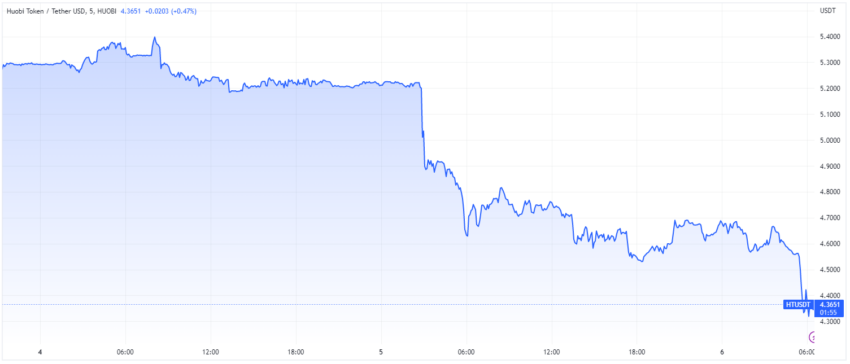

The global trading volume of the Huobi exchange plummeted in the past day amid rumors of internal turmoil. The Huobi Token (HT) and TRON (TRX) tokens are also down sharply.

Huobi Global is experiencing a sharp drop in trading volumes after reports are emerging of a meltdown. The exchange’s 24-hour trading volume tanked by over 22%, going down from roughly $1.6 billion to $1.23 billion at press time.

Net flow on Ethereum has also been sharply negative, with seven-day net flow amounting to -$34.9 million. Most of the Huobi portfolio consists of the HT token, which amounts to $908 million in balance. The total Ethereum portfolio balance is $2.1 billion. The Huobi balance across all chains is $2.9 billion.

Huobi advisor Justin Sun, a well-known and sometimes controversial figure in the crypto industry, tweeted about the company’s business state on Jan. 5.

“…recent business development momentum is good, core indicators have maintained rapid growth, and the average daily growth rate of new registered users and capital inflows exceeds the peak in 2022,” he said.

He went on to say that the infrastructure is secure and Huobi would focus on global compliance. Some were skeptical of these claims, saying that the exchange and USDD were imploding.

Sun Allegedly Fired Multiple Employees

There is a lot of commotion taking place in the Huobi and TRON communities currently. Those inside are claiming a meltdown and that Sun has fired multiple people. Chinese Telegram channels are reportedly filled with messages of “things falling apart rapidly.”

Crypto journalist Colin Wu reported that Sun is attempting to change the salary of Huobi employees from fiat to USDT or USDC. Employees are reportedly protesting as a result. According to Wu, Huobi will also fully deregister as a domestic entity, and employees will be obliged to sign agreements with overseas entities.

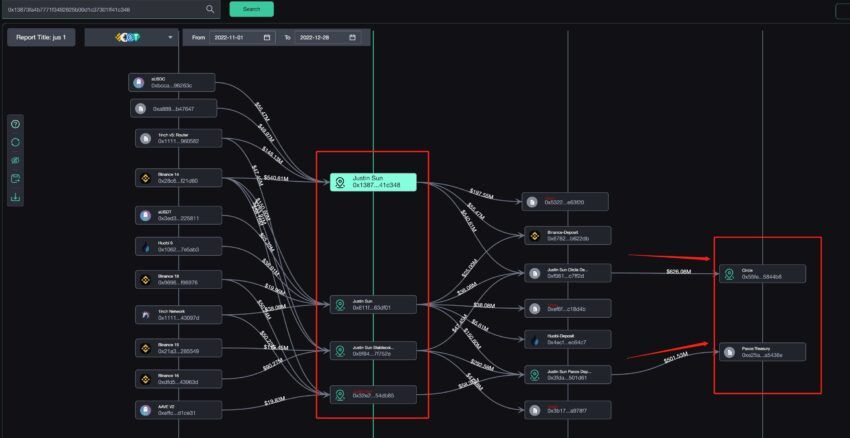

There is also the fact that Sun has cashed out $626 million in USDC and $501 million in BUSD. Such concerns are arising as the USDD stablecoin loses its peg once again.

USDD Loses Peg Yet Again

The TRX coin is down by 7.7% in the past 24 hours, while the HT token is down 6.23%. The news of layoffs and other internal changes have sparked a sharp drop in prices. Sun has denied that any layoffs have taken place.

The USDD token also lost its peg and is currently at $0.997. The token has depegged in the past, and there have been concerns that USDD might follow the path of Terra’s UST stablecoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.