Goldman Sachs predicts that institutional adoption and regulation of blockchains will mature digital assets in 2024. The bank’s head of digital assets, Matthew McDermott, said businesses that have experienced blockchain’s efficiency are now scaling to maximize commercial opportunities as the markets await a Bitcoin exchange-traded fund (ETF).

McDermott suggested that blockchains’ positive impacts on businesses are only realized at scale. He expects the renewed uptake from banks to enhance liquidity in the markets for tokenized assets.

Goldman Sachs Predicts Future of Digital Assets

“When you look at collateral mobility, there’s still a lot of inefficiencies that are a function of systems that are many decades old- when you actually start to see people adopt the adopt the technology, they’ll recognize that not only can you see a commercial proposition on the forward, you can actually see it today,” According to McDermott.

McDermott predicts that traditional assets will be tokenized ahead of their more exotic counterparts. Less common assets will benefit the most in the areas of liquidity, pricing visibility pricing, and transparency.

Read more: What is Tokenization on Blockchain?

His sentiments echo those of William Quigley, the co-founder of the collectibles-focused blockchain WAX. Quigley told BeInCrypto he expects the tokenization industry to build a niche in 2024 before maturing in 2030.

Bitcoin ETFs Will Grow Slowly

In the meantime, McDermott argues that the approval of Bitcoin exchange-traded funds (ETFs) will invite investments by pension funds and insurers who will improve Bitcoin’s overall liquidity. The US Securities and Exchange Commission (SEC) has until Jan. 10, 2024, to rule on an ETF application by ARK Invest. Analysts expect the SEC to approve all thirteen applications and ARK’s to ensure fair competition.

McDermott predicts Bitcoin ETFs may not grow immediately upon approval. Rather, they will gain traction as the year progresses.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

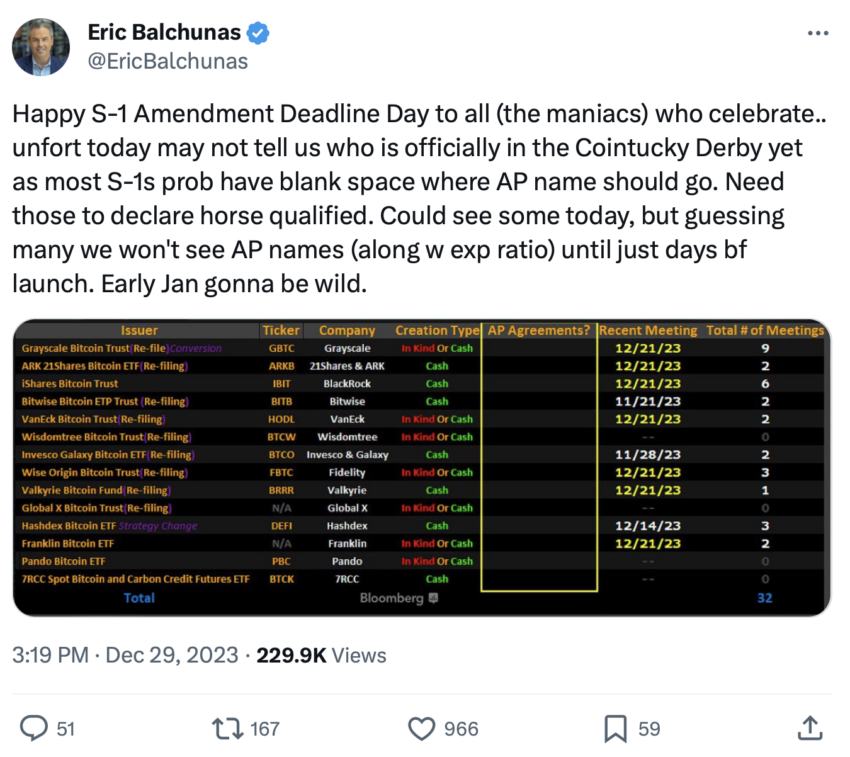

Applicants had until Dec. 29, 2023, to amend their S-1 filings with the SEC. Bloomberg ETF analyst Eric Balchunas predicts that many firms will only list authorized entities that can create and redeem ETF shares closer to the ARK deadline.

Do you have something to say about Goldman Sachs’ opinion the future of digital assets or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.