The Decentralized Finance (DeFi) market is growing at breakneck speed. Users can access all kinds of services from borrowing to trading to yield farming. But are these services accessible to people with little technical know-how? BeInCrypto explains all you need to know about borrowing on DeFi.

When DeFi first came roaring on the scene, most users were borrowing stablecoins against their crypto (ala borrowing DAI collateralized against ETH). Now, DeFi offers a wide range of services.

We decided to explain what it takes to borrow against crypto assets on DeFi. For our experiment, we chose the Aave platform, which is one of the most popular methods of borrowing in DeFi, with some users even using the platform to get mortgages.

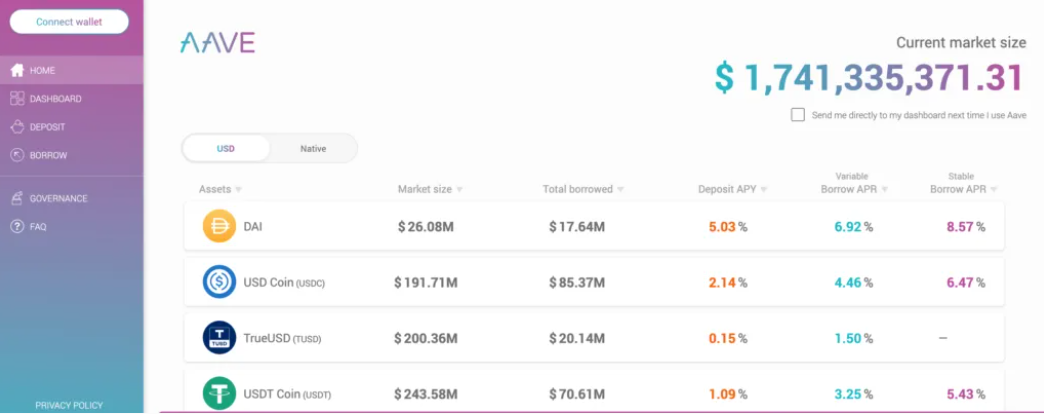

Step 1. Study the market

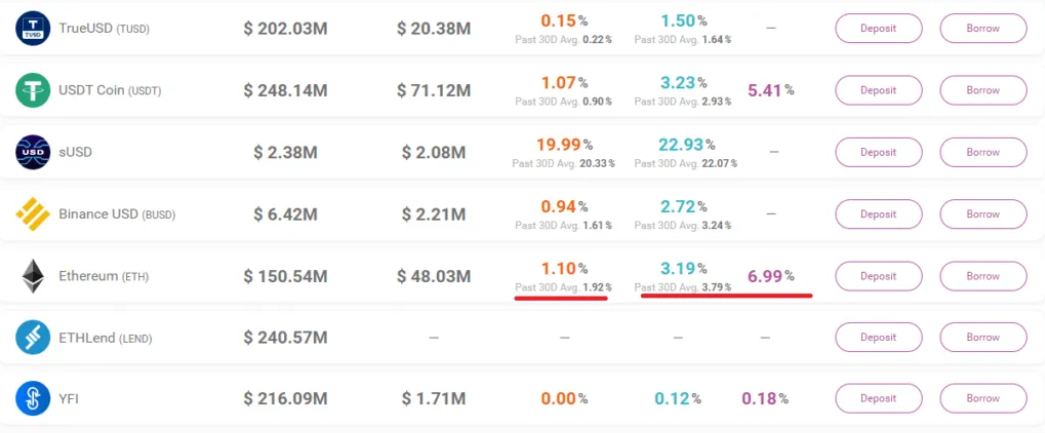

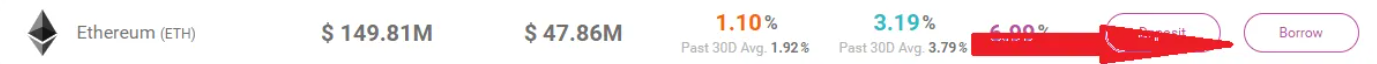

Aave offers different kinds of cryptocurrencies to borrow. Some examples are Dai, USDC, TrueUSD, BUSD, and more. The amount one can borrow depends on how much collateral they put up (and what type). The interest rates also depend on the collateral, and can vary from currency to currency. In this example, one can borrow ETH with an interest rate of 3.19% variable APR and 6.99% fixed APR. Some people lend their crypto as well — in this case, the return would be 1.10% APY.

Step 2. Understanding interest rates

Aave offers two kinds of interest rates: variable and fixed. What’s the difference? Variable Interest Rate. Variable interest rates can change over time (sometimes called floating interest rate). The variable interest rate is recalculated to reflect supply and demand in the market. Over the course of loan repayment, the interest rate could go up and down. Fixed Interest Rate. The fixed rate does not change, at least in the short term. If market conditions shift significantly, the interest may change. But generally, this is the one to pick when choosing a strict repayment plan. Users can change which type of interest rate they are using in their account settings.Step 3. Choosing a wallet

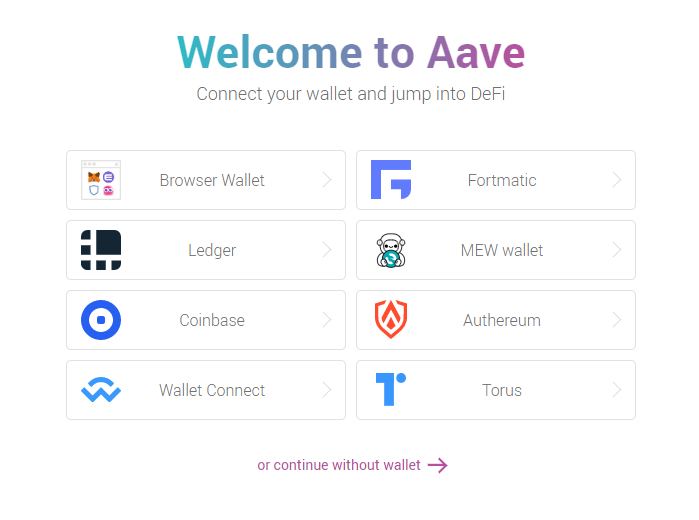

If you already have a cryptocurrency wallet, you can connect it directly to the Aave platform. Aave accepts several different types of wallets, including Ledger, Coinbase, Wallet Connect — which can be used to connect several kinds of wallets — and more. Even without a wallet, it is possible to begin the borrowing process. If you do not already have a wallet, you can choose “continue without a wallet.” To cover all our bases, we will choose this in our example.

If you do not already have a wallet, you can choose “continue without a wallet.” To cover all our bases, we will choose this in our example.

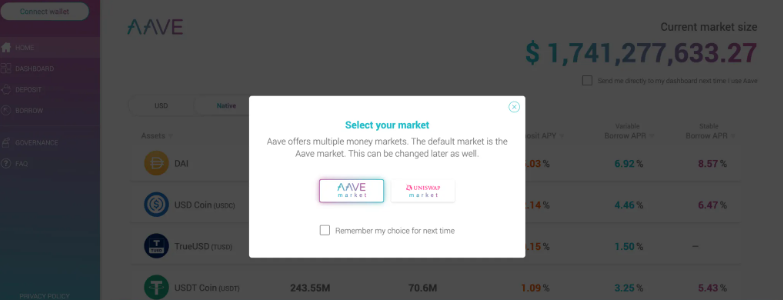

Now, it will ask you to choose your market: Aave or Uniswap. For now, we will choose Aave as it is more straightforward. It is possible to change this later down the line.

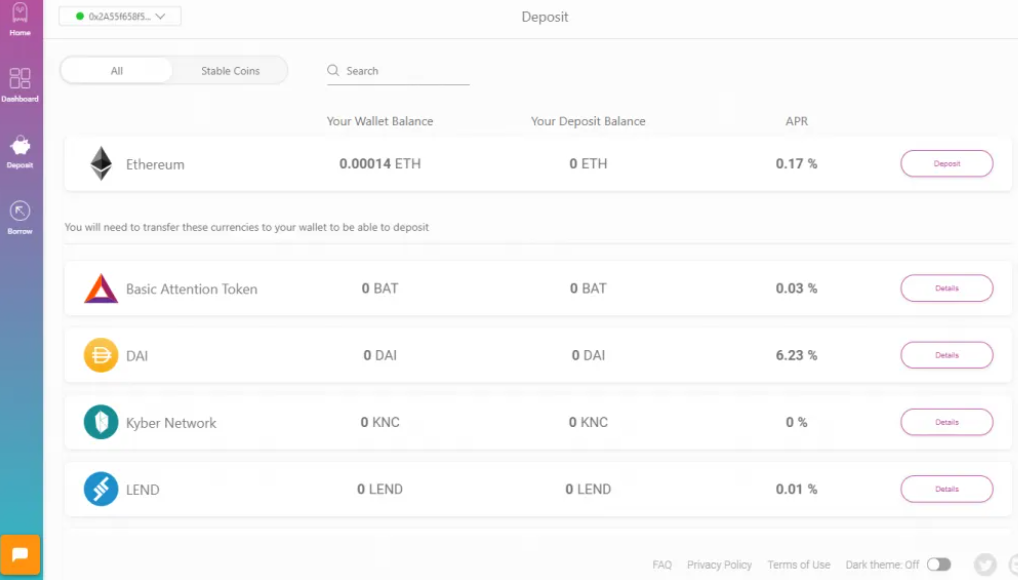

The next screen shows all the different coins/tokens that you can lend or borrow.

Now, it will ask you to choose your market: Aave or Uniswap. For now, we will choose Aave as it is more straightforward. It is possible to change this later down the line.

The next screen shows all the different coins/tokens that you can lend or borrow.

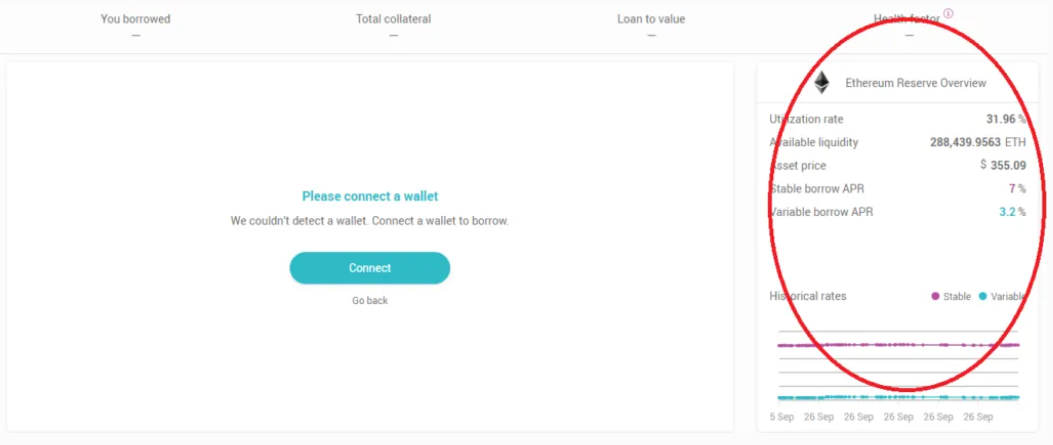

Step 4. Choosing a token

At this point, the site will let you know that you do indeed need a wallet. You can’t do anything without a wallet except look at the different lend and borrow rates. In this case, we will chose ETH, and see the offered rates.

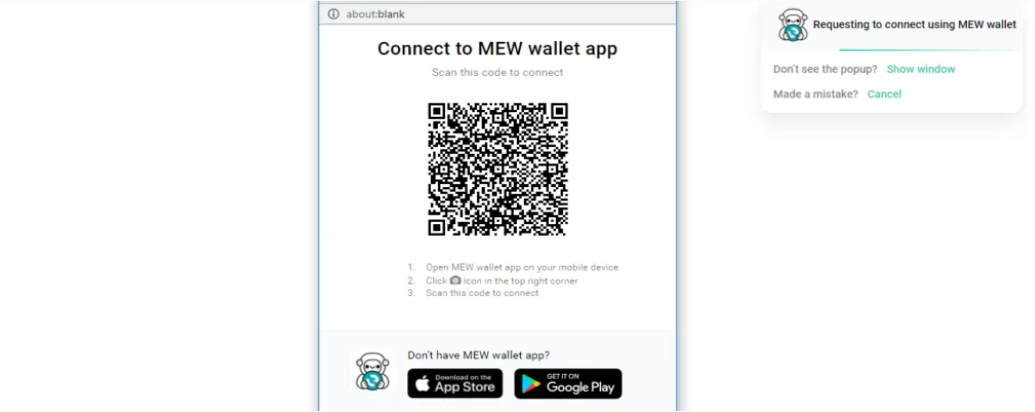

Step 5. Connecting a wallet

So we come back to the “wallet connect” screen (seen above). You have many choices, and one of the most common wallets is the MEW wallet. If you choose MEW, you’ll run into a problem. The MEW wallet requires you to connect via the mobile app, so you’ll need to go to your app store and download the mobile version of the wallet. It is possible to use MEW within your browser via WalletConnect or by getting a Chrome/Firefox MEW extension. Any way you do it, though, you’ll need to download the app and scan a QR code to activate the wallet. When creating a wallet, always remember to store your private key, .json file, and/or secret phrase securely. Password protection is also important, but the key is where the power lies. Anyway, once you have downloaded MEW, you can go to the Aave site and click “Connect.” It will be easier to go through a smartphone, but you may also set up your wallet on your browser.

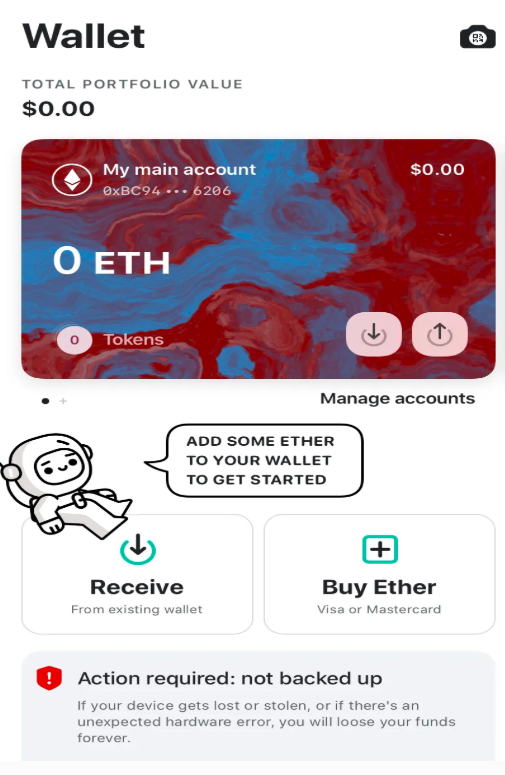

Step 6. Add ETH to the wallet

Finally, we have a wallet. Now, we have to put some currency into it! Since we are using ETH in this example, we need to fund the wallet either by purchasing ETH with a card or from a bank account, or by transferring it from another wallet.

Step 7. Funds on the wallet

After sending currency to the wallet, the money should automatically be entered into the Aave system since we have connected the wallet to Aave. Note: If you are using a different wallet method, or if for any other reason your “borrow” button is greyed-out, you may need to click the “deposit” button to transfer funds from your wallet to your Aave account.

Note: If you are using a different wallet method, or if for any other reason your “borrow” button is greyed-out, you may need to click the “deposit” button to transfer funds from your wallet to your Aave account.

Step 8. Borrow money

To borrow money, we will choose the Borrow function on the main page or directly in the account page. After clicking “Borrow,” the account page should pop up. The conditions of your loan should show up there: the amount of tokens in the wallet, the borrowing interest rate, the value of the tokens in real time, etc. You enter in how much you want to borrow, and there you have it! The money should go into the wallet you connected to Aave.

The cool thing about DeFi is that you still control the funds. Aave technically just converts your tokens into the Aave “version” of your tokens on your wallet. They are still on your wallet, protected by your private keys.

So, voilà, loan complete!

After clicking “Borrow,” the account page should pop up. The conditions of your loan should show up there: the amount of tokens in the wallet, the borrowing interest rate, the value of the tokens in real time, etc. You enter in how much you want to borrow, and there you have it! The money should go into the wallet you connected to Aave.

The cool thing about DeFi is that you still control the funds. Aave technically just converts your tokens into the Aave “version” of your tokens on your wallet. They are still on your wallet, protected by your private keys.

So, voilà, loan complete!

Some important notes

Health factor. This is a number that represents the safety of your loan compared to collateral. In other words, it measures the chances of your loan getting liquidated. The higher the number, the safer your funds. If the health factor reaches 1, then your deposits will (begin to) be liquidated. The higher the amount of collateral, the less likely liquidation will occur. Basically, you get to borrow against your collateral. Since that collateral can be ETH, which has a relatively volatile price, there is a chance the ETH price could drop to the point where your loan was no longer collateralized by your tokens. In this case, the system would automatically sell your funds to make up the difference. The amount of collateral necessary depends on the currency of the loan and market conditions. These are the same factors that dictate interest rates. DeFi systems like Aave usually try to keep users with a very high health factor, but liquidation does happen.Issues

DeFi loans are pretty simple. The hard part is the integration of all the pieces outside the site. Getting the loan takes a few clicks, but getting the right wallet, connecting it, and purchasing crypto in the first place as collateral can take a few more steps. For beginners, it might be worth doing the whole process through mobile wallets and a mobile version of the site. The integration is better and there are fewer chances for confusion. The Aave interface itself is pretty intuitive, and most beginners should have no problem.Why to get crypto loans

Sometimes new users want to know what the point of getting a loan on DeFi is. Well, getting a loan on DeFi gets around a lot of potential problems such as high interest rates or rejection for bad credit. If you really need the cash, DeFi can be a life saver. So here are some advantages:- You can get a loan for a longer period

- APR can be lower than in banks

- You don’t need to get all your documents in order

- You do not need to risk giving away personal information

- Everyone receives the right conditions for a loan under their own terms. The loan amount is determined by the amount and type of collateral

- Loans are disbursed instantly

- No physical collateral. You only risk the tokens you put up, and they remain in your wallet

- DeFi can be used anywhere, for example, in a country with an inefficient or untrustworthy banking system

- A wide range of currencies

Now, the disadvantages

- Your collateral and loan can be liquidated if the token price crashes

- The crypto market is volatile, so interest rates can change even with a fixed rate APR

- Some know-how is required to get everything up and running

- There is always a risk of losing funds in a hack.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored