Hong Kong’s leading bank, HSBC, is set to expand its footprint in tokenization of real-world assets. This move aims to provide customers with innovative digital products.

As part of its strategic plan, HSBC seeks to position the city as a forefront runner in digital finance, reinforced by recent government initiatives to increase public access to digital assets.

HSBC Wants to Stay Away From Crypto

This strategic expansion was highlighted following the introduction of the HSBC Gold Token. It stands as the first retail product of its kind in Hong Kong.

At a recent media roundtable, HSBC CEO Noel Quinn shared insights into the advantages of tokenization.

“Tokenisation is a more efficient trading mechanism and provides liquidity to that asset. In theory, you can tokenize anything. The key criterion for me is whether there is substance behind the token. Has it got predictability? Does it exist?,” Quinn said.

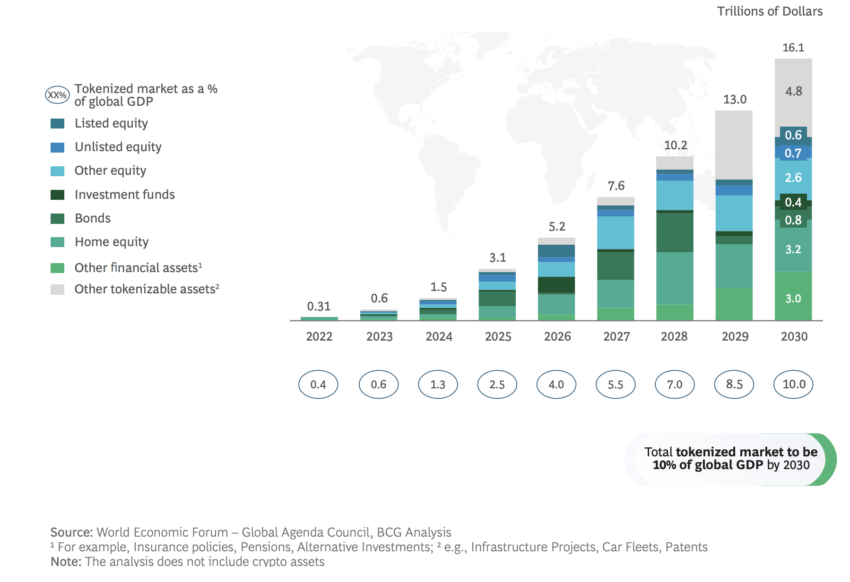

Tokenized products digitally represent assets on blockchain platforms. This method allows direct access for investors or distribution through intermediaries. The Securities and Futures Commission of Hong Kong has recognized that the tokenization of real-world assets is essential for modernizing trading and financial practices.

Read more: What is Tokenization on Blockchain?

Focusing on tangible assets such as gold and bonds, HSBC deliberately avoids cryptocurrencies.

“A cryptocurrency may be based on similar technology but is more volatile and unpredictable. HSBC would be staying away from crypto,” Quinn argued.

However, public blockchains like Ethereum require cryptocurrency to maintain transparency and decentralization. These are critical for powering decentralized financial systems, contrasting with the centralized models of traditional banks.

Moreover, as a part of a broader global movement, the Bank for International Settlements (BIS) and seven central banks have embarked on Project Agorá. This project aims to merge digital and traditional financial systems to optimize global financial operations.

The project addresses long-standing inefficiencies in cross-border payments by integrating tokenized commercial and central bank funds on a unified ledger. It enhances financial controls like anti-money laundering efforts.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Simultaneously, UK Finance is advancing its experimental ledger pilot to track banking payments involving major banks like Barclays, Lloyds, and Citigroup. This pilot is a step towards a commercial system that could use tokenized assets to make cross-border transactions smoother, faster, and more secure.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.