Crypto exchange platforms enable the exchange of one digital asset for another. Centralized crypto exchanges have been providing services for trading cryptocurrency since 2010, but with numerous hacks, trust problems, and scams, decentralized exchanges (DEXs) have become an alternative for many people. This guide explores how to evaluate a DEX using on-chain analytics. But first, let’s explore the rise of DeFi & DEXs.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto projects & alternatives to CEX, get technical analysis on coins & answers to all your questions from PRO traders & experts!

The rise of DeFi and DEXs

Ethereum was designed as the premier smart contract platform, utilizing blockchain technology to enable the creation of smart contracts. This enables developers to build new protocols using these smart contracts on the Ethereum network, which can interact with users in a decentralized manner. Among the growing category of protocols on the Ethereum network are decentralized exchanges (DEXs). These DEXs provide a decentralized trading platform, with all interactions taking place directly between the user (through web3 wallets) and the financial service provider, the DEX. Transactions on these platforms do not require intermediaries (as is the case with centralized exchanges), giving users full control over their assets during the transaction.

DeFi (decentralized finance) is the category of decentralized solutions that a DEX falls into. DeFi has seen tremendous growth since the famous “DeFi Summer,”; the name given to the summer of 2020 after the emergence of several new platforms in the space. The DeFi ecosystem has expanded and evolved significantly in recent years, driven in part by the rise of DEXs. DeFi offers benefits in terms of privacy and security, but it has also become popular among crypto users due to the availability of yield-generating strategies.

DEX on-chain analytics: identifying the top pools

The DeFi ecosystem is composed of various types of DApps with unique functions and services that set them apart from one another. Some of the most prevalent types of DApps include decentralized exchanges, lending protocols, and derivatives protocols.

The primary role of DEXs as exchange providers is to maintain sufficient liquidity to facilitate the trading of token pairs. DEXs achieve this by allowing users to deposit pairs of tokens into pools provided by each protocol. These depositors earn swap fees charged to traders utilizing the DEX services.

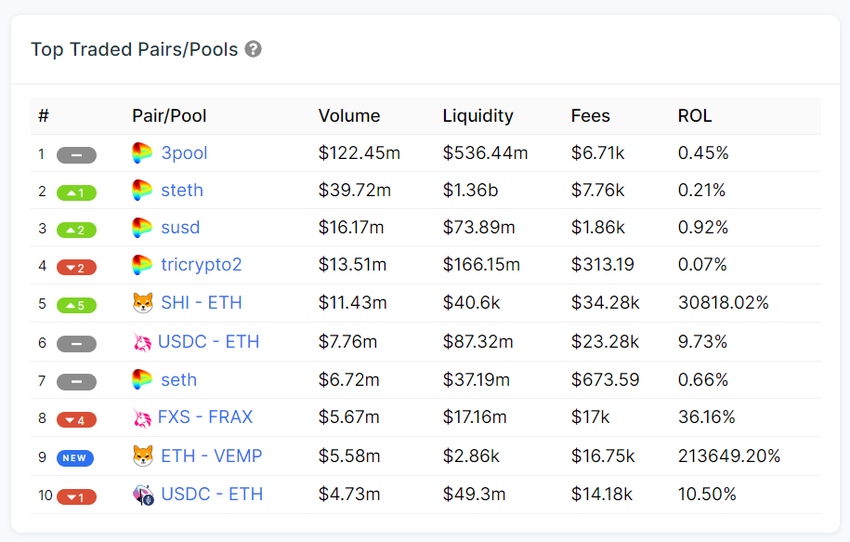

On-chain data can identify the token pairs/pools with the highest trading activity across supported DEXs. This provides insights into pools with high liquidity and volume within the DeFi ecosystem.

The indicator above displays the top 10 pools ranked based on the volume of trade. The volume column aggregates the trading volume over a 24-hour period. Liquidity refers to the combined supply of both tokens in the trading pair. Fees, which are typically 0.3% in the case of Uniswap, are calculated based on trading volume and earned by liquidity providers. The indicator shows the fees collected in the past 24 hours. Lastly, the Return on Liquidity (ROL) is an estimate of the expected return, excluding token rewards, that liquidity providers will receive from the pair based on 24-hour data.

The Return on Liquidity (ROL) varies based on the trade volume and the amount of liquidity provided. It operates as a relationship between the two: higher trading volume results in more fees generated, leading to higher rewards for liquidity providers.

Conversely, less liquidity in a pool translates to a larger share for individual liquidity providers, particularly if the pool experiences high trading volume, resulting in greater rewards.

Volume and fees relationship

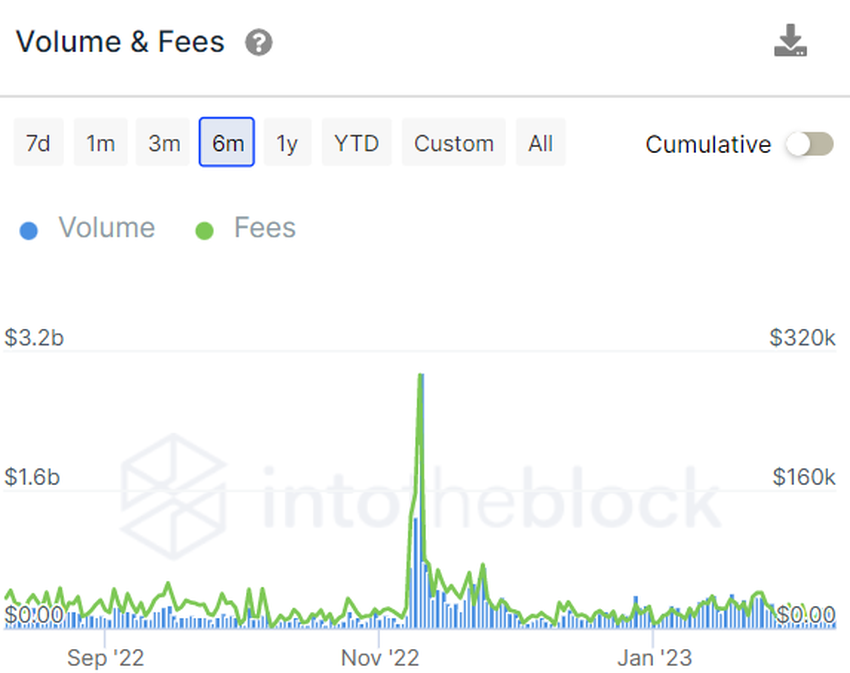

An essential metric to monitor is the volume of transactions processed by DEXs. This metric provides insight into the number of users on the platform and the fee revenue generated by liquidity providers through these transactions.

As DEXs function in a decentralized manner, they rely on liquidity providers (LPs). Users can become an LP by depositing funds into one of the DEX’s permissionless pools. LPs on a DEX earn swap fees charged to users trading on the platform. In other words, the revenue generated by the DEX through swap fees is distributed among the LPs.

In this case, the indicator shown below portrays the daily volume traded and fees generated on Curve’s pools on Ethereum.

The fees that the protocol generates stand as a derivative of the volume processed. The graph above depicts the volume processed and the fees earned by LPs since Sept. 10, 2022. The big increase in volume during the beginning of November is directly related to the collapse of the FTX exchange. Times of volatility in the market bring high trading volumes due to speculation.

Total Value Locked (TVL) and it’s meaning

Total Value Locked (TVL) is an important metric to evaluate. It gives us an insight into the value that has been deposited into the protocol with the purpose of earning returns. In this case, as with the “Volume & Fees” indicator, the graph shows data from the Curve protocol on the Ethereum network.

Deeper liquidity pools enhance stability and promote the acceptance of the protocol. The primary objective for decentralized exchanges (DEXs) is to increase their trading volume and the TVL to the protocol. Future advancements of the protocol should concentrate solely on this end goal. Reducing barriers for users participating in both the functions of the protocol is a crucial aspect to consider.

As explained, the Volume & Fees indicator shows a sharp drop in the liquidity provided to the protocol during the months of November, correlated to the FTX collapse. During times of uncertainty, LPs have, in the past, rushed to safeguard their assets by withdrawing their positions.

DEX on-chain analytics and impermanent loss: explaining its simulation

Offering liquidity in DeFi can be incredibly beneficial. However, it is crucial to consider other potential risks, such as impermanent loss. This occurs when a pool has to adjust its assets to maintain equal value between the paired tokens. It results in the loss of tokens for the LP if the value of one of the tokens changes in relation to the other. This is a common issue faced by pools that require a 50-50 balance between the pairs.

On-chain ROI calculators, like the one shown below, offer an easy method to estimate impermanent loss/ROI based on the on-chain situation. These calculators help to track the impermanent loss based on your liquidity provided.

The indicator you see above calculates and compares the return on investment (ROI) based on your input amount. It simulates the scenario of LPing the tokens as opposed to simply holding them (hodl). It presents the different outcomes of these two options as its output. In this case, we are tracking the Uniswap V2 ETH-USDC pool going back to Sept. 10, 2022.

By examining the USDC-ETH pool, we can observe the returns generated for liquidity providers. For instance, if an LP deposited $1,00, divided equally between ETH and USDC, into the pool on Sept. 26, 2022, it would have resulted in a -4.79% return.

On the other hand, holding these two assets individually would have produced a -7.05% return. Hence, in this scenario, taking into account the significant market turbulence during the last months of 2022, it would have been advantageous for the LP to provide liquidity to this pool, resulting in a higher relative return.

Improve your use of DeFi and DEXs with on-chain analysis

DEXs continually innovate and enhance their services for users. As DeFi and DEXs continue to evolve and provide the best user experience while maintaining their unique characteristics, we can expect to see a migration of users and increased adoption of this new technology.

DeFi is a developing system that holds great promise. Its increasing Total Value Locked now plays a significant role in the cryptocurrency industry. At present, there are ample opportunities to participate in the market and earn returns on your assets. However, it is essential to be mindful of the potential risks associated with DeFi, such as high gas fees or impermanent loss for liquidity providers on decentralized exchanges.

It’s crucial to be aware of these trends and user migrations. Keeping a close eye on the ecosystem can also be beneficial in identifying opportunities to participate in the market and earn returns on your assets.

Frequently asked questions

What are some of the top DEXs on the Ethereum network?

Who creates the trading pools on DEXs?

How are the fees structures on DEXs for LPs?

What other factors besides high volume in pools should LPs take into account?

About the author

Pedro Negron is currently a junior research analyst at IntoTheBlock, where he is directly involved with analysis of the most recent developments in crypto. He examines crypto from a data-centric perspective researching major sectors such as DeFi’s major protocols. Other areas of interest include Bitcoin and NFTs, which are analyzed from a data-driven standpoint.