Bitcoin (BTC) has made a strong start to 2023, climbing 43%, its strongest rally in two years. But since the start of Feb., price has remained flat. Since testing $24,000 resistance, BTC dropped 4% to reach a seven-day low of $22,700. But how will the market respond, and how long will this correction last?

BeInCrypto looks at On-chain Network Activity, Exchange Flows, and Miner’s Reserves to analyze the potential of Bitcoin support/resistance points in the coming weeks.

Bitcoin Network Activity Shows Low Interest From Large Investors.

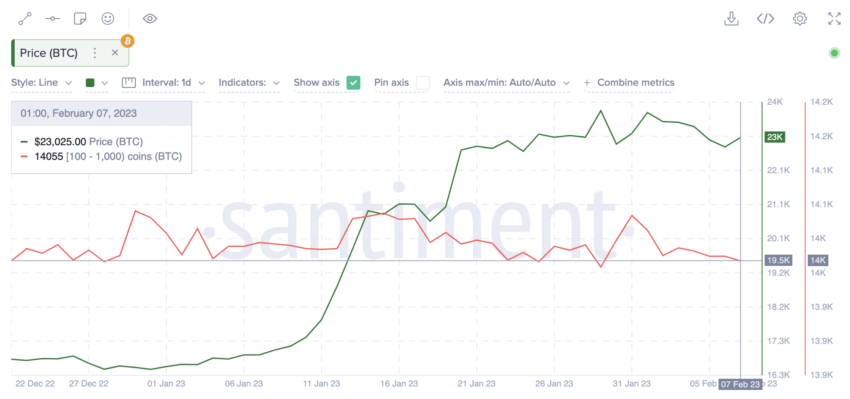

Bitcoin whale transaction count has taken a downturn since Feb. 2, coinciding with a 4% correction from $23,800.

Bitcoin network activity data compiled by Santiment showed that on Jan. 4, transactions above $100,000 on the Bitcoin network reached a 2023 peak of 12,069. But a month later, the whale transaction volume had dropped below 8,000 daily.

The trend has been largely due to increased negative perception surrounding BTC and growing interest in critical altcoin sectors. Altcoins native to blockchain-based artificial like SingularityNET has been the biggest gainers this year. At the same time, whale interest in proof-of-stake networks like Cardano (ADA and Polygon(MATIC) have also contributed to the declining dominance of Bitcoin.

Another critical metric that has set the pace for recently flat performance is the increasing sell pressure from whales holding balances of 100 to 1,000 BTC. Historically, this group of holders’ wallet balances has been highly correlated to the price of BTC.

Recently, as highlighted by Santiment, whale holders in the 100 to 1,000 BTC range have been increasingly selling off their tokens. Albeit marginally, this could be a strong indicator that Bitcoin is likely to remain below $23,000 in the coming week.

In/Out of the Money Around Price (IOMAP) is a metric that monitors Bitcoin wallet addresses that are approaching the break-even point. Historically, holders tend to sell off their tokens as BTC approaches its average purchase price.

IntoTheBlock’s IOMAP data indicates that BTC mid-point support at around the $22,500 point is significantly weaker than the resistance cluster at $23,500. This means that BTC looks likely to drop to $22,500 in the coming week.

Considering the sizeable supply wall around the $23,300 point, if BTC breaks below $22,800, it could lead to a more significant drop in price as the cluster of holders seeks to cut their losses.

Exchange Net flows and Wallet Addresses approaching the break-even point show that Bitcoin could drop below $22,000 again.

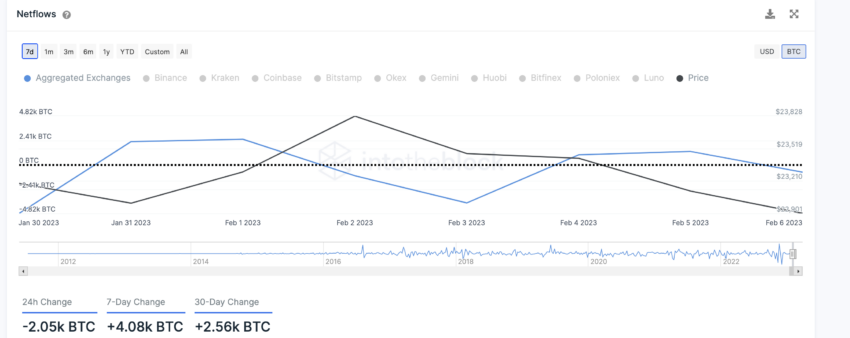

The netflow of Bitcoin across top exchanges is another metric flashing a mild bearish signal in Feb. Exchange netflow compares the rate BTC is deposited on exchanges to withdrawals.

BTC Exchange Net flows Feb. 2023. Source: IntoTheBlock

IntoTheBlock data shows that Bitcoin supply on exchanges has increased by about 4080 BTC in the last seven days. This represents a 60% increase over the 30-day net change. Historically, when exchanges receive more deposits, BTC holders could be looking to pile on sell pressure in the coming days.

Typically, a positive exchange netflow value indicates that more Bitcoin holders may be looking to sell off their tokens in the coming days.

Mining Costs Have Dropped – But Enough to Drive a BTC Price Rally?

In more optimistic terms, Bitcoin mining costs have dropped considerably over the last seven days. And many top miners are once again in a net-positive position.

The BTC price currently sits above the average cost of mining a block, according to data presented by Cambridge-affiliated platform, MacroMicro. Historically, miners have been observed to accumulate block rewards in their reserves when prices are higher than operating costs.

Miners’ reserve trends will considerably influence the prices of Bitcoin in the coming days. Even amid the declining BTC dominance and increasing negative perception, if mining costs stay below $22,000, BTC may witness another price surge in Feb.

Keeping an Eye out for the Feds

Bitcoin sparked the current crypto rally on Jan. 12 after the U.S. Federal Reserve published the CPI report for Dec. The report showed that inflation on household items has slowed by 0.1% compared to the previous month. Leading the Fed to dial down its January interest rate hike.

The next CPI report is scheduled to be released on Feb. 14. If inflation drops again, BTC might be set for another rally as Central Banks may look to cut interest rate hikes for the second consecutive month.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.