Blockchain’s rise has sparked a debate between CeFi vs. DeFi. CeFi connects crypto to traditional finance, while DeFi uses transparent smart contracts to remove intermediaries. Understanding the pros and cons of each is important for anyone interested in crypto in 2025. Here’s what to know.

KEY TAKEAWAYS

• DeFi operates with transparency through decentralized, public smart contracts but is vulnerable to smart contract exploits.

• CeFi platforms are regulated, offering user-friendly experiences similar to traditional banking, but require KYC procedures. DeFi, while more open and permissionless, remains largely unregulated.

• In 2025, CeDeFi models, which combine the strengths of both CeFi and DeFi, are gaining traction.

What is decentralized finance (DeFi)?

Ethereum defines DeFi as:

“an open and global financial system built for the internet age — an alternative to a system that’s opaque, tightly controlled, and held together by decades-old infrastructure and processes.”

Decentralized finance reflects a shift from traditional finance (TradFi) to direct transactions powered by public computer code. Essentially, it’s a way of handling financial assets without banks, using blockchain technology to manage financial transactions.

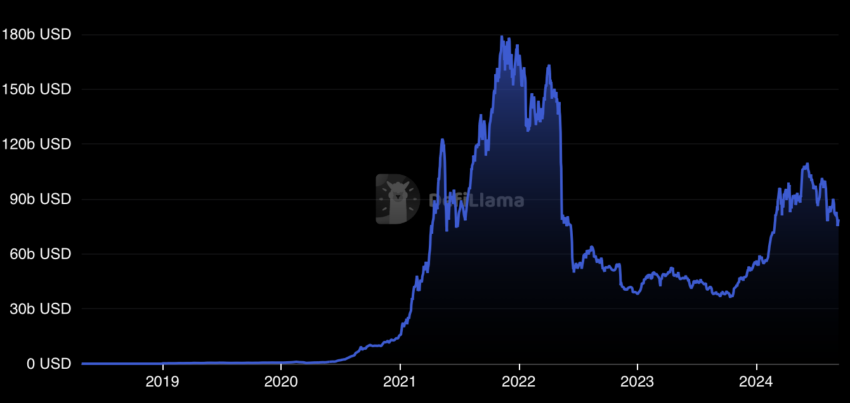

DeFi also supports a vast assortment of blockchain-based applications. Between 2020 and 2021, total value locked (TVL) in DApps increased 14-fold, reaching $303.8 billion in December 2021.

In 2024, data shows TVL fluctuating, with approximately $50-$70 billion locked in DeFi protocols, reflecting market volatility and shifting investor sentiment.

Advantages of DeFi

DeFi’s transparency and interoperability are superior to TradFi. In this environment, financial products are owned by the community without top-down control. With its contractual efficiency, shared infrastructure, and public nature, a DeFi protocol can foster financial inclusion.

Autonomy and self-custody

Peer-to-peer interactions are based on immutable smart contracts — computer programs that automate agreements between people or entities. Thus, independent of any government or institution, they eliminate the need for a central authority and data storage. Users of web3 wallets like MetaMask maintain full custody of their assets and control of their personal information.

Accessibility

DeFi platforms accept users from anywhere in the world, with a few exceptions (dYdX blocks U.S. customers from particular features). Thanks to permissionless blockchains like Ethereum, anyone with an internet connection can use DeFi without KYC checks.

Low fees and attractive interest rates

DeFi protocols do not engage intermediaries like banks or credit card networks, which charge fees. Two parties can negotiate interest rates directly. For example, peer-to-peer lending provides cost advantages to borrowers and higher returns to lenders compared to bank rates.

Security and transparency

Records of completed blockchain transactions are public and immutable. New data is documented after verification of authenticity without revealing user identities. In the future, these mechanisms could improve due diligence and scam detection. In addition, as DeFi protocols on Ethereum use open-source code, anyone can view, audit, and build upon them.

Disadvantages of DeFi

For DeFi to reach its full potential, the industry must address the inherent challenges of decentralization. While the concept of smart contracts appeared in 1997, it did not enter mainstream engineering until 2014, when the Ethereum whitepaper came out. Recent hacks of Axie Infinity and Poly Network show that this form of programming is still fragile.

Smart contract risk

Cybercriminals may use a logical error in the code (software bug) or an economic exploit. Here is one of the hypothetical scenarios mentioned in DeFi and the Future of Finance by Campbell R. Harvey, Ashwin Ramachandran, and Joey Santoro.

A smart contract is designed to escrow specific deposits and transfer the total balance to a lottery winner. Due to a bug, the internal number, which tracks the amount of tokens held, exceeds the actual balance, and transfer execution fails. Furthermore, in the absence of a failsafe mechanism, the tokens are locked within the protocol and may not be recovered.

Did you know? In October 2021, an 18-year-old graduate student manipulated the Indexed Finance crypto fund into undervaluing users’ tokens. The hacker then purchased the tokens at a deep discount in a trade that cost the platform $16 million.

Governance

This risk is unique to DeFi, as some protocols rely on human-controlled risk management. For example, holders of MakerDAO’s MKR token vote on changes to protocol parameters. In theory, acquiring the majority of all governance tokens could give control over the protocol and its funds.

Fact check:

In March 2021, this happened with the DAO minting True Seigniorage Dollar ($TSD). The perpetrator gradually acquired a 33% stake, proposed a malicious change, voted for it, minted 11.5 quintillion $TSD, and sold them on PancakeSwap.

In October 2022, a hacker stole $100 million from Mango Markets using an Oracle price exploit. Shortly afterward, they used looted governance tokens to manipulate the Mango DAO into accepting their own solution for returning the stolen funds.

Oracle risk

DeFi protocols use oracles to access off-chain data — transactions beyond the native blockchain. Many routine operations require data feeds with reliable asset prices. These oracles may involve token owners, APIs, or application-specific services.

On-chain oracles are vulnerable to front-running — exploiting prior access to information about future transactions. Meanwhile, oracle services are susceptible to outages. For example, in 2020, liquidation prices on Maker collapsed, and some liquidators received free ETH due to network congestion and Dai illiquidity.

Scalability

DeFi’s ability to provide financial inclusion depends on the scalability of host blockchains. For instance, Ethereum is notorious for low speeds and high fees during periods of network congestion.

On Sep. 15,2022 it abandoned energy-intensive mining, which should facilitate further scalability upgrades. An alternative solution is using layer 2 networks built on top of Ethereum, such as Polkadot and Polygon.

No Regulation

Despite DeFi’s exponential growth, there is still no legal framework for it. Even the developers behind some protocols are anonymous or pseudonymous. DeFi users must take full responsibility for their crypto assets, do their own research, and take precautions to stay safe.

Taxation is one of the gray areas — the IRS has not addressed DeFi as a subset of crypto services, while the HMRC has only issued general guidance. Yet, as regulators recognize the risks, regulation appears inevitable.

In a landmark case in August 2022, the U.S. Treasury Department’s Office of Foreign Assets Control imposed sanctions on Tornado Cash, a DeFi crypto mixer that had processed transactions for illicit actors.

What is centralized finance (CeFi)?

CeFi fuses familiar financial services and products with blockchain technology. It provides faster, cheaper, and more secure transactions than TradFi through exchanges, wallets, crypto lending, and other options.

A central exchange has a central point of control — a single entity with formal leadership. At the same time, these platforms use distributed ledger technology and, like decentralized exchanges, provide asset management, crypto lending, margin trading, spot trading, and savings accounts. Transactions are secure, transparent, and immutable, and CeFi users only need an internet-connected device.

Advantages of CeFi

The advent of CeFi was driven by the need for trustworthy and user-friendly services. Users benefit from faster transactions at a lower cost compared to TradFi and interact with a legal entity subject to regulatory oversight.

Familiar user experience with support

Popular CeFi platforms resemble conventional finance apps, with a convenient interface allowing intuitive navigation. In comparison, DeFi services like yield farming are complicated for beginners, and there is no customer support or supervisory body to report to in case of a hack or malfunction.

Did you know? The CeFi experience is similar to banking — a user can reach out to the team by email, live chat, or phone. A centralized exchange (CEX) must provide timely assistance to boost trust and user confidence. Not only are CEXs responsible for users’ funds, but they also educate them on the best practices and new use cases.

Fiat-to-crypto

Unlike DeFi, centralized platforms are integrated with TradFi institutions to offer fiat-to-crypto transactions. Buying or selling crypto for fiat currency outside of CeFi is possible, but it involves complicated OTC mechanisms.

Crypto-to-fiat on-ramps simplify onboarding and convenience. Users can transfer fiat and get crypto on their centralized exchange. Similarly, they may convert their holdings back to fiat and withdraw the funds to a bank account.

Wider coin choice

The support of multiple blockchains underlies more diverse asset selections. Popular CEXs offer coins with a substantial market caps, most of which exist on independent blockchains, such as Bitcoin and Ethereum.

Regulatory compliance

Well-established CEXs are licensed business entities with formal leadership and strict internal procedures. They comply with applicable regulations in their jurisdiction, including KYC, AML, user protection, and investor protection requirements. CeFi businesses are also liable for losses due to hacks or other malfeasance.

Did you know? CeFi platforms licensed as financial institutions in Estonia follow clear-cut procedures for account transfers, execution of court decisions, and inheritance that were adopted from TradFi regulations. Users’ funds and data are safeguarded in accordance with local legislation.

Custodial solutions

Reputable CeFi businesses maintain high asset protection standards, including internal risk monitoring systems and proven custody solutions. Thus, a user does not need to worry about managing their seed phrase and private key. Multiple layers of security, including two-factor authentication, prevent unauthorized access to popular CeFi platforms.

For example, access recovery often requires a liveness face check or other forms of biometric verification. Sensitive actions like password change may trigger alerts and a temporary withdrawal hold.

Disadvantages of CeFi

Although CeFi dominates the industry of crypto services thanks to convenience, security, and costs, it is not everyone’s cup of tea. Depending on the platform, users may find the range of assets limited or question the company’s internal practices.

No autonomy over one’s funds

Users of CeFi services rely on third parties for execution, security, and custody — hence the “Not your keys, not your crypto!” adage. While DeFi hacks accounted for the largest share of crypto stolen in 2021, centralized platforms may also have security breaches. In addition, as CEXs do not rely on smart contracts, it is easier for them to slash trading or withdrawal limits — for example, during market turmoil.

Another concern is insider threats. Limiting access to sensitive information is not enough — CEXs must implement additional safeguards, such as multi-signature and restrictions on multiple transaction parameters.

Transaction costs and trading options

As CeFi businesses are legal entities and connect to conventional payment channels (credit cards, Apple Pay, etc.), they still involve a middleman for some operations. As a result, the handling fees may exceed the costs of similar services in DeFi.

Furthermore, each platform supports a specific range of assets, so its services are limited to those particular tokens or coins. While the biggest CEX, Binance, supports 500+ cryptocurrencies, smaller platforms may feature a few dozen. As a result, users have to open additional wallets to diversify their portfolios beyond the available range.

Regulatory requirements

Due to regulatory compliance, CeFi platforms have KYC procedures. Privacy-conscious users may not feel comfortable sharing their personal information with an entity, even a regulated one.

Did you know? There has been a dramatic increase in security breaches targeting CeFi platforms in 2024. Specifically, access control incidents in centralized exchanges rose by 35%, while smart contract vulnerabilities in DeFi decreased by 83%. This shift indicates a growing focus of attackers on centralized systems, especially after high-profile hacks like the $305 million breach of DMM Bitcoin in May 2024.

Secondly, contrary to DeFi’s democratization, CEXs operate in specific jurisdictions. Thus, they are inaccessible to specific groups of users, including the unbanked. Around 1 billion people worldwide have no legally-recognized identity.

Transparency of practices

Transactions happening within a CeFi exchange are not recorded on a blockchain. Some companies do not disclose their trading mechanisms, price formation principles, or yield generation models. In comparison, all DeFi transactions on public blockchains are visible to everyone.

A platform’s leadership may pursue policies that put users’ funds at risk. For example, Celsius failed to maintain sufficient collateral after diversifying its holdings in DeFi to earn yield.

Single point of failure

CeFi’s higher liquidity attracts hackers. At the dawn of CeFi, exchanges like Mt. Gox, Poloniex, and Kraken saw catastrophic hacks of users’ funds. Today, popular CeFi platforms have multi-layer defense, and DeFi is the main target for exploits. However, CeFi platforms still rely on centralized databases, which makes them vulnerable.

DeFi vs. CeFi: Major differences

While CEXs have centralized management, DeFi fully relies on smart contract technology. Both systems pursue the same goal — driving the crypto industry forward — using different methods.

CeFi builds trust through regulation, compliance, and multi-layer security. Fiat-to-crypto conversions appeal to investors holding conventional currency, and cross-chain trading enhances flexibility. Customer support is at users’ fingertips, while KYC and AML compliance combined with blockchain analytics help CeFi businesses prevent illicit activities.

As DeFi services are decentralized, any changes to their features require approval at the smart contract level. Smart contracts are automatic, immutable, and transparent, with all transaction data recorded in a public ledger.

Although DEXs do not have customer support, they do not hold users’ private keys, giving you full autonomy over your funds and personal information.

| CeFi | DeFi | |

| KYC | Yes (most times) | No |

| Custodian | Yes | No |

| Fiat-to-crypto | Yes | No |

| Cross-chain interoperability | Yes | No |

| Customer support | Depends on the jurisdiction | No |

| Regulation | Require changes at the smart contract level | Being developed |

| Withdrawal limits / Trade limits | Yes, depends on the jurisdiction | No |

| Central database | Yes | No |

| Changes of rules/features | Decided by management | Require changes at smart contract level |

CeFi vs. DeFi: The verdict

Centralized and decentralized finance are the two main facets of the crypto industry. CeFi, which powered the first crypto exchanges, has come a long way in recent years. There are clear pros and cons to centralization. Meanwhile, the future of DeFi largely depends on its ability to address the vulnerabilities of smart contract programming.

Overall, users who are new to crypto often

Frequently asked questions

Is CeFi safer than DeFi?

What does CeFi mean?

Is Bitcoin CeFi or DeFi?

What is a CeFi platform?

How does DeFi differ from centralized finance?

Is Coinbase a CeFi?

About the author

Anna Guseva, a leading writer on the CoinLoan team, has been creating news and research articles for the company since 2021. She is a content writer, editor, and course creator with prior experience in journalism, finance, and the oil industry in Eastern Europe. Before her involvement with CoinLoan, Anna helped dozens of brands and other crypto businesses build a strong online presence through high-quality research. Anna combines extensive knowledge of conventional banking and behavioral economics with a passion for cryptocurrencies and the written word. Her diverse background, insider understanding of CeFi, and curiosity for other dimensions of the crypto economy help her keep an open mind and maintain a focus on objectivity.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.