Hong Kong is gearing up to launch its second batch of tokenized green bonds. This initiative, led by the Hong Kong Monetary Authority (HKMA), is a clear signal of the city’s commitment to revitalizing its economy through advanced financial technologies and sustainable practices.

The issuance of these tokenized green bonds marks a significant leap in Hong Kong’s financial sector. It is quickly becoming a leader in utilizing blockchain technology for enhanced efficiency and transparency.

Hong Kong Builds Upon Tokenized Bond Initiative

Eddie Yue, CEO of HKMA, emphasized the importance of adapting to global economic shifts. At the Hong Kong Economic Summit 2024, Yue stated:

“But it also means that Hong Kong needs to be more proactive in striving for our own development opportunities and injecting some momentum into our economy.”

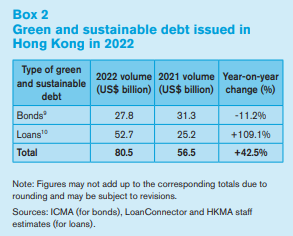

This proactive stance is evidenced by the substantial growth in the green bonds and loans market within Hong Kong. These combined markets soared from US$11 billion to over US$80 billion in just two years. This trend underscores Hong Kong’s dedication to green finance and also positions it as a global leader in this arena.

The upcoming tokenized bonds are set to launch in the next few months. They represent a novel approach to the government’s digital bond offerings.

The Hong Kong government’s first issuance in February amounted to HK$800 million (US$102 million). It set a global precedent and paved the way for further digital innovation in the city’s financial sector.

Additionally, HKMA plans to host a “Green Finance Week” in February, collaborating with the World Bank’s International Finance Corporation. This event aims to convene global experts to discuss the transformation of green finance and explore opportunities in blended finance with the International Monetary Fund.

Read more: What Is The Impact Of Real World Asset (RWA) Tokenization?

Fintech at the Forefront

HKMA’s central bank digital currency (CBDC) project is also a testament to its forward-thinking approach. This project involves collaboration with the central banks of China, Thailand, the United Arab Emirates, and BIS’ innovation hub in Hong Kong. The project’s focus is on using CBDCs to settle international payments.

Hong Kong’s Financial Secretary Chen Maobo also highlighted the government’s plans to issue tokenized green bonds for institutional investors, indicating a broader strategy to integrate advanced technologies into the financial ecosystem.

Overall, this approach aligns with the government’s recent efforts to establish regulatory frameworks for cryptocurrencies and digital assets, further cementing Hong Kong’s position as a hub for financial innovation.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.