As the world edges closer to a digital financial environment, institutions like KfW and Revolut are at the forefront. These European banks are deepening their forays into the crypto and blockchain arenas.

This move reflects their adaptation to technological advancements. It also highlights a strategic pivot in the traditional financial (TradFi) industry toward more innovative systems.

Digital Securities and Crypto Trading: KfW and Revolut’s New Frontier

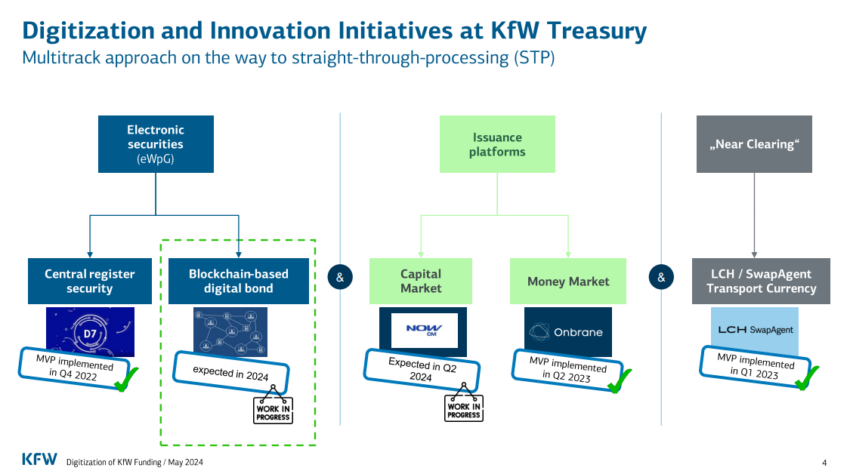

The German bank – KfW is preparing to issue its first blockchain-based digital bond as crypto security, aligning with the German Electronic Securities Act (eWpG). KfW schedules this transaction for the summer of 2024.

Melanie Kehr, Member of the Executive Board of KfW Group, highlights that this innovation is crucial. She further explains its importance for enhancing the competitiveness of the European financial market. By pioneering such initiatives, KfW tests new financial instruments and sets the stage for future digital transactions across the market.

“One of our most important goals is to make an active contribution to the development of the market for digital securities in Germany and Europe. […] We are once again testing an innovation on the financial market and aim to pave the way for future transactions of this type for other market participants,” Kehr stated.

Read more: What is Tokenization on Blockchain?

KfW’s journey into digitalization began in 2022, starting with its money market and derivatives. The bank is now advancing to blockchain technology after successfully issuing a digital bond as central register security.

Furthermore, KfW’s strategy also emphasizes robust investor engagement. A preparatory phase involving discussions with European institutional investors, including Union Investment as a significant anchor investor, aims to familiarize them with the nuances of blockchain transactions.

Supporting this venture, a consortium of major banks, including Deutsche Bank, LBBW, and Bankhaus Metzler, will play pivotal roles. Additionally, DZ Bank will serve as the custodian for the bond.

Shifting focus to the UK, fintech giant Revolut has launched ‘Revolut X,’ a crypto trading platform that promises competitive fees and robust accessibility. Introduced on May 7, the platform caters specifically to retail customers.

Revolut X is designed to provide a more seamless experience, featuring fixed fees of 0% for makers and 0.09% for takers. This pricing structure might appeal to a wide range of traders and also directly challenge established crypto exchanges.

The platform will offer over 100 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and XRP, for the initial stage. However, the company plans to expand its selection in the near future.

Furthermore, the platform enables converting fiat currencies like the British pound to crypto and vice versa. This feature is expected to encourage wider adoption among UK residents.

Read more: RWA Tokenization: A Look at Security and Trust

These initiatives by KfW and Revolut highlight the growing interest of traditional banks in the crypto and blockchain sectors. Previously, Landesbank Baden-Württemberg (LBBW), Germany’s largest state bank, plans to offer cryptocurrency custody services in collaboration with Bitpanda exchange.

Likewise, HSBC, a leading bank in Hong Kong, plans to enhance its tokenization of real-world assets (RWA) and launched the HSBC Gold Token.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.