With the crypto market buzzing in 2025, we’ve compiled a detailed and data-packed Ethereum price prediction to help you make sense of ETH’s future potential price path. Here’s what to know about the technical and fundamental analysis behind the second largest crypto by market cap.

KEY TAKEAWAYS

➤ Ethereum’s price could skyrocket by 2035, with projections ranging from $125,862 to $245,219, showing its potential to remain dominant in the crypto space despite challenges from competitors like Solana and Cardano.

➤ Historical patterns and technical analysis predict significant price fluctuations, including corrections and surges.

➤ Ethereum’s future depends on addressing UX challenges, scalability, and regulatory hurdles, with modular interoperability being key to onboarding the next wave of users.

Ethereum (ETH) price prediction until the year 2035

| Year | Maximum price of ETH (expected) | Minimum price of ETH (expected) |

| 2025 | $6767 | $1800 |

| 2026 | $3130 | $1894 |

| 2027 | $1987 | $1511 |

| 2028 | $4822 | $2234 |

| 2029 | $7082 | $5100 |

| 2030 | $17658 | $11175 |

| 2031 | $37442 | $21477 |

| 2032 | $67851 | $37055 |

| 2033 | $111182 | $58950 |

| 2034 | $169587 | $88205 |

| 2035 | $245219 | $125862 |

The price and actual prices will also depend on how other supposed “Ethereum-killers,” such as Solana and Cardano, manage to innovate over the years.

Ethereum technical analysis

Throughout the next few sections, we shall discuss the broader charts associated with the price of Ethereum. The idea will be to locate the average price percentages between the previously elapsed highs and lows to build a more accurate technical analysis and form a data-backed ETH price prediction. But before we delve into the weekly charts, let us do a quick short-term technical analysis to understand ETH’s near-term future price potential.

Even though ETH is playing hide and seek with the $2000 level, this quote from a few months backstill makes sense.

“Strong bounce from Ethereum resulting into a likely uptrend. Needs to break through 0.06 BTC to make sure that the trend can continue, but the weekly bullish divergence identifies that there will be substantial strength in the coming months.”

Michaël van de Poppe, founder of MN Trading: X

Weekly patterns and historical price moves

We can first pull out the Ethereum weekly chart — Binance’s ETH/USDT pair, and some clear patterns surface. The price of ETH, evaluated since 2017, is seen in a set pattern, A-B-C-D-E-X. Post X, the same pattern seems to be replicating itself, currently holding steady at D1 and waiting for the next E1 and X1.

If we can identify the percentage peaks and drops for the A-to-X pattern and the A1-D1 pattern, we can determine the average price percentage levels for the next high at E1 and the subsequent low at E1.

Supplementing this price move is the RSI indicator, which teased the price move earlier, post the higher high formations associated with the A-to-X pattern.

A similar RSI formation is now being seen post-D1, which might mean that, like E forming above A, E1 might form above A1, ensuring new all-time highs for the coin price.

Calculations

Here are two tables — one with every level charted between A to X and the other charting every level between A1 to D1:

Table 1:

| A to B | -76.25% in 77 days |

| B to C | 138.64% in 35 days |

| C to D | -91.61% in 231 days |

| D to E | 6088.93% in 875 days |

| E to X | -61.18% in 70 days |

Additional point: X to A1- 187.13% in 112 days

Table 2:

| A1 to B1 | -55.68% in 77 days |

| B1 to C1 | 65.44% in 63 days |

| C1 to D1 | -75.46% in 70 days |

Using data from above, we shall now locate the average price moves — percentages and days needed — for Ethereum’s high-to-low and low-to-high moves.

High-to-low: 72.036% in 105 days (lowest drop would be -55.68% in bull markets)

Low-to-high: 1620.035% in 271 days (lowest surge would be 65.44% in saturated markets)

We shall now use the details to locate the future price of ETH over the years.

Ethereum (ETH) price prediction 2024 (concluded)

We expected the next high to surface anywhere between a surge of 65.44% to 1620.035%, which is the average low-to-high price percentage per pattern.

Assuming this level E1 and the next low or X1 surfaced at $1850, we expected the minimum price of ETH in 2024 to not fall under the $1800 mark.

Ethereum (ETH) price prediction 2025

Outlook: Bullish

The dip should not exceed 55.68%, per data from the tables above. Therefore, the minimum price of ETH in 2025 should find support at $1800. Earlier this price was close to $2500 but the recent corrections made us tweak the lows.

From this price, we can expect another surge of 187.13%, which is expected to surface towards the end of 2025. This puts the ETH price forecast for 2025 at $6767 or even $5000 if you are looking for a more conservative measure. This analysis keeps the 2024 high of $4000 in mind and builds on that.

Projected ROI from the current level: 207%

Ethereum (ETH) price prediction 2030

Outlook: Very bullish

If our ETH price forecast for 2025 holds and the coin price reaches $6767 by the end of 2025, we can expect a deeper correction in 2026, courtesy of rapid selling. At this point, 100% of the ETH holders should be in the money, making 2026 the year of a stricter correction. From the previous high or C2, we can then expect ETH to drop 72.036% in 105 days, per our average price identification.

This would put D2 or the 2026 low at $1894. With the bears being in charge, the high from this level might only scale to 65.44%, the lowest price surge in a bear market. This puts the 2026 high at $3130.25.

If we keep these bull and bear cycles in mind, ETH should assume an all-time high of $7082 by the end of 2029. If this level is reached, with the 2029 low expected to form around $5100, we can expect the price of Ethereum to surge as high as $17658 by 2030.

Emir Beriker, Co-founder and Head of Strategy at Union: BeInCrypto interview

Projected ROI from the current level: 702%

Ethereum key fundamental metrics

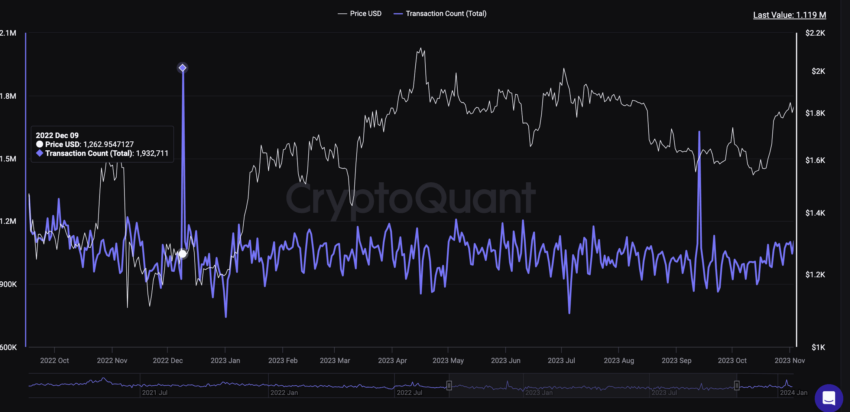

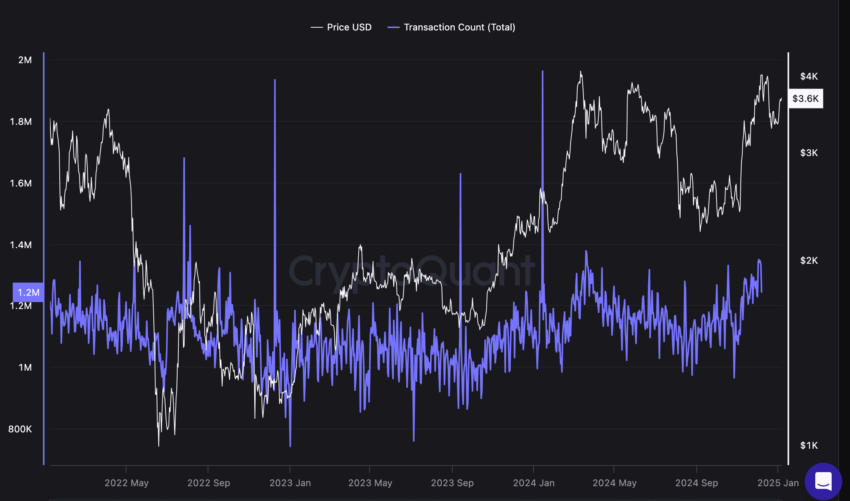

A quick metric to start this segment would be the transaction count. Notably, the transaction count surged towards the end of 2022, followed by a miraculous price surge in under a month. Something similar started happening in October 2024, after which the prices surged.

As of early 2025, the transaction count is steady, even though the prices have almost doubled since 2023. Yes, the transaction count dipped a bit in March 2025, but the levels aren’t alarming yet.

Another bullish metric:

Another crucial metric to look at is the active address count. Notice how the prices peaked in 2025, despite the steady active address count. These peaks can be attributed to the occasional surges in the active address number. While the image is from January 2025, the active address count as of March 2025 hasn’t changed, showing steady adoption.

Does Ethereum have a future?

Our Ethereum price prediction model believes that ETH could be one of the more aggressive altcoins in the near future despite a large market cap. With the ETH 2.0 roadmap expected to go further in the coming years, focusing on lowering the main net fees and increasing scalability, Ethereum looks poised for a bullish decade. Regardless of these expectations, it would help to always do your research (DYOR) before taking long or short positions at ETH’s counter. Remember only to invest what you can afford to lose.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The Ethereum price predictions discussed here are based on historical data, technical analysis, and speculative insights, which are subject to change due to market conditions, regulatory shifts, and unforeseen developments. Always conduct your own research (DYOR) and consult with a financial advisor before making investment decisions.

Frequently asked questions

How much will 1 Ethereum be worth in 2025?

What will Ethereum be worth in 2030?

Can Ethereum rise again?

Will Ethereum reach $50,000?

Is ETH still a good investment?

How high can Ethereum go?

Can Ethereum hit $5,000?

Will Ethereum reach $10,000?

Will Ethereum go to zero?

What’s the difference between Ethereum and Bitcoin?

Who founded Ethereum?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.