Once valued at $32 billion and the third-largest crypto exchange by volume, FTX had more than one million users before its rapid implosion in 2022. The astonishing meltdown reverberated across the crypto sector, taking down a handful of debtors and causing a wider market crash. Is any entity in crypto too big to fail? This guide explores the reasons behind the FTX collapse, its longer-term impact, and the current state of affairs in 2026.

KEY TAKEAWAYS

➤ FTX was a major crypto exchange that collapsed in 2022 due to financial mismanagement.

➤ The collapse was triggered by a liquidity crisis, largely due to Alameda Research’s reliance on FTT.

➤ Aggressive marketing and poor governance prior to the crisis further exacerbated FTX’s downfall.

➤ In 2026, the FTX estate has begun a creditor repayment program set to total more than $16 billion. Around $1.2 billion was released to smaller claim holders on Feb. 18, 2025.

What happened to FTX?

The FTX collapse was not a one-day event. It unfolded over nearly two weeks, with new developments at every turn. But, before we get into the details, we have to tell you that this is going to be a long read. So, if you are pressed for time, here is a quick rundown of the details.

The backdrop

- FTX launched in 2019, with Alameda Research already in existence. Alameda is a quantitative trading firm founded by Sam Bankman-Fried.

- Blockchain analytics platform Nansen reported that there was no clear separation between the two entities, which raised questions.

- FTX attracted significant attention with its seemingly overconfident public image, particularly when it secured a $135 million deal in June 2021 for naming rights to the FTX Arena.

May 2022 – June 2022: The first nail (TerraUSD crash)

- TerraUSD’s crash marked the beginning of FTX’s troubles.

- Nansen’s investigation revealed massive outflows of FTT tokens from FTX during the UST crash.

- Questions arose about whether Sam Bankman-Fried was using FTT tokens to bail out companies or if user tokens were sent to Alameda Research for short positions.

October 2022: Rising tensions

- Changpeng Zhao (CZ) from Binance criticized SBF’s stance on DeFi.

- SBF responded sharply, which escalated tensions and brought U.S.-China relations into the debate.

Nov. 2, 2022: CoinDesk revelations

- CoinDesk revealed that Alameda Research’s balance sheet was heavily dependent on FTT, which caused even more concerns.

- The firm’s major holdings included FTT, along with substantial amounts of SOL, and smaller positions in BTC and ETH.

Nov. 6, 2022: Binance’s move

- Binance announced plans to sell its FTT holdings, comparing the situation to the TerraUSD collapse.

- This announcement triggered panic, which caused the FTT price to decline.

- Caroline Ellison, CEO of Alameda Research, offered to buy CZ’s FTT tokens.

Nov. 7, 2022: SBF’s reassurances

- SBF tweeted that FTX’s assets were fine, though these tweets were later deleted.

- Binance expressed interest in reviewing FTX’s books but ultimately decided not to pursue the acquisition.

Nov. 8-11, 2022: The collapse

FTX had to finally wind down operations. Here’s what happened:

- Binance said no to buying FTX.

- FTX paused withdrawals.

- Markets plunged.

- FTX and its affiliates filed for bankruptcy.

Here is an FTX collapse explainer as seen on Reddit:

Now, let’s explore the details surrounding the collapse and the events that unfolded afterward.

The 2022 hack and the aftermath

On November 11, 2022, FTX announced that John J. Ray III had taken over as CEO following the resignation of the company’s founder, Sam Bankman-Fried.

On the same day, following the bankruptcy filing, FTX wallets (including those in the U.S.) experienced wallet hacks. Over $663 million was drained.

While some appeared as withdrawals, approximately $450 million was likely stolen. The hacker, who had not been identified, might have utilized Kraken to transfer funds.

Furthermore, the hacker made multiple hops to shuffle funds around undetected. At that time, he held $288 million in funds, all in ETH, after swapping stablecoins for them.

The hack diminished the prospects of retrieving customer funds. Nevertheless, investigations continued.

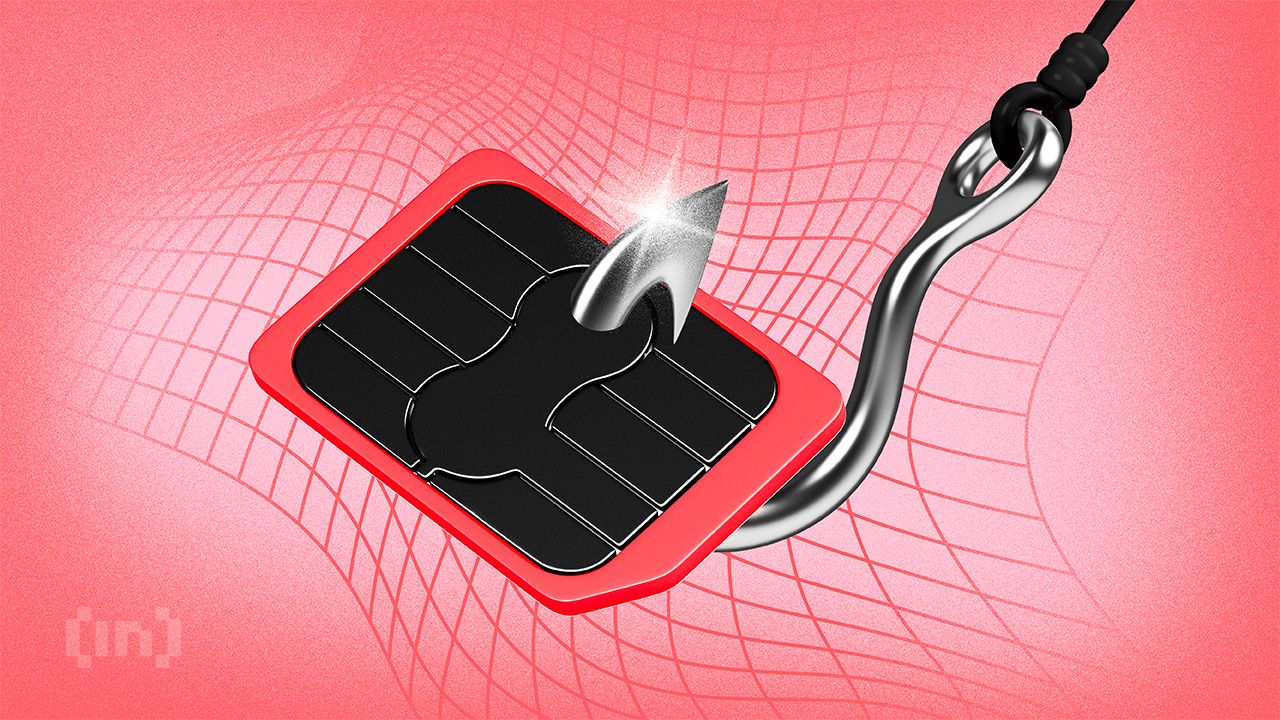

On Jan. 24, 2023, U.S. federal prosecutors charged Robert Powell, Emily Hernandez, and Carter Rohn for conducting a SIM swap attack, thereby fraudulently acquiring the identities of 50 individuals.

The attack led to the defunct FTX exchange losing $400 million in crypto assets, according to Bloomberg.

The group used an employee’s account and illicitly moved these funds across various exchanges to launder the money. Authorities labeled this scheme an ‘insider job,’ which involved the attackers using SIM swapping to hijack victims’ mobile numbers and bypass two-factor authentication.

The trio was arrested and charged with identity theft, access device fraud, and conspiracy to commit wire fraud.

2024: Bankman-Fried’s sentencing

CNBC reported that on March 28, 2024, a Manhattan federal court sentenced Bankman-Fried to 25 years in prison, a term significantly shorter than the 40 to 50 years federal prosecutors had sought but far exceeding the five to six-and-a-half years his lawyers recommended. Additionally, he will have to pay the U.S. government $11 billion in forfeiture.

The judge, reflecting on his 30 years of service on the federal bench, remarked that he had never witnessed trial testimony quite like Bankman-Fried’s.

While Bankman-Fried acknowledged some responsibility, he maintained that his exchange’s customers would eventually recover their funds. He attributed the delay in making customers whole to the federal bankruptcy court’s actions.

“There is a risk that this man will be in a position to do something very bad in the future.”

Judge Lewis Kaplan

Bankman-Fried’s family expressed that they were heartbroken for their son and will continue to defend and support him.

In August 2024, a U.S. court ordered FTX to pay $12.7 billion in restitution and disgorgement to customers who lost funds during the exchange’s collapse.

This amount includes $8.7 billion in restitution and $4 billion in disgorgement as part of the Commodity Futures Trading Commission’s (CFTC) litigation against FTX and its sister company, Alameda Research.

The bankruptcy estate of FTX is projected to hold between $14.5 billion and $16.3 billion by the end of September 2024, which could be used to reimburse customers.

2025: Creditor repayment program begins

As of 2026, the FTX estate’s creditor repayment program has kicked off. In all, more than $16 billion is set to be repaid, starting with smaller claim holders (those under $50,000). On Feb. 18, 2025, $1.2 billion was released.

FTX before the collapse

FTX is was founded by Sam Bankman-Fried (SBF), an MIT graduate, in the Bahamas in 2019. By early November 2022, before things got ugly for FTX, it was the second-largest centralized exchange by volume after Binance.

FTX had the backing of marquee investors like Temasek, Softbank, and Sequoia. And it quickly soared in terms of trading volumes, registering close to $2 billion at its peak.

Led by SBF, FTX was a “Squeaky Clean” name in crypto. The platform was doing good, making a name for itself with all the promotional hype advertising that money could afford. And money was something FTX had in plenty.

It was in May 2022 when FTX expanded its vision by featuring stock trading functionality. This initiative was led by FTX U.S. — the platform’s U.S. division.

FTX also had its own token, the FTT token, which was doing well before November 2022. Plus, its sister firm Alameda Research’s Solana holdings did great things for SOL’s price action. Overall, FTX was big at the time and lifted everything it touched.

But that’s not all that stood out. FTX promoted itself and crypto quite a lot. It even invested in and acquired several other firms during its ascendancy.

FTX’s aggressive marketing and sponsorship strategies

In June 2021, FTX made a bold move by securing a $135 million deal for the naming rights to the Miami arena, home of the Miami Heat. This high-profile sponsorship was a key part of FTX’s strategy to establish itself as a leading player in the cryptocurrency market.

Following FTX’s bankruptcy, the naming rights agreement was dismantled.

FTX continued its aggressive marketing push with a $6.5 million, 30-second Super Bowl advertisement during a challenging bear market. The ad featured comedian Larry David, co-creator of Seinfeld.

Beyond these marquee sponsorships, FTX invested heavily in diverse marketing initiatives throughout 2021. The company partnered with Mercedes and entered the esports arena by signing deals with teams like TSM and Furia.

FTX also formed a five-year partnership with Major League Baseball (MLB) and secured a $17.5 million naming rights deal with the University of California.

Additionally, FTX collaborated with sporting icons such as Tom Brady and Gisele Bündchen, who invested in the company. These high-profile endorsements and sponsorships were designed to enhance FTX’s brand presence and promote the FTT token.

Despite the initial success, FTX’s extensive marketing and sponsorship efforts contributed to an overconfident public image that ultimately could not withstand financial mismanagement.

What is the FTT token?

FTT is FTX’s native token and one of the primary reasons why the FTX collapse sped up. It is a utility token ensuring that customers get a discount on the trading fee. Users could also use it as an exchange token and deposit it as collateral for future positions.

The FTT token went all the way up to $85.02 in September 2022. Even in early November 2022, the FTT price was well above the $22 mark.

The collapse began when the ex-CEO of Binance CZ (Changpeng Zhao) announced on Twitter that Binance planned to sell off the FTT stockpile it received from FTX during divestment. He stated that this decision responded to some “recent revelations.”

As of 2026, with the FTX bankruptcy proceedings underway, FTT no longer has any use.

Who is Sam Bankman-Fried?

Sam Bankman-Fried (SBF) was once a prominent figure in the crypto world, known for founding FTX and its U.S. affiliate. At his peak, SBF’s net worth reached $22 billion, making him the wealthiest 29-year-old in the world.

He gained widespread recognition for his role in assisting struggling crypto firms like Three Arrows Capital and Celsius during the Luna crash. These actions further solidified his status as one of the most influential people in crypto.

However, this image was only part of the story. SBF, the son of Stanford professors Barbara Fried and Joseph Bankman, entered the crypto market with a strong background in finance.

He started by trading ETFs at a quant firm before going on to found Alameda Research, a quantitative trading firm that would be later closely tied to FTX.

SBF was known for his commitment to “effective altruism,” a philosophy that emphasized giving away wealth for the greater good.

However, his reputation began to falter with the introduction of the so-called “DeFi killing bill” in October 2021, which proposed controversial crypto regulations.

This, along with his aggressive political donations—pledging up to $1 billion for the 2024 U.S. presidential elections — sparked criticism.

Despite his efforts to support the crypto ecosystem, these actions, combined with the financial entanglements between FTX and Alameda Research, contributed to the eventual downfall of FTX.

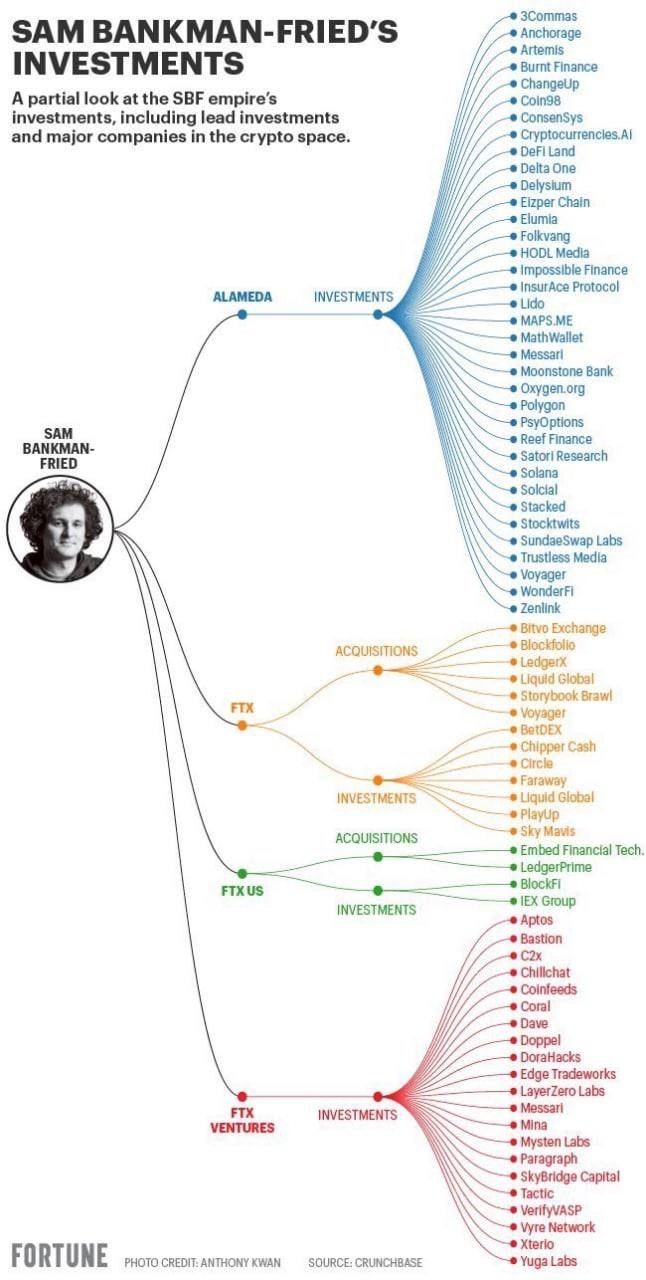

Unpacking Alameda Research

Alameda Research is a quantitative trading firm for cryptocurrencies. It is also FTX’s sister company, a hedge fund, and also SBF’s brainchild.

Alameda had always been a heavy DeFi investor. It also had investments in Messari, Coin98, Voyager, Zenlink, and several other firms.

Data from Crunchbase suggests that Alameda made close to 185 investments over the past five years, with Fordefi coming across as one of them.

The company was also known for establishing DeFi deals across the Solana and Ethereum ecosystems. Here is an analysis from the on-chain analytics platform Lookonchain, citing the DeFi holdings:

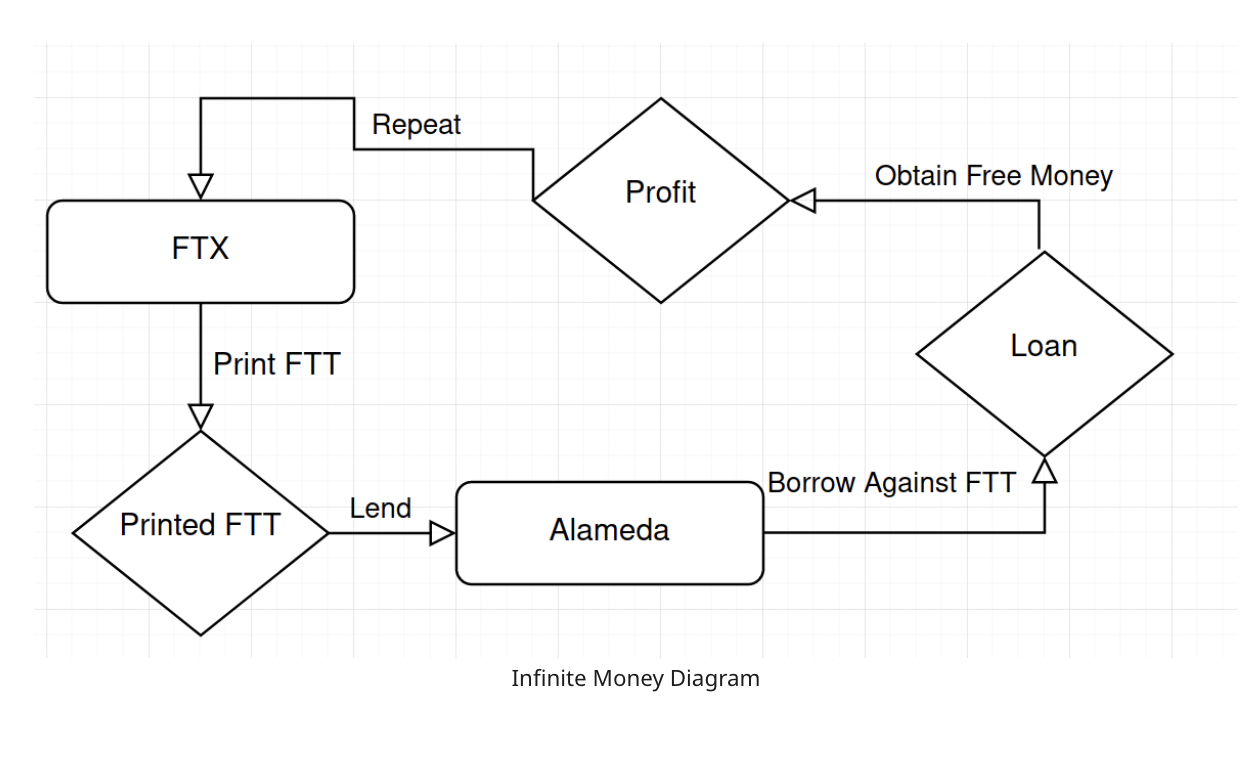

Ultimately, it was Alameda’s BS (balance sheet) deficit that triggered the spectacular collapse of FTX.

It was also worth noting here that while SBF founded Alameda, Caroline Ellison, an American executive, was heading it at the time. In fact, it was Ellison who said that Alameda would happily buy Binance’s FTT token at $22 — as Changpeng Zhao had plans to sell.

Ellison, reportedly an ex-girlfriend of SBF, pleaded guilty to multiple charges in 2022. She eventually played a major role as a “star witness” in SBF’s conviction.

Charges against Ellison included two counts of wire fraud, two counts of conspiracy to commit wire fraud, as well as conspiracy to commit commodities fraud, securities fraud, and money laundering.

FTX collapse explained

FTX’s collapse was not an isolated event but rather the culmination of several interconnected factors. For instance, the exchange’s close tie with Alameda Research was at the heart of this debacle.

Alameda’s heavy involvement in risky investments and speculative trades, often using FTX customer funds, played a critical role in the eventual implosion of the exchange.

In November 2022, CoinDesk revealed that Alameda’s balance sheet was heavily dependent on FTT, FTX’s native token, which raised immediate concerns. The revelation indicated that Alameda had been using FTT as collateral for its trading activities, exposing both the firm and FTX to significant financial risk.

This exposure became even more apparent when Binance, led by Changpeng Zhao (CZ), announced plans to sell off its FTT holdings, comparing the situation to the TerraUSD collapse earlier that year.

The announcement triggered a massive sell-off, leading to a sharp decline in the price of FTT. Despite attempts by Alameda’s CEO, Caroline Ellison, to stabilize the situation by offering to buy FTT at $22 per token, the price continued to plummet.

This rapid devaluation of FTT exacerbated liquidity issues for both Alameda and FTX, forcing FTX to pause customer withdrawals.

As the crisis deepened, SBF attempted to reassure the market through public statements, but these efforts were in vain.

The close financial ties and commingling of funds between FTX and Alameda Research highlighted significant governance issues, which contributed to the collapse.

On November 11, 2022, FTX filed for bankruptcy, marking one of the most significant failures in the history of the cryptocurrency industry.

The collapse of FTX serves as a stark reminder of the risks associated with over-leveraging, poor corporate governance, and the dangers of intertwining the financial interests of related entities.

Who’s been affected by the FTX collapse?

The FTX contagion continues to spread. And many companies that have previously been invested in by FTX and Alameda research have started showing catastrophic effects.

FTX, along with Alameda Research and 130 other affiliated firms, filed for Chapter 11 relief or bankruptcy on 11 Nov. 2022.

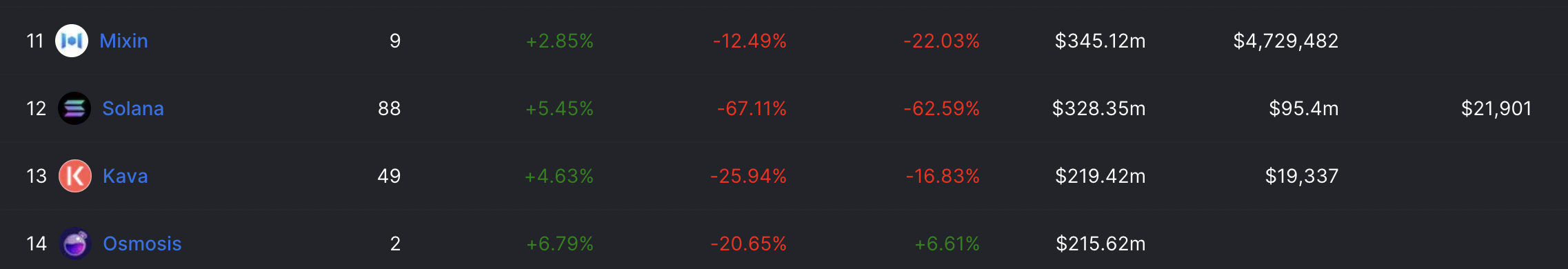

And filing for bankruptcy brought a tumultuous FTX collapse saga to an end. Solana and its SOL token price saw sharp dips. Solana, being the collateral of choice after FTT, was hit particularly hard following the debacle.

In other related developments, BlockFi — a company that SBF once bailed — also filed for bankruptcy. Later, reports suggested that FTX.us had extended a loan of $250 million to BlockFi.

The impact on the broader crypto industry

Despite kickstarting with the devaluation of the FTT token, the fallout of FTX eventually had an impact on the broader crypto market.

Furthermore, the FTX collapse explained one simple thing to all of us no exchange should ever use customer funds for taking trading positions, and that too against their knowledge.

The FTX CEO did that to his own peril, and the fallout of FTX eventually affected the broader market. Almost all major crypto, including the likes of BTC, ETH, and SOL continued their downward spiral for a period.

The way forward

As of August 2024, FTX has made some progress in its reorganization efforts led by John J. Ray III. The court has approved a detailed plan that aims to wind down FTX’s operations efficiently, with customer repayments expected within 60 days of the plan’s final approval.

FTX has assured that 98% of its customers will receive full repayment, with plans to return over 100% of their claims. While the exchange’s collapse has led to stricter industry scrutiny and a renewed emphasis on proof of reserves, it also serves as a reminder of the risks inherent in the crypto market.

Frequently asked questions

FTX announced that nearly all its customers would receive the money they owed two years after the cryptocurrency exchange collapsed. Some customers will even get more than what they were originally owed. This marks a significant recovery effort following FTX’s implosion.

In 2024, Bankman-Fried was sentenced to 25 years in prison. This sentencing resulted from the scandal that heavily impacted the cryptocurrency market. His conviction marked a pivotal moment in the aftermath of FTX’s collapse.

It is speculated that FTX used customer funds to take trading positions at its sister firm, Alameda Research, using FTT tokens as the primary resource. So when the FTT price started to drop, most positions liquidated themselves, making Alameda and FTX insolvent.

It was Sam Bankman-Fried’s debatable business model that triggered the FTX collapse. It is speculated that he used customer funds to trade and make money. With Alameda’s balance sheet out in the open, showing a majority of its holdings to be in FTT, things started to get out of hand, causing broader market concerns.

U.S.-bound FTX was doing better than FTX Bahamas. However, the current bankruptcy filing has even made FTX.us solvent. So, FTX might not be operational in the U.S.

FTX has collapsed due to its native token, FTT, losing value; FTT price nosedived after Binance CEO made it public that the company intends to exit all of its FTT holdings.

People with money in FTX are stuck for now. While the funds haven’t been lost, recovery might take a long time, but things should look more hopeful by the end of 2024.

FTX cannot be trusted as it has taken an active role in helping spread the collapse contagion. User funds are stuck, the FTT token price is closing in on all-time lows, and even companies that FTX invested in or bailed out, like BlockFi, are feeling the heat.

The FTX meltdown was a contagion effect caused by the possible collusion between the FTX cryptocurrency exchange and the trading firm Alameda Research. As the FTT token started losing value, Alameda’s trading position started liquidating, which eventually caused a ripple effect and took SBF down.