Decentralized Physical Infrastructure Networks (DePINs) are one of the latest innovations in the blockchain space. They combine distributed ledgers, token incentives, and physical infrastructure. This DePIN guide covers how these networks function and what they offer. We also list some of the top DePIN projects in 2026.

KEY TAKEAWAYS

➤ DePINs utilize blockchain and token rewards to build real-world physical infrastructure.

➤ Some of the top DePIN projects in 2026 include Filecoin, Render Network, and The Graph.

➤ With DePIN, the ownership of physical infrastructure is decentralized and authority is distributed among network stakeholders. This represents an alternative model to corporate and government ownership.

What is DePIN?

Decentralized Physical Infrastructure Networks (DePINs) are decentralized networks that leverage blockchain and token incentives to build and maintain physical infrastructure.

Think of a physical infrastructure setup, such as an electricity grid or waste management. Such large-scale projects require a significant amount of capital. For this reason, governments and large companies have traditionally been in charge of managing such resources.

DePINs are now changing this approach by allowing for the decentralization of these networks. The concept of DePINs traces back to the early days of blockchain technology.

Pioneer projects, like Power Ledger and OpenBazaar, introduced blockchain to energy distribution and e-commerce, paving the way for other DePIN initiatives.

How do DePINs work?

DePINs typically operate using blockchain, the Internet of Things (IoT), token incentives, and smart contracts.

Blockchain architecture makes it possible to decentralize the ownership and control of physical infrastructure. Another core element of DePINs is crypto rewards. The peer-to-peer (P2P) networks use crypto tokens to incentivize participants who maintain the infrastructure.

Providers receive tokens as rewards so they can keep providing services in the real world. The entire process is automated through the use of smart contracts, which allow for hardware interconnectivity, execute complex transactions, and manage the rewards.

DePINs can be categorized into two main types based on how they operate.

- Physical Resource Networks deal with physical and tangible resources and focus on optimizing the flow of these resources through processes like supply chain management.

- Conversely, Digital Resource Networks focus on digital resources and create the back-end cloud for suppliers in industries such as computing, bandwidth, and storage.

DePINs are a clear web3 use case, leveraging different technologies to connect service providers to end users. These protocols ensure the decentralization of infrastructure, making these services cheaper and faster.

“DePINs represent a significant advancement in the blockchain industry by demonstrating the technology’s real-world applicability. They offer innovative solutions that enhance efficiency, reduce costs, and empower individuals and communities to participate in and benefit from decentralized networks. As the technology continues to evolve, more sectors are likely to adopt DePIN models, driving further growth and transformation.”

Wilfred Daye, CEO at Samara Alpha Management: BeInCrypto

The DePIN Flywheel

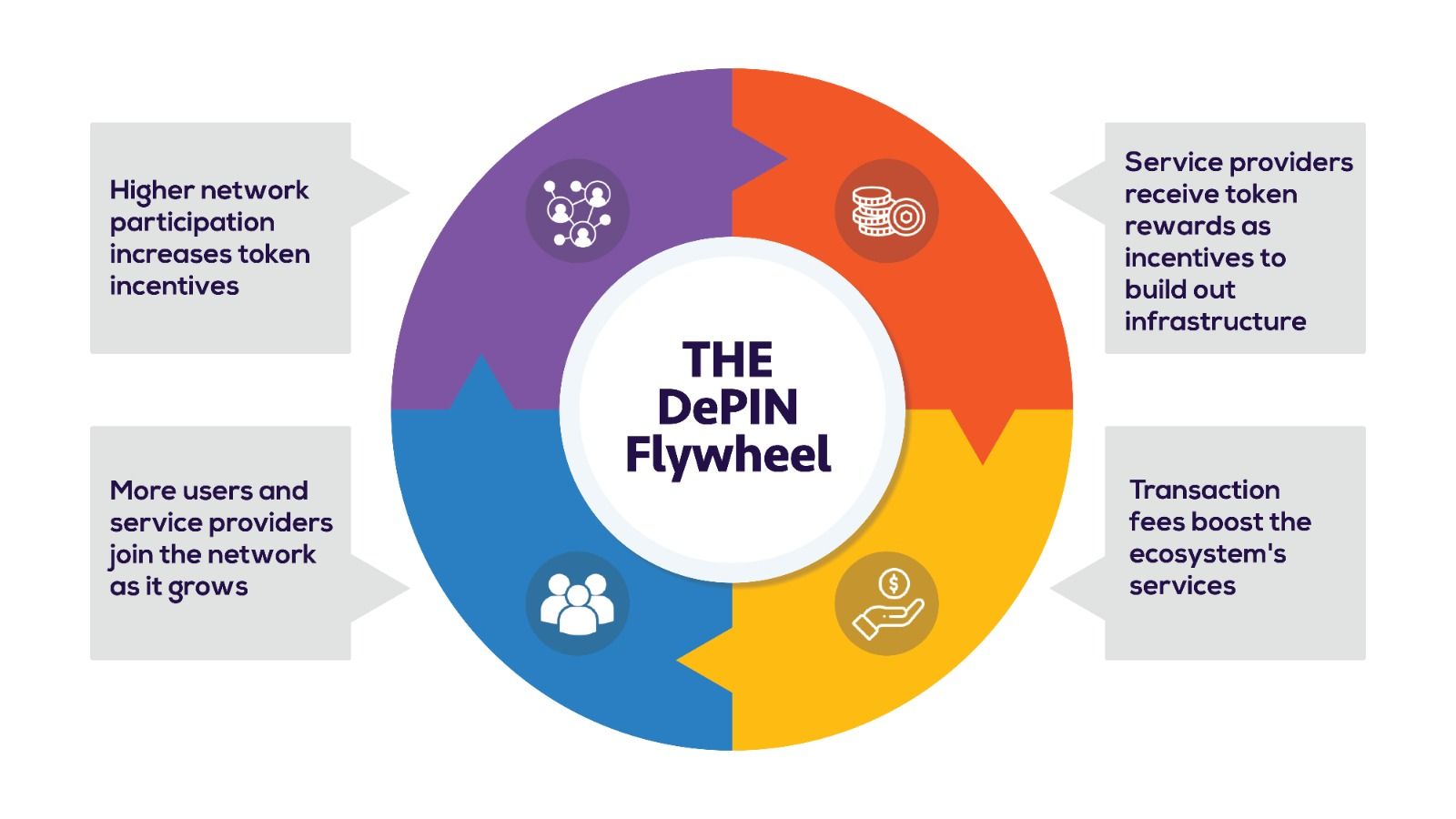

The DePIN Flywheel shows how DePINs work to incentivize users to build out physical infrastructure that others need without the high upfront costs that would be traditionally required.

The cryptocurrency rewards incentivize service providers to join the network. These providers then earn tokens by offering their services to other users.

DePIN key features

Decentralized Physical Infrastructure Networks rely on four key principles to build and maintain infrastructure ecosystems: blockchain technology, tokenization, smart contracts, and decentralization. Here’s a more detailed look at the role of each.

Blockchain

Blockchain is the cornerstone of Decentralized Physical Infrastructure Networks. It maintains a public ledger of all transactions in the ecosystem and timestamps on them. The technology also handles payments and escrow contracts between the service providers and end users.

The transparency offered by blockchain technology makes it easier to build and maintain infrastructure networks in a decentralized and permissionless P2P environment.

Tokenization

DePINs incentivize service providers by paying out rewards. The networks use DePIN tokenomics to encourage participation in the infrastructure networks. The tokens received give access to network resources.

More participation in the networks could potentially increase the token’s value, ensuring its stability and that of the ecosystem.

Smart contracts

Smart contracts streamline network operations in the DePINs by automating processes. The self-executing protocols ensure network efficiency and optimize resource allocation.

Smart contracts reduce dependency on middlemen, ultimately making access to the infrastructure cheaper and more convenient.

Decentralization

DePINs distribute authority among network stakeholders, creating a P2P ecosystem. They eliminate large corporations and governments that would withhold control of the resources. In so doing, DePIN networks help make infrastructure resources more accessible as there are fewer entry barriers.

Major DePIN projects

Now that we have covered how DePINs work let’s examine three leading DePIN projects available in 2026.

Filecoin

Filecoin is one of the pioneering DePIN projects, having launched in 2014. The P2P network allows for decentralized data storage, making it easier for network participants to monetize, store, retrieve, and compute data.

Users with excess data storage can use Filecoin to trade space for a fee with other users who need it. They then receive the network’s native token, FIL, as payment.

Render Network

Render Network is a P2P GPU network that connects users looking for GPU computing services, like 3D rendering and machine language training in web3 and web5 systems.

GPU service providers contribute their used GPU and receive RENDER/RNDR tokens in return. They need to build their reputation on the platform over time, which in turn increases their job volumes. The platform also gives users reputation scores to weed out malicious participants.

Although Render was initially launched on the Ethereum blockchain, the network migrated to Solana in November 2023. It is the fourth largest DePIN project by market capitalization as of late October 2024.

The Graph

The final DePIN project on our list is The Graph, which launched in 2020. The decentralized indexing project allows users to retrieve and read complex blockchain data easily.

Developers can access on-chain data to a registry of several supported networks, including Ethereum. This data is especially useful when building DApps. They then use GRT tokens to pay the service providers on the platform.

Benefits of DePIN

Here are some of the advantages that DePINs bring about.

- Enhance the accessibility of resources

- Provide a decentralized marketplace with no single point of failure

- Because resources are crowdsourced, the services are affordable and fairly priced

- Underlying blockchain technology ensures transparency in the ecosystem

- DePINs are borderless and permissionless, allowing for expansion without government intervention.

Challenges and limitations of DePIN

Despite their advantages, DePINs also present certain challenges and limitations. These include:

- Security concerns as the smart contracts are susceptible to bugs and hacks

- Token price volatility can affect the ecosystem

- Requiring technical expertise to set up

Do DePINs have a future?

Decentralized Physical Infrastructure Networks are revolutionary and bridge physical infrastructure and web3. These networks combine various technologies, such as blockchain and IoT, to provide decentralized access to tangible and vital resources. They make it easier to build and manage resources that would otherwise be under a centralized authority.

Despite the advantages, DePINs have several hurdles to overcome before achieving widespread adoption. It remains to be seen how these networks could evolve, as the technology is still under development. However, the growth of the leading DePIN projects in 2026 is an encouraging sign for the technology and its real-world use cases moving forward.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in DePIN projects comes with risk. Profits are never guaranteed.