In an era where modern conveniences are often taken for granted, it’s hard to imagine life before the advent of innovative financial tools such as payment apps. Services like Cash App have revolutionized our financial interactions and perceptions. Explore the transformative impact of this platform in our comprehensive Cash App review.

- Cash App at a glance: Our overall rating

- What is Cash App?

- What can I trade on Cash App?

- Where is Cash App available?

- How to sign up for Cash App in December 2023

- Welcome offer/bonus

- Deposit and withdrawals

- How does Cash App compare to others?

- Features and tools from Cash App

- Customer support

- How we have tested Cash App

- Regulatory compliance and safety

- Invest responsibly

- Cash App review: 21st-century finance

- Frequently asked questions

Cash App at a glance: Our overall rating

| Criteria | Assets | Fees | Customer support | Features | Availability |

|---|---|---|---|---|---|

| Score | 5/5 | 5/5 | 3/5 | 4/5 | 3/5 |

Overall, Cash App is a great app with real-world utility. However, it is only available to a limited market, geographically, and its customer support.

What is Cash App?

Cash App is a mobile payment service owned by Block Inc. (formerly known as Square, Inc.), originally founded by Jack Dorsey, the former CEO of Twitter.

The service, Cash App, was created by the recently deceased, Bob Lee, an American businessman and software engineer. He served as MobileCoin’s chief product officer and Square’s chief technology officer.

Cash App can transmit money by leveraging the existing banking infrastructure. When you initiate a transaction, Cash App communicates with your linked bank account or debit card to move the funds from your account to the recipient’s account.

In other words, it acts as an intermediary to facilitate the transfer securely and quickly. It’s important to note that during this process, Cash App employs security measures such as encryption and authentication to protect user data and financial transactions.

Additionally, the speed of the transaction can vary depending on factors like the user’s banking provider, network connectivity, and recipient verification process. Cash App acts as an intermediary that streamlines and simplifies the transaction. Its design makes it an attractive option for anyone seeking a hassle-free way to handle financial transactions, whether you need to split a restaurant bill with friends, reimburse a family member, or pay for services.

What can I trade on Cash App?

Cash App distinguishes itself with its cryptocurrency trading feature, allowing users to invest in Bitcoin directly within the app. This convenient feature empowers users to explore the world of digital assets and potentially grow their investment portfolios.

Crypto trading on Cash App

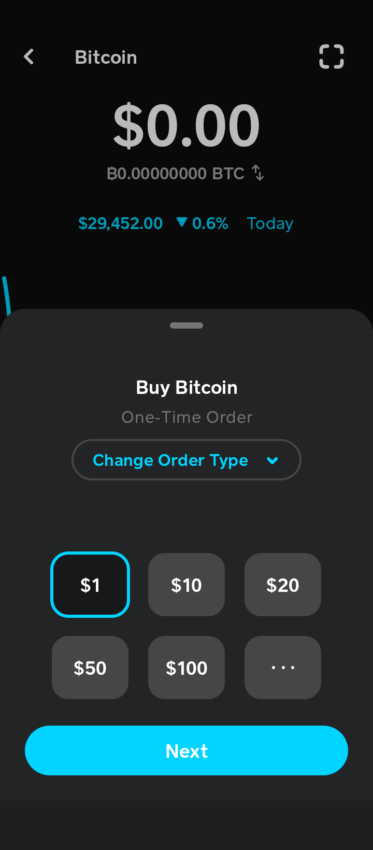

Cash App simplifies cryptocurrency trading, offering a hassle-free experience for users. To start, you can buy bitcoin directly from your Cash App account.

This streamlined process eliminates the need for navigating complex cryptocurrency exchanges, making it an excellent choice for beginners and experienced traders alike.

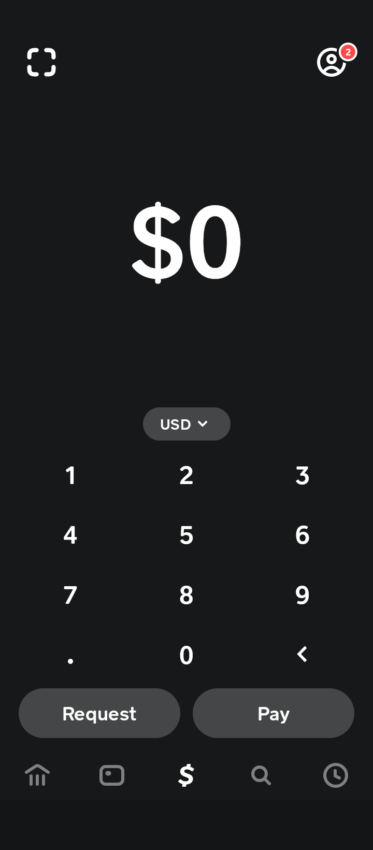

As you can see below, upon entering the app the design is very simple and easy for users to navigate. This simple design makes it easy for new users to gain exposure to the cryptocurrency landscape without the complexities that most are accustomed to.

As opposed to centralized exchanges with MT4 and MT5 software, advanced signals and indicators, and real-time, incoming buy and sell orders, Cash App gives you one chart and the current price — and that’s it.

Moreover, Cash App only supports bitcoin. On the bright side, you can send your BTC to third-party exchanges or personal wallets with ease. You can also also get paid in bitcoin via direct deposit.

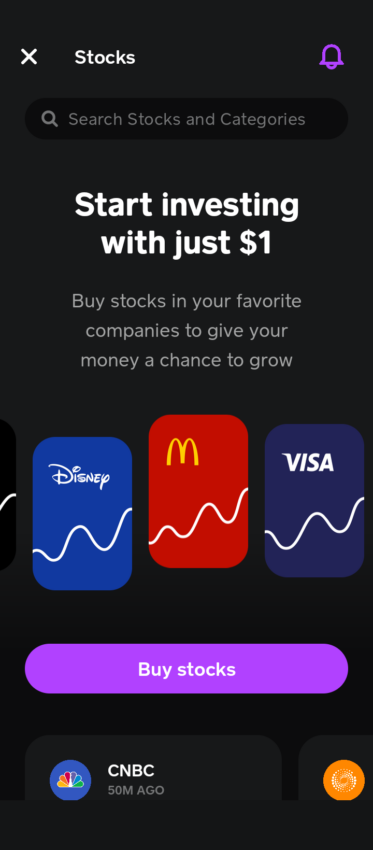

Stock trading on Cash App

Since its inception, Cash App has expanded its services to allow users to buy and sell stocks meeting specific criteria. Some of these criteria include:

- Traded on NASDAQ/NYSE

- Having a market capitalization above $300 million

- A 60-day average trade volume above 500,000

- A 52-week low price above $5 per share

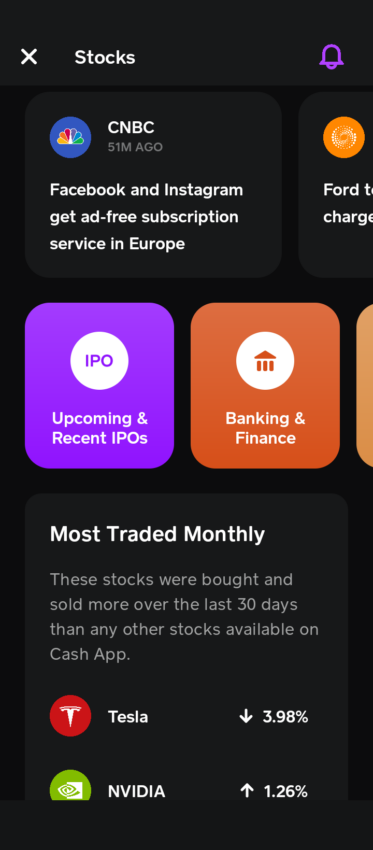

The platform provides access to a wide range of supported stocks and ETFs, enabling users to manage their portfolio view monthly statements and trade confirmations, and view corporate actions such as upcoming IPOs and other information.

Users can open an investing account by making their first purchase through Cash App. It’s important to note that trading stocks via Cash App Investing may have personal tax implications.

Cash App Investing offers a variety of order types to facilitate stock trading. The “Standard Order” is a straightforward option placed during regular market hours and executed as soon as possible.

Conversely, the “Scheduled” (after-hours order) functions similarly but is executed when the market reopens on the next trading day.

For users seeking more control, “Custom Orders” enable the selection of a specific share price that triggers a Standard Order for buying or selling stock, providing flexibility in trade management.

“Auto Invest” allows scheduled Standard Orders to occur at daily, weekly, or bi-weekly intervals, allowing users to dollar cost average (DCA) as they see fit.

Where is Cash App available?

As of December 2023, Cash App operates primarily in the United States and the United Kingdom. It may expand its availability to other regions in the future, but as of now, it is limited to these countries.

How to sign up for Cash App in December 2023

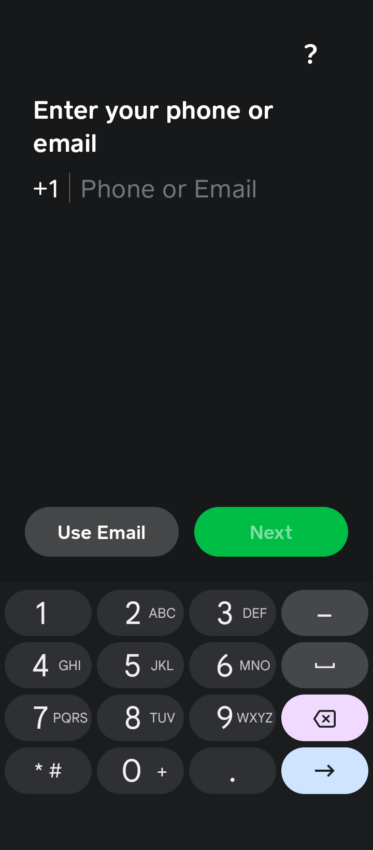

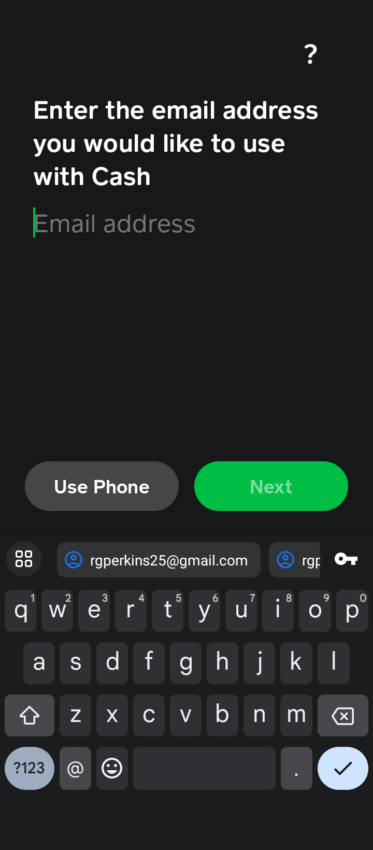

1. Firstly, download Cash App. Upon opening the app, you will witness the following screen. You will have to sign up using an email or phone number.

2. In this Cash App review sign-up guide, we will use the email to sign up. Additionally, you will receive a code to confirm your email.

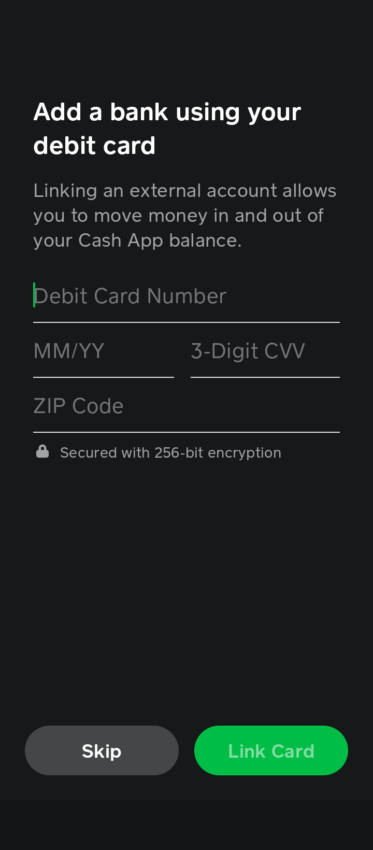

3. Thirdly, enter your bank account information.

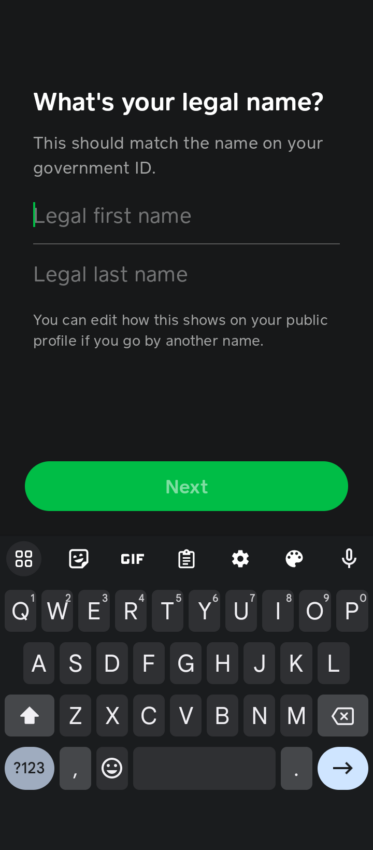

4. You will have to light KYC to continue. Simply enter your legal name.

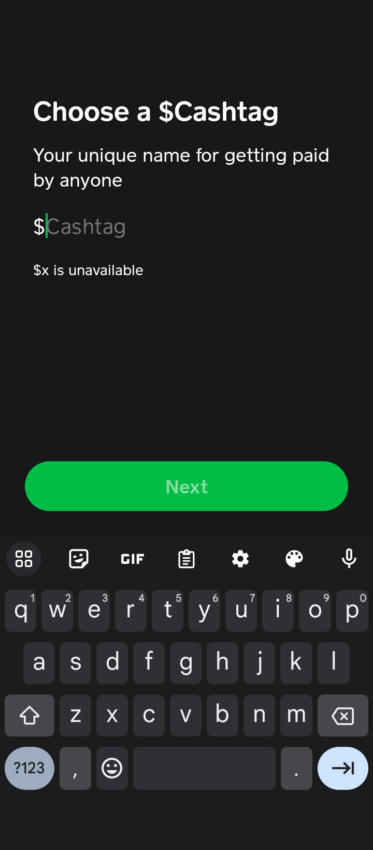

5. Lastly, choose a “$Cashtag.” This is a unique identifier that your friends and family will use to send you money.

6. After you have finished the previous steps, you will have completed your Cash App sign-up.

Welcome offer/bonus

To earn a bonus on Cash App, you can invite friends or family to join. When a friend signs up using your referral code and sends at least $5 or £5 from their newly created account with a linked debit card, both you and your friend receive a bonus.

Your referral code is a combination of numbers and letters found in your invitation link, which can be shared directly from the app or online.

Your friend has 14 days from the date they enter your referral code to verify their account and send a qualifying payment of at least £5 or $5 from a newly linked debit card. After 14 days, the referral bonus expires.

If you’ve been invited to Cash App, you must verify your account and enter the referral code provided by the person who referred you to receive your bonus. You can check the status of your referral by tapping “Reward Status” in the app.

Deposit and withdrawals

Cash App provides two deposit options: standard deposits to your bank account and Instant Deposits to your linked debit card. Standard deposits are free and typically take 1-3 business days to arrive.

On the other hand, instant deposits offer immediate access but come with a fee ranging from 0.5% to 1.75%, with a minimum fee of $0.25.

Cash App refers to withdrawals as “Cash Out.” When you Cash Out to your bank account from your Cash App, these transactions will be indicated on your bank statement with the prefix “Cash App.”

If you’ve moved your Cash App balance to a linked account, you can monitor the status of these transactions in your activity feed.

Payment methods accepted by Cash App

There are multiple ways to add funds to your Cash App balance. Firstly, you can use accepted payments from other Cash App users to fund your account.

You can also link your bank account for easy transfers, use a linked debit card for instant access, or link a credit card (with a 3% fee) for added convenience. Using your Cash Balance, you can transfer free stock and bitcoin to friends and family.

Cash App accepts debit and credit cards from Visa, MasterCard, American Express, and Discover. If you prefer to deposit paper money, Cash App allows this option at participating retailers.

However, please note that Cash App charges a flat-rate $1 processing fee for each paper money deposit, which is automatically deducted from the deposited funds.

You can make paper money deposits at select retailers, including Walmart (Customer Service Desk/Money Centers), Walgreens, and Duane Reade.

How does Cash App compare to others?

| Platforms | Assets | Funding | Support | Fees (sending) | Platform type |

|---|---|---|---|---|---|

| Cash App | USD, bitcoin, and stocks | Bank account, debit/credit cards, and cash | U.S. and U.K. | Mostly free (3% using credit card) | Mobile payment service |

| Paypal | USD, PYUSD, BTC, ETH, LTC, and BCH | Bank account, debit/credit cards | 200+ countries | Mostly free (except for conversions, 4.5% ) | Online payment service |

| Venmo | USD, PYUSD, BTC, ETH, LTC, and BCH | Bank account, debit/credit cards | U.S. | Mostly free (3% using credit card) | Peer-to-peer payment app |

| Zelle | USD | Bank account | U.S. | Free for users | Payment routing app |

Cash App

Cash App primarily sends money through its mobile app, making it easy for users to send and receive money directly from their linked bank accounts or debit/credit cards. Users can also send funds from their Cash App balance.

Cash App offers the option for instant transfers with a fee, allowing users to send money quickly. Standard transfers may take between one and three business days.

PayPal

PayPal operates as an online payment platform. Users can send money using the recipient’s email address or mobile number. The platform also offers in-person payment options and business solutions.

PayPal offers quick transfers, but the speed can vary depending on the funding source and recipient’s account setup. It may take time for recipients to transfer PayPal funds to their bank accounts.

Venmo

Venmo is a peer-to-peer payment app designed for casual and social payments. Users link their bank accounts or cards to Venmo and send money to friends using the recipient’s username, email, or phone number.

Transactions on Venmo are typically quick and can happen instantly within the app. However, transferring Venmo balance to a bank account may take time.

Zelle

Zelle operates primarily as a payment routing app for bank-to-bank transfers. Users send money by linking their bank accounts and using the recipient’s email or mobile number.

Zelle transactions are usually swift, with the funds typically arriving within minutes to the recipient’s bank account. It’s designed for bank transfers rather than maintaining a balance within the app.

Features and tools from Cash App

Cash App Pay

Cash App Pay allows Cash App customers to make payments to Square Sellers and select third-party merchants by simply scanning a QR code. It offers the convenience of using the customer’s stored balance or their linked debit card for quick and versatile transactions.

Cash Card

“We see the launch and advertising of new Cash App features as an important way to attract new customers. Features such as Cash Card… enhance Cash App’s utility for customers and provide reasons for individuals to try Cash App.”

An excerpt from Cash App’s annual report

The Cash Card is a free, customizable debit card linked to your Cash App balance. It can be used anywhere Visa is accepted, both online and in physical stores. However, there is a $2.50 charge for ATM withdrawals.

The Cash Card operates independently of your personal debit card or bank account, and it even supports digital wallet payments through Google Pay or Apple Pay for in-store purchases.

Tax filing (formerly Credit Karma Tax)

Cash App offers easy, accurate, and completely free tax filing through Cash App Taxes (formerly Credit Karma Tax). This feature includes a Max Refund Guarantee, free Audit Defense, and more, simplifying the tax filing process for users.

Savings account

With the Cash App Savings account, users can set up automatic payments and savings without the need for minimum balances or opening new accounts. It provides a fee-free way to save and manage finances efficiently.

Crypto trading

Cash App offers cryptocurrency trading, allowing users to buy, sell, and hold cryptocurrencies like Bitcoin. It provides a straightforward platform for cryptocurrency enthusiasts to invest and manage their digital assets.

Stock trading

Cash App Investing allows users to invest in stocks and exchange-traded funds (ETFs) easily. Users can buy, sell, and hold shares in various publicly traded companies, making it accessible for individuals to participate in the stock market.

Cash App Offers

“Cash App Offers” offers cashback rewards and discounts on eligible purchases made with the Cash Card at participating merchants.

Direct deposit

Cash App provides users with a routing and account number, allowing them to set up direct deposits for paychecks, government benefits, and more. It offers a convenient way to receive funds directly into the Cash App balance.

Cash for Businesses

Cash for Business is a feature that enables individuals to manage their business finances separately from personal finances within the Cash App, facilitating expense tracking and financial management

Customer support

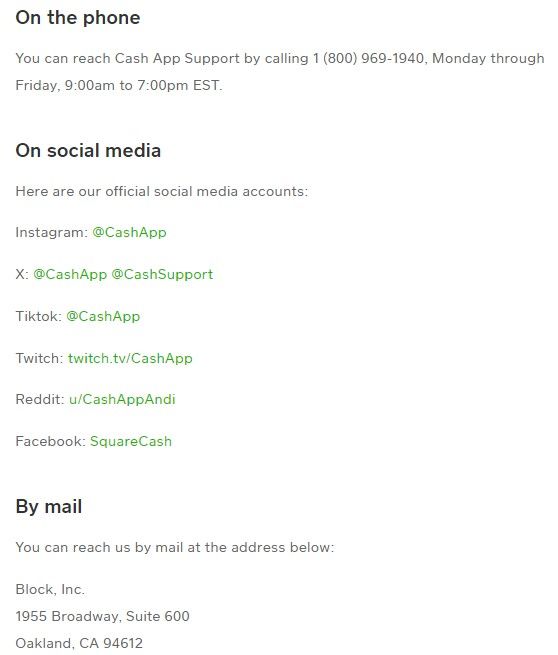

When it comes to Cash App’s customer support, you have a few options to consider. Firstly, your best bet is to use the Cash App help center. It covers some of the most frequent questions and concerns. However, if this does not resolve your issues, you can contact Cash App.

The image below shows all of the options you have to contact customer support. Your options range from mail and email to phone and social media.

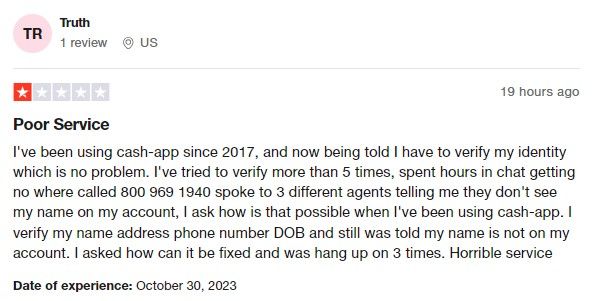

Although Cash App has a lot of resources for contact, the actual customer service is another story. Cash App’s customer service receives poor reviews, according to reviews on Trustpilot. Many of the concerns cite poor customer service, unresolved issues, and little or unreliable explanations. When we contacted Cash App on the phone with queries, however, we found the responses satisfactory, although the verification process is lengthy.

How we have tested Cash App

To provide you with an informative and comprehensive review of Cash App, we’ve conducted extensive firsthand testing and research. Our assessment is based on practical experience gained from using the platform for various financial activities. We used the services over several months and interacted with customer support.

In addition to using Cash App, we’ve researched Cash App’s parent company, Block, Inc. (formerly Square, Inc.), its subsidiaries, and its partnerships. This research enhances our understanding of the platform’s ecosystem and its offerings. Lastly, to ensure a comprehensive understanding of the fintech’s offerings, we have closely examined the platform’s official documentation and legal documents. This includes terms of service, privacy policies, and the app’s regulatory compliance.

Regulatory compliance and safety

Before we dive into Cash App’s regulatory compliance, let’s make a few distinctions. Firstly, Cash App is primarily a peer-to-peer mobile payment service. Cash App Investing LLC, on the other hand, is focused on investment services. It offers users the ability to invest in stocks and ETFs.

Cash App Investing LLC is a specialized arm of Cash App’s parent company, Block, Inc., that offers investment services, whereas Cash App primarily focuses on peer-to-peer payments and financial transactions. Cash App Investing LLC is a member of the Securities Investor Protection Corporation (SIPC), which protects securities held in your Cash App Investing account, up to a limit of $500,000.

Additionally, Cash App’s parent company, Block Inc., holds money transmitter or equivalent licenses in multiple states. The company enables the sale of Bitcoin to customers by acquiring it from various third-party sources.

It’s important to note that Cash App Investing LLC does not engage in the trading of virtual currency or offer related services. Lastly, Cash App states that the majority of the Bitcoin that is held is kept in cold storage.

Invest responsibly

Investing in financial markets involves inherent risks and uncertainties. The value of investments can fluctuate, and there are no guarantees of profit. It is crucial to approach investing with caution and responsibility.

By choosing to invest, you acknowledge and accept the inherent risks associated with investing and agree to invest responsibly, taking into account your financial circumstances and objectives.

Cash App review: 21st-century finance

All in all, the Cash App is a vital service that has brought finance and payments into the 21st century. It carves out a unique position and name for itself in the market with its distinctive offerings. This review acknowledges that Cash App is well-positioned for enduring success and will likely remain a staple in digital finance.

Frequently asked questions

Does Cash App have any fees?

Can Cash App be trusted?

What is Cash App used for?

Is Cash App regulated?

Why shouldn’t you use Cash App?

What is safer than Cash App?

What is the disadvantage of Cash App?

How do I withdraw money from Cash App?

Is Cash App a safe app?

What country is Cash App in?

What is the limit on Cash App?

Does Cash App have a withdrawal fee?

Can I store money in Cash App?

Can I transfer money from Cash App to my bank account?

Does Cash App require KYC?

Is Cash App a legit site?

Can you withdraw from Cash App?

Is Cash App the safest?

Which countries cannot use Cash App?

Does Cash App offer any special offers or bonuses?

Does Cash App have good customer support?

What is the minimum deposit on Cash App?

What are the withdrawal times on Cash App?

Does Cash App have a mobile app?

Does Cash App offer a demo account?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.