The third Bitcoin halving is expected to occur on May 12. When comparing the price movement and technical readings of the first two halvings, the similarities are scarce.

Numerous investors and speculators are anticipating this event and the general interest is at an all-time high, as evidenced by the rapidly increasing google searches for the term “Bitcoin halving.” However, it is not yet clear what effect this event will have on the price, due to the bleak economic climate.

Well-known trader @TheCryptoDog made an interesting inquiry on Twitter about the possibility of the halving being priced in:

Do you think the halving is priced in? Be honest.As stated previously, the Bitcoin halving is projected to occur on May 12. Below, we will take a closer look at the BTC price movement and compare it with the previous two halvings in order to see if any similarities arise that can help us determine if the event is priced in.

RSI Similarities and Differences

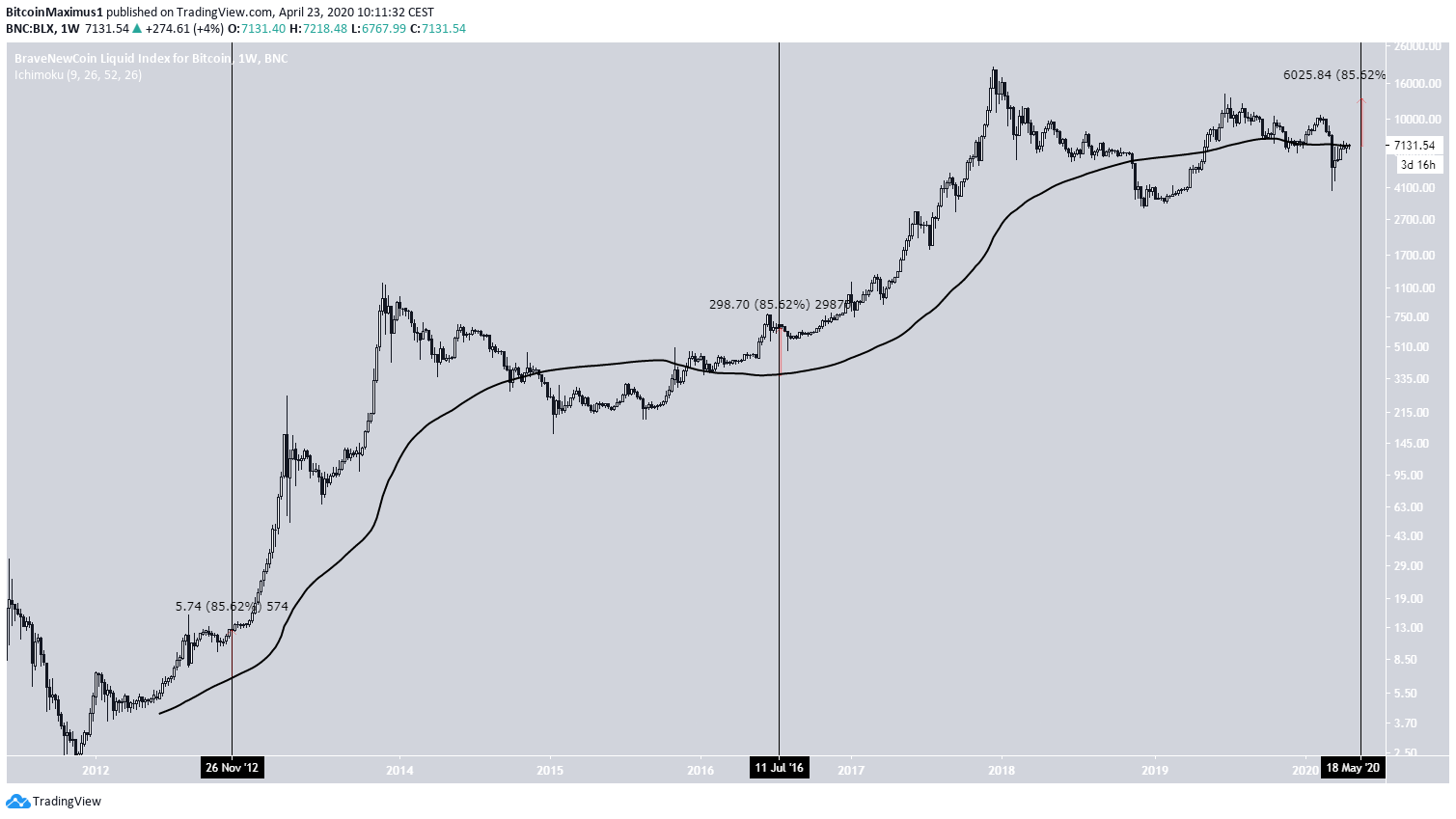

The previous two Bitcoin halvings occurred on Nov. 26, 2012, and July 11, 2016. During the first event, the high was reached 105 days prior to halving. On that date, the weekly RSI briefly went into overbought levels before dropping sharply. Similarly, the RSI jumped to overbought levels during the top prior to the second halving. However, this top was reached only 28 days prior to the first event. Similarly, both the price and the RSI decreased after this top. However, unlike the first halving, the decrease continued well after the event — with the price reaching a low several weeks afterward. In the current movement, the most recent high has been that of $10,504 reached on February 7, 2020. If the halving occurs on May 12, the top would be 98 days prior to the event. However, the current movement is quite dissimilar to the first two:- First, the aforementioned high was not combined with an overbought RSI value.

- In addition, the Bitcoin price was subject to a very sharp drop of more than 50 percent soon after reaching the February high — which was not the case during the previous to events.

Moving Average Comparison

An interesting comparison comes when incorporating the 100-week moving average (MA) into the analysis. At the date of the first two halvings, the Bitcoin price was exactly 85 percent above this MA. In comparison, the current price is on a level with the same MA. If the same 85 percent increase transpires, it would give us a price of around $13,500 right on the halving date. Such an increase does not seem likely — especially due to the short-term bearishness in the BTC price — so it is likely that the February high of $10,505 is the highest price prior to halving.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored