Ethereum is like the digital oil of the cryptocurrency world; a lot of applications, protocols, and blockchains depend on it—directly and indirectly. Therefore, traders, investors, and developers need a simple and easy way to purchase Ethereum with little difficulty. In this guide, you will learn how to buy ETH in three simple steps.

Step-by-step guide on how to buy Ethereum

There are a few steps that you need to take to purchase Ethereum. In brief, this includes choosing an exchange, depositing funds, and then actually buying Ethereum. In the following sections, we will go over the process associated with each of these steps.

1. Choose a cryptocurrency exchange

Selecting a cryptocurrency exchange is the first and perhaps most important step in buying Ethereum. When selecting an exchange to buy the ETH token it is important to research it and understand the transaction fees associated with any relevant actions on the exchange.

You should also assess the security of the exchange and the assets held on the platform. This includes proof of reserves, segregated assets, multi-factor authentication, and so on.

Assessing the features is another big part of choosing an exchange. Some may only want to buy and sell crypto, while others may want to trade ETH or deposit their Ether to earn rewards.

Popular exchanges

Binance

Binance is a global cryptocurrency exchange that sets itself apart by its suite of features and liquidity. One of its most popular products is the BNB Chain, which is one of the most popular EVM-compatible blockchains, hosting many popular decentralized applications (DApps) and tokens.

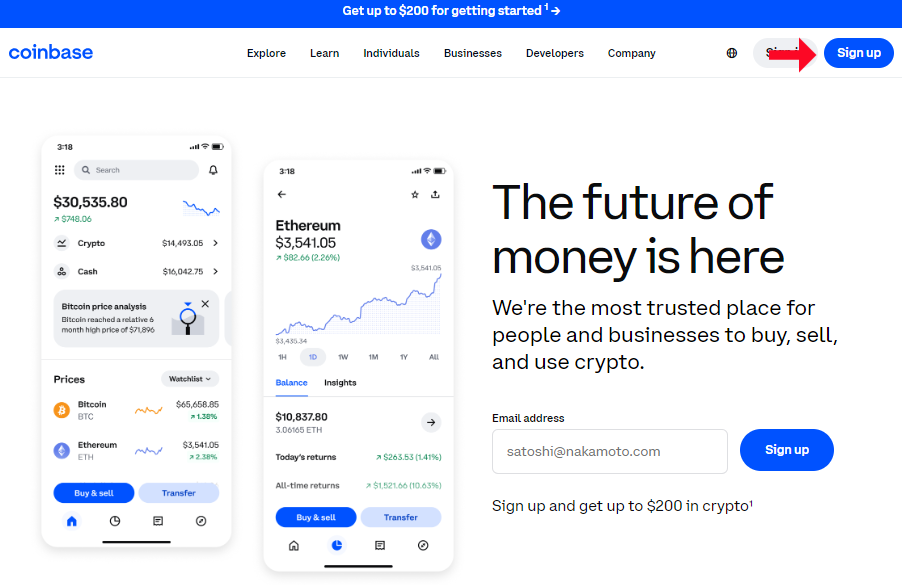

Coinbase

Coinbase is a U.S. based exchange that was created by Fred Ehrsam and Brian Armstrong. It is the second most popular exchange in the world by trading volume to buy crypto. Coinbase is notable because of its many feature sand products, such as Base Chain, Coinbase wallet, and earning yield on USDC deposits.

YouHodler

YouHodler is an online cryptocurrency trading platform that has become popular for its loans and earning opportunties. It supports crypto-collaterlized loans and supports loans paid in multiple fiat currencies.

Account creation and verification

Due to its popularity, most exchanges support ETH purchases. For our guide, we will use Coinbase to purchase ETH.

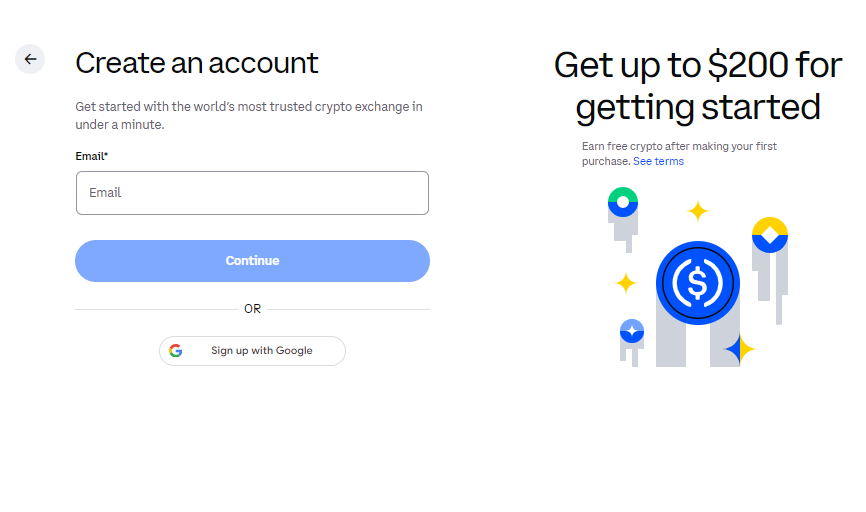

1. Navigate to the Coinbase website and select the “Sign-up” button.

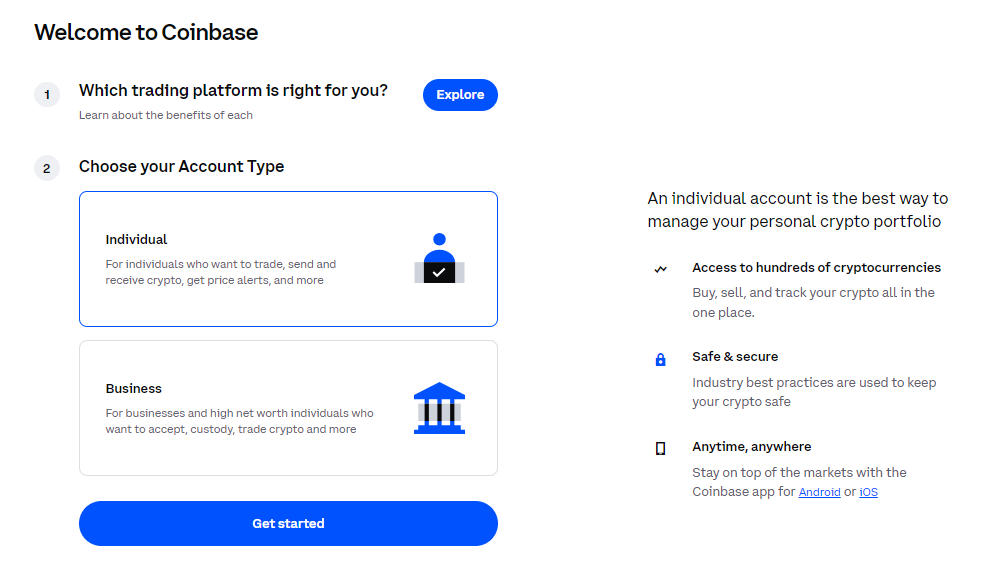

2. Select the type of account. We will use the individual account.

3. Enter an email address. You can simplify this process by signing in with Google.

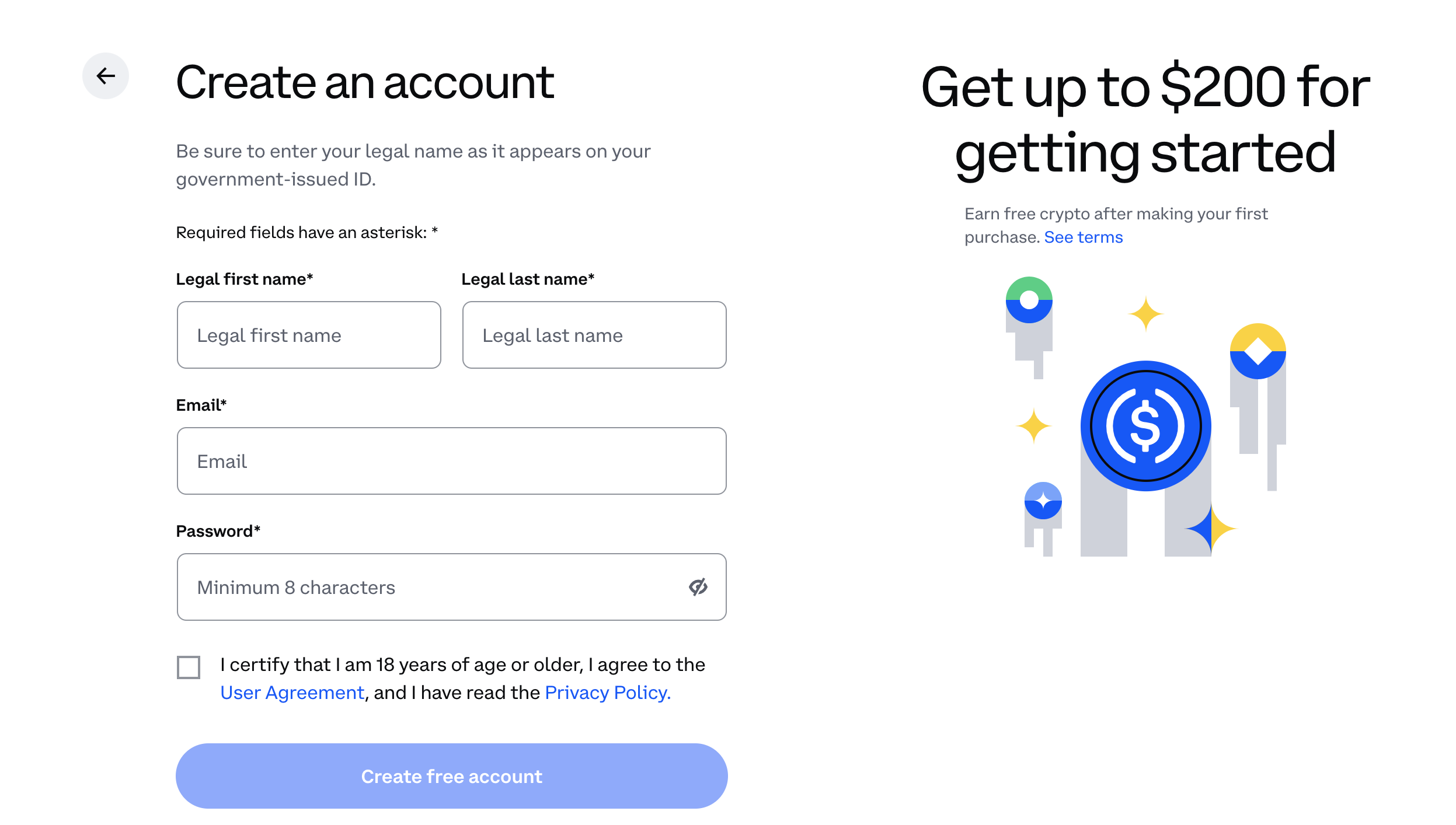

4. Fill out the form with your legal name, email, and password to create a free account.

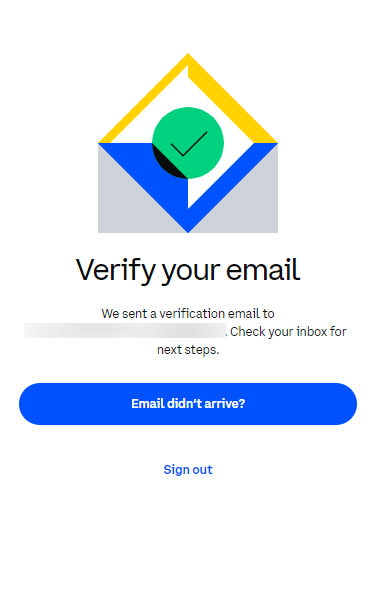

5. Open your email. Select the email from Coinbase and follow the instructions to verify your email.

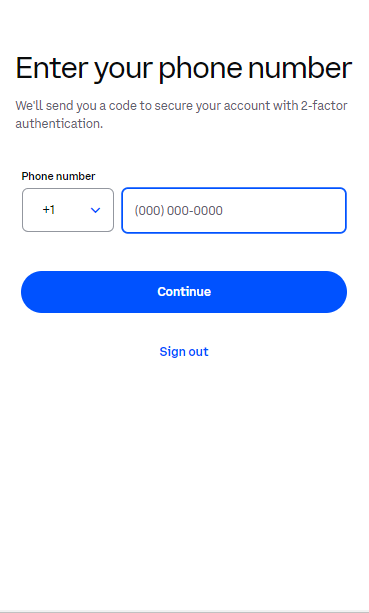

6. Enter your phone number to receive a confirmation email.

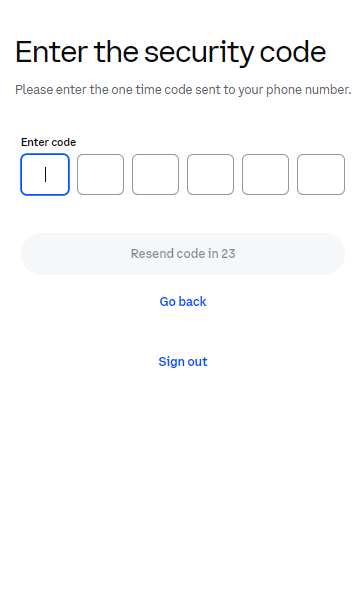

7. Enter the security code sent to your phone.

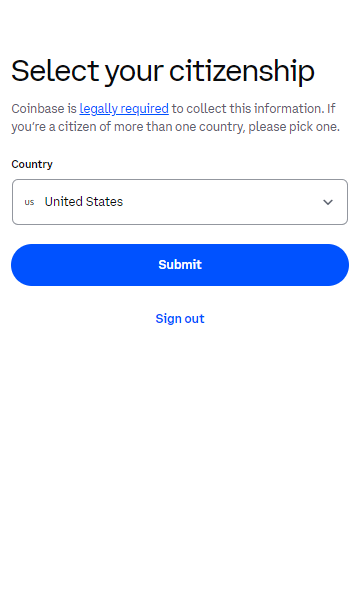

8. Select the country where you have citizenship.

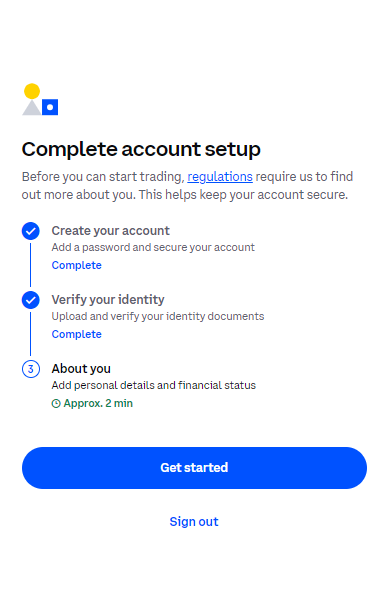

9. The next few steps will require you to verify your identity.

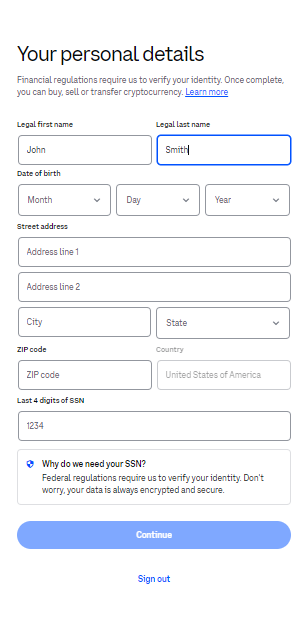

10. Fill out your personal information, such as your full legal name, date of birth, address, and the last four digits of your social security number (SSN).

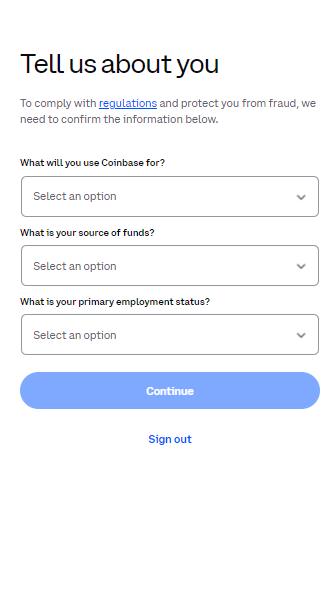

11. Coinbase is required to collect some personal information from you. Answer the following questions to continue.

12. Answer a few more questions regarding your estimated amount to transfer to Coinbase and the industry you work in.

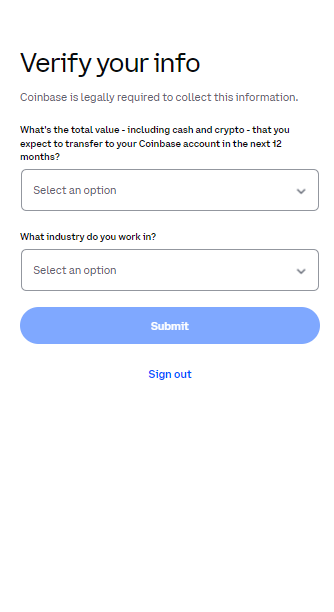

13. Upload your government-issued identification document to complete the account verification process.

2. Deposit funds

In most cases, exchanges will require you to deposit funds to make a purchase; instant exchanges, of course, being the exception to the rule. Therefore, you will need to know your options when it comes to depositing funds to buy ETH.

Funding options

The second step to buying ETH is to deposit funds. Naturally, you will need to have some payment methods prior to depositing funds on any exchange. Here is a brief list of the most common payment methods on cryptocurrency exchanges:

- Bank transfer (e.g. ACH, wire, SEPA, Interac e-Transfer, etc.)

- Debit/credit card (e.g. Visa/MasterCard)

- Google Pay/Apple Pay

- Cryptocurrency

- Payment aggregator (e.g. PayPal, Simplex, Mercuryo, etc.)

- Alternative payment methods (e.g. POLi, PayID, PLAID, etc.)

Before we dive into the deposit process in our example, it is necessary to point out that each method has its own associated fees, perks, and limits. Therefore, it is important to understand your best options. For example, depositing cryptocurrency does not typically incur a fee on most exchanges.

Additionally, some funding options may have a minimum deposit requirement, depending on how much it costs the institution, exchange, or payment gateway to process the transactions. Generally, the more intermediaries the deposit method requires, the more it costs to deposit and buy ETH.

How to deposit

Again, we will use Coinbase to demonstrate how to deposit to buy ETH. Due to the abundance of payment methods on Coinbase, we will limit the scope of our guide to depositing via a bank account.

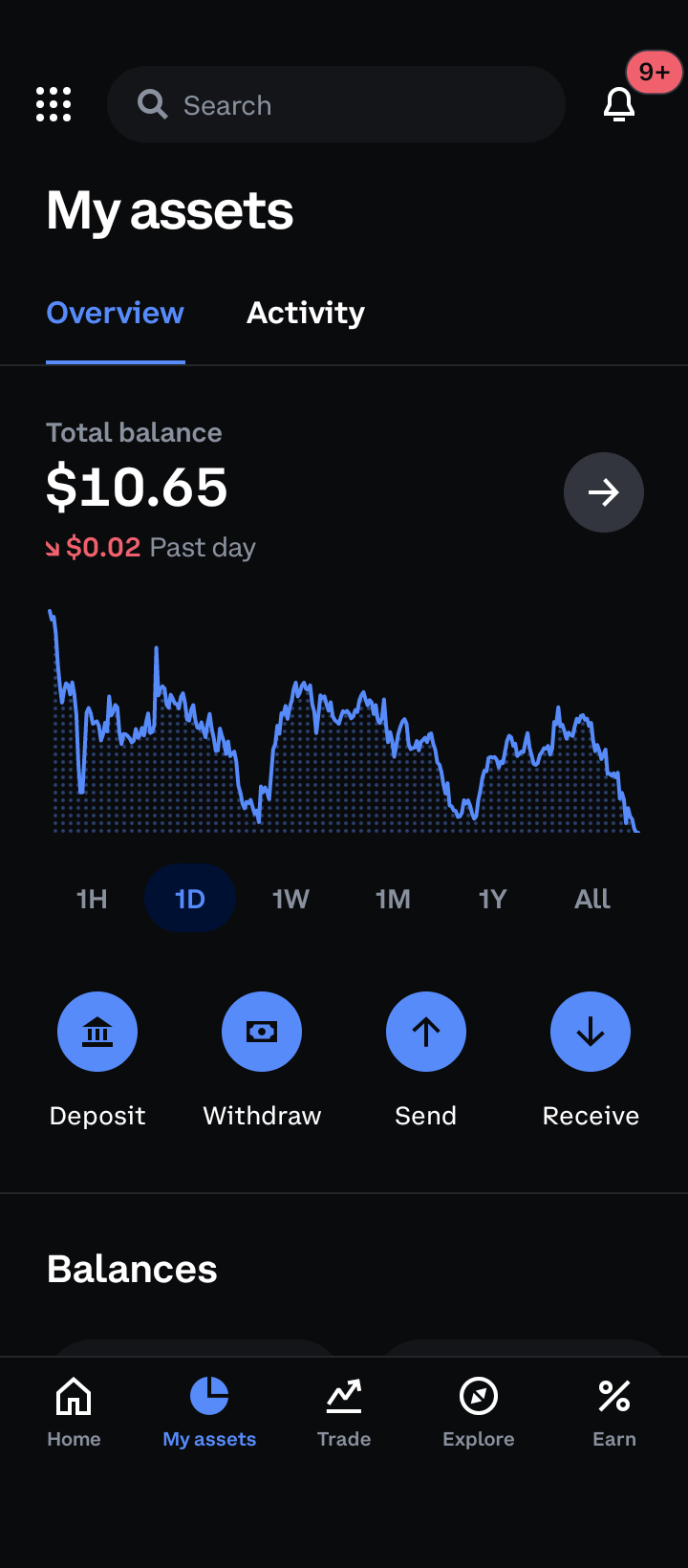

1. Open the Coinbase app.

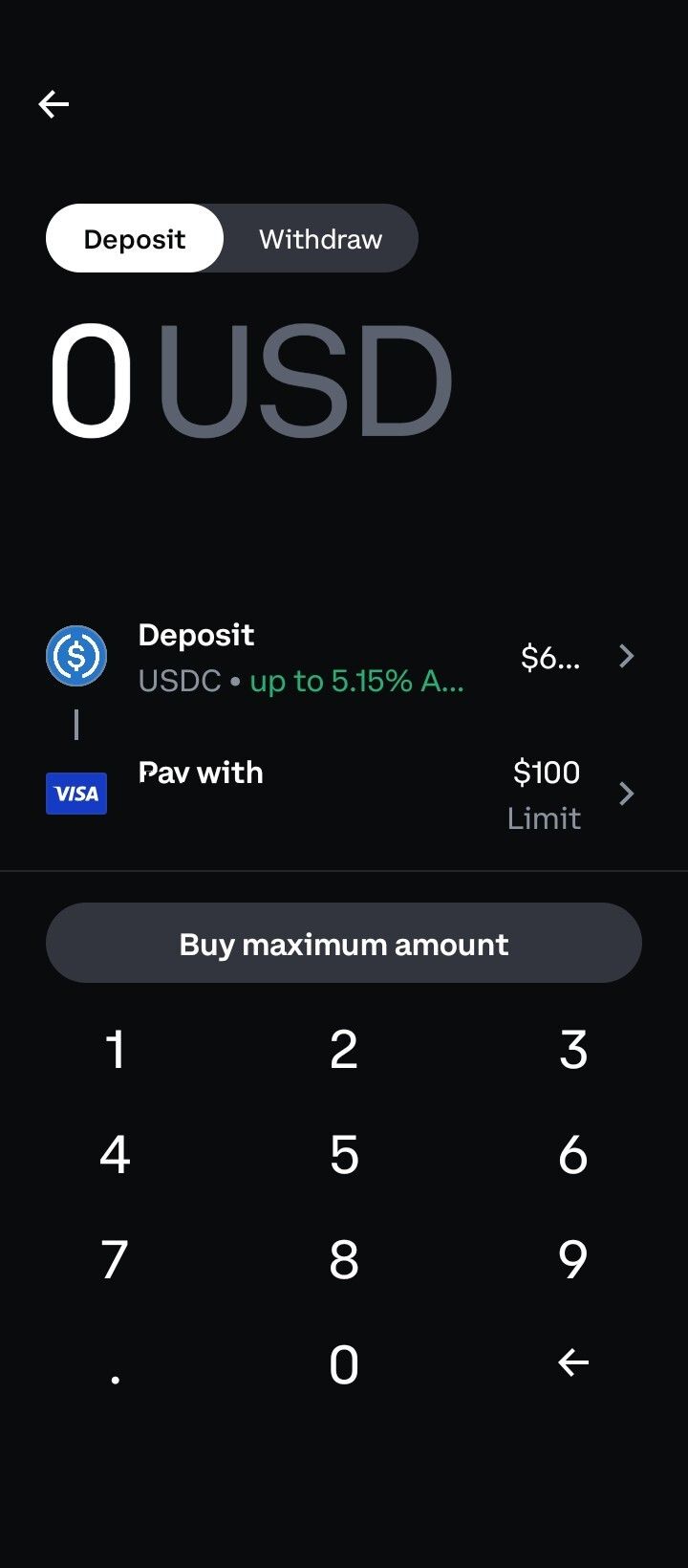

2. Select “Deposit.”

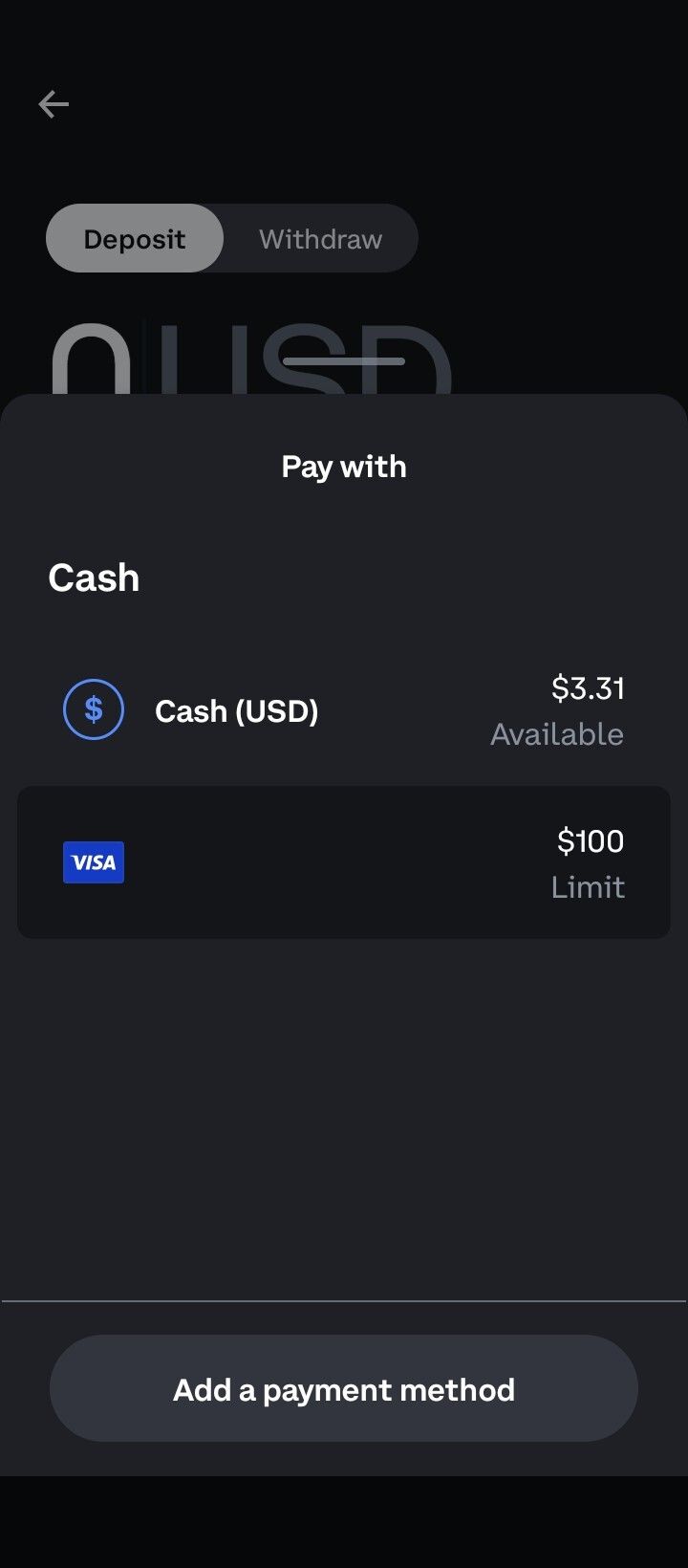

3. Select “Pay with” to view payment method options.

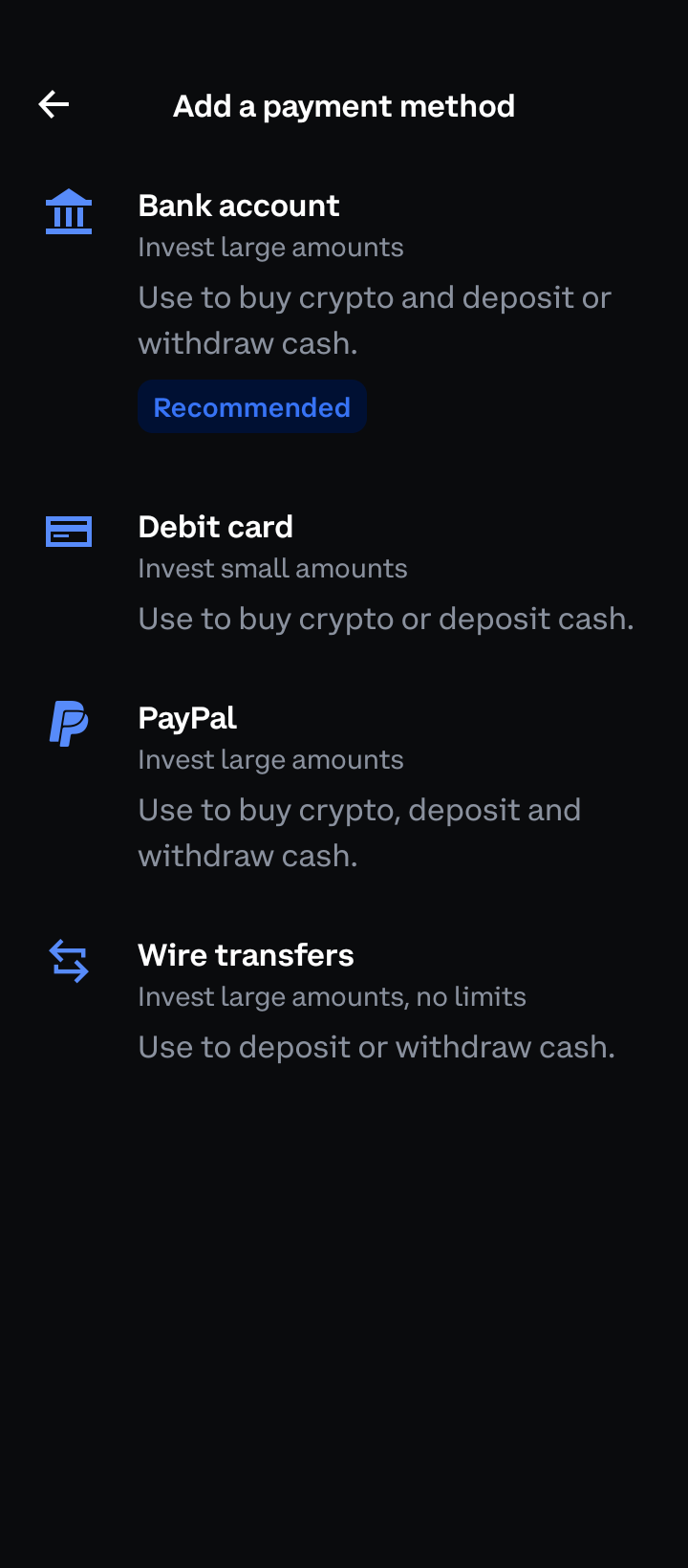

4. At the bottom of your screen, select “Add a payment method.”

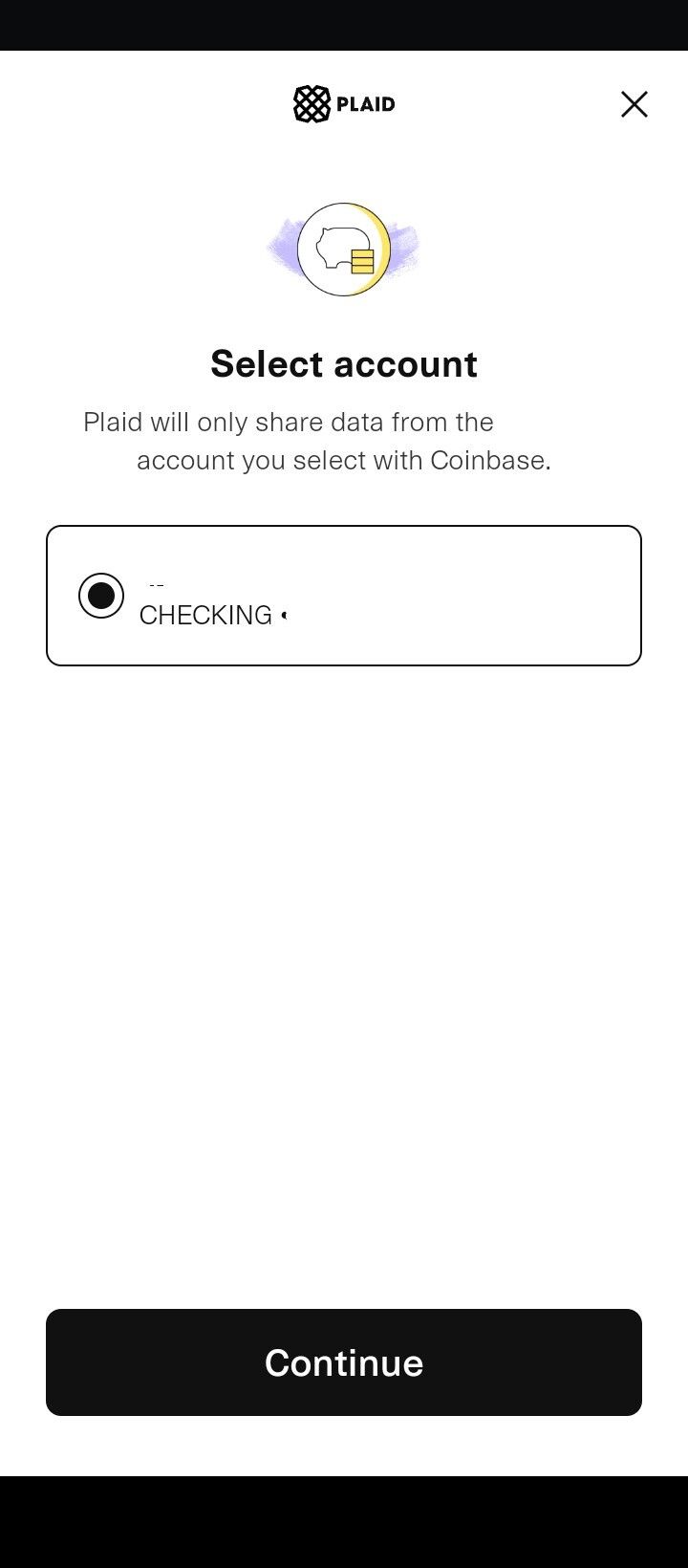

5. On Coinbase, it is recommended to use bank transfers. This method is supported by PLAID. To continue, select “Bank account.”

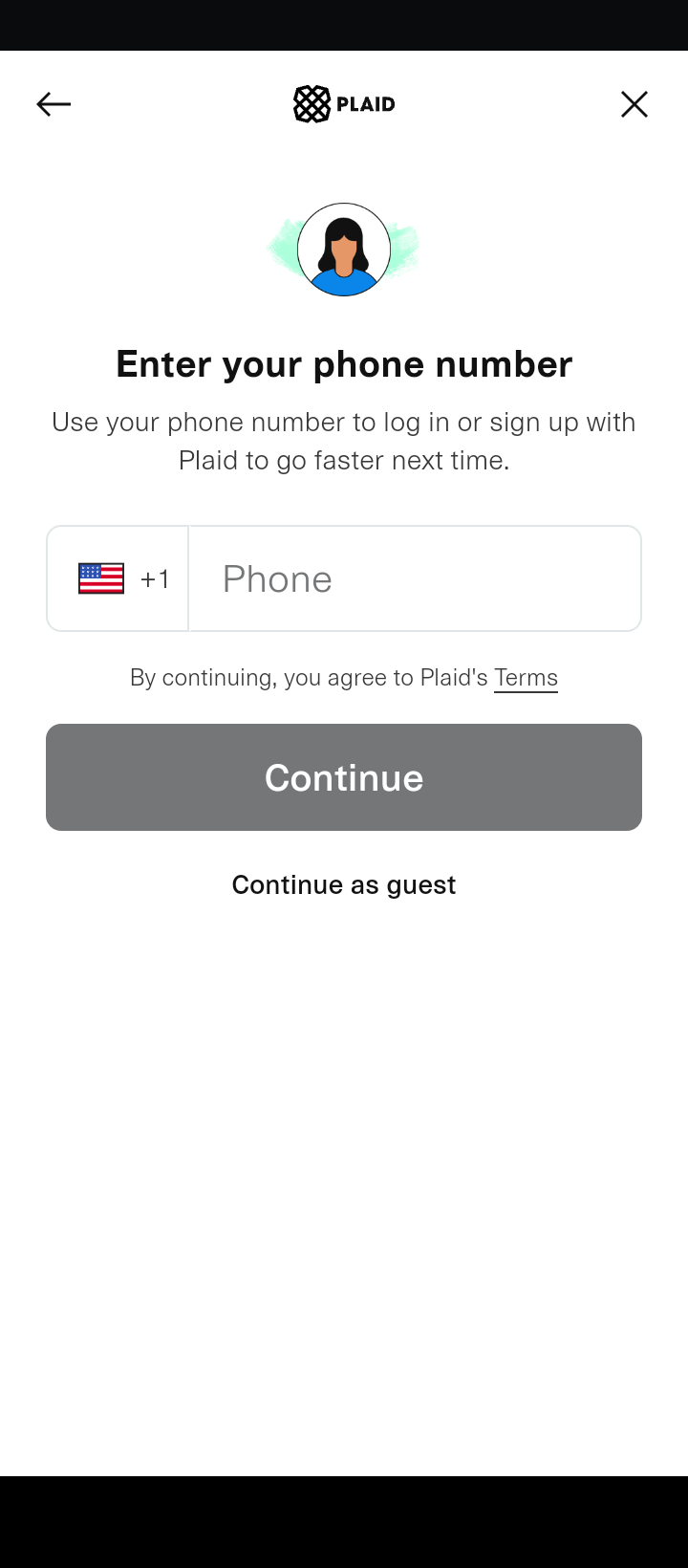

6. You can enter your phone number or continue as a guest. We will use a phone number.

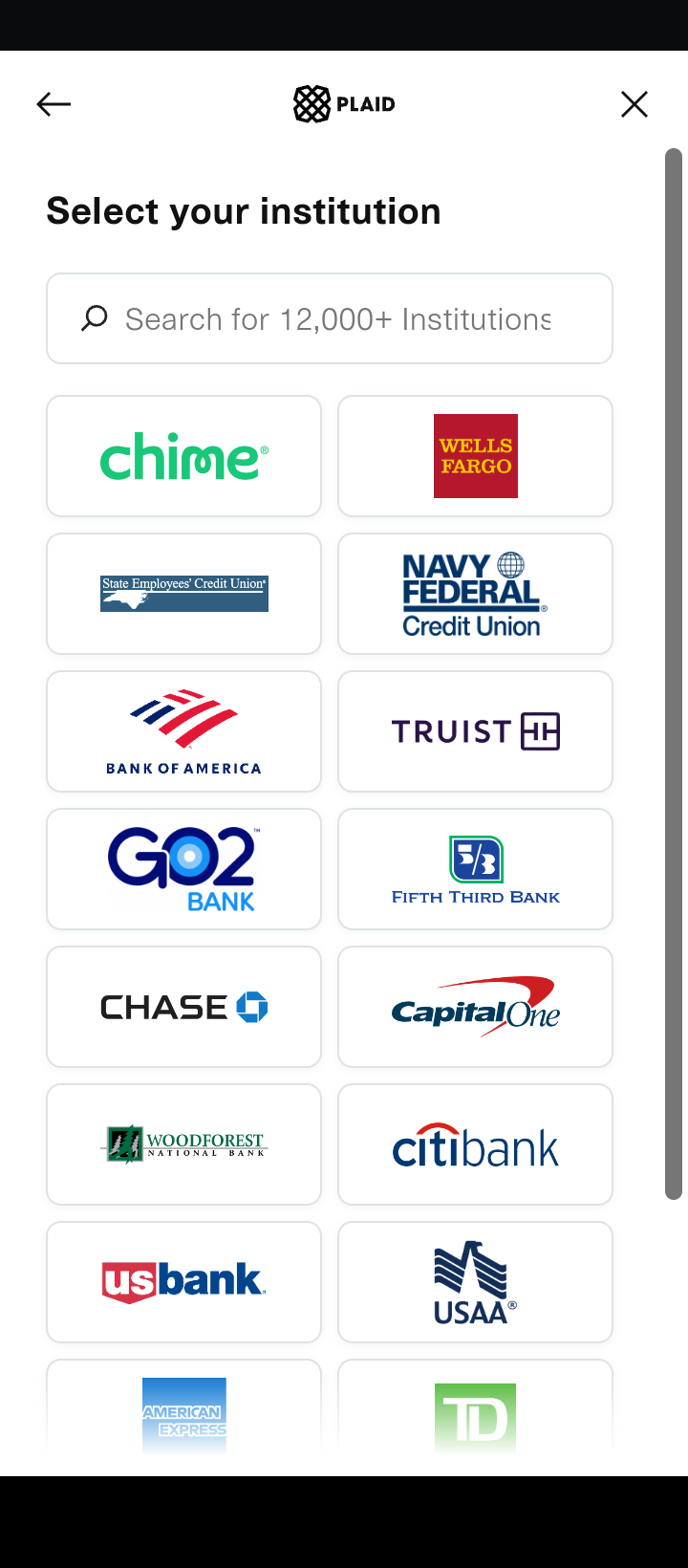

7. On the following page, you will notice a list of banks to choose from. Choose your banking institution.

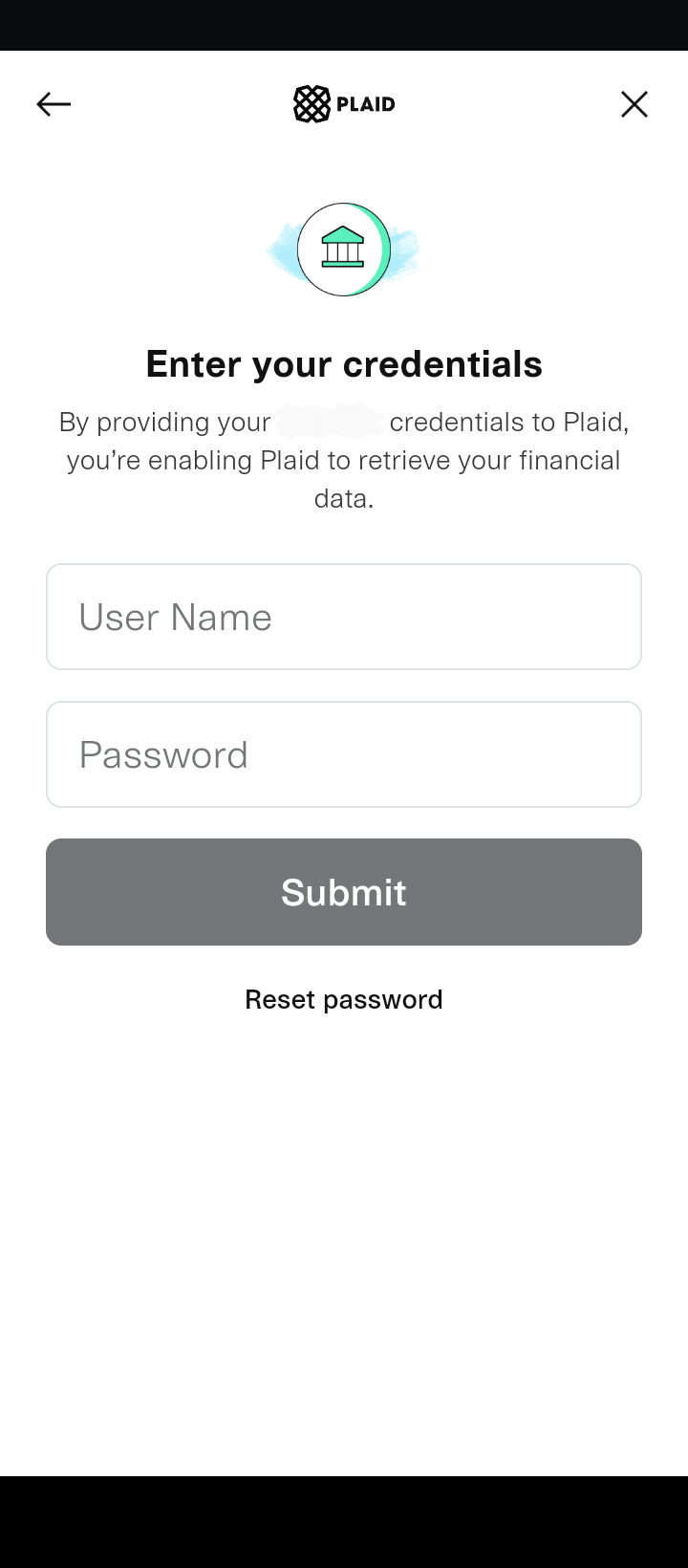

8. Enter the username and password that you use to access your bank account, not Coinbase.

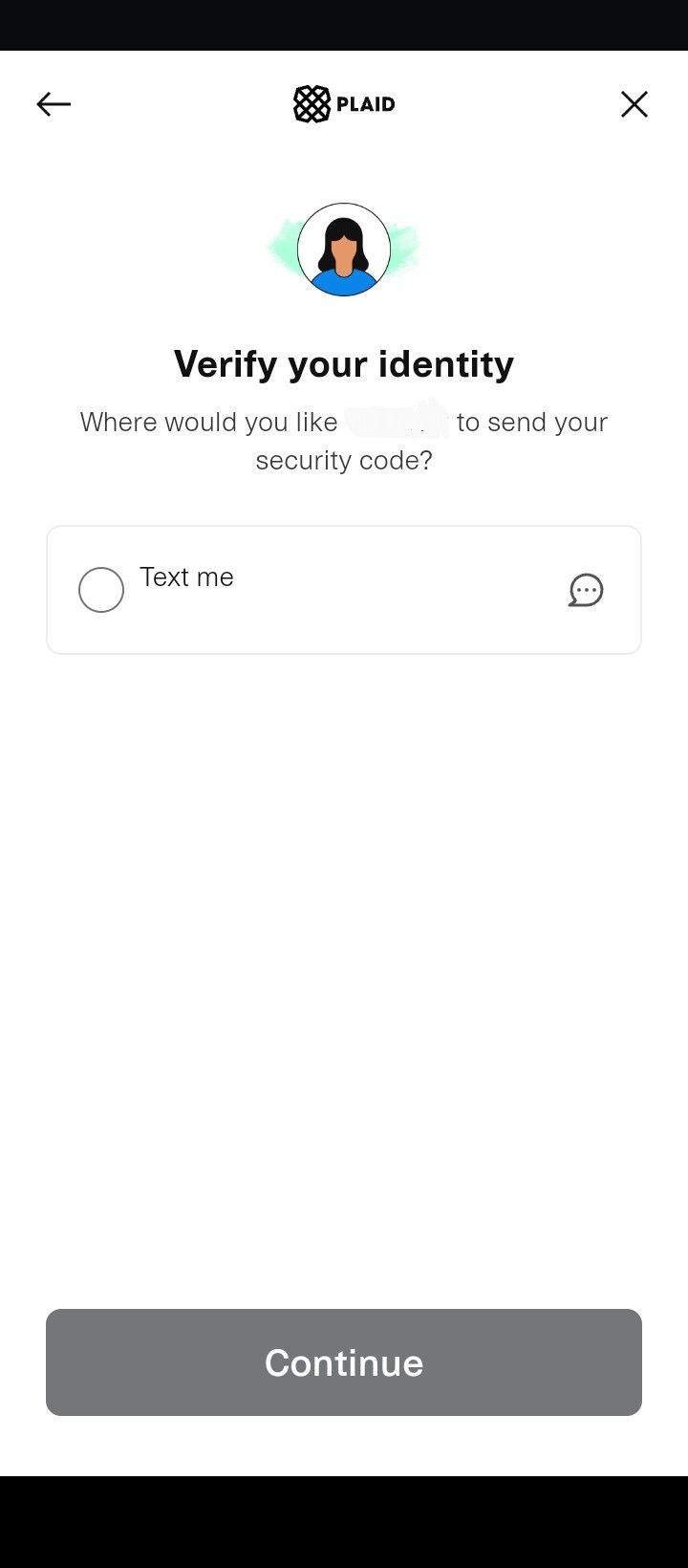

9. As a form of two-factor authentication, you will need to enter the security code sent to the phone number that you provided.

10. Lastly, select the account that you wish to connect to your Coinbase account.

3. Buy Ethereum

Most exchanges have a simple buying process. However, some even go as far as to provide a simple, user-friendly interface and an advanced interface for more experienced users. We will show you the difference in placing an order on both.

Placing an order

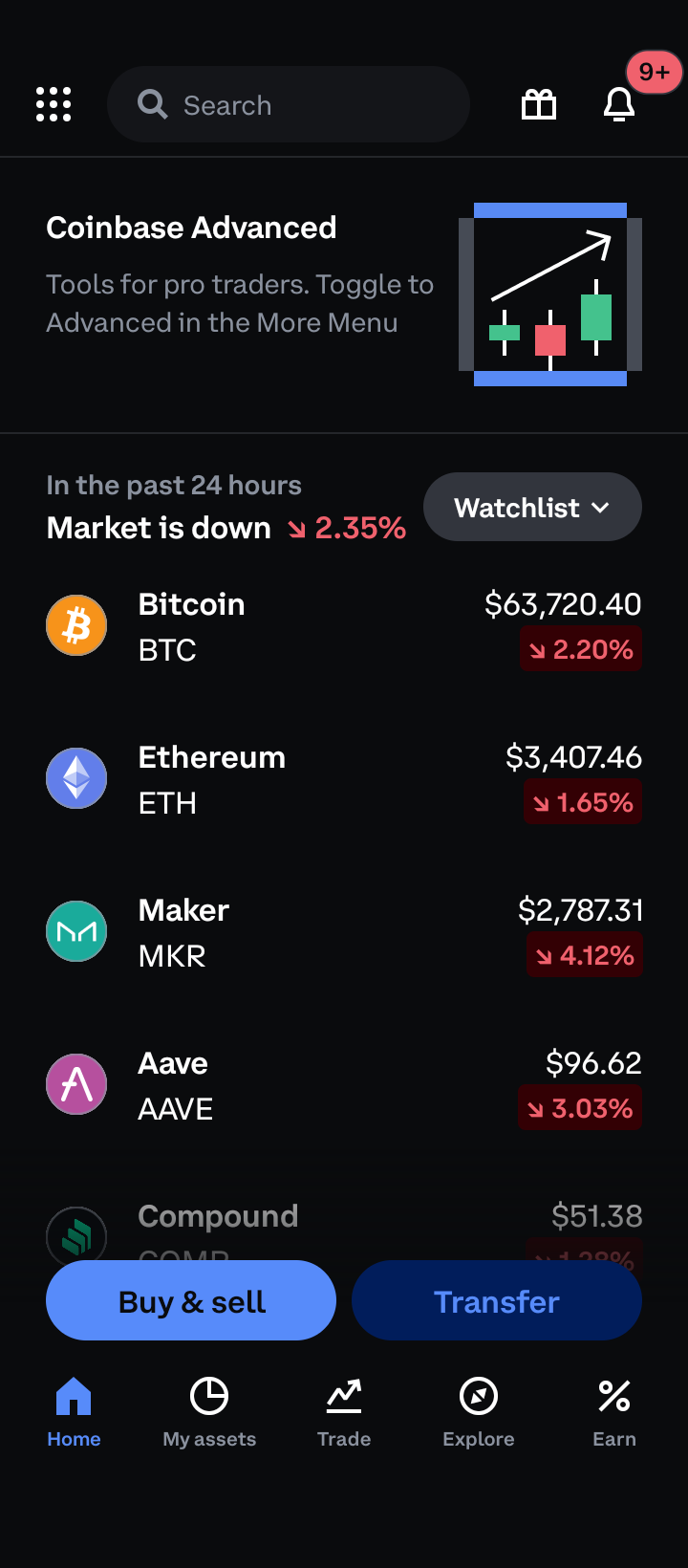

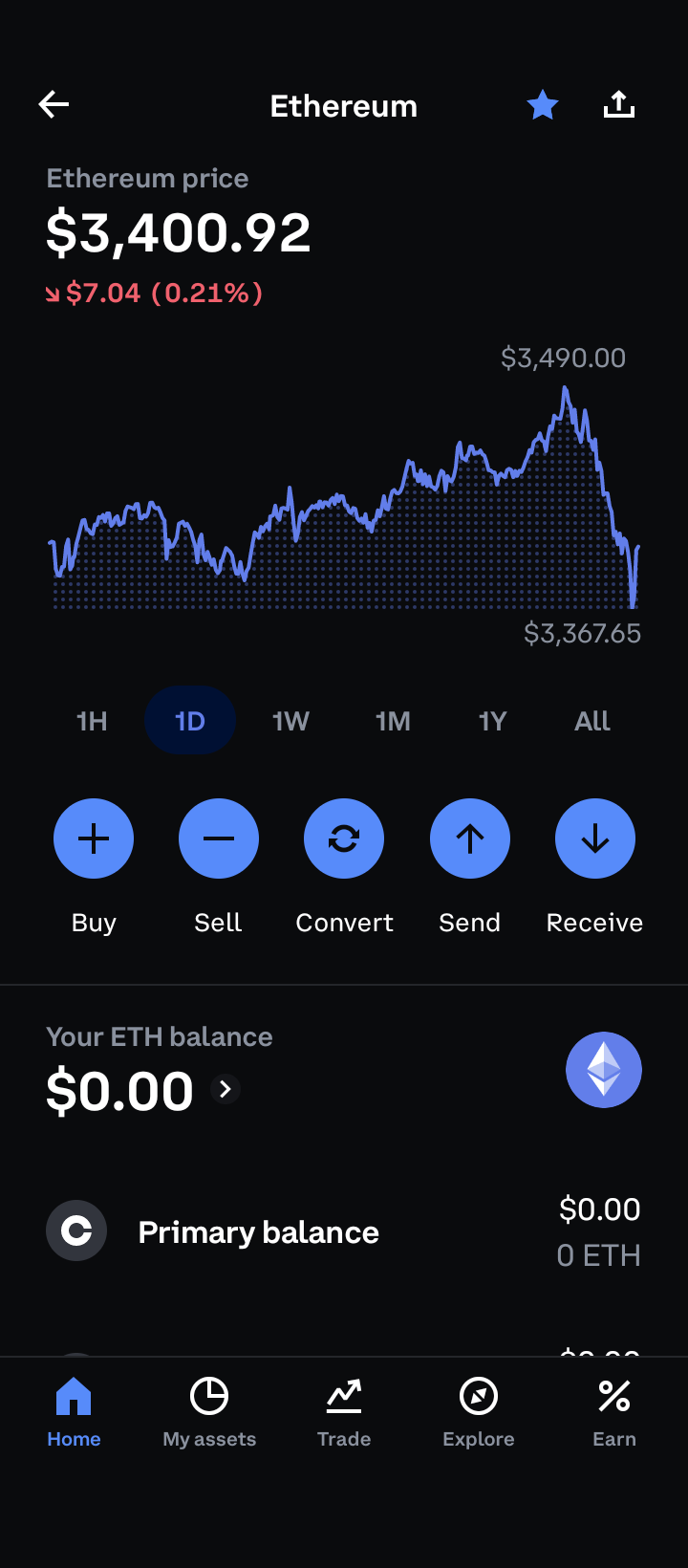

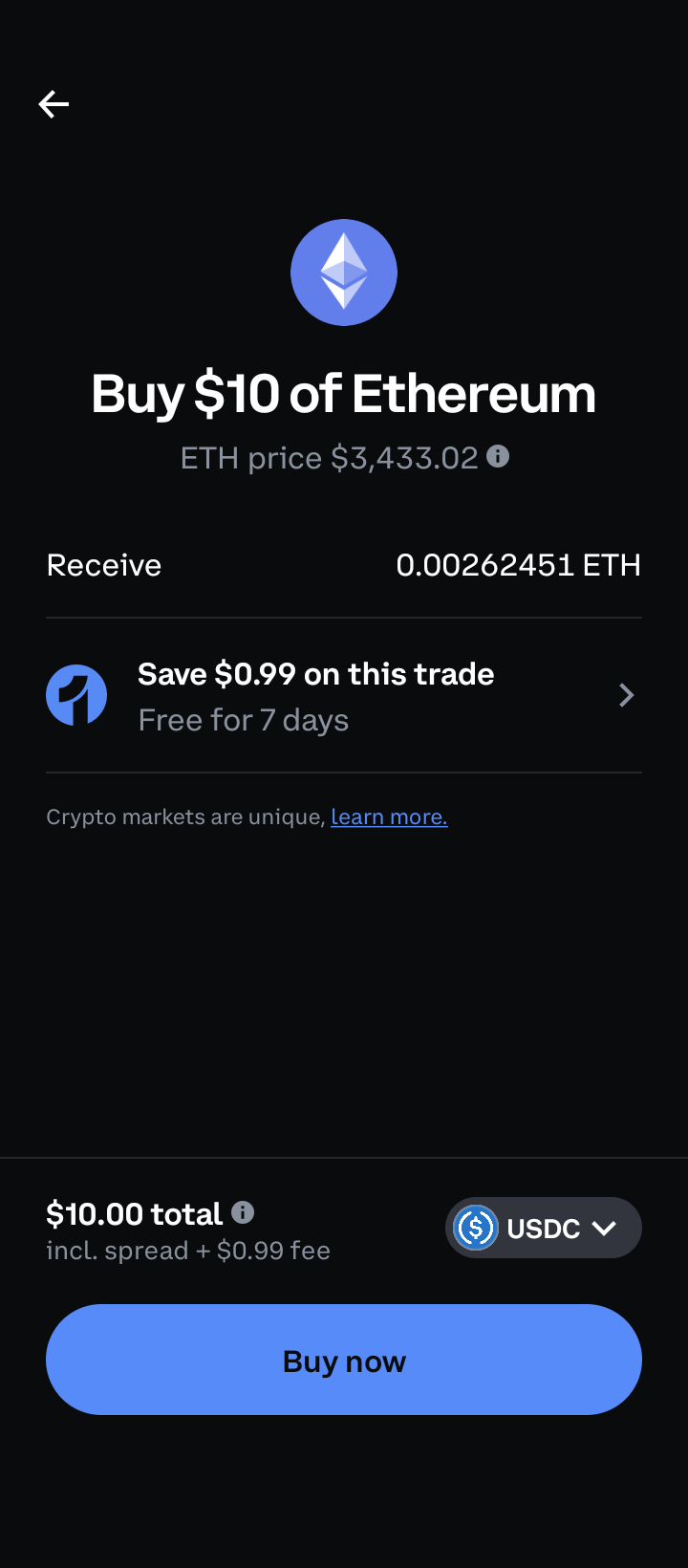

1. Open the Coinbase app and select Ethereum.

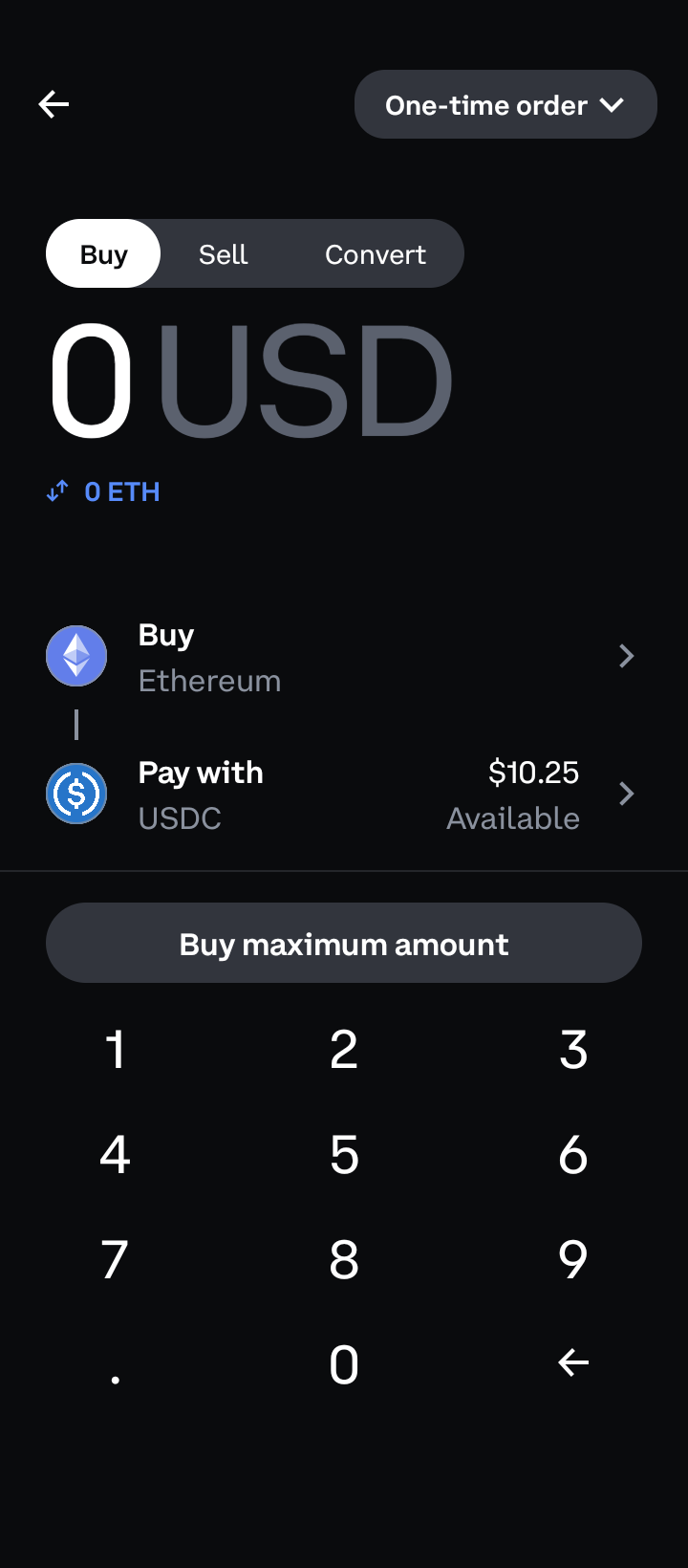

2. Select the “Buy” button to purchase ETH.

3. Enter the amount of ETH you would like to purchase and your preferred method of payment.

4. Review your order to make sure all of the information is accurate. Then select “Buy now” to complete your ETH purchase.

Order types (market, limit)

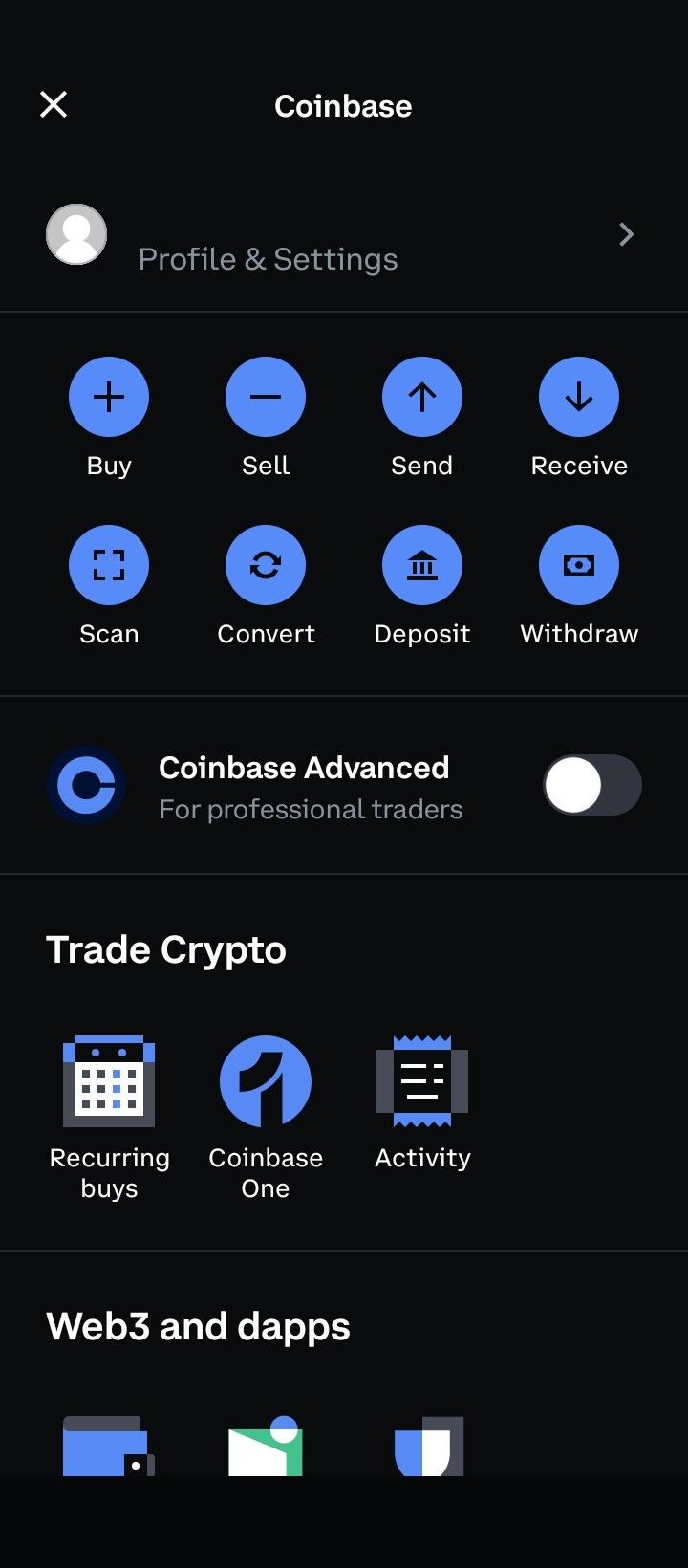

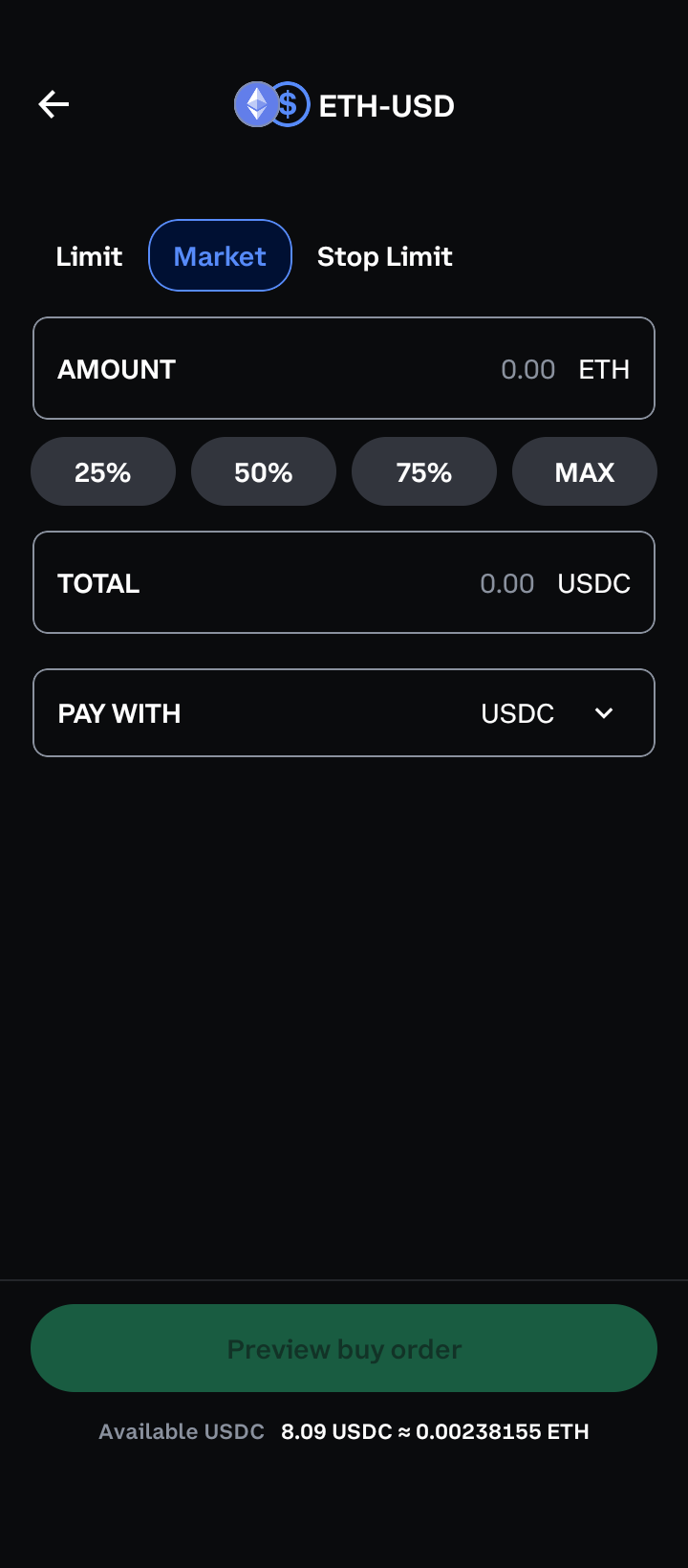

You will have to switch to the Coinbase advanced interface to access the more advanced features, such as order types. This interface is more suitable for advanced Ethereum trading.

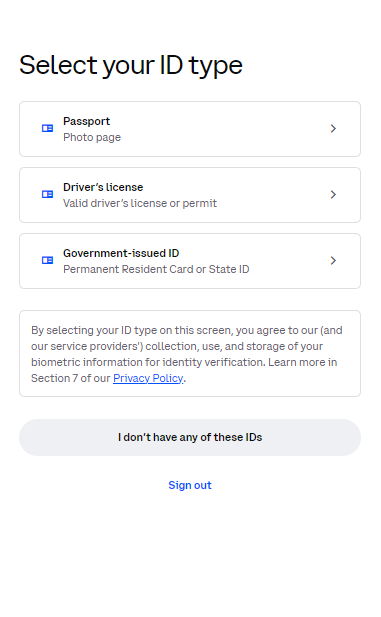

1. Open the app and select the hamburger menu in the top left corner beside the search bar. Select the “Coinbase Advanced” slider to continue to the next step.

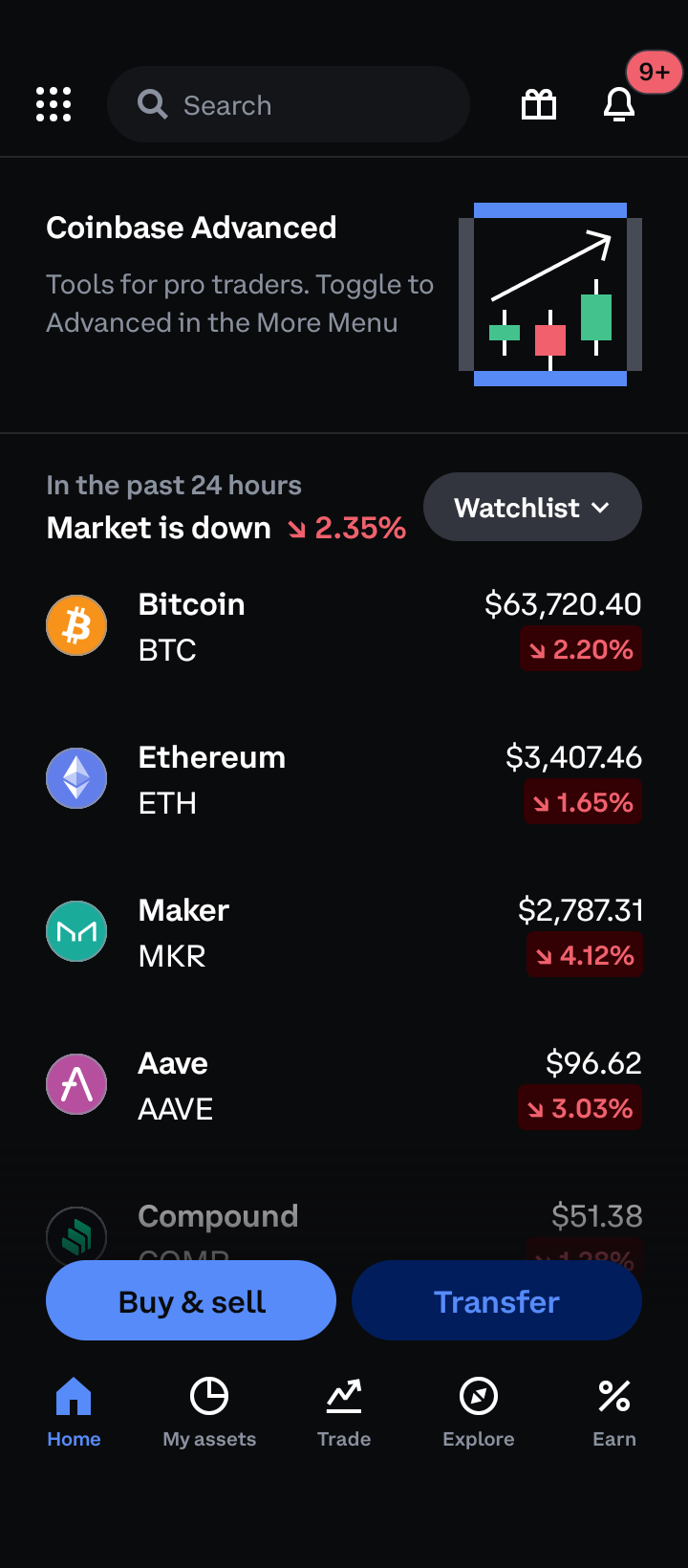

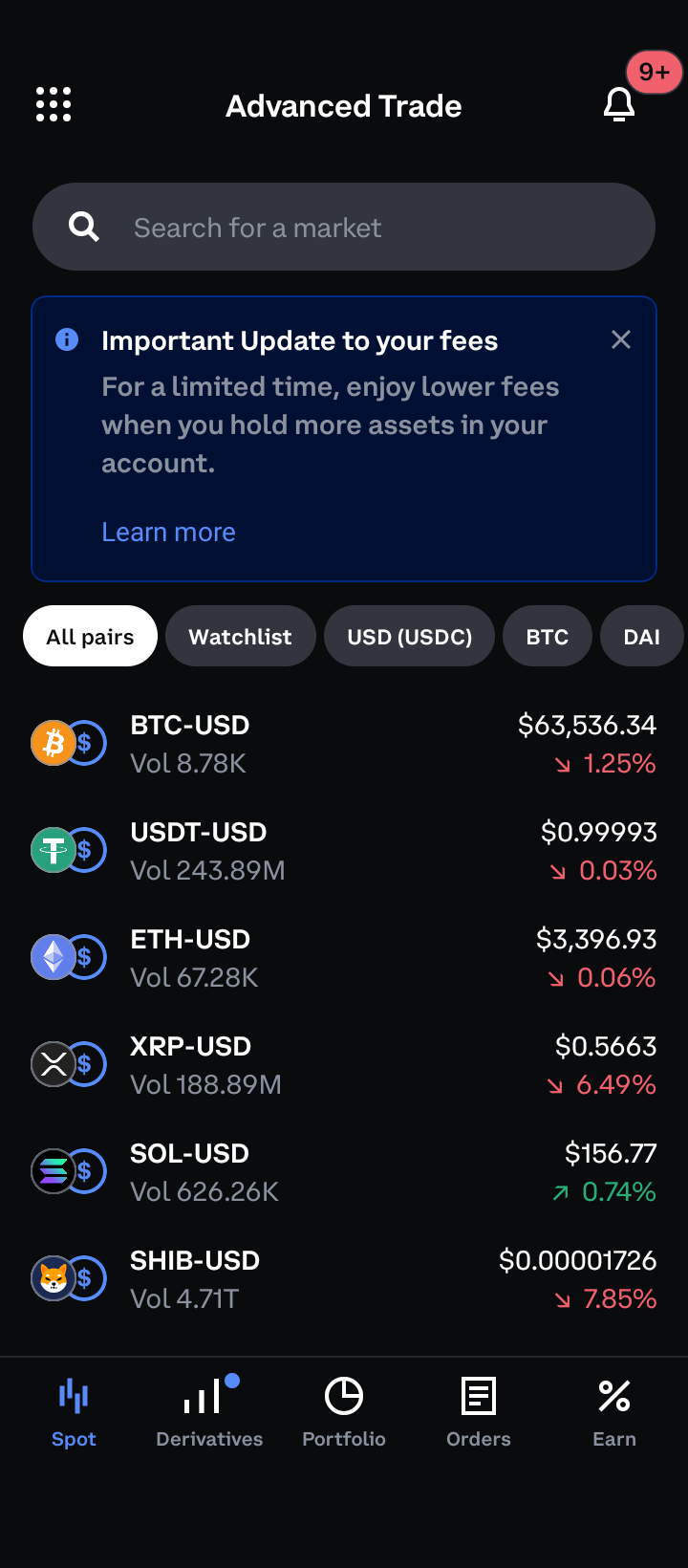

2. Select the ETH-USD pair to continue.

3. Here, you can see the more advanced features, such as time intervals, Ethereum price highs and lows, indicators, and candle wicks. To continue with your ETH investment, press the green “Buy” button.

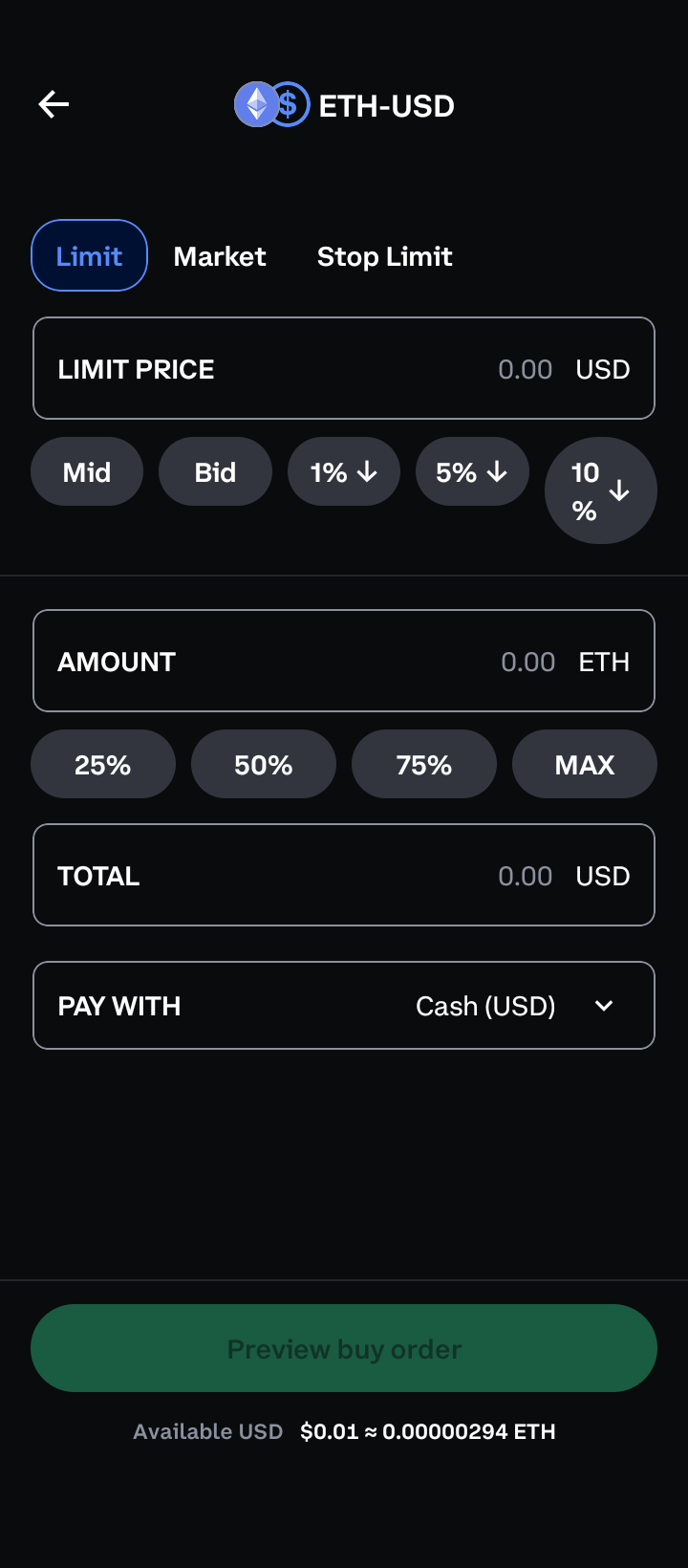

4. The previous step will automatically redirect you to a limit order. Here, you can manually set the limit price or use the buttons below to set a predetermined price. You can also purchase ETH using a predetermined amount and select your payment method at the bottom of the screen.

5. When you use the simple Coinbase interface, you are executing a market order (if you do not alter the settings). Therefore, the steps for executing a market order are pretty much the same as purchasing ETH on the regular interface.

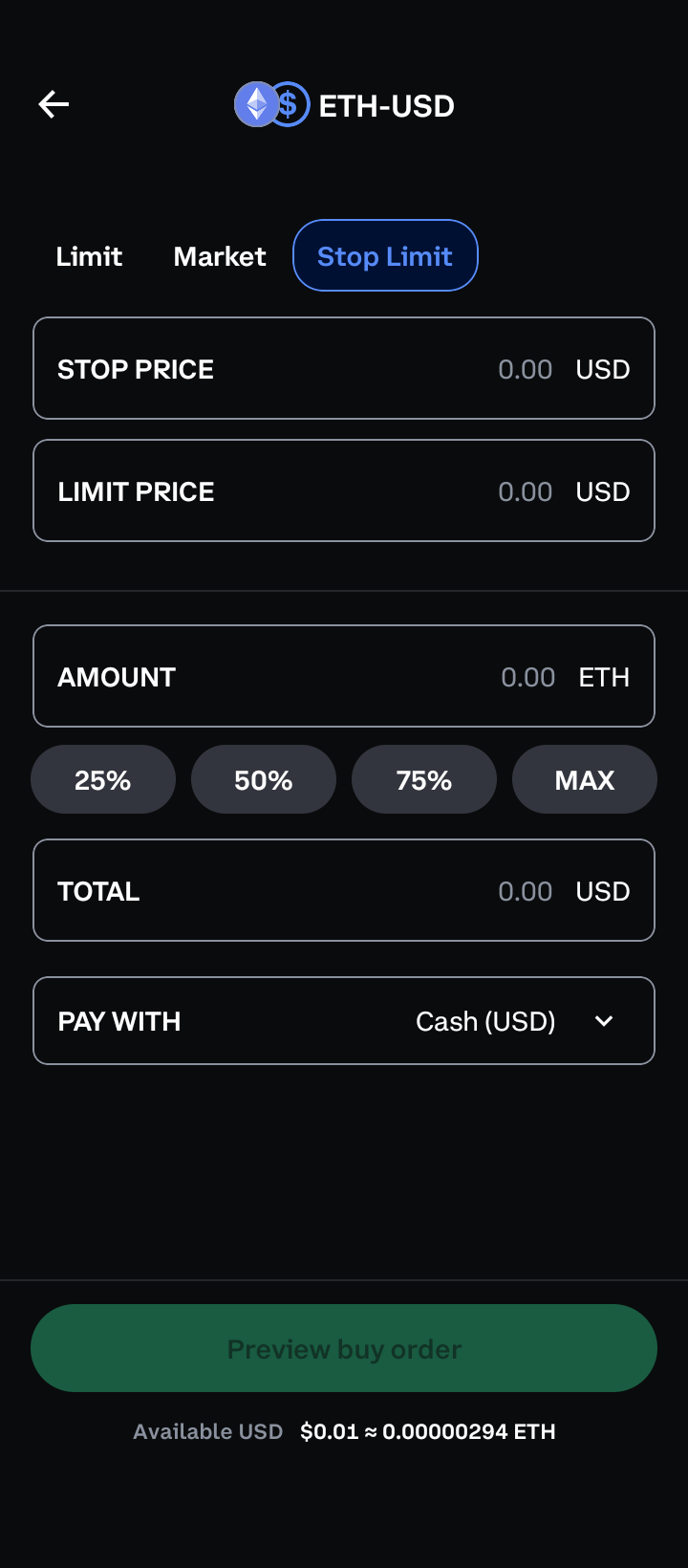

6. At the top of the screen on the far right, you can also select a stop limit order. Again, you can manually set the limit price, as well as the stop price, amount, and payment method at the bottom. Because of the nature of limit orders, it could take some time to complete a stop limit order purchase. Therefore, we will continue our demonstration with the market order.

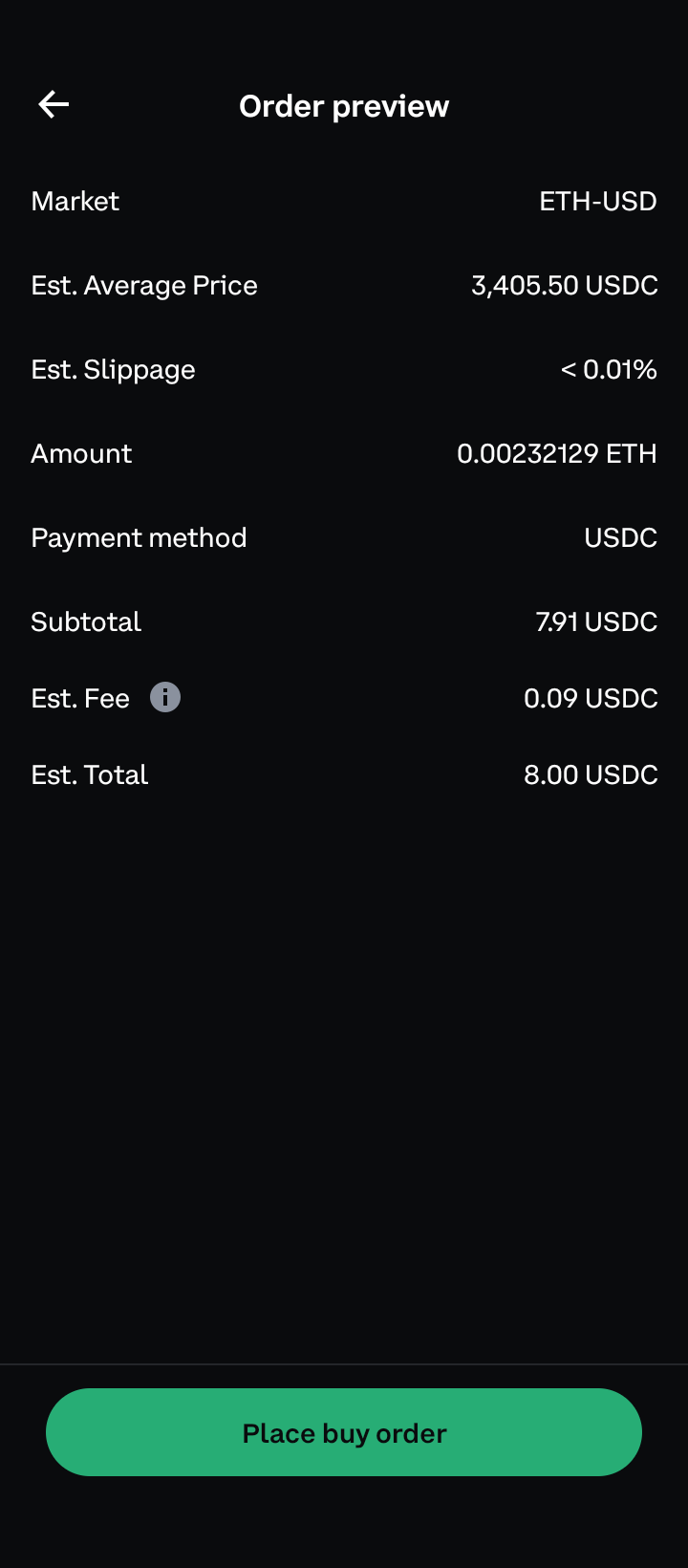

7. On the following page, review your order to make sure that all of the information is correct. When you are certain, continue by selecting the green “Place buy order” button.

How to secure your Ethereum

After your Ethereum purchase, it is considered best practice to remove it from the cryptocurrency exchange you purchased it from. To do this, you will need to secure your Ethereum with a crypto wallet and utilize the best operational security.

Using a crypto Wallet

A crypto wallet is your first line of defense for securing your Ethereum investment. It’s no wonder that in 2022, the global cryptocurrency wallet market was valued at more than $8 billion — a figure that reflects how much of an emphasis users place on securing their cryptocurrency.

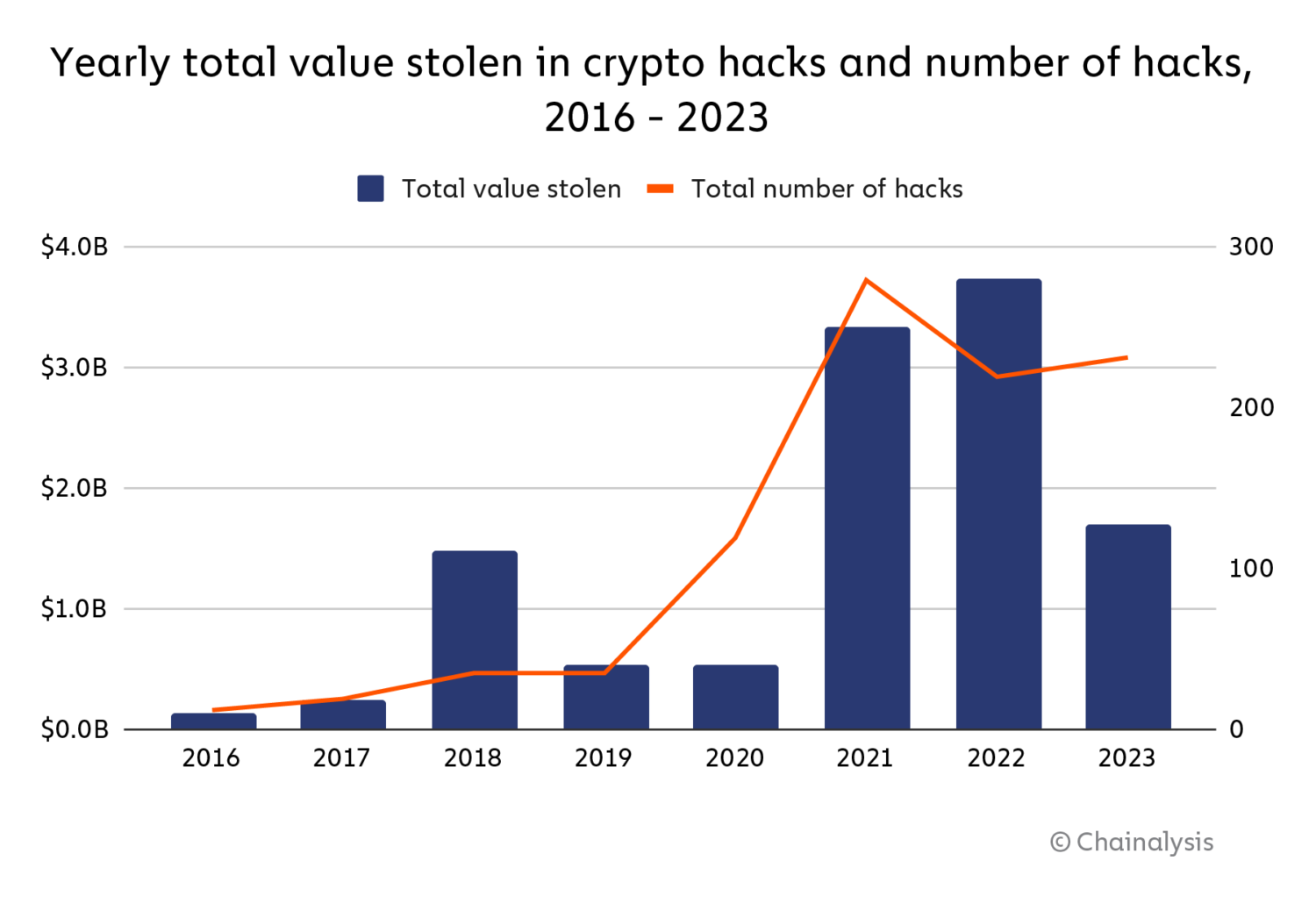

According to a 2024 Chainalysis report, approximately $1.7 billion in value was lost to various types of cryptocurrency hacks in 2023. And while the value of attacks has dropped in recent years, the number of attacks increased from 2022 to 2023 — ergo, you still need to use a wallet.

Types of wallets (hardware, software, paper)

Thanks to the popularity of blockchain technology, there are multiple wallets and wallet types available today. However, it is important to remember that no wallet type is necessarily better than the others, but they all have their strengths and weaknesses. You can see the features of each in the table below.

| Type | Description | Pros | Cons |

|---|---|---|---|

| Hardware | A non-custodial physical device that stores crypto (private keys) offline | Safer against online threats | Can be lost or damaged |

| Software | Digital app or program that stores crypto on a computer or mobile device | Convenient for frequent transactions | Vulnerable to hacks and malware |

| Paper | Physical print of private and public keys | Immune to online attacks | Inconvenient for frequent on-chain activity |

| Hot | Wallets that connect to the internet (e.g. software wallets) | Quick access to funds for transactions | Higher vulnerability to hacks |

| Cold | Wallets that do not connect to the internet (e.g. hardware and paper wallets) | Ideal for long-term storage | Less convenient for frequent transactions |

While software wallets are extremely convenient for frequent on-chain activity and transactions, they are less safe due to the constant exposure to the internet.

Hardware wallets, on the other hand, are better for long-term cold storage. Generally, the best kind of hardware wallets are air-gapped. This means that they have no WiFi, Bluetooth, or near-field communication (NFC) abilities, in which the device emits or receives a signal that can be intercepted by hackers.

Lastly, paper wallets can be considered top-of-the-line cold storage. However, they are extremely inconvenient and still require a client and RPC node to submit transactions to the blockchain.

Best practices for security

Most of the best practices for securing your Ethereum will boil down to good operational security. This means protecting your personal data, keeping your devices and wallet software updated, and refraining from clicking malicious links or revealing your private keys under any circumstances.

There are other crypto wallet security tips that can enhance safety, like enabling multi-factor authentication on your devices. This also creates an additional layer of security.

Choosing a safe and reputable wallet may be difficult for users to determine themselves. Thankfully, sites like WalletScrutiny can aid in this process. The site asks 12 key questions to determine the security of the wallet. Those that pass all 12 are considered more secure. Some of these include:

- Is the provider ignorant of the keys?

- Does the device hide your keys from other devices?

- Can the user verify and approve transactions on the device?

- Is the source code publicly available?

- Is the decompiled binary legible?

- Can the product be built from the source provided?

- Does the published binary match the published source code?

Securing your ETH investment is not the task of blockchain technology alone; it requires an element of common sense as well. In other words, you must remain cognizant of phishing, pig butchering, and generally any other kind of crypto scams that bait users into revealing any sensitive information or giving away their crypto.

Pig butchering is a popular scam where fraudsters develop a relationship with a victim over time, after which they convince them to invest in fraudulent schemes.

Why buy Ethereum?

Ethereum is like the Silk Road — the original one — of the blockchain world. The Silk Road was an ancient network of trade routes that connected the East and West, thereby facilitating the exchange of not only goods and services but also ideas and cultural practices.

Ethereum is a general purpose blockchain. So, unlike other blockchains, like Bitcoin for example, that are designed around one application. So the way that Bitcoin is designed around digital money, Ethereum is an open platform that allows people to build their own applications on top.

Vitalik Buterin, creator of Ethereum

In its early years, Ethereum gained the network effect and first mover’s advantage for creating a working blockchain that other developers can build on top of. As a result, it gained a high amount of network traffic and value due to the decentralized applications (DApps) that were built on it, which were largely financial ones.

This has created an information highway where blockchains and applications, which were originally siloed, can now access and gain exposure to one another and exchange value, data, and ideas, much like how the Silk Road connected the East and West. So, why buy Ethereum?

Ether, the native coin of Ethereum, is like the U.S. dollar. Whereas USD is the world reserve currency, Ethereum is the reserve currency for the blockchains and applications built on top of it—and even some that aren’t. This means that there is a high demand for Ether.

Benefits

With new technologies and concepts like liquid staking derivatives, restaking, and layer two blockchains, the demand for ETH is apparent and growing. When you hold ETH, some of the many benefits are:

- Using Ether like “gas” to fuel on-chain activity

- Becoming a validator to earn gas and transaction fees

- Staking to earn more ETH

- Liquid staking to engage in yield farming

- Restaking to secure your decentralized applications

- Sending value in a peer-to-peer manner without intermediaries

These benefits align with those who are seeking yield, which is important in today’s increasingly financialized world. Some of the other benefits are also advantageous for those who want to build or use Ethereum and other blockchains. Regardless, buying ETH has many benefits.

Use cases

There are also numerous use cases for ETH. If you don’t have a safe payment gateway or fiat on-ramp, then you would have to go through the laborious task of becoming a validator to earn ETH. Buying ETH allows you to skip the many pitfalls of running a full node and all of the frustrations that come with it.

Additionally, holding the ETH token gives you access to the blockchain and the many applications and networks that run on Ethereum. In essence, ETH is like the U.S. dollar. If you are a digital nomad or a frequent traveler, then you probably know that a lot of countries and merchants will accept the U.S. dollar.

Without this system, calculating exchange rates and finding the accepted currency in a nation to transact would be complicated. The same is true for blockchains. Developers, traders, and other users require ETH to use applications, and if they bridge to other EVM-compatible blockchains, the “fuel” to power applications and pay gas fees is most often ETH.

Ethereum also uses ETH as a form of economic security. Validators must stake or use their ETH as collateral to become eligible to process transactions. In exchange for processing transactions and updating the blockchain, validators receive more ETH.

If they act maliciously, they lose the ETH that they have staked. This mechanism acts as a deterrent for those who would attack the Ethereum network. In summary, ETH is used for:

- economic security

- a medium of exchange

- paying gas fees

Users need an easy way to purchase ETH

Blockchains and applications on Ethereum are engaged in a proverbial arms race; this has led to a high demand for the native coin, Ether. Because everyone who uses Ethereum can not run a full node to earn ETH, users need an easy way to buy ETH. In this guide, you learned the simple way to buy ETH, which has many benefits, as outlined previously. Always remember, after you buy crypto, choose a reputable exchange and store it safely.

Frequently asked questions

Ethereum is a distributed computer and a blockchain. Users can build applications on Ethereum, send transactions, and verify the result without any intermediaries. It is considered quasi-Turing complete, which means that you can build applications with limited complexity on it.

The best platforms to buy Ethereum depend on your country of residence, the range of fees you want to pay, and platform security. Some of the best centralized exchanges to purchase ETH are Coinbase, Binance, and YouHodler.

Yes, users that want to purchase ETH must pay fees. Centralized exchanges typically have a minimum of trading, conversion, and deposit fees. Decentralized exchanges typically only have gas fees and trading fees.

To store your Ethereum, you will need a wallet. You can choose from a hardware, software, or paper wallet. Hardware and paper wallets are considered safer but inconvenient; on the other hand, software wallets are more convenient but have more vulnerabilities.

MEXC currently has the lowest trading fees, sitting at zero fees. This fee is subject to change at times. Most exchanges’ fees for purchasing ETH are around 0.1%.

Yes, it is possible to purchase Ethereum with a credit card. Some exchanges are limited in the payment methods they accept. However, many exchanges will accept purchases from credit cards directly or through third-party payment processors.