern in some way, which explains the projected minimal ROI.

Therefore, from A1, we can expect the average prices of NuCypher to start following the same pattern — A to A1, all over again. The peaks and throughs can be placed differently depending on the overall market condition and adoption of NuCypher.

From A1, we can expect the next drop to be at M2 — the starting point of the next pattern. This level can also be the NuCypher price prediction low for 2025. The drop of 79.88% might not happen as post-A1 — at the brink of a new pattern — the price of NU tokens might not adhere to the average drop or hike percentages.

Therefore, over the next 160 days, we can expect the price to drop to a strong support level of $0.0611 — which aligns with the all-time low of NuCypher. We can mark this point as M2. (Refer to the 2026 chart in the section above for reference).

If NuCypher stays alive and trades across exchanges by the end of 2025, we can expect the 2026 high to follow the 140-day path — per the table above. The price rise can settle at a minimum hike of 557.67%, according to the table above. This puts the NuCypher price forecast high for 2026 at $0.4120 — closer to its 2023 high.

Road to 2030

We now have the 2026 high and 2025 low in sight. It is possible to connect these levels using the Fib indicator to trace the path till 2030.

If the same growth path from 2025 to 2026 is followed, the NuCypher price prediction for 2030 high could surface at $4.1450. Notably, this is a very optimistic level for NU.

Projected ROI from the current level: 4994%

NuCypher (NU’s) long-term price prediction until 2035

Outlook: Bullish

While we have access to the expected NuCypher prices until 2030, it is only appropriate to see how they might fare till 2035. Here is a table to help with that:

You can easily convert your NU to USD here

| Year | | Maximum price of NU | Minimum price of NU |

| 2023 | $0.1989 | $0.05138 |

| 2024 | $0.2446 | $0.0517 |

| 2025 | $0.1754 | $0.0611 |

| 2026 | $0.4120 | $0.2554 |

| 2027 | $0.618 | $0.48 |

| 2028 | $1.39 | $0.862 |

| 2029 | $2.29 | $1.42 |

| 2030 | $4.1450 | $2.818 |

| 2031 | $5.18 | $3.211 |

| 2032 | $6.475 | $5.05 |

| 2033 | $8.41 | $5.21 |

| 2034 | $9.26 | $7.22 |

| 2035 | $11.57 | $9.02 |

Is the NuCypher price prediction model accurate?

NuCypher has seen a transition. And while the prices and future prospects were hit, the protocol’s innovation and privacy tools remain relevant. This NuCypher model is unique in considering the slowing trading momentum. As you can see, the near-term prices are unlikely to surge due to the current state of events. But then, if NuCypher shows some utility in its own right, the average prices up to 2030 and beyond might become buoyant. In short, this price prediction is realistic yet practical, capturing tokenomics and on-chain metrics to paint a holistic picture of the future of the NU token.

Frequently asked questions

Is NuCypher coin a good investment?

What will NuCypher coin be worth in 2030?

How high will NuCypher go?

What type of crypto is NuCypher?

Who is behind NuCypher?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.