DeFi Pulse and Set Protocol Partnership

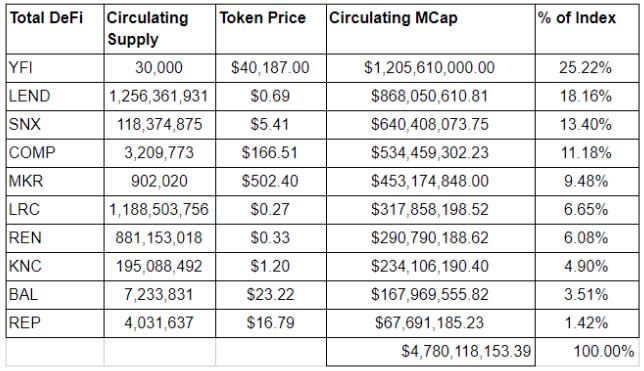

In a partnership with Set Protocol, the data provider has launched a permissionless index of the very best DeFi tokens. It stated that TVL was created to help the community interpret the value locked within the DeFi ecosystem, and it sees the DPI as a natural progression of that idea for the wider community.The index is built on Set Protocol’s new v2 infrastructure and can be purchased as a TokenSet through its integration partners such as Zapper and Dharma. The index is comprised of a diversified mix of tokens including YFI, LEND, COMP, SNX, MKR, REN, KNC, LRC, BAL, and REP. It is a passive index that tracks the performance of these tokens without engaging in traditional DeFi farming activity. Token prices and circulating supplies are taken from CoinGecko, and the price per token has been multiplied by the circulating supply determines the circulating market cap. At the time of writing the market cap for the DPI was $662,700. The index is reweighted every month and below is a snapshot of the current list.1/ 🍇 Introducing The DeFi Pulse Index 🍇

— DeFi Pulse 🍇 (@defipulse) September 14, 2020

The DeFi Pulse Index is a capitalization weighted index built on @SetProtocol's new V2 infrastructure and consists of 10 of the most popular tokens in #DeFi. https://t.co/0UUDcnSQn9

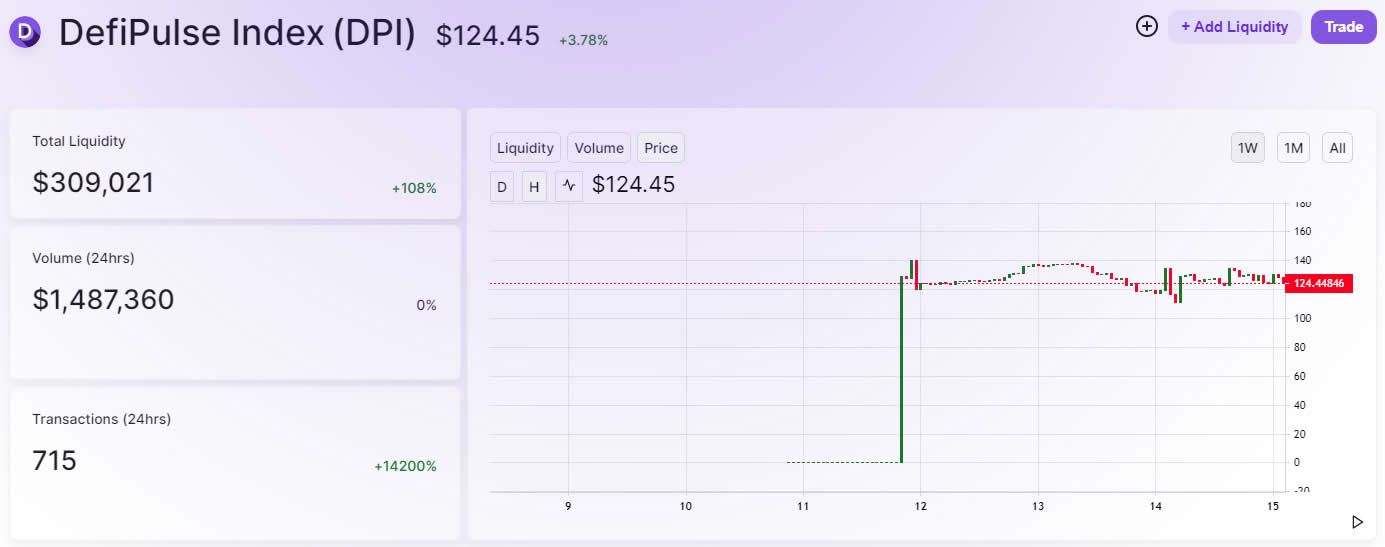

We want a way that people can get exposure to DeFi without having to go and buy every token individually, because that costs a lot of gas,Set CEO Felix Feng added that he thinks it’s going to be a key asset in the entire industry, with the anticipation that it will be used for yield farming. At the time of press, the DPI was trading at around $125 according to Uniswap.

Yam Finance Readies For Relaunch

In a related DeFi development, Yam Finance is preparing for relaunch on Friday, Sept 18. Yam kick-started the DeFi food farming frenzy back in mid-August offering an experimental elastic supply and a zero-value token for liquidity providers. Farmers flocked to the protocol lured by huge yields on a number of pools. However, the crops didn’t last long as the discovery of a code bug in the rebase contract resulted in the team to launch a ‘Save Yam’ campaign. Whales eventually rescued the unaudited protocol allowing it to migrate to v2 before sitting down for a rethink.A month later and the team is ready to replant Yams following a full audit by security firm PeckShield. The migration from v2 to v3 will begin on Sept 18 at a 1:1 basis with no deadline. 50% will be immediately redeemable and 50% continuously vested over 30 days, the announcement added. The new Yam protocol will have one liquidity pool, YAM/yUSD, with rewards totaling around 925,000 YAMs. 10% will be distributed in the first week and will decrease by 10% each following week. YAM v2 token prices have already started to react following the announcement. A 40% surge has lifted it from $24 to $34 over the past few hours according to Coingecko. However, a pullback has brought prices back down to around $28 at the time of press.After a month of interim governance and auditing, YAM is set to relaunch on Friday, September 18.

— Yam Finance (@YamFinance) September 14, 2020

Please see here for full information: https://t.co/1Mra5biT59

You can view the audit here:https://t.co/VhITXIBIN3

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.