Many projects choose to launch new coins through ICOs (initial coin offerings). Much like stock market IPOs, an ICO is a fundraising instrument. Early investors are invited to support a project in its initial stages and acquire crypto assets at a discount. If you have an idea for a coin or project, this guide will cover everything you need to know and demonstrate how to launch an ICO in 2025.

KEY TAKEAWAYS

► ICOs are a fundraising method for cryptocurrency projects, offering early investors a chance to buy tokens at low prices, but they come with a few risks.

► Launching an ICO requires careful planning, including creating a whitepaper, developing smart contracts, choosing a token sales model, and marketing the project effectively.

► There are several token sales models available, such as fixed rate, soft cap, hard cap, and Dutch auctions, each with different strategies for managing token distribution.

► Although ICOs were extremely popular in 2017, they have since faced regulatory challenges, and other fundraising methods, like airdrops, have become more common in recent years.

How to launch an ICO

There are many ways to launch an ICO; it all depends on your needs. However, there are a few steps that are commonplace amongst most ICO launches. Let’s take a look at each.

Step 1: Have an idea

While it may be fairly obvious that to launch an ICO, you need an idea. You should work out the details of how your coin will work and its general purpose.

For example, some coins focus on niche industries, creating blockchain solutions, while others simply seek to launch a new coin for others to invest with and trade.

Ask yourself if the solution really requires a blockchain and work out the fine details of the use case before moving to the next step.

Step 2: Assemble a team for the project

Putting together a team allows you to consult experts in the areas where you need input. This may include legal experts, growth marketers, security auditors, etc. An experienced team can provide valuable insight before a coin goes public and help iron out any kinks in the project.

Step 3: Draft a whitepaper

Any legitimate crypto project needs a whitepaper detailing the tokenomics, purpose, and business model for its token, among other details.

The paper, in theory, provides all the essential information that investors need to decide on the coin.

A whitepaper should set out what issue the coin solves, if any, and how it will solve the problem. Ideally, you should host this on your website to pitch the coin to potential supporters. Furthermore, in this document, you should include a product roadmap detailing future plans for the coin.

Step 4: Smart contracts

One of the final stages of creating an ICO is the creation of smart contracts. With this step, you will need to choose a chain to launch on if you aren’t building your own blockchain.

While the most common contract is ERC-20, the industry standard, there are other options, such as the SPL (Solana), BRC-20 (Bitcoin), or Jetton (TON blockchain).

Additionally, if you don’t know how to create a smart contract, OpenZeppelin provides a tool (and template) for creating one, which requires minimal information from your side. Once this is complete, examine it thoroughly and deploy it.

Step 5: Picking a sales model for your coin

The next step is to pick a sales model, of which there are several. Which one you choose may depend on several factors, including the location of your headquarters (as different countries have different rules about ICOs). There are eight different token sales models that you may use for an ICO.

ICO token sales models

1. Supply at a fixed rate (uncapped)

This model means that a token would go on sale for a fixed price, allowing early adopters to buy an initial number of tokens without the market fluctuations usually associated with the cryptocurrency market. This, in contrast, will only remain at a set price for a certain period of time, after which buyers of the token will purchase it at the market rate.

2. Soft cap

In a soft cap sales model, the creator of the token determines the minimum fundraising amount of the ICO and sets the price accordingly.

As such, this model requires you to sell a certain number of tokens for a set amount, after which the ICO will continue until the set end date and time. This increases the possibility of successful fundraising.

3. Hard cap

Contrary to a soft cap, a hard cap means that the token creator sets the maximum amount of capital needed. The ICO ends at this cap or at the end of the ICO period, whichever comes first. This may mean that potential investors miss the opportunity to invest in the ICO, leaving some unlikely to consider investing later on.

4. Hidden cap

When using a hidden cap, investors will not know the amount of capital allocated until the time of the ICO. Equally, they will not know other goals until the ICO goes live. This may be useful if the ICO is subject to a lot of speculation, as this would keep key details under wraps until the public needs to know.

5. Dutch auction

A Dutch auction is a method where, in the case of cryptocurrencies, the value of one coin will start at the highest asking price. Subsequently, the price comes down to a level at which the bids received will encompass all tokens on offer.

This method is relatively complicated, so it is not the best for an individual looking to launch their first ICO.

6. Reverse Dutch auction

While you might expect that the reverse Dutch auction would, logically, be the opposite of the above, this is not entirely true. The good news is that it is simpler.

There is a limited number of tokens, and the number of tokens sold each day is equally divided by the duration of the ICO.

For instance, if the ICO lasted for five days, 20% of the total token amount would be sold each day. This is a fairly simple method that controls the distribution of tokens if there is significant demand for the ICO.

7. Collect and return

In this method, there is a set price, but buyers may bid above this set price. Where the price is above a set amount, some capital may be returned to the investors. To obtain larger amounts, investors will have to go through multiple smaller transactions.

This gives more people a chance to partake in the ICO. The disadvantage is that it results in higher transaction fees for participants.

8. Dynamic ceiling

The dynamic ceiling prevents investors with a significant amount of money from buying many coins in one transaction. Instead, it forces them to buy in smaller amounts throughout the ICO, spreading their buys over the duration of the ICO.

This stops major investors from taking control of a large number of coins and gives smaller investors a chance. Any of these sales models may work for an ICO; however, depending on the ICO, one will very likely work better than the others. It is an important consideration before putting your token out to the public.

What is an ICO?

In crypto, an ICO is the initial offering to the public of an asset — in this case, a crypto asset. An ICO often starts with a cryptocurrency at a meager price, so it is a great opportunity for beginner crypto enthusiasts to get in with little initial investment.

ICOs are a method that projects use to raise capital for new or ongoing developments. They are also a way to distribute coins and tokens fairly.

An airdrop is a targeted marketing strategy where crypto projects distribute free tokens to boost awareness, engagement, and adoption.

While crypto airdrops often do not require an investment, ICOs are considered fundraising events.

With ICOs, new projects sell tokens to investors with the aim of raising capital for project development.

ICOs are not without flaws. Many traders prefer fair launch ICOs as assurance that they will not be used as exit liquidity for larger investors.

Even if an ICO is legitimate, it still carries significant risk. If there is little appetite for a token, investors could easily lose capital.

Marketing your ICO and coin

Before you launch an ICO, there needs to be significant interest in the project for investors to buy into a new coin. If not, there is little point in learning how to launch an ICO if there is little enthusiasm for it.

To achieve this, you need to market an ICO and the coin to tell people what they can gain from it and what the aims are. You can do this by setting up social media and using relevant publications or news websites to spread the word.

Add your coin to ICO calendars and post in groups that talk about cryptocurrency on multiple platforms. These are all great ways to create a discussion around your upcoming ICO.

Listing your ICO on exchanges

Finally, to launch your ICO, apply to exchanges such as Coinbase, Binance, Kraken, and Gemini to list your ICO. To better your chance of listing on these exchanges, you should give them the following details (at the very least):

- Coin name

- Coin ticker

- A brief description of the project and coin

- Any branding that exchanges, including a logo may need

- Intended launch date

- Source code (after it has been reviewed)

The state of ICOs in 2025

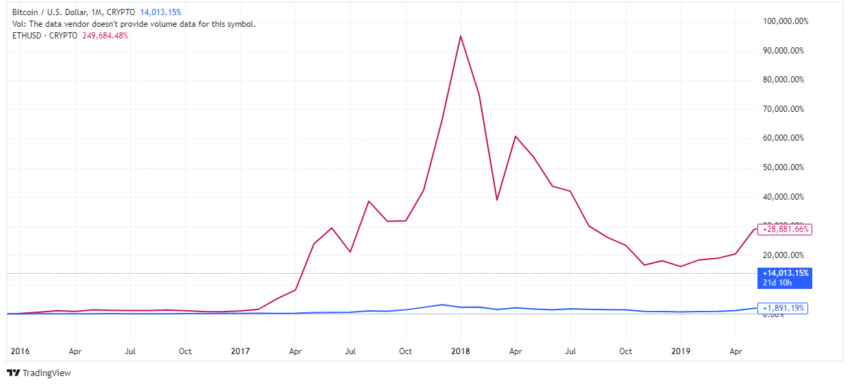

ICOs peaked in 2017. This was the year ICOs became extremely popular as a fundraising mechanism for blockchain-based projects.

During this period, a huge number of new cryptocurrencies and blockchain startups used ICOs to raise capital by selling their tokens to investors. The boom was largely fueled by the rapid rise in the value of major cryptocurrencies like Bitcoin and Ethereum.

In recent years, ICOs have taken a backseat to more popular token distribution mechanisms, such as airdrops. This is due to regulatory scrutiny. Because of scams and the possibility of offering unregistered securities, many projects are cautious of using ICOs.

Stay compliant

Once you’ve completed all the aforementioned steps, you can launch your ICO. Remember that not all coins succeed; in fact, most don’t.

Make sure to follow all compliance standards, provide potential investors with the information they need, and carry out general due diligence. There is much that goes into an ICO, so ensure you do your own research and only launch your project when it is completely ready to go.

Frequently asked questions

How much does it cost to launch an ICO?

How do I launch an ICO successfully?

Is an ICO illegal?

Can you make money with ICO?

Is it worth investing in ICO?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.