Crypto volatility makes managing risks challenging. Hard pegging offers a solution by fixing a stablecoin’s value to an external asset, minimizing fluctuations. This article explores the key differences between hard and soft pegging and why hard pegging is crucial for managing risks in crypto in 2026.

KEY TAKEAWAYS

• Hard pegging ensures stability in volatile crypto markets by fixing a stablecoin’s value to an external asset, making it a reliable trading tool.

• Depegging can occur when reserves are insufficient or market forces outperform the algorithms, as seen with Terra (UST) in 2022.

• Stablecoins face increasing regulatory scrutiny, with clearer guidelines introduced in 2024, but their impact on DeFi and overall stability remains under debate.

What is hard pegging in crypto?

Hard pegging in crypto involves fixing the value of a stablecoin to a real-world asset like fiat currency, another crypto, or a commodity. This provides stability in a volatile market.

Stablecoins are backed by reserves, ensuring a 1:1 exchange ratio — meaning, for instance, 1 USDT can always be exchanged for $1. Unlike soft pegs, hard pegs maintain this fixed value without fluctuation, offering transparency and reliability.

Did you know? This 1:1 ratio is an example of a hard pegging in crypto because it does not allow for any fluctuation in the value. Note that the value of the crypto will always remain the same value as the asset it is pegged to. Essentially, hard pegs offer a more trusted and transparent trading environment.

Hard peg vs. soft peg

Often, currencies start out with a fixed rate but, over time, begin to fluctuate more freely in accordance with market conditions. Since fluctuations are so common, a method to stabilize the cryptocurrency value is to provide a value with a certain range against the reserve currency. This is referred to as a soft peg.

Fun fact: Did you know that Tether (USDT) is considered both a hard and soft peg? It has a hard peg of $1 and the soft peg permits it to go up or down by 2%.

Contrary to a hard peg, soft pegging in crypto represents an exchange rate regime that allows for limited flexibility between the pegged crypto’s value and its peg.

The most common example of this in world currencies is the Chinese Yuan. It was pegged to the U.S. dollar from 1994 to 2005, after which it was revalued to appreciate 2.1% against the dollar.

What is depegging in crypto?

One challenge in crypto pegging exists in cases where the reserves backing the crypto are not enough to back every issued token.

If, for example, a large number of people sell their USD-backed stablecoin for dollars, it would make it harder to maintain the peg if there’s a shortage of the USD to back them all. This is an example of depegging in crypto.

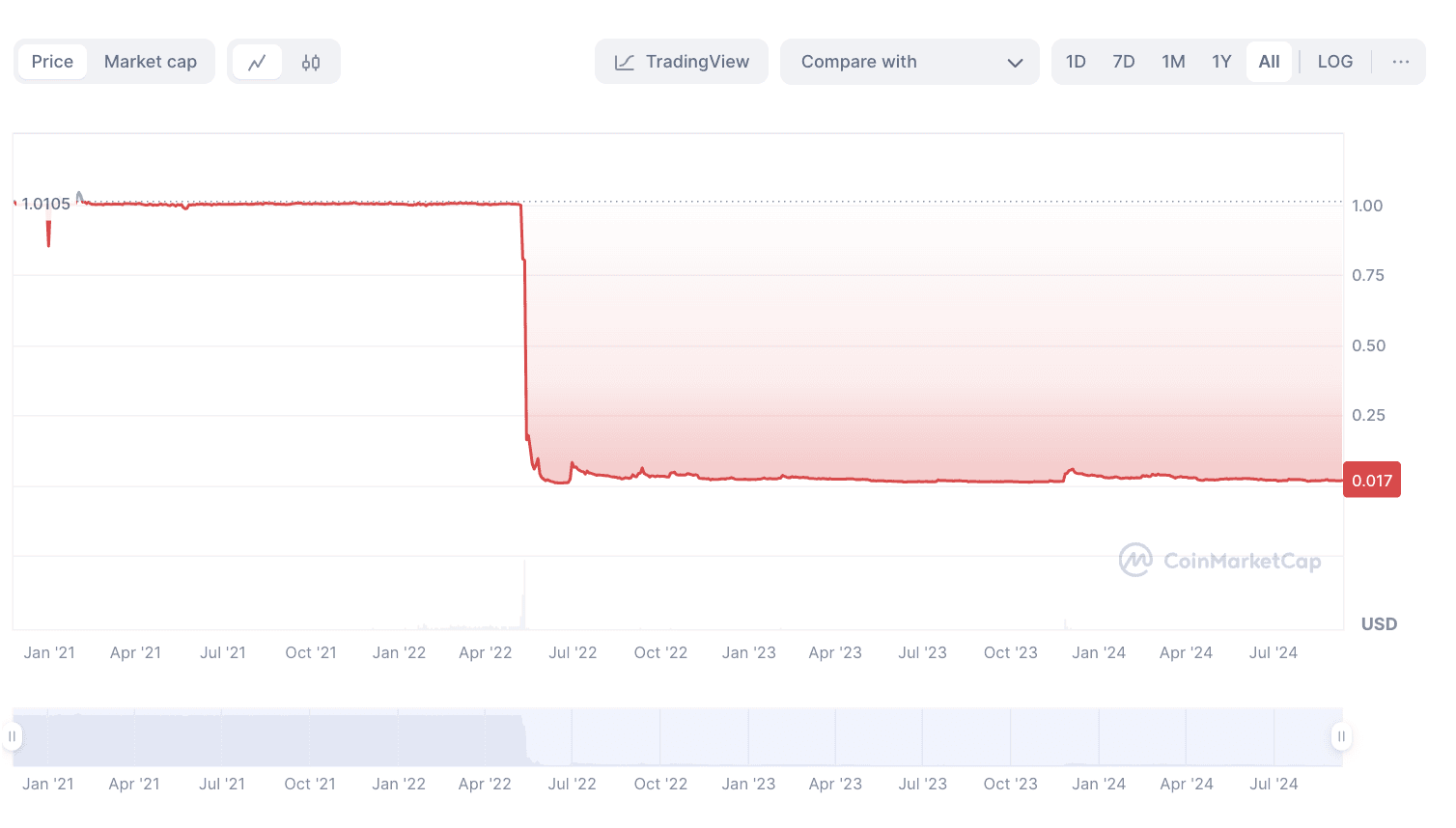

The most known depegging event happened in 2022 with Terra (UST). The stablecoin was intended to retain a $1 value, using LUNA to back the peg. Both coins then collapsed, and due to supply and demand, Luna’s increased supply, coupled with Terra’s depegging, eventually made Luna worthless.

In the chart below, you can see the fall in the stablecoin’s price since the depegging. It is being traded at $0.017 as of mid September 2024.

TerraUSD to USD: CoinMarketCap

Some causes that can result in depegging include:

- Unmatched reserves — When the issuing entity fails to maintain enough backed reserves to keep the peg, a depegging will ensue as we went over. However, this is an issue that is not always open to the public, and markets must be aware of this imbalance.

- Market outperformance — Another scenario that can cause depegging to occur is if the market outperforms the algorithm. Supply and demand can secure an asset’s currency peg by smart contracts, but only to a certain extent. The market can crash quickly or even outperform the smart contract algorithms, leading to a currency’s depegging. This is what happened to Terra UST.

What types of stablecoins are there?

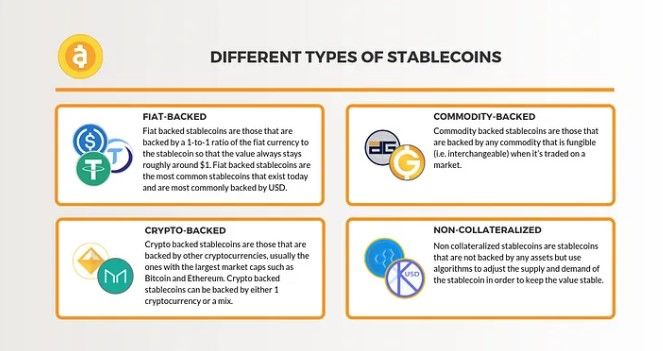

Many people think of common stablecoins pegged to real-world currencies like USD. However, cryptocurrencies can be backed by other means. The most common stablecoins are coins backed by fiat, crypto, commodities, or are algorithmic.

Fiat-backed stablecoins

Fiat-backed stablecoins are backed by a fiat currency, which in most cases is the U.S. dollar. Fiat-equivalent reserves collateralize them with a 1:1 ratio. This means one stablecoin can be exchanged for one fiat currency unit that it’s pegged to.

Fiat-backed stablecoins are the simplest and also the most centralized types in the market. The most popular are Tether (USDT), Binance USD (BUSD), and USD Coin (USDC).

Crypto-backed stablecoins

Some stablecoins are backed by other cryptocurrencies, which are referred to as being crypto-backed. They are often issued to launch their underlying crypto asset on other blockchains.

One thing to note is that these stablecoins are often over-collateralized. This means that there’s a surplus of reserves that greatly outnumber the value of the stablecoin.

One good example of a crypto-backed stablecoin is MakerDAO’s (DAI), which is pegged to USD but backed by ETH and other cryptocurrencies.

Commodity-backed stablecoins

Not all stablecoins have other currencies backing them; commodity-backed coins derive their value from another tangible asset. These commodities can be in the form of precious metals such as gold or silver.

Crude oil is another tangible asset that can be used to back a stablecoin. Paxos Gold (PAXG) is a stablecoin pegged to real gold reserves.

Algorithmic stablecoins

Instead of asset backing, algorithmic stablecoins remain stable due to a preset formula run on a computer program. Essentially, the computer algorithm controls the coin’s supply and demand via smart contracts. As a result, this affects the coin’s overall market value.

Centralized reserves do not always back algorithmic stablecoins. And because of that, you can consider them decentralized. TerraUSD (UST) was an example of an algorithmic stablecoin before it lost its peg.

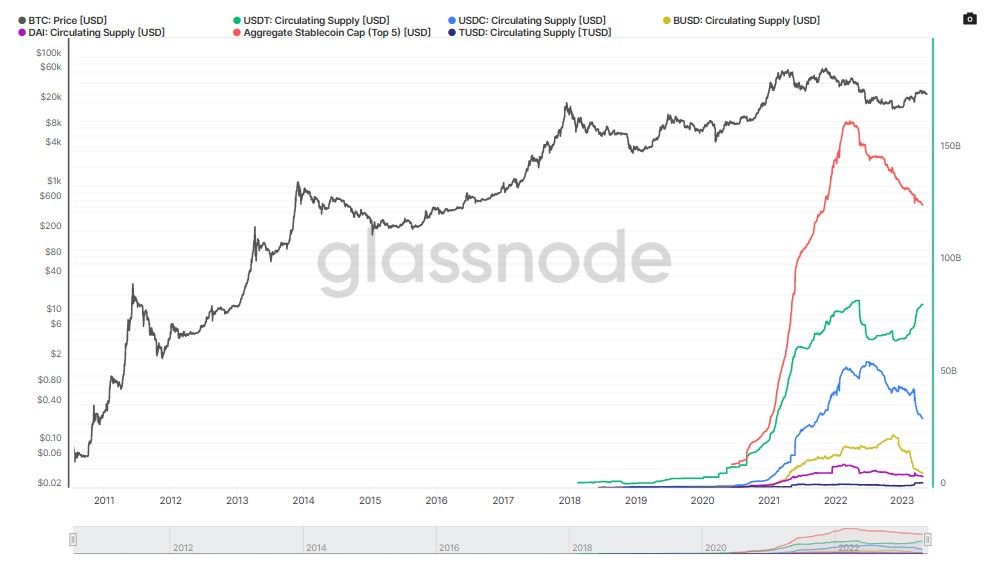

The below chart tracks the aggregate supplies of the following major stablecoins:

The future for stablecoins

Amid significant market chaos —from centralized exchanges like FTX collapsing to stablecoins debugging and banks shutting down — stablecoins are facing increased regulation. In 2023, several U.S. Senate and House bills sought to impose stricter standards on stablecoins, with a focus on transparency and reserve backing.

Notably, Paxos faced a potential SEC lawsuit early in 2023, raising questions about the future of stablecoin regulation. Circle’s USDC also came under regulatory pressure, further shaking confidence in stablecoin stability.

While the regulatory environment has become more defined in 2024, stablecoins still pose risks, especially for DeFi protocols.

For instance, Tether CTO Paolo Ardoino highlighted that 90% of DeFi protocols depend on USDC, underlining the potential threat that de-pegging events could have on the entire ecosystem.

“I think regulators should give a bit more guidance on how stablecoins operate and what should have in its reserves. That, to me, is extremely important because right now there is no big jurisdiction that provides guidance on stablecoin reserves,”

Paolo Ardoino, Tether CTO: BeInCrypto

Regulators now have clearer guidelines on stablecoin reserves, but questions remain about how effectively these measures will play out, leaving stablecoins at the center of ongoing financial debates.

Why hard-pegging crypto is necessary

Hard-pegging in crypto is vital for stability in an unpredictable market. By fixing stablecoin values to external assets, hard pegging ensures a more secure and trustworthy trading environment. Stablecoins must uphold this stability to thrive, and the rise of Central Bank Digital Currencies (CBDCs) may drive further stablecoin adoption, shaping the future of digital assets.