Pickle Pegging Hopes on Stablecoins

Pickle has the grand plan of bringing the four largest stablecoins USDT, DAI, USDC, and sUSD closer to their peg by using the power of farming and ‘pVaults’, which have just been rebranded to ‘pJars.’ The project was announced on Sept 11 and has accrued over $50 million in liquidity over the weekend. Pickle’s token liquidity pools are boasting what have become the typical four-figure returns for DeFi. The general idea is to offer greater rewards to below-peg stablecoin pools and fewer rewards to above-peg stablecoin pools. Capital movement between stablecoins is encouraged by distributing PICKLE tokens to Uniswap liquidity providers for stablecoin/Ethereum pools. Using the slogan ‘Off-peg bad, on-peg good,’ Pickle Finance is looking to incentivize users to sell stablecoins that are trading above their peg and buy ones that are below it. Stablecoins often trade above their pegs which provide good arbitrage opportunities for whales swapping large bags between them, however, this is of little benefit to the DeFi ecosystem as a whole as it exacerbates the problem. A stablecoin that isn’t stable is of little use to the rest of us. When a stablecoin is above peg, the protocol will distribute fewer PICKLE tokens to that particular pool and more to other pools. As yield farmers chase the best returns, this creates sell pressure for the overvalued stablecoin and buying pressure for the others. There is also a ‘Pickle Swap’ feature, which enables liquidity providers to change positions from one stablecoin pool to another in a single click. The native PICKLE token can be used for governance voting, but as with most other DeFi clones, it is likely that mostly just the whales exercise this privilege. Pickle Finance has taken this a step further though by introducing quadratic voting which lessens the control over heavy bag holders.

Ethereum co-founder Vitalik Buterin questioned the safeguards, if any, that are in place to prevent abuse of the system;

The native PICKLE token can be used for governance voting, but as with most other DeFi clones, it is likely that mostly just the whales exercise this privilege. Pickle Finance has taken this a step further though by introducing quadratic voting which lessens the control over heavy bag holders.

Ethereum co-founder Vitalik Buterin questioned the safeguards, if any, that are in place to prevent abuse of the system;

“Nice! How do you determine individual identities to prevent individuals from splitting their funds into many accounts to avoid being square-rooted?”Pickle responded that as of yet, they cannot control it but wanted to make it more difficult for whales to game the system. Within days of the launch, Dai started trading above its peg which spurred a governance vote to reduce rewards on that pool however it remains unclear as to whether this had a direct effect on Dai returning closer to its peg. Either way, the team did claim credit for it in a rather surreptitious way;

DAI back down to 1.02 after highs of 1.04. Is it because of the $PICKLE? Or is it 103% CR for USDC-A vaults? 🤔🤔

— Pickle Finance 🥒 (@picklefinance) September 15, 2020

Who cares? This is great because this is in align with our mission to bring stable coins closer to their peg.

🥒🥒🥒🥒🥒 🥒🥒🥒🥒🥒🥒🥒🥒🥒🥒🥒 https://t.co/YhG5GBqdsU pic.twitter.com/42UN4dMhbY

Pickle Jars to Seek Higher DeFi Yields

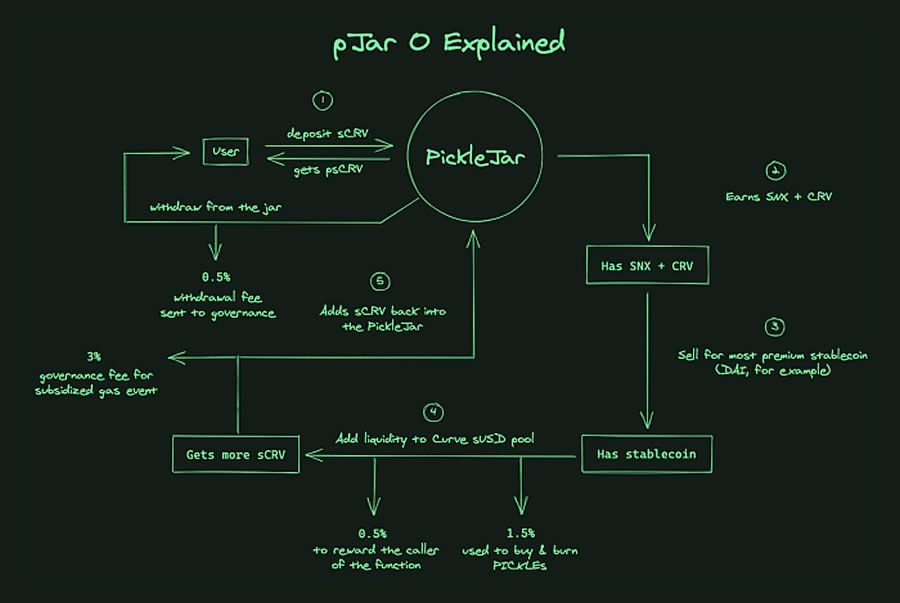

On Sept 15, Pickle Finance introduced something called ‘Pickle Jars’ which is the next iteration of their pVaults system. The unaudited contracts have been taken from Yearn Finance’s yVaults which have so far proved successful. Each ‘pJar’ will employ a different alpha-seeking strategy such as flash loan arbitrage for the best returns. Collateral is deposited in exchange for a ‘pAsset’ which is then sent to the strategy with returns being distributed back to the pools, just as yEarn does with its popular yETH vault. The fee structure allocates 3% to governance for subsidized gas, 0.5% to the function caller as a reward for triggering the strategy, 1.5% is used to buy and burn PICKLE tokens from the market, and there is a 0.5% withdrawal fee. The first pJar will be using the Curve pool to generate more sCRV tokens. The following image breaks it down:

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.