In a web3 world in need of layer-1 blockchains with both speed and scalability, EOS delivers. Termed a 3rd gen layer-1 solution, EOS focuses on customizable smart contracts and the lowest possible latency. EOS follows a dPoS or Delegated proof-of-stake consensus to secure the network — a feature that promises high transaction speeds. In this EOS price prediction, we will explore the future price possibilities of the altchain’s native coin, EOS.

- The role of fundamental analysis

- EOS price prediction and token economics

- EOS price prediction and other key metrics

- EOS price prediction and technical analysis

- EOS (EOS) price prediction 2023

- EOS (EOS) price prediction 2024

- EOS (EOS) price prediction 2025

- EOS (EOS) price prediction 2030

- EOS (EOS’s) long-term price prediction until 2035

- Is the EOS price prediction model accurate?

- Frequently asked questions

Want to get EOS price prediction weekly? Join BeInCrypto Trading Community on Telegram: read EOS price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

The role of fundamental analysis

For starters, EOS is an open-source blockchain. EOSIO software lays the foundation of the entire network. Developed by Dan Larimer, EOS is driven by smart contract support and allows participants to build DApps on it.

Did you know? EOS conducted one of the most profitable and longest ICOs in the history of crypto assets. At the record time, the ICO was valued at $ 4 billion and it lasted a year.

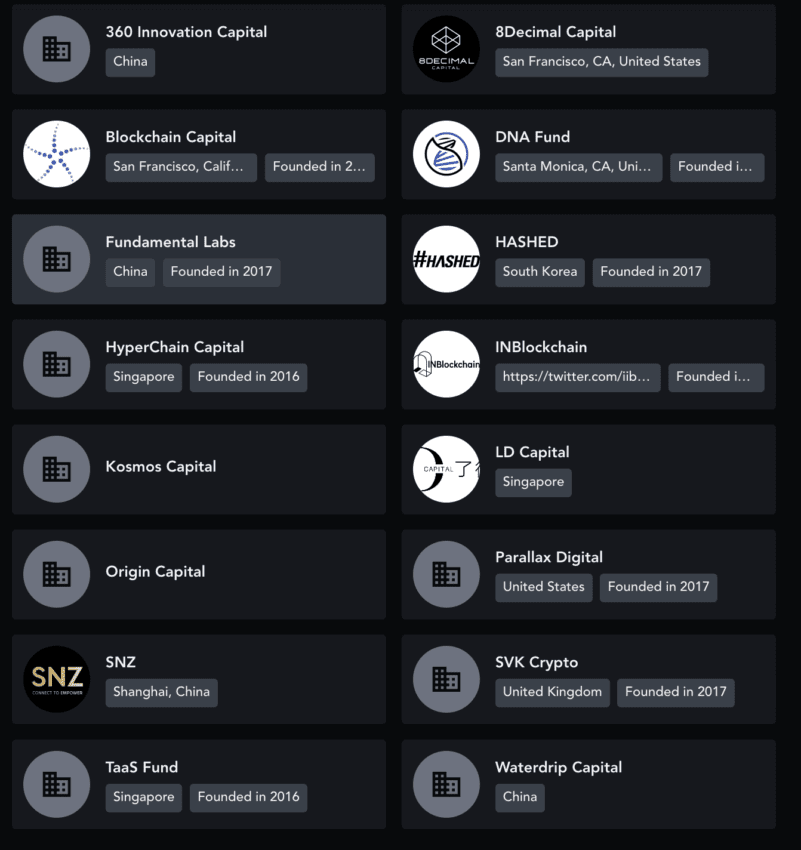

The native coin EOS finds a use-case in on-chain governance. But that’s not all you need to know about EOS. The chain has a celebrated lineup of investors, with Blockchain Capital being a prominent one.

EOS is one of the few chains to use innovative scaling and parallel processing technologies for better transaction speeds. The altchain uses parallel computing and Graphene technology to achieve improved scalability.

Fundamentally, EOS looks to be a robust project. And if the network adoption keeps growing, it may even compete with the likes of Cardano and Ethereum over time.

“EOS EVM has already launched 4 months ago. It’s “designed to be the most performant and compatible EVM on the market,” offering: • 1-second block intervals • Low gas fees ($0.01 USD) • Support for 800+ swaps per second.”

Ignas, DeFi Researcher and the Founder of Pink Brains: X

EOS price prediction and token economics

Before delving into the token economics model, here is what you can do using EOS:

- Pay for the network resources — including storage capacity and computational power.

- Staking

- On-chain governance

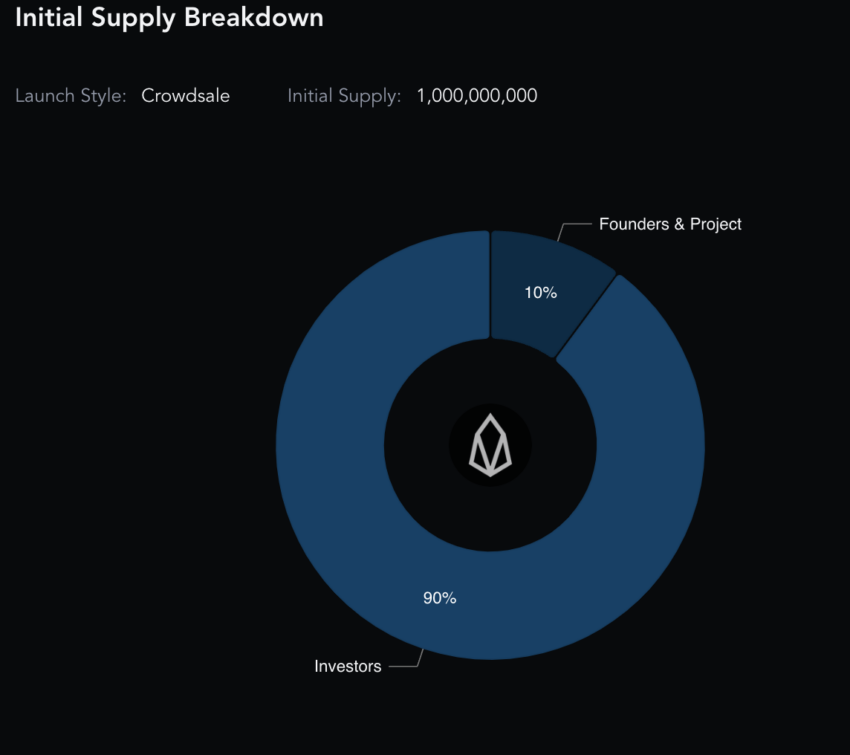

Coming to the coin supply, it all started with an Initial Coin Offering for EOS. Post the ICO, the supply schedule tilted 90% in favor of investors, whereas the project and founders received 10% of the total supply.

However, there isn’t a supply cap making EOS an inflationary cryptocurrency. The 3% inflation rate is still decent if you compare it with the likes of AVAX.

And while the tokenomics model is expected to have a positive issuance rate for some time now, the rate seems to be in control for now. An increase in network activity and adoption can, therefore, increase demand, despite the increase in the supply of EOS.

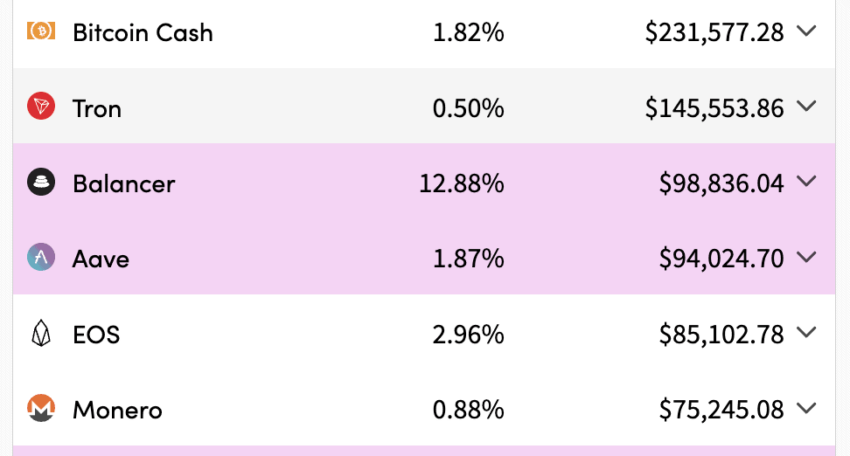

EOS price prediction and other key metrics

Considering EOS from an investment perspective, you must know the price volatility. The 4-week price volatility chart suggests a slight increase in the metric despite the corresponding price increase. It is important to note that a price dip follows every volatility peak. Therefore, an increase might just lead to a short-term consolidation at the EOS counter.

Development activity was generally quite low during Q3 and Q4 2022, barring a late-September peak. The chart shows a price surge right before the increase in development activity in early 2023. Hence, the future price levels and an increasing market cap of EOS might bring in more developers.

For the most of 2023, Development activity hasn’t peaked significantly. This could be a reason why prices haven’t surged beyond expectations.

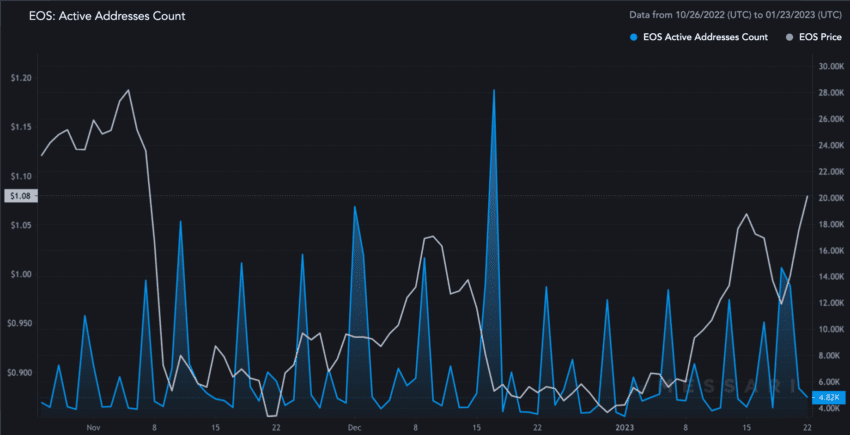

The active address count over the past 90 days, as of early 2023, was steady. And the levels increased with the higher prices.

Overall, the EOS indicators hint at mixed price-related signals.

EOS price prediction and technical analysis

It’s now time to shift focus to technical analysis of EOS to help map both short-term and long-term price predictions. Let us start with the more recent short-term analysis:

Our December 2023 analysis

The daily EOS/USD chart reveals that EOS has recently broken out of a wedge pattern. However, the momentum might be questionable, courtesy of the bearish divergence exhibited by the Relative Strength Index indicator. In case the surge continues, the $0.9267 is the level to breach in case EOS wants to scale higher.

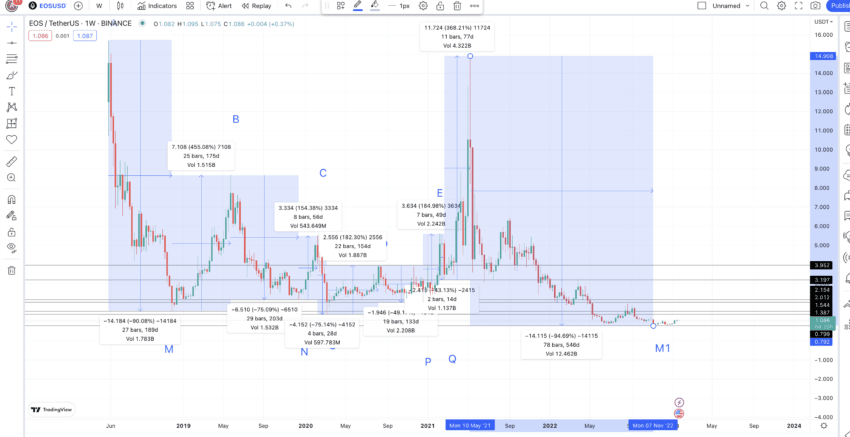

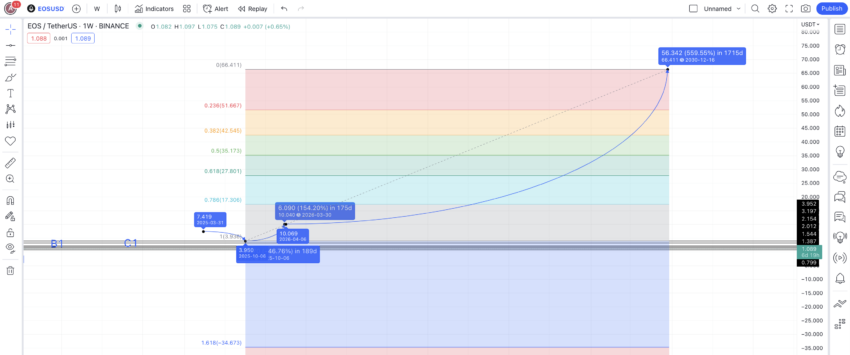

Notice that we use the EOS-USDT trading chart from Binance, with the weekly timeframe in play. Here is the raw chart for your reference:

Pattern identification

A clear pattern is visible. The chart starts with EOS trading at a high and then quickly correcting a bottoming out. Since then, EOS has made three visible lower highs before a higher high and peaking out.

That peak can be used as the starting point of another formation as EOS again dropped to the bottom days after forming the top. Therefore, we can expect the A to A1 pattern to get repeated for EOS.

Here is the chart with all the important points in place:

Price changes

Notice how we have M1, the last low, in place. From this level, we must locate the B1, C1, or the entire path until the next peak or A2. But we do not have values to rely on. For that, we shall locate the price changes, both percentage changes and timeframes from A to A1.

Here are the tables to help you with the same:

Using the tables above, we can locate the high-to-low averages — average percentage change and time taken for the same. The figures come out as 71.21% and 186 days. The low-to-high averages — percentage change and time take — come out as 268.99% and 102 days.

Moreover, the percentage gain and drop might vary from the averages, depending on the state of the crypto market.

EOS (EOS) price prediction 2023

In 2023, EOS scaled a level of $1.32, which was still far off from our predicted price point. Yet, the growing momentum at the counter and the popularity of L1 chains make us optimistic about the mentioned analysis, which reads as follows:

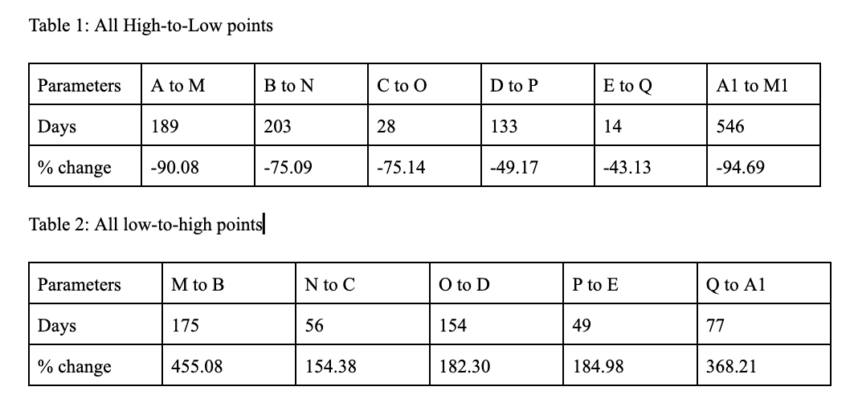

From point M1, we can use the low-to-high average of 268.99% to plot the next high or B1. As the crypto market is slowly recovering, we might have to take the distance as 175 days (maximum distance for a low-to-high point from the table above) instead of the average of 102 days.

Therefore, the EOS price prediction for 2023 might surface at a high of $2.129 — by May 2023.

The next low could be due to a sharp dip of 71.21% — per the average high-to-low percentage change value. It might take EOS coins 186 days to attain the next low or N2. This puts the minimum price prediction for EOS at $0.837 by the end of 2023.

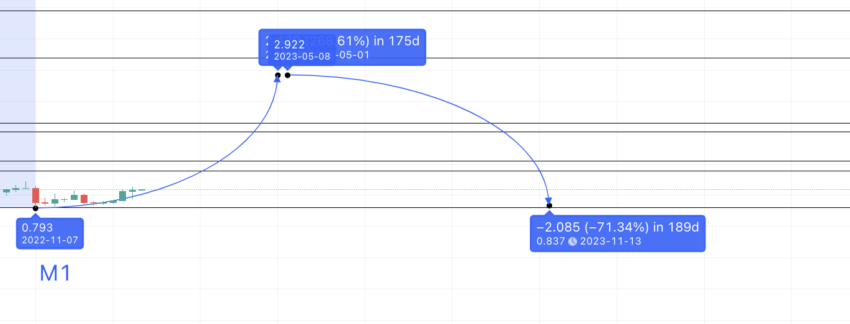

EOS (EOS) price prediction 2024

Outlook: Bullish

The next high, from the minimum price in 2023, might also follow the average hike of 268.99%. If we plot the path for the next 140 days (the average value), the EOS price prediction for 2024 might surface at $3.086.

The low, this time, might not drop by over 71%. Instead, if the price of EOS can make consecutive highs this early in the pattern — with C1 higher than B1 — the next low might take support at $2.01. Do note that it is a very strong support level for EOS. This could be the minimum price of EOS in 2024.

However, as the prices didn’t rise much in 2023, you can expect the $0.837 level or the proposed low for 2023 to remain the lowest point for 2024.

Projected ROI from the current level: 247%

EOS (EOS) price prediction 2025

Outlook: Bullish

From this level, the next high could still be at an upper level of 268.99%. Therefore, our EOS price prediction model puts the price of EOS in 2025 at $7.42.

The low from this level might again not drop by over 71%. Instead, over the next 186 days, we can expect the minimum price of EOS in 2025 to take support at a strong support level of $3.95.

Projected ROI from the current level: 733%

EOS (EOS) price prediction 2030

Outlook: Bullish

Now, we have the EOS price prediction points till 2025; we can again use the average low-to-high point to locate the next point in 2026. However, this time, we should consider some corrections at the counter and even profit booking.

Therefore, instead of the average price growth of 268.99%, we might see EOS only incrementing by 154.38% — the lowest growth level from Table 2. This assumption puts the EOS price prediction for 2026 high at $10.040.

We can now connect the 2025 price prediction low, or $3.950, and the 2026 price prediction high, or $10.04, to trace the price of EOS till 2030. We can connect the points using the Fibonacci indicator. Extending the path of EOS till the end of 2030 puts the projected price at $66.41.

The EOS price prediction low in 2030 can show up at $35.17 — 50% down from the maximum price projection.

Projected ROI from the current level: 7361%

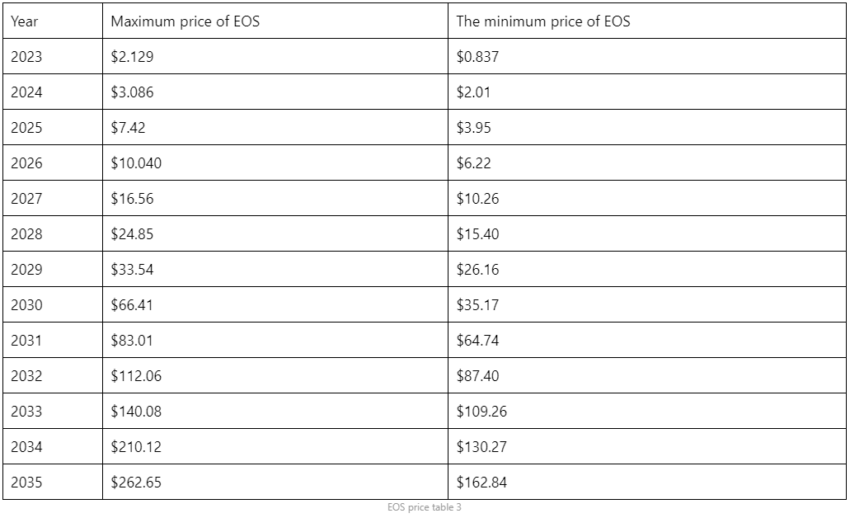

EOS (EOS’s) long-term price prediction until 2035

Outlook: Bullish

If you want to hold the EOS cryptocurrency until 2035, here is a table to help you look at future price possibilities.

You can easily convert your EOS to USD here

Notice that the minimum and maximum price of EOS cryptocurrency in any given year will still depend on macroeconomic factors, market cap change, the state of smart contract development, circulating supply of EOS, and other metrics. Therefore, the price might change depending on where the crypto market stands at that instant.

Is the EOS price prediction model accurate?

This EOS price prediction model doesn’t inflate the maximum prices to project absurd bullishness. Instead, it offers a holistic picture — taking EOS tokenomics, fundamentals, and even on-chain metrics into consideration. Plus, our technical analysis is data-backed and offers a zoomed-out view of the coin’s future price. Of course, crypto is dynamic and volatile, and the future EOS price will depend on the state of the market, layer-1 competition, and adoption of EOS.

Frequently asked questions

Is EOS crypto a good investment?

Is EOS good for the long term?

Is EOS better than Cardano?

Which is better EOS or Ethereum?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.