In addition to Bitcoin, gold prices are also on a tear reaching their highest-ever levels. However, a renowned BTC pioneer and cryptography expert has predicted that there could be a flippening of market capitalizations for the two assets.

Spot gold prices rose to a new record high of $2,110 per ounce during Asian trading on Monday morning before giving up some gains.

Bitcoin to Flip Gold?

Gold prices built on last week’s momentum to hit new highs this week. Spot bullion was changing hands for $2,084/oz at the time of writing, cooling from its peak a few hours ago.

Moreover, prices of the yellow metal have risen for two consecutive months. The Israel-Palestinian conflict has boosted demand for the safe-haven asset. Additionally, expectations of interest rate cuts have provided further support, reported CNBC.

According to BMI, a Fitch Solutions research unit: “We believe the main factors buoying gold in 2024 will be interest rate cuts by the U.S. Fed, a weaker U.S. dollar and high levels of geopolitical tension,”

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

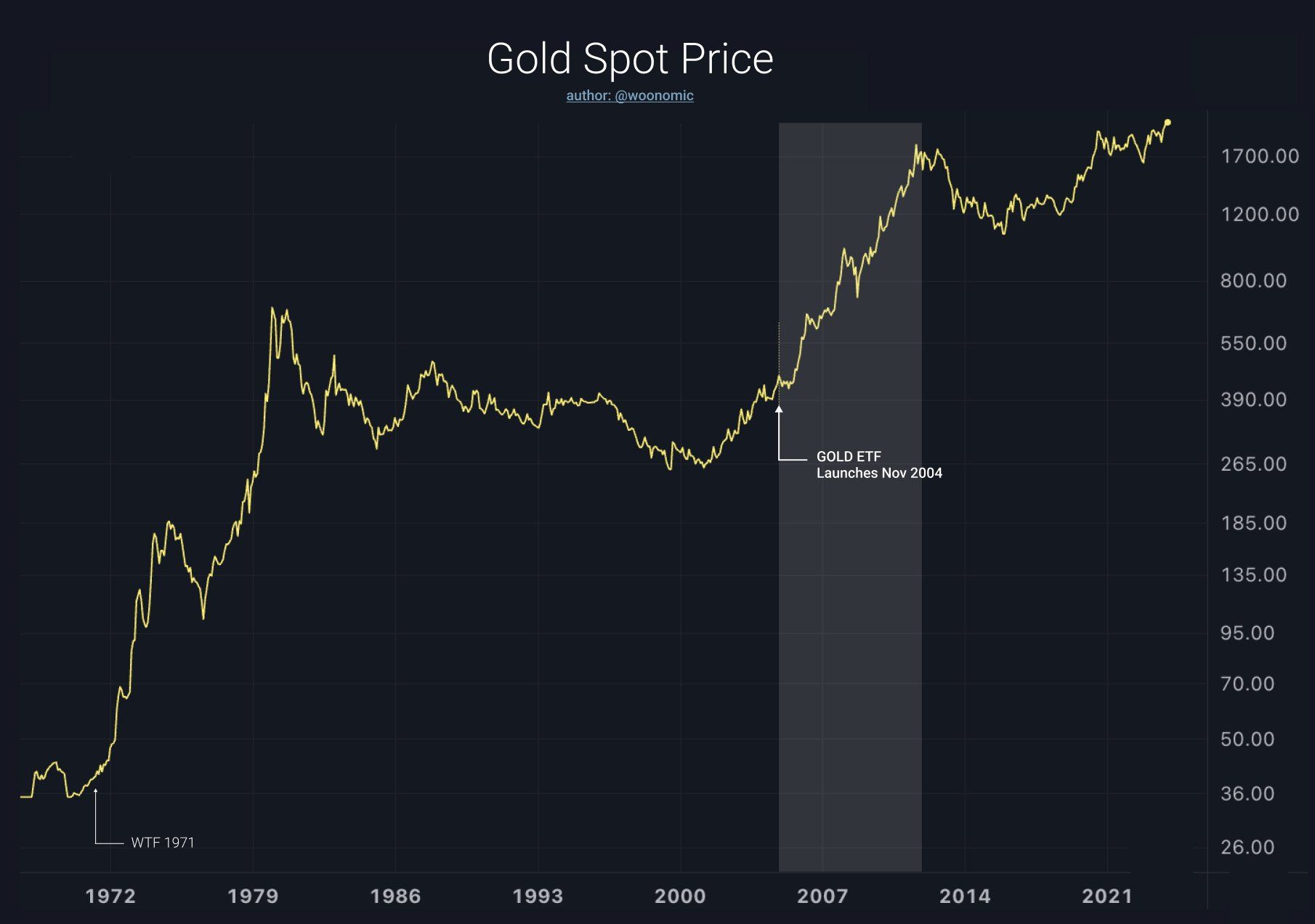

Chart guru Willy Woo commented on the first spot gold ETF, the SPDR Gold Trust, and how it drove markets for years to follow.

“It provided a simple way for investors to access gold in their portfolio. When it launched gold went on to an 8-year rally with no single down year between 2005 – 2012.”

Massive Wealth Transfer

On Dec. 4, cryptography expert Adam Back predicted that Bitcoin, or digital gold, will “surely flip physical gold sooner or later; and probably this halving cycle, so within a year or two.”

He added that BTC prices would need to reach $700,000 for this to happen. However, this may be adjusted downwards if people start selling gold to buy Bitcoin, he said.

In a separate post, Back also predicted another “hyperbitcoinization after-burner,”

“As boomers (age 59-77) leave their wealth to the next generations, gen X and millennials; more stocks, bonds, and pension pots will be liquidated to buy Bitcoin.”

Tether and VanEck strategy advisor Gabor Gurbacs reminded readers that it is the “greatest generational wealth transfer” totaling $68 trillion.

Naturally, gold bug Peter Schiff took his usual swipe at Bitcoin, stating that the gold price’s correction from ATH has provided a catalyst for Bitcoin to spike near $41K.

“This could be Bitcoin’s swan song,” he gloomily lamented before adding that it was a “speculative frenzy” around spot Bitcoin ETFs which will end soon.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.